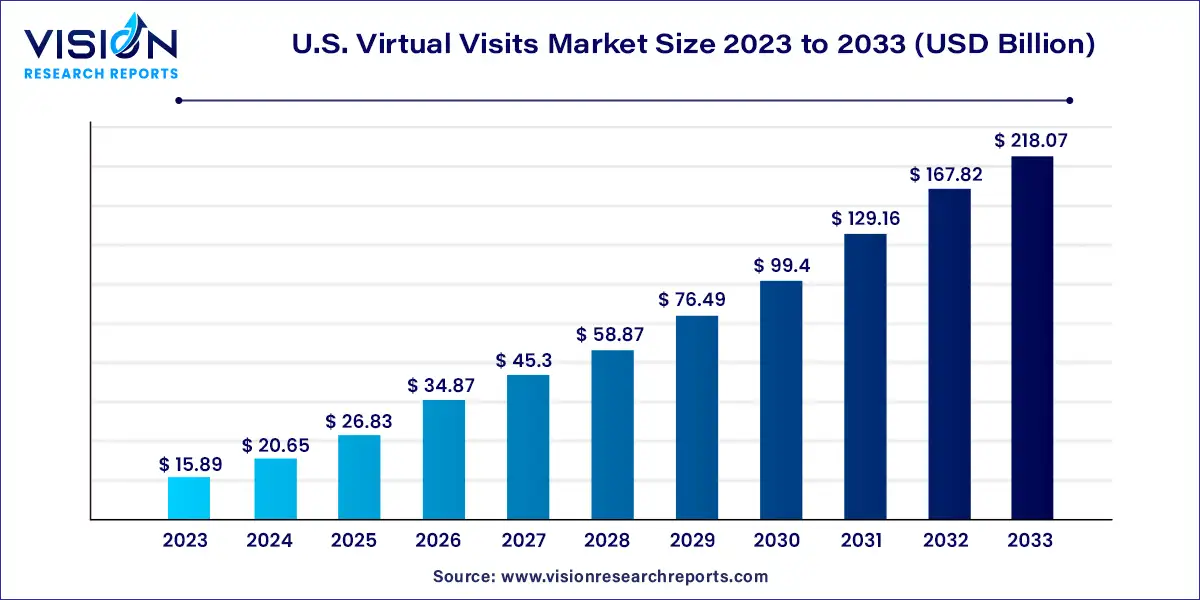

The U.S. virtual visits market was estimated at USD 15.89 billion in 2023 and it is expected to surpass around USD 218.07 billion by 2033, poised to grow at a CAGR of 29.94% from 2024 to 2033.

The U.S. virtual visits market is driven by the increasing adoption of telehealth solutions and the growing demand for convenient and accessible healthcare services. Virtual visits, also known as telemedicine or telehealth appointments, allow patients to consult with healthcare providers remotely using video conferencing, audio calls, or secure messaging platforms.

The growth of the U.S. virtual visits market is driven by an advancement in technology, particularly in telecommunications, have facilitated seamless remote consultations between patients and healthcare providers. Additionally, the changing landscape of healthcare towards value-based models and patient-centric approaches has spurred the adoption of telehealth solutions. The COVID-19 pandemic has also played a significant role, accelerating the acceptance of virtual visits as healthcare systems sought to maintain continuity of care while minimizing the risk of virus transmission. Consumer demand for convenience has further fueled market growth, as virtual visits offer a flexible and accessible alternative to traditional in-person appointments. Moreover, regulatory support, including expanded reimbursement policies and relaxed licensure requirements, has facilitated widespread adoption.

| Report Coverage | Details |

| Market Size in 2023 | USD 15.89 billion |

| Revenue Forecast by 2033 | USD 218.07 billion |

| Growth rate from 2024 to 2033 | CAGR of 29.94% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of age group, the 18 – 34 years segment dominated the market with the largest revenue share in 2023. An increase in the penetration of smartphones in this age group, increasingly high internet usage, and a steady increase in the number of mental health issues have resulted in a large market share. The increase in the number of people reporting mental health issues and the increased rate of anxiety and depression among people in this age group is expected to propel growth in this segment.

The 35 to 49 years age group segment is expected to grow at the fastest CAGR over the forecast period due to the increasing prevalence of chronic illnesses like diabetes, hypertension, and various cardiovascular diseases. According to a report by the Centers for Disease Control and Prevention, nearly 18.2 million adults aged 20 and above suffer from coronary artery disease; nearly half the adult population in the U.S. has hypertension, and 47% population or 116 million people have hypertension. The numerous advantages associated with virtual visits like lesser waiting time due to pre-scheduling, decreased chances of contracting additional infections from hospitals, and ease and comfort of the process are all expected to propel the virtual visits market in the forecast period.

In terms of gender, the female segment dominated the market with the largest revenue share of 66% in 2023. The pandemic highlighted the need to access healthcare facilities in a safe environment for pregnant women to avoid the risk of contracting the virus through hospital visits, which was the primary factor for the large revenue share for this segment. Virtual visits were the need of the hour and were increasingly adopted by women all over the country.

The male segment is expected to grow at the fastest CAGR of 31.74% over the forecast period owing to the ease of use of teleconsultations for various conditions like increasing mental health issues, sexual health concerns like erectile dysfunction and STDs, stress management, and various other health conditions without visiting the doctor in person. Virtual visits have come a long way and are not just restricted to video calling, connected apps, and devices that make patient monitoring easier. Consumers are increasingly leaning towards this form of consultation to avoid wastage of time and resources by going to hospitals unless necessary. These factors are expected to boost the growth of the segment over the forecast period.

In terms of service type, the urgent care segment dominated the market with the largest revenue share of 31% in 2023. The increase in demand for virtual visits within the urgent care segment can be attributed to the convenience and accessibility that virtual visits offer to patients. By seamlessly integrating technology into the urgent care industry, individuals have the opportunity to seek medical advice and treatment remotely, thereby eliminating the need for physical visits to healthcare facilities.

The allergies segment is expected to grow at the fastest CAGR of 35.55% over the forecast period. Allergies, which can cause mild discomfort to severe reactions, are a prevalent health condition that affects a large percentage of the U.S. population. Individuals can seek medical advice and treatment for allergy-related illnesses through virtual visits, which eliminates the need for in-person visits to healthcare institutions. Virtual visits enable individuals to communicate with licensed healthcare providers via a variety of online portals, smartphone apps, and telecommunication channels. Individuals seeking allergy-related care have found this ease of access to virtual appointments to be extremely beneficial.

The cold and flu management segment held a considerable market share of 31% in 2023. This can be attributed to the fact that patients are increasingly preferring virtual visits to consult physicians regarding cold and flu symptoms. The majority of the patients in this category resorted to teleconsultations to avoid the spread of infection and contracting additional symptoms through physical visits to hospitals. An increase in the prevalence of influenza during the pandemic has also resulted in the growth of the segment.

In terms of commercial plan type, the self-funded/ASO group plans segment dominated the market with the largest revenue share in 2023 owing to an increase in the prevalence of chronic diseases, skyrocketing healthcare costs, and an increase in demand for affordable healthcare solutions.

The small group commercial plan segment is anticipated to grow at the fastest CAGR over the forecast period. Demand for virtual care has been steadily increasing and more so due to the COVID-19 pandemic, Several initiatives undertaken by both public and private entities to decrease the burden of healthcare costs on small businesses and their employees, which in turn is expected to boost the growth of small group commercial plan segment.

By Service Type

By Age Group

By Gender

By Commercial Plan Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Virtual Visits Market

5.1. COVID-19 Landscape: U.S. Virtual Visits Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Virtual Visits Market, By Service Type

8.1. U.S. Virtual Visits Market, by Service Type, 2024-2033

8.1.1. Cold and Flu Management

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Allergies

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Urgent Care

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Preventive Care

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Chronic Care Management

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Behavioral Health

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Virtual Visits Market, By Age Group

9.1. U.S. Virtual Visits Market, by Age Group, 2024-2033

9.1.1. Age 18-34

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Age 35-49

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Age 50-64

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Age 65 and above

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Virtual Visits Market, By Gender

10.1. U.S. Virtual Visits Market, by Gender, 2024-2033

10.1.1. Male

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Female

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Virtual Visits Market, By Commercial Plan Type

11.1. U.S. Virtual Visits Market, by Commercial Plan Type, 2024-2033

11.1.1. Small Group

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Self-Funded/ASO Group Plans

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Medicaid

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Medicare

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Virtual Visits Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Age Group (2021-2033)

12.1.3. Market Revenue and Forecast, by Gender (2021-2033)

12.1.4. Market Revenue and Forecast, by Commercial Plan Type (2021-2033)

Chapter 13. Company Profiles

13.1. American Well

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. MDLIVE

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Doctor On Demand by Included Health, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. eVisit

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Teladoc Health, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. MeMD

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. HealthTap, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Vidyo, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. PlushCare

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Zipnosis

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others