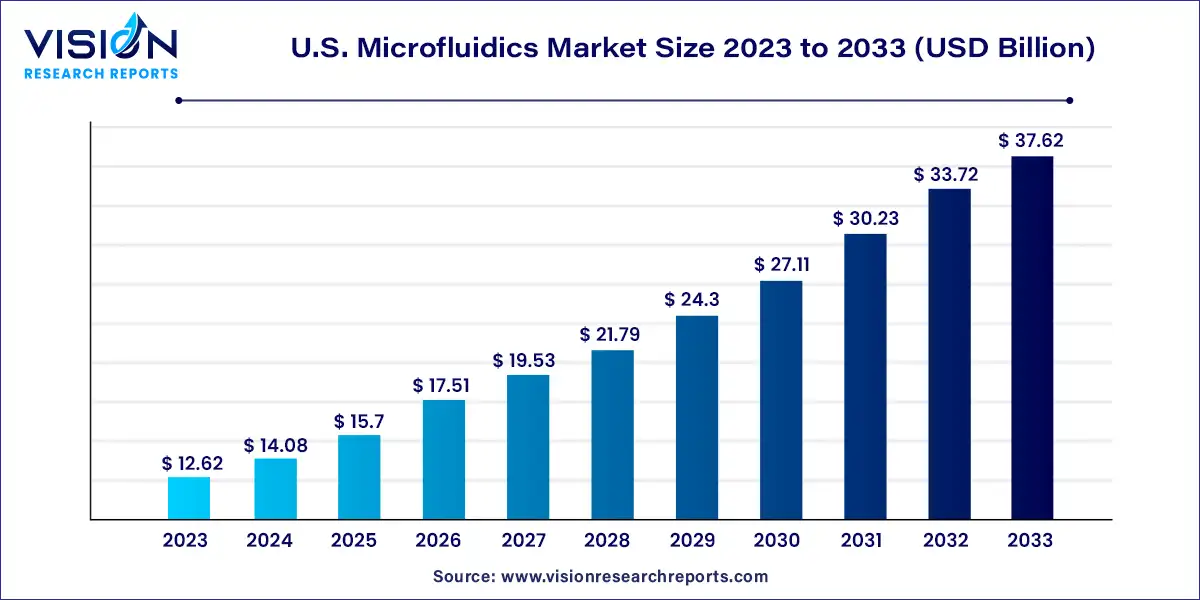

The U.S. microfluidics market size was estimated at around USD 12.62 billion in 2023 and it is projected to hit around USD 37.62 billion by 2033, growing at a CAGR of 11.54% from 2024 to 2033.

The field of microfluidics in the United States has witnessed significant growth and innovation driven by advancements in technology and increasing demand across various industries. This overview aims to provide a comprehensive analysis of the U.S. microfluidics market, including key trends, drivers, challenges, and opportunities.

The growth of the U.S. microfluidics market is propelled by the rising demand for personalized medicine and point-of-care diagnostics, driving the need for innovative microfluidic solutions. Secondly, advancements in microfabrication techniques are enhancing the performance and reliability of microfluidic devices, encouraging their adoption across various industries. Additionally, the increasing use of microfluidic platforms in drug development and clinical research is fueling market growth. Moreover, investments in healthcare infrastructure and research facilities are contributing to the expansion of the microfluidics market in the United States.

Polydimethylsiloxane (PDMS) dominated the market in 2023, holding the highest revenue share of 36%, and is anticipated to maintain its lead with the fastest compound annual growth rate (CAGR) throughout the forecast period. PDMS, a widely utilized polymer in microfluidics, offers a plethora of advantages including non-toxicity, durability, optical clarity, gas and oxygen permeability, biocompatibility, elasticity, affordability, and the capacity to facilitate intricate microfluidic device designs through layering multiple levels. The rapid adoption of microfluidics-enabled Lab-on-a-Chip (LOC) devices has created numerous growth opportunities for PDMS in experimental microfluidics. With its biocompatibility, permeability, and minimal autofluorescence, PDMS is anticipated to witness substantial utilization across various future biotechnology and biomedical engineering applications.

Glass secured the second-highest market revenue share in 2023 and is poised for lucrative growth in the forecast period. Renowned for its optical transparency, chemical inertness, and biocompatibility, glass stands as a preferred material in microfluidics, suitable for a wide array of applications within the field. Additionally, glass exhibits excellent properties for microfluidic devices, such as minimal autofluorescence and high thermal stability, crucial for preserving sample integrity and ensuring precise results in microfluidic systems. These inherent characteristics render glass a favored choice in the microfluidics industry, contributing significantly to its substantial market revenue share.

Microfluidic components emerged as the dominant force in the market in 2023, capturing the largest revenue share of 71%, and are poised to maintain this lead with the highest compound annual growth rate (CAGR) during the forecast period. These components encompass chips, micro-pumps, sensors, and other integral parts utilized in microfluidic devices. Characterized by their compact size and versatility, these components facilitate a wide range of applications, including automation, screening, analysis, and quantitative determination of biological elements such as galactose. The escalating demand for microfluidic components is driven by the imperative to analyze low-volume samples and the continual evolution of advanced technologies in the field. Notably, droplet microfluidics has emerged as a potent tool, enabling rapid and cost-effective compartmentalization of cells and analytes under precisely controlled conditions. This robust technology is poised to foster high-throughput screening, thereby bolstering market growth in the forecast period.

Microfluidic-based devices are anticipated to experience rapid growth during the forecast period, leveraging microfluidics principles to analyze fluids at the microscale level. Offering myriad advantages for biological analysis, these devices require minimal reagent volume and smaller samples, effectively mitigating the high costs associated with bulk quantities and space constraints in conventional laboratory setups. Furthermore, their compact size enables simultaneous processing of multiple analytes, further enhancing efficiency and cost-effectiveness. These inherent benefits are expected to propel the microfluidic-based devices market forward in the coming years.

In 2023, Lab-on-a-chip technology emerged as the dominant force in the market, boasting the highest compound annual growth rate (CAGR) of 37%. This innovative technology facilitates rapid DNA probe sequencing and high-speed thermal shifts at the microscale, crucial for DNA amplification using Polymerase Chain Reaction (PCR). Notably, Elveflow's Fastgene system, acclaimed as the fastest qPCR system, can detect bacteria and viruses within a mere 7 minutes. Additionally, nanopore technologies promise even swifter genome sequencing of DNA probes compared to traditional lab-on-a-chip methods, offering the potential for quick immunoassays completed in just 10 seconds, a significant advancement over macroscopic technologies. Lab-on-a-chip technology showcases immense potential in cell biology, particularly in regulating cells at the single-cell level while efficiently handling large volumes of cells. Elveflow's Opto Reader, a rapid optical detector, further enhances cell detection and isolation. Moreover, this technology finds applications in stem cell differentiation, micro patch-clamp, cell sorting, and high-speed flow cytometry, positioning lab-on-a-chip technology as a promising solution for ultra-fast detection of viruses and bacteria.

The organs-on-chips are projected to witness the fastest growth with a CAGR of 14.72% from 2024 to 2033, playing a pivotal role in drug discovery and development. The National Center for Advancing Translational Science (NCATS), in collaboration with the FDA and other National Institute of Health (NIH) centers, has spearheaded drug discovery efforts since 2012 through its Tissue Chip for Drug Screening initiative. This initiative focuses on crafting human tissue chips that faithfully replicate human organs, aiming to bridge the gap between research discovery and clinical trials, with a particular focus on high-need cures. For instance, a collaboration between NCATS, the FDA, and various NIH institutes aims to develop human tissue chips that closely mimic the structure and function of vital organs such as the heart, liver, and lungs. This collaborative endeavor seeks to enhance the accuracy and expediency of predicting human drug safety, marking a significant advancement in the field of drug development and safety assessment.

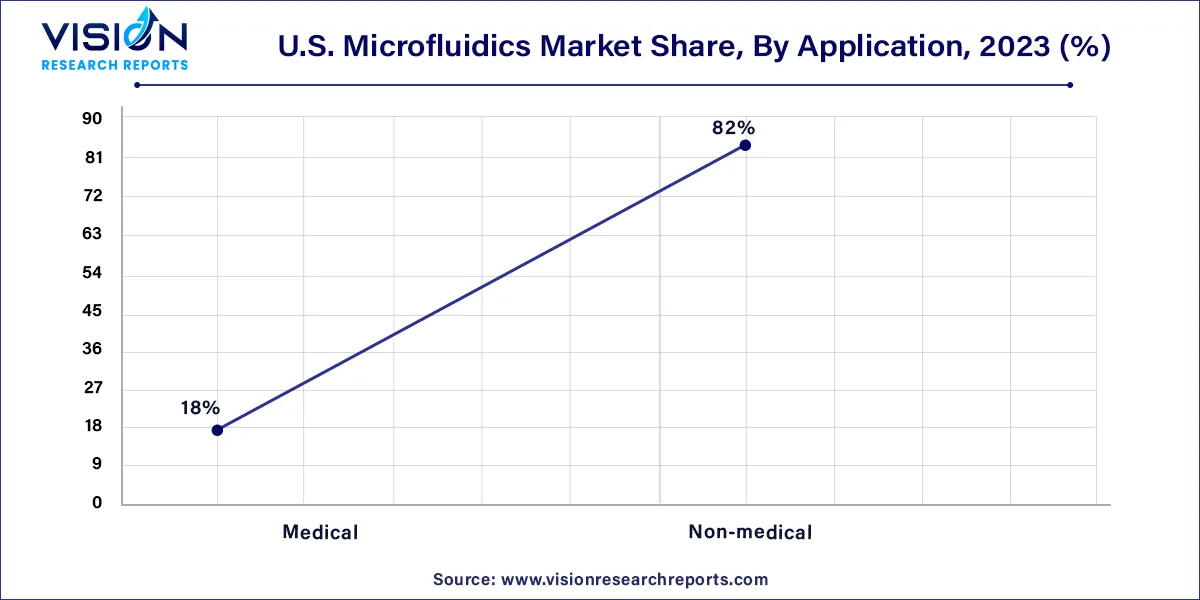

In 2023, the medical sector emerged as the dominant force in the market, commanding the highest revenue share of 82%, and is poised to sustain its leadership with the fastest compound annual growth rate (CAGR) during the forecast period. Microfluidics, a pivotal technology in biological analysis, chemical synthesis, and information technology, has revolutionized traditional laboratory equipment. It enables minimal reagent usage, maximizes information extraction from small samples, streamlines assay protocols, enhances sample processing, and provides precise control over cell microenvironments. Its applications extend to the medical and pharmaceutical realms, facilitating advancements in infectious disease diagnosis, cancer treatment, and the fabrication of functional tissues and organs. For instance, in August 2022, a team in Atlanta utilized microfluidics to develop the Cluster-Well chip, enabling swift detection and treatment of metastatic cancer. Furthermore, the automation of PCR reaction mix preparation in microfluidic PCR devices significantly reduces the risk of false positives and contamination attributable to human error.

Meanwhile, the non-medical segment is poised for lucrative growth in the forecast period. Microfluidics finds diverse applications in non-medical fields such as crude oil extraction, plant pathogen detection, and gas bubble production. It proves instrumental in developing methodologies for extracting crude oil from pollutant-mixed porous rocks, owing to its adeptness in handling complex interactions between pore structure and fluids. Moreover, micron-scale gas bubbles generated through microfluidics are widely utilized across industries, including food for fat reduction and texture modulation, and in other sectors for producing active ingredients, mesoporous materials, and facilitating natural gas recovery. The ability to generate micron-scale gas bubbles within the microfluidic industry presents novel opportunities for highly controlled fluid compartmentalization and holds promise for advancing various industrial processes.

By Product

By Application

By Material Type

By Technology

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others