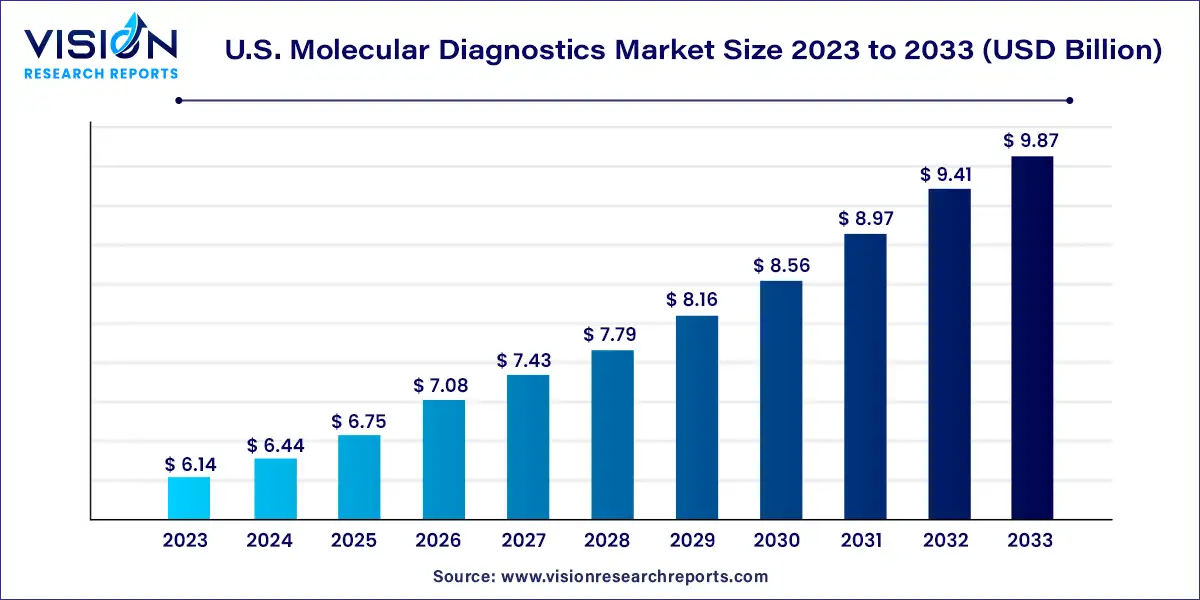

The U.S. molecular diagnostics market size was estimated at around USD 6.14 billion in 2023 and it is projected to hit around USD 9.87 billion by 2033, growing at a CAGR of 4.85% from 2024 to 2033.

The U.S. molecular diagnostics market represents a dynamic and rapidly evolving sector within the broader field of healthcare. Molecular diagnostics involves the analysis of genetic material at the molecular level to gain insights into various aspects of health and disease. In the United States, this market has experienced substantial growth, driven by technological advancements, a rising incidence of chronic diseases, and a shift towards personalized medicine.

The growth of the U.S. molecular diagnostics market is driven by an advancement of technology, with the integration of cutting-edge tools such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), enhancing the precision and efficiency of diagnostic procedures. A surge in the incidence of chronic diseases, including cancer and genetic disorders, further fuels market expansion as molecular diagnostics plays a pivotal role in early detection and personalized treatment strategies. Collaborations and partnerships within the industry contribute to the development of innovative diagnostic solutions, fostering a climate of shared expertise and resources. Additionally, regulatory support and evolving standards ensure the safety and efficacy of diagnostic technologies, providing a conducive environment for market growth. The trajectory is further buoyed by the transformative shift toward personalized medicine, where treatment plans are tailored to an individual's genetic makeup, reflecting a holistic approach to healthcare.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.14 billion |

| Revenue Forecast by 2033 | USD 9.87 billion |

| Growth rate from 2024 to 2033 | CAGR of 4.85% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The respiratory disease segment dominated the market with a share of 42% in 2023. The growth is attributed to the increasing prevalence of respiratory infections such as HPIVs, MDR-TB, and group A streptococcal, among others, coupled with the increasing awareness regarding the availability of diagnostics tests for diagnosing and treatment of infections. According to a study conducted by the CDC, there has been a significant increase in the number of parainfluenza infections till December 2023. This is further contributing to the growing number of hospitalizations caused by HPIVs.

The healthcare-associated infections segment is anticipated to witness the fastest growth from 2024 to 2033. The growth is attributed to the increasing incidences of HAI and technological advancements in diagnostic techniques are driving the growth. According to a study published by the National Library of Medicine in December 2023, around 4% of the total hospitalizations are affected by HAI in the U.S. every year. Furthermore, rising government support in the form of initiatives to reduce the incidence of infections during hospitalizations is anticipated to fuel the growth over the forecast period. For instance, in 2023, the Centers for Medicare & Medicaid Services introduced the Hospital-Acquired Condition (HAC) Reduction Program to encourage hospitals to reduce incidences of infection during hospitalization and improve overall patient safety.

The hospital core laboratory held the largest share of 40% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is attributed to the increasing prevalence of infections, such as MRSA, Staphylococcus aureus (SA), and enterovirus. According to a study published by NCBI in May 2023, the prevalence of SA carriage was found to be 30.2% among individuals aged between 18 years and 64 years, 20.7% among children, and 16.7% among people aged more than 65 years.

Reference labs are also expected to register a considerable CAGR during the forecast period. Increasing government support through initiatives and reimbursement policies is anticipated to drive market growth over the forecast period. For instance, in March 2023, the U.S. government launched the AHRQ Safety Program for MRSA Prevention. The program is anticipated to boost the demand for molecular diagnostic techniques by creating awareness regarding multidrug-resistant organisms and MRSA transmission.

By Disease

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others