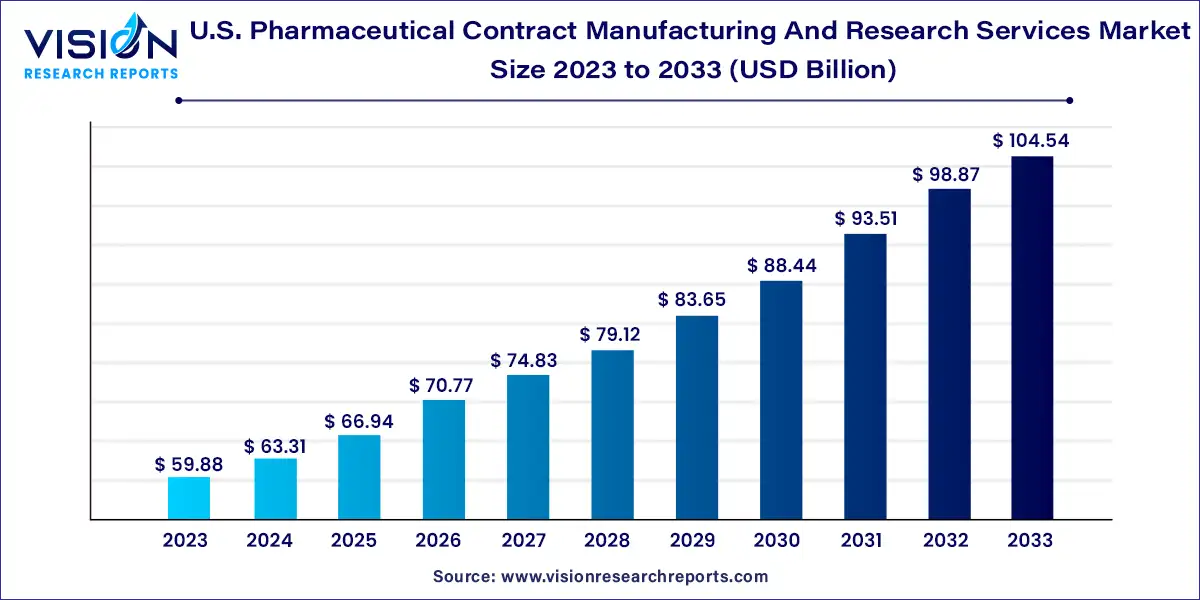

The U.S. pharmaceutical contract manufacturing and research services market size was estimated at around USD 59.88 billion in 2023 and it is projected to hit around USD 104.54 billion by 2033, growing at a CAGR of 5.73% from 2024 to 2033. The U.S. pharmaceutical contract manufacturing and research services market is driven by cost and time efficiency advantages linked with outsourcing. Companies are continually investing in facilities, workforce, and technology to capture a larger portion of the outsourcing revenue.

The pharmaceutical contract manufacturing and research services market in the United States is a dynamic and rapidly evolving sector, playing a crucial role in the development and production of pharmaceutical products. This market encompasses a wide range of services provided by contract manufacturing organizations (CMOs) and contract research organizations (CROs) to pharmaceutical companies, biotechnology firms, and academic institutions.

The growth of the U.S. pharmaceutical contract manufacturing and research services market is driven by several key factors. Firstly, the increasing complexity of drug development processes has led pharmaceutical companies to outsource manufacturing and research services to specialized firms, driving demand in the market. Additionally, the growing trend towards personalized medicine and biologics necessitates advanced manufacturing capabilities and expertise, further fueling market expansion. Moreover, stringent regulatory requirements and the need for compliance with Good Manufacturing Practices (GMP) prompt pharmaceutical companies to collaborate with contract manufacturing organizations (CMOs) possessing the necessary expertise and infrastructure.

Furthermore, the rise of innovative technologies such as continuous manufacturing and advanced analytics enhances efficiency and cost-effectiveness, driving adoption among pharmaceutical manufacturers. Overall, these factors contribute to the robust growth of the U.S. pharmaceutical contract manufacturing and research services market, offering opportunities for both service providers and pharmaceutical companies seeking to streamline their operations and focus on core competencies.

Manufacturing asserted its dominance in the market, securing the largest revenue share of over 67% in 2023. This was fueled by a growing inclination among companies to outsource the production of drug substances, APIs, and completed drug products or clinical trial materials. Contract manufacturers offer an array of services to the pharmaceutical industry, including safety evaluation, dosage and formulation development, regulatory support, analytical assay development, and release and stability testing. These manufacturers are often chosen as a temporary solution to address limitations in production capacity. The manufacturing sector is further segmented into various sub-sectors, encompassing API/bulk drug manufacturing, advanced drug delivery formulations, packaging, and finished dose formulations. Companies are actively investing in establishing large-scale manufacturing facilities, both at the pilot and commercial levels.

Research is poised to experience the fastest CAGR during the forecast period. The growth in this segment is propelled by the presence of numerous multinational and established contract service providers such as Charles River Laboratories, Pharmaceutical Product Development Inc. (PPD), Covance, and Quintiles. These market players stand to benefit from the rising trend of outsourcing. The Contract Research Organization (CRO) sector has witnessed a surge in mergers and acquisitions, intensifying competition among CROs. Consequently, CROs are enhancing their capabilities to meet the evolving needs of drug developers. Services offered by CROs span from drug development inception to final marketing approval. The segment is further subdivided into oncology, vaccines, inflammation & immunology, cardiology, neuroscience, and other specialized areas.

By Service

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others