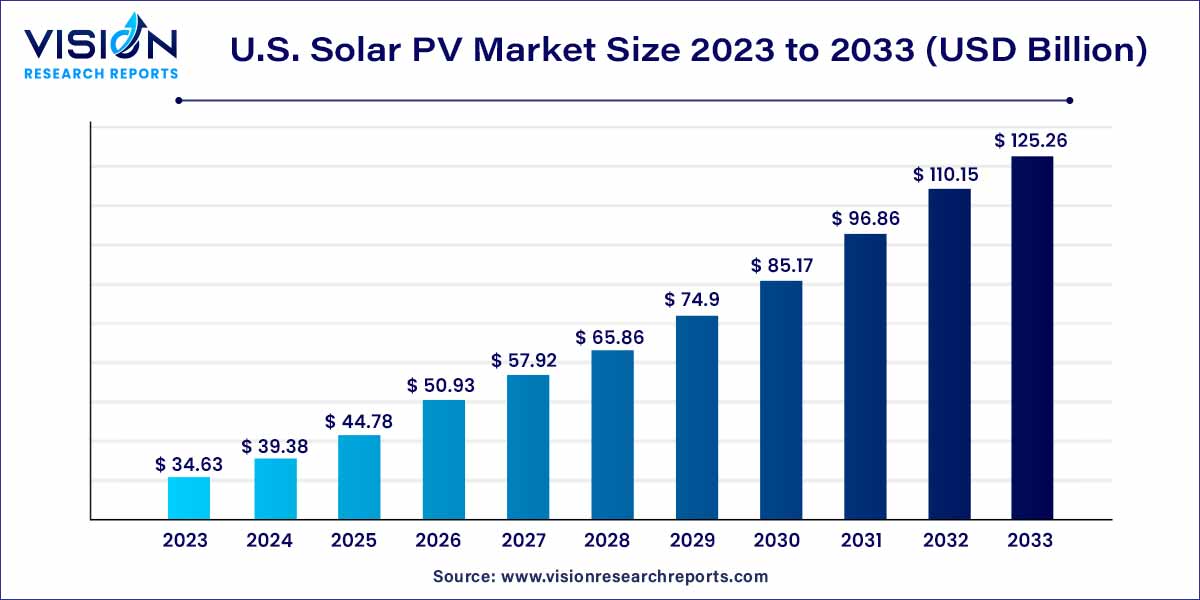

The U.S. solar PV market size was estimated at USD 34.63 billion in 2023 and it is expected to surpass around USD 125.26 billion by 2033, poised to grow at a CAGR of 13.72% from 2024 to 2033.

The U.S. solar photovoltaic (PV) market stands as a beacon of innovation and sustainability in the realm of renewable energy. With advancements in technology, supportive policies, and increasing environmental consciousness, solar PV has become a cornerstone of the nation's energy transition. This overview provides a detailed insight into the current landscape of the U.S. solar PV market, shedding light on its key components, market size, growth trends, and the factors driving its expansion.

The growth of the U.S. Solar PV market can be attributed to several key factors. Firstly, robust government incentives and policies have significantly reduced the financial barriers for both residential and commercial consumers, making solar PV installations more accessible and appealing. Additionally, advancements in solar technology, including the development of more efficient and affordable solar panels, have bolstered the market. Rising environmental awareness and the global push towards sustainable energy solutions have further accelerated the adoption of solar PV systems. Moreover, increased investment in research and development has led to innovations in energy storage solutions, addressing the intermittent nature of solar power and enhancing grid stability. These factors, combined, have created a favorable environment for the widespread growth of the U.S. Solar PV market, making it a leading player in the renewable energy sector.

| Report Coverage | Details |

| Market Size in 2023 | USD 34.63 billion |

| Revenue Forecast by 2033 | USD 125.26 billion |

| Growth rate from 2024 to 2033 | CAGR of 13.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The utility segment held the largest revenue share of 67% in 2023. Utility companies across the country are increasingly turning to solar PV as a reliable source of renewable energy, contributing significantly to the reduction of greenhouse gas emissions and meeting the escalating energy demands of the nation. The advantage of utility-scale solar lies in its ability to produce electricity at a scale capable of powering thousands of homes and businesses, thereby driving the transition towards a more sustainable energy infrastructure. Additionally, utility-scale solar projects have become economically competitive, attracting investments from both public and private sectors, further fueling the expansion of solar energy generation across the country.

The residential segment is anticipated to grow at the fastest CAGR of 13.95% during forecast period. The residential solar PV applications have become increasingly prevalent in the United States. Homeowners are embracing solar energy as a viable solution to reduce electricity costs while contributing to environmental conservation. Residential solar PV systems, typically installed on rooftops, harness sunlight and convert it into electricity for domestic use. Advancements in solar technology have made these systems more efficient and affordable, making solar PV installations an attractive option for homeowners seeking energy independence and sustainability. Federal and state-level incentives, such as tax credits and net metering programs, have further incentivized residential solar adoption, allowing homeowners to sell excess electricity back to the grid, thus enhancing the overall economic feasibility of residential solar installations. The residential sector's enthusiasm for solar PV reflects a growing trend towards decentralized energy production, empowering individual households to actively participate in the shift towards renewable energy sources.

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Solar PV Market

5.1. COVID-19 Landscape: U.S. Solar PV Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Solar PV Market, By Application

8.1.U.S. Solar PV Market, by Application Type, 2024-2033

8.1.1. Residential

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-residential

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Utility

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Solar PV Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. First Solar

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. SunPower

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Suniva

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. 1Soltech

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Sharp

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Alps Technology

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Advance power

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Auxin solar

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. BORG Inc.

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Pionis Energy

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others