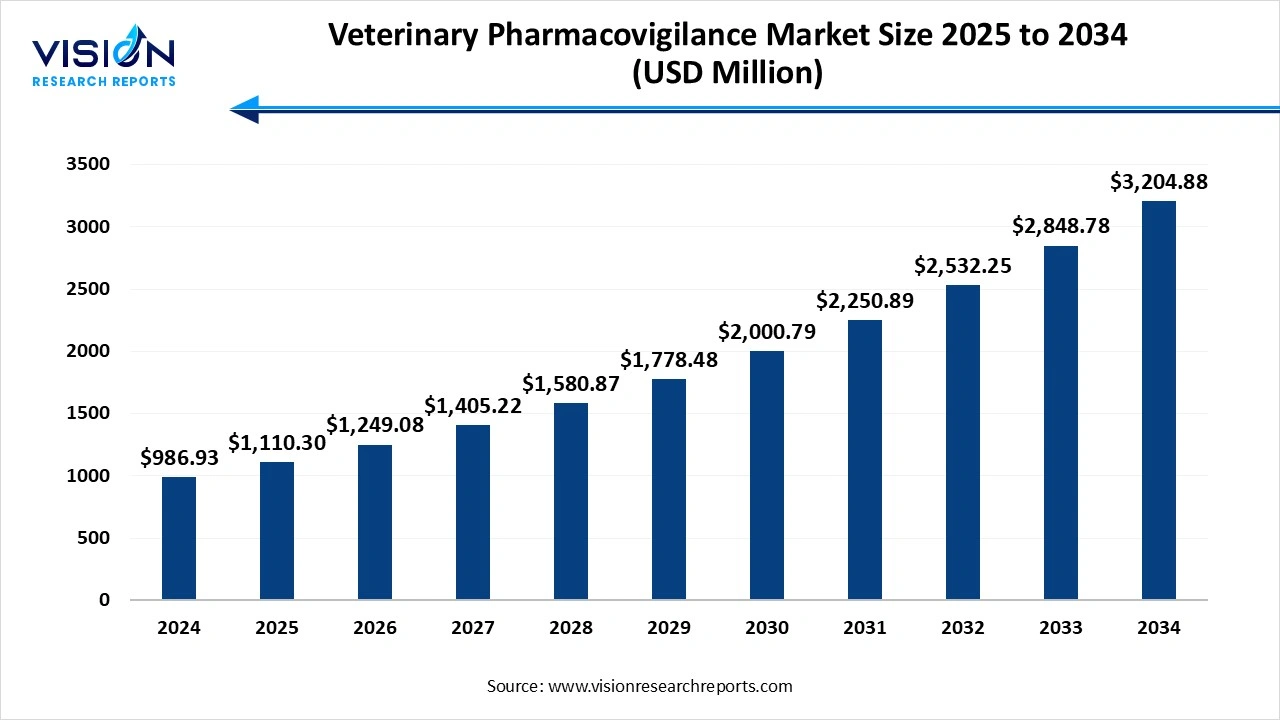

The global veterinary pharmacovigilance market size was valued at USD 986.93 million in 2024 and it is projected to hit around USD 3,204.88 million by 2034, growing at a CAGR of 12.5% from 2025 to 2034. The market growth is driven by the increasing global pet ownership, rising awareness regarding animal health, and stringent regulatory mandates for drug safety monitoring, the veterinary pharmacovigilance market is experiencing steady growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 986.93 million |

| Revenue Forecast by 2034 | USD 3,204.88 million |

| Growth rate from 2025 to 2034 | CAGR of 12.5% |

| Base Year | 2024 |

| Forecast Period | 2024 to 2035 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | ArisGlobal; Accenture; Ennov; Sarjen Systems Pvt. Ltd.; Pharsafer Associates Limited; Knoell; Biologit; Indivirtus; Azierta Contract Science Support Consulting; Oy Medfiles Ltd. |

The veterinary pharmacovigilance market plays a critical role in ensuring the safety and effectiveness of veterinary medicines by monitoring, assessing, and preventing adverse effects associated with their use. As the demand for animal healthcare grows globally driven by increasing pet ownership, livestock production, and the growing significance of animal-derived food products the importance of pharmacovigilance in veterinary medicine continues to rise. Regulatory authorities and pharmaceutical companies are increasingly emphasizing post-marketing surveillance to maintain public health, animal welfare, and environmental safety.

The market is also being driven by stricter regulations from agencies such as the European Medicines Agency (EMA), the U.S. Food and Drug Administration (FDA), and other national veterinary drug regulatory bodies. These organizations are implementing guidelines that mandate more rigorous reporting and monitoring of veterinary drug safety, thereby boosting the demand for robust pharmacovigilance systems.

The growth of the veterinary pharmacovigilance market is primarily fueled by the rising global awareness regarding animal health and food safety. As the consumption of animal-derived products such as milk, meat, and eggs continues to increase, there is growing concern over drug residues and antimicrobial resistance. This has prompted governments and international organizations to implement stricter regulations and monitoring systems for veterinary drug use. The push for regulatory compliance encourages pharmaceutical companies and veterinarians to adopt pharmacovigilance practices to detect, assess, and prevent adverse drug events, driving the overall market forward.

In addition, the surge in companion animal ownership, coupled with higher spending on pet healthcare, is boosting the need for safer and more effective veterinary treatments. With more veterinary drugs being developed and marketed, there is a parallel increase in the demand for post-marketing surveillance systems to ensure product safety. Technological advancements in pharmacovigilance tools such as real-time data analytics, AI-based signal detection, and cloud-based reporting systems are also enhancing the efficiency and accuracy of monitoring adverse events.

One of the primary challenges faced by the veterinary pharmacovigilance market is the underreporting of adverse drug reactions (ADRs) in animals. Unlike human healthcare, veterinary professionals and animal owners often lack awareness or formal training on how and when to report drug-related side effects. Additionally, limited infrastructure and inconsistent reporting systems in developing regions contribute to data gaps, making it difficult to assess the true safety profile of veterinary products. These factors reduce the effectiveness of pharmacovigilance programs and delay the identification of harmful drug reactions.

Another significant hurdle is the complexity of managing pharmacovigilance across various animal species, each with unique physiological responses to medications. The market also faces challenges in collecting standardized data, as adverse effects can be influenced by breed, age, species, and environmental conditions.

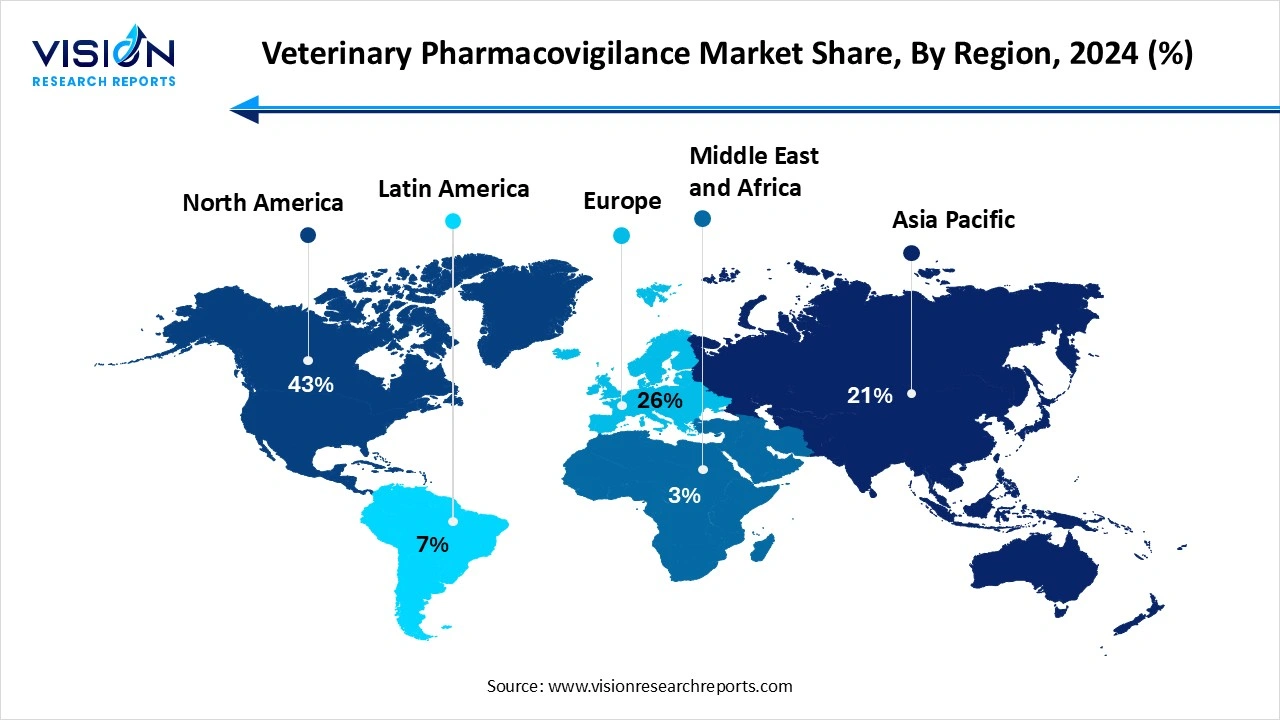

North America led the global veterinary pharmacovigilance market, holding the largest revenue share of 43% in 2024. Food and Drug Administration (FDA), and growing investments in veterinary research. The region benefits from advanced pharmacovigilance infrastructure, high awareness among veterinarians and pet owners, and increasing pet ownership, all of which contribute to the consistent reporting and monitoring of adverse drug events.

The veterinary pharmacovigilance market in Asia Pacific is projected to expand at a promising CAGR of 15.5% throughout the forecast period. While the region is still developing its pharmacovigilance capabilities, growing awareness and adoption of digital health technologies are improving the reporting and tracking of adverse drug reactions. Countries like China, India, and Australia are making strategic advancements in veterinary healthcare and pharmacovigilance systems, positioning Asia Pacific as a promising market for future expansion.

The veterinary pharmacovigilance market in Asia Pacific is projected to expand at a promising CAGR of 15.5% throughout the forecast period. While the region is still developing its pharmacovigilance capabilities, growing awareness and adoption of digital health technologies are improving the reporting and tracking of adverse drug reactions. Countries like China, India, and Australia are making strategic advancements in veterinary healthcare and pharmacovigilance systems, positioning Asia Pacific as a promising market for future expansion.

The software segment led the global veterinary pharmacovigilance industry, capturing the highest revenue share of 52% in 2024. Software solutions are gaining rapid traction due to their ability to streamline data collection, manage adverse event reports, and support regulatory compliance. These platforms often integrate with cloud-based systems and utilize advanced technologies such as artificial intelligence and machine learning to identify safety signals and patterns more efficiently. Veterinary pharmacovigilance software also enables real-time tracking and centralized data management, significantly improving the accuracy and speed of pharmacovigilance processes.

The services segment is projected to register a CAGR of 14.1% during the forecast period. These services typically include case processing, signal detection, risk management, regulatory submissions, and compliance support. Many animal health companies are partnering with specialized service providers to navigate complex regulatory frameworks and focus on core research and development activities. The outsourcing of pharmacovigilance tasks not only reduces operational costs but also provides access to expert knowledge and global databases, enhancing the quality and reliability of safety monitoring.

The in-house segment dominated the market, accounting for the largest revenue share of 55% in 2024. These companies invest in dedicated teams, advanced technologies, and regulatory systems to closely monitor and control the entire pharmacovigilance process. This model offers greater control over data confidentiality, real-time reporting, and compliance management. In-house pharmacovigilance also facilitates quicker decision-making, as communication channels and reporting structures are well-established within the organization, ensuring timely response to potential safety concerns.

The contract outsourcing is projected to grow at a strong CAGR of 14.8% over the forecast period. By outsourcing pharmacovigilance functions to third-party service providers, companies can reduce operational burdens while gaining access to skilled professionals, global regulatory knowledge, and advanced analytical tools. Outsourcing allows for scalable solutions tailored to specific project or product needs, which is particularly beneficial in a highly regulated and evolving market.

The anti-infective segment accounted for the largest market share at 46% in 2024. Given their extensive use, particularly in the livestock industry, there is a heightened need for vigilant pharmacovigilance to monitor potential adverse effects, drug resistance, and residue levels in animal-derived food products. The widespread administration of anti-infective agents has raised global concerns about antimicrobial resistance, prompting stricter regulatory guidelines and increased reporting requirements. As a result, pharmacovigilance systems for anti-infectives are being strengthened to ensure safety, efficacy, and compliance with evolving international standards.

The biologics are expected to register the fastest CAGR of 14.5% between 2025 and 2034. These products offer targeted and often more sustainable solutions for disease prevention and treatment in animals. With the expansion of the biologics pipeline in veterinary medicine, especially in response to emerging zoonotic diseases and improved animal welfare practices, there is a growing need for robust post-marketing surveillance. Pharmacovigilance for biologics focuses on detecting immunological reactions, rare adverse events, and long-term safety outcomes. As biologics are typically more complex than traditional small-molecule drugs, they require advanced monitoring tools and detailed safety assessments.

The dogs accounted for the largest share of revenue in the veterinary harmacovigilance industry, holding a dominant position with 51% in 2024. As the number of domestic cats continues to rise globally, particularly in urban households, the demand for safe and effective veterinary drugs for feline healthcare is increasing. Cats are susceptible to a variety of health conditions, including respiratory diseases, parasitic infections, and chronic illnesses, requiring ongoing treatment and preventive care. This growing use of veterinary pharmaceuticals in cats necessitates a robust pharmacovigilance system to monitor potential adverse drug reactions, ensure drug safety, and maintain the well-being of the animal.

The cats segment is projected to register a notable CAGR throughout the forecast period. Cats may metabolize medications differently compared to other animals, making them more vulnerable to certain side effects if not properly monitored. As a result, pharmaceutical companies and veterinary healthcare providers are prioritizing post-marketing surveillance in feline therapeutics. With increasing awareness among cat owners about pet safety and the importance of veterinary oversight, there is a stronger emphasis on adverse event reporting and regulatory compliance.

By Solution

By Product

By Type

By Animal Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Veterinary Pharmacovigilance Market

5.1. COVID-19 Landscape: Veterinary Pharmacovigilance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Veterinary Pharmacovigilance Market, By Solution

8.1. Veterinary Pharmacovigilance Market, by Solution, 2025-2034

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Veterinary Pharmacovigilance Market, By Product

9.1. Veterinary Pharmacovigilance Market, by Product, 2025-2034

9.1.1. Biologics

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Anti-infectives

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Other Product

9.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Veterinary Pharmacovigilance Market, By Type

10.1. Veterinary Pharmacovigilance Market, by Type, 2025-2034

10.1.1. In-house

10.1.1.1. Market Revenue and Forecast (2025-2034)

10.1.2. Contract Outsourcing

10.1.2.1. Market Revenue and Forecast (2025-2034)

Chapter 11. Global Veterinary Pharmacovigilance Market, By Animal Type

11.1. Veterinary Pharmacovigilance Market, by Animal Type, 2025-2034

11.1.1. Dogs

11.1.1.1. Market Revenue and Forecast (2025-2034)

11.1.2. Cats

11.1.2.1. Market Revenue and Forecast (2025-2034)

11.1.3. Other Animal Types

11.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 12. Global Veterinary Pharmacovigilance Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Solution (2025-2034)

12.1.2. Market Revenue and Forecast, by Product (2025-2034)

12.1.3. Market Revenue and Forecast, by Type (2025-2034)

12.1.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Solution (2025-2034)

12.1.5.2. Market Revenue and Forecast, by Product (2025-2034)

12.1.5.3. Market Revenue and Forecast, by Type (2025-2034)

12.1.5.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Solution (2025-2034)

12.1.6.2. Market Revenue and Forecast, by Product (2025-2034)

12.1.6.3. Market Revenue and Forecast, by Type (2025-2034)

12.1.6.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Solution (2025-2034)

12.2.2. Market Revenue and Forecast, by Product (2025-2034)

12.2.3. Market Revenue and Forecast, by Type (2025-2034)

12.2.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Solution (2025-2034)

12.2.5.2. Market Revenue and Forecast, by Product (2025-2034)

12.2.5.3. Market Revenue and Forecast, by Type (2025-2034)

12.2.5.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Solution (2025-2034)

12.2.6.2. Market Revenue and Forecast, by Product (2025-2034)

12.2.6.3. Market Revenue and Forecast, by Type (2025-2034)

12.2.6.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Solution (2025-2034)

12.2.7.2. Market Revenue and Forecast, by Product (2025-2034)

12.2.7.3. Market Revenue and Forecast, by Type (2025-2034)

12.2.7.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Solution (2025-2034)

12.2.8.2. Market Revenue and Forecast, by Product (2025-2034)

12.2.8.3. Market Revenue and Forecast, by Type (2025-2034)

12.2.8.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Solution (2025-2034)

12.3.2. Market Revenue and Forecast, by Product (2025-2034)

12.3.3. Market Revenue and Forecast, by Type (2025-2034)

12.3.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Solution (2025-2034)

12.3.5.2. Market Revenue and Forecast, by Product (2025-2034)

12.3.5.3. Market Revenue and Forecast, by Type (2025-2034)

12.3.5.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Solution (2025-2034)

12.3.6.2. Market Revenue and Forecast, by Product (2025-2034)

12.3.6.3. Market Revenue and Forecast, by Type (2025-2034)

12.3.6.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Solution (2025-2034)

12.3.7.2. Market Revenue and Forecast, by Product (2025-2034)

12.3.7.3. Market Revenue and Forecast, by Type (2025-2034)

12.3.7.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Solution (2025-2034)

12.3.8.2. Market Revenue and Forecast, by Product (2025-2034)

12.3.8.3. Market Revenue and Forecast, by Type (2025-2034)

12.3.8.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Solution (2025-2034)

12.4.2. Market Revenue and Forecast, by Product (2025-2034)

12.4.3. Market Revenue and Forecast, by Type (2025-2034)

12.4.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Solution (2025-2034)

12.4.5.2. Market Revenue and Forecast, by Product (2025-2034)

12.4.5.3. Market Revenue and Forecast, by Type (2025-2034)

12.4.5.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Solution (2025-2034)

12.4.6.2. Market Revenue and Forecast, by Product (2025-2034)

12.4.6.3. Market Revenue and Forecast, by Type (2025-2034)

12.4.6.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Solution (2025-2034)

12.4.7.2. Market Revenue and Forecast, by Product (2025-2034)

12.4.7.3. Market Revenue and Forecast, by Type (2025-2034)

12.4.7.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Solution (2025-2034)

12.4.8.2. Market Revenue and Forecast, by Product (2025-2034)

12.4.8.3. Market Revenue and Forecast, by Type (2025-2034)

12.4.8.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Solution (2025-2034)

12.5.2. Market Revenue and Forecast, by Product (2025-2034)

12.5.3. Market Revenue and Forecast, by Type (2025-2034)

12.5.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Solution (2025-2034)

12.5.5.2. Market Revenue and Forecast, by Product (2025-2034)

12.5.5.3. Market Revenue and Forecast, by Type (2025-2034)

12.5.5.4. Market Revenue and Forecast, by Animal Type (2025-2034)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Solution (2025-2034)

12.5.6.2. Market Revenue and Forecast, by Product (2025-2034)

12.5.6.3. Market Revenue and Forecast, by Type (2025-2034)

12.5.6.4. Market Revenue and Forecast, by Animal Type (2025-2034)

Chapter 13. Company Profiles

13.1. ArisGlobal

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Accenture

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Ennov

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Sarjen Systems Pvt. Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Pharsafer Associates Limited

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Knoell

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Biologit

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Indivirtus

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Azierta Contract Science Support Consulting;

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Oy Medfiles Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others