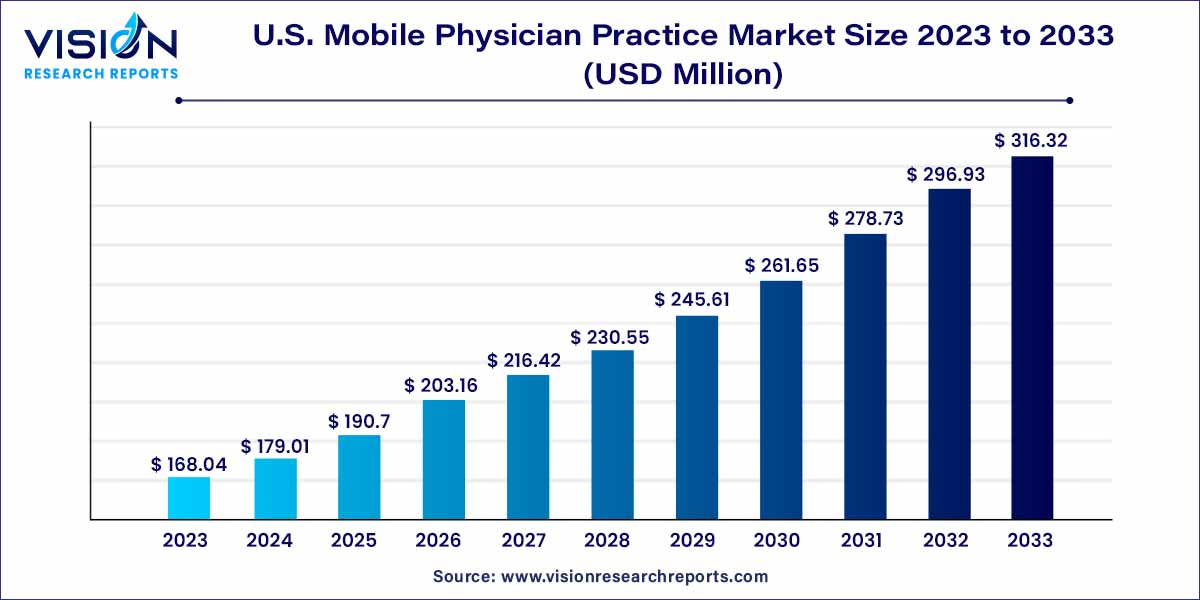

The U.S. mobile physician practice market size was valued at USD 168.04 million in 2023 and it is predicted to surpass around USD 316.32 million by 2033 with a CAGR of 6.53% from 2024 to 2033.

The U.S. mobile physician practice market is witnessing a paradigm shift in the delivery of healthcare services. With technological advancements and changing patient expectations, mobile physician practices are becoming a noteworthy component of the healthcare landscape. This overview aims to provide a comprehensive understanding of the key elements shaping the U.S. mobile physician practice market.

The growth of the U.S. mobile physician practice market is propelled by several key factors. Firstly, the rapid integration of advanced technologies, including mobile applications and telehealth platforms, has significantly enhanced the efficiency and accessibility of healthcare services. This technological evolution allows healthcare providers to offer timely consultations and medical support directly to patients' locations, fostering a more patient-centric approach. Additionally, the rising demand for convenient healthcare solutions aligns with the on-the-go nature of modern lifestyles, making mobile physician practices an appealing option for individuals seeking accessible and flexible medical care. The adoption of telemedicine solutions, coupled with the widespread use of mobile health applications, further contributes to the market's growth by providing users with seamless access to health-related information and services. Overall, these technological advancements and shifting patient preferences are driving the expansion of the U.S. Mobile Physician Practice Market, offering a promising and innovative avenue for healthcare delivery.

| Report Coverage | Details |

| Market Size in 2023 | USD 168.04 million |

| Revenue Forecast by 2033 | USD 316.32 million |

| Growth rate from 2024 to 2033 | CAGR of 6.53% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The emergency medicine segment dominated the market with the largest revenue share of 45% in 2023. The dominance is attributed to the increasing presence of the geriatric population, which requires frequent medical interventions. The increasing cost of visits to emergency medical departments, longer wait times, and understaffed emergency rooms (ER) have made it difficult for patients to get quality care.

The telehealth segment is expected to grow at the fastest CAGR of 7.45% during the forecast period. Rapidly evolving healthcare technology has enabled medical practitioners to use telehealth software and devices to remotely monitor patients and provide continuous quality care. Furthermore, mobile physician practice services are operating through mobile applications and websites that enable patients to schedule appointments at their convenience.

The primary care segment led the market with the highest revenue share of 20% in 2023. Primary care mobile practice provides routine check-ups, preventive care, and general consultation. Additionally, by providing primary care directly to patients, these practices enhance accessibility for patients with limited mobility.

The rehabilitation services material segment is estimated to register the fastest CAGR of 7.83% over the forecast period. The growth of the segment can be attributed to the increasing use of these practices in the treatment of patients recovering from surgeries, injuries, or strokes. Mobile rehabilitation practices provide targeted interventions, exercises, and therapies in the comfort of patients' homes, promoting faster recovery, improved functional outcomes, and reduced hospital readmissions.

Services offered by mobile physician practice services are an effective alternative in the U.S. healthcare delivery model. Physician house calls have significantly reduced healthcare expenditure for services such as primary care, wound care, rehabilitation, and short-term care services. Furthermore, mobile physician practice services have also reduced the number of non-emergent cases in hospital ER, which leads to unnecessary procedures and tying up of ER staff.

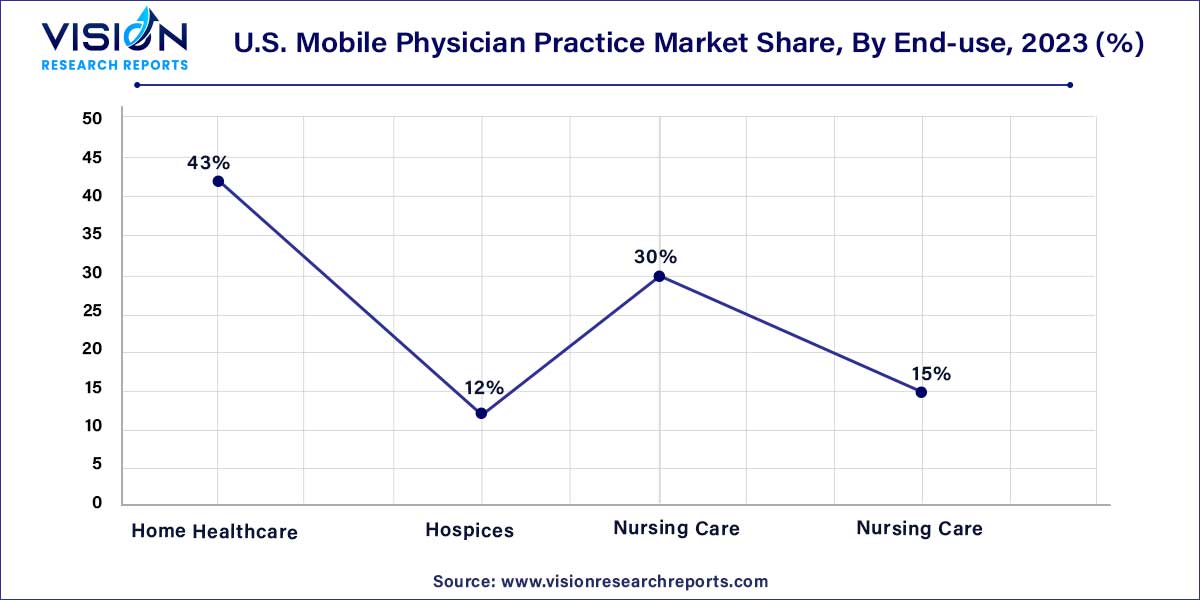

The home healthcare segment contributed the largest market share of 43% in 2023. The dominance is attributed to the convenience and comfort offered by mobile physician practice services. Long-term care centers collaborate with mobile physician services instead of maintaining in-house physicians, nursing practitioners, or assistants. Such collaborations allow these facilities to reduce the high cost of maintaining in-house medical practitioners. Most of the people receiving homecare in the U.S., are aged above 65 years, with approximately 97% of them requiring assistance while taking the bath and 91% of them requiring aid while transferring in and out of bed.

Mobile physician practice providers offer group care packages that allow patients to schedule home calls with medical practitioners for routine checkups or medical emergencies. Mobile physicians use telehealth software for remote patient monitoring for residents of these facilities. The payment of such services is generally covered by Medicare or third-party insurance. Uninsured patients can make out-of-pocket payments to service providers.

The hospices segment is expected to grow at the fastest CAGR of 8.37% over the forecast period. The home healthcare segment contributed the largest market share of 43% in 2023. Hospice care bring comprehensive medical services and support to patients in their homes, ensuring comfort, dignity, and quality of life in the final stages of illness. Mobile hospice provides personalized care, pain management, symptom control, and emotional support, creating a more compassionate and familiar environment for patients and their families. Therefore, contributing to the growth of the market.

By Type

By Services

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Mobile Physician Practice Market

5.1. COVID-19 Landscape: U.S. Mobile Physician Practice Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Mobile Physician Practice Market, By Type

8.1. U.S. Mobile Physician Practice Market, by Type, 2024-2033

8.1.1 Emergency Medicine

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Telehealth

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Mobile Physician Practice Market, By Services

9.1. U.S. Mobile Physician Practice Market, by Services, 2024-2033

9.1.1. Primary Care

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Short-Term Episodic Care

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Monitoring Services

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Wound Care

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Pain Management

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Rehabilitation Services

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Palliative Care

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Mobile Physician Practice Market, By End-use

10.1. U.S. Mobile Physician Practice Market, by End-use, 2024-2033

10.1.1. Home Healthcare

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Hospices

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Nursing Care

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Assisted Living Facility

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Mobile Physician Practice Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Services (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Mobile Physician Services, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. TeamHealth.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Doctor On Demand by Included Health, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Florida Mobile Physicians, LLC.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PriveMD.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PatientPop, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SOS Doctor Housecall.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others