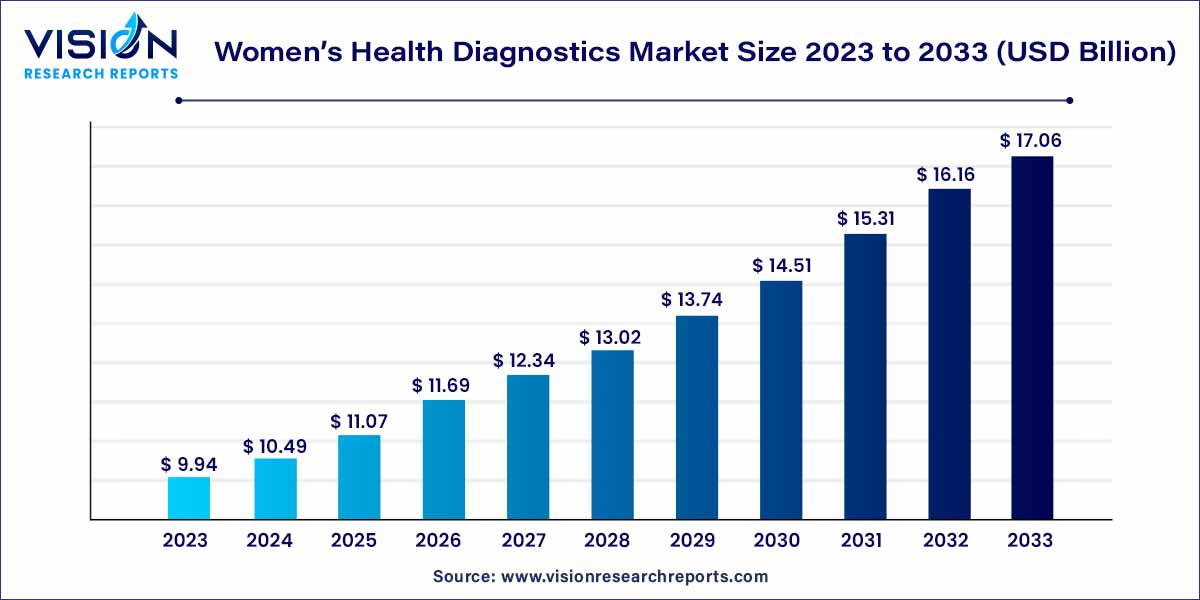

The global women’s health diagnostics market size was estimated at around USD 19.21 billion in 2023 and it is projected to hit around USD 39.01 billion by 2033, growing at a CAGR of 7.34%from 2024 to 2033. The increasing occurrence of infectious diseases, like hepatitis and urinary tract infections, among women is expected to boost growth in the forecast period. Early detection of health issues using digital and mobile mammography tools, such as breast MRI, ultrasound, and bone density testing, is crucial.

The women’s health diagnostics market represents a critical segment within the broader healthcare landscape, dedicated to addressing the distinct healthcare needs of women across various life stages. This market encompasses a wide array of diagnostic technologies, services, and products aimed at detecting, monitoring, and managing conditions specific to women's health.

The growth of the women’s health diagnostics market is propelled by several key factors. Increasing awareness and prioritization of gender-specific health needs, coupled with a rising emphasis on preventive healthcare, are driving more women to seek diagnostic services. Technological advancements play a pivotal role, with continuous innovations in diagnostic imaging, in vitro diagnostics, and genetic testing enhancing the precision and efficiency of diagnostic procedures. The integration of advanced technologies, such as molecular diagnostics and point-of-care testing, further contributes to the market's expansion. Collaborative efforts between healthcare professionals, researchers, and industry stakeholders foster the development of novel diagnostic solutions. Additionally, the market benefits from a holistic approach to women's health, incorporating comprehensive disease-specific diagnostics tailored for conditions such as breast and gynecological cancers. As these growth factors converge, the women’s health diagnostics market is positioned to advance, providing women with improved access to accurate and timely diagnostic interventions for better overall health outcomes.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 39.01 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.34% |

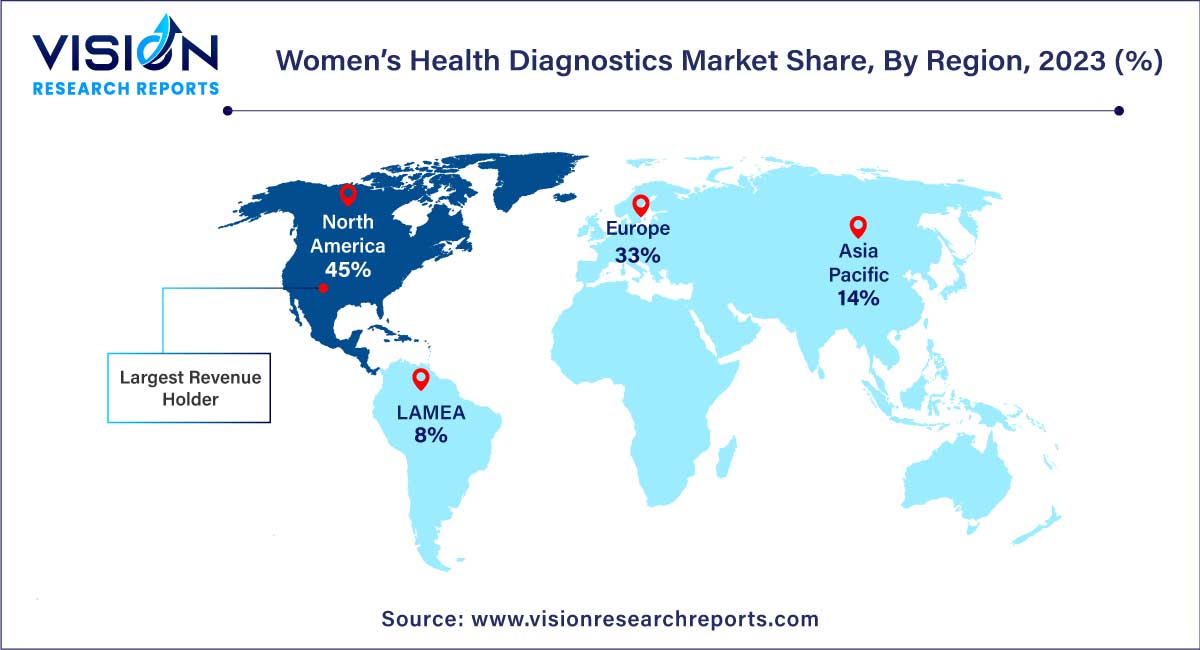

| Revenue Share of North America in 2023 | 45% |

| CAGR of Asia Pacific from 2024 to 2033 | 8.35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The infectious diseases segment accounted for the largest revenue share of 53% in 2023. The global emergence of SARS, H1N1, Ebola, and COVID-19 have negatively impacted women, specifically their sexual and reproductive health. According to the National Centre for Biotechnology Information, STDs. was the cause of 50% of avoidable infertility in the U.S. Additionally, the majority of STDs can be transmitted to an unborn child or fetus, occasionally with catastrophic results. In addition, the findings indicate that women are more likely to develop active Mycobacterium TB illness.

The prenatal segment is expected to grow at the fastest rate of 11.73% during the forecast period. The infectious diseases that the mother has is transmitted to the unborn child or fetus, which is driving the growth of this segment. According to the National Centre for Biotechnology Information, 20,000 babies are born to hepatitis B virus (HBV) infected mothers in the U.S. 6,000 of these infants would develop chronic HBV infections without postexposure prophylaxis, and 1,500 would succumb to chronic liver disease before their time.

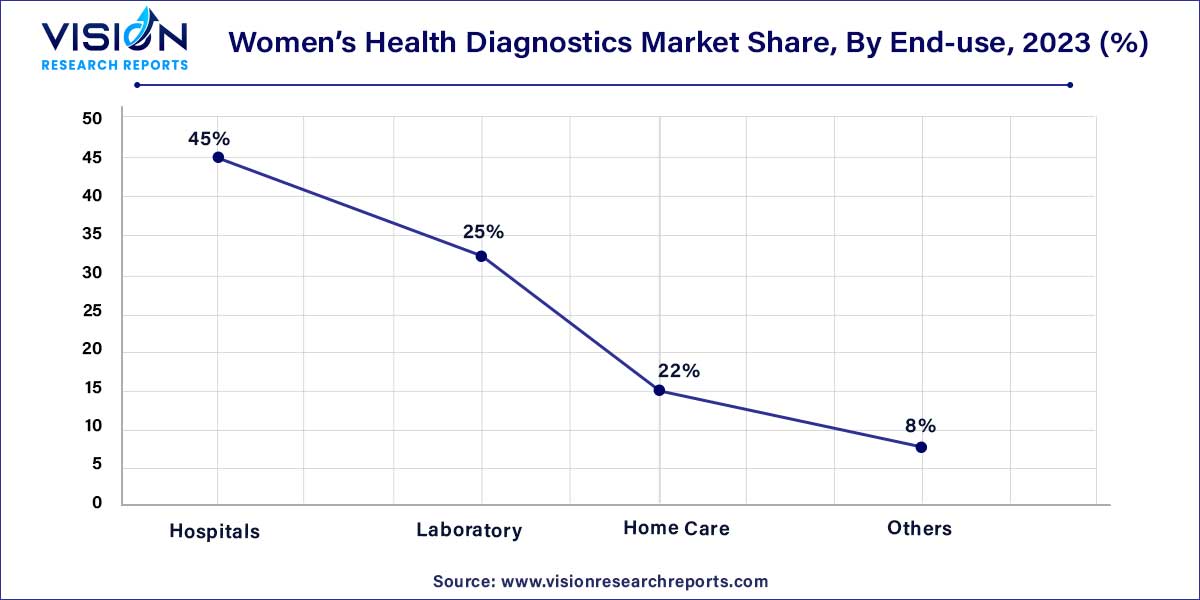

The hospitals segment contributed the largest market share of 45% in 2023, as they are the first choice as the diagnostic center for women for the detection of cancer, infectious disease, osteoporosis, pregnancy & fertility tests. In March 2021, iCad announced The U.S. Food and Drug Administration (FDA) approval of ProFound A.I. Version 3.0 for Digital Breast Tomosynthesis (DBT). It is a deep learning, high-performance workflow solution that helps in detecting malignant soft tissue calcifications and densities.

The homecare segment is anticipated to grow at the noteworthy CAGR of 9.07% over the forecast period owing to increasing investments by market players to commercialize portable and point-of-care devices. Furthermore, growing awareness about home diagnostic devices is estimated to spur the growth of the segment. Yeast infections of the vagina and urinary tract, menopause, colon cancer, breast cancer, and fertility are the diseases for which self-diagnosis devices/kits are used by women. In October 2018, the FDA approved the PicoAMH Elisa by Ansh Labs, a self-diagnosis menopause kit.

North America dominated the market with the largest revenue share of 45% in 2023. This can be attributed to the high adoption of technologically advanced products, product launches, and government initiatives.

National Women’s Health Week (NWHW) begins on 14th May - 20th May every year and The FDA Office of Women’s Health (OWH) theme for NWHW 2023 was to encourage women to #KNOWHmore About Your Health, Today and Every Day. In May 2019, Bayer launched a campaign “Test Your Cancer” to help cancer patients understand that genomic testing is a very important step in diagnosis thereby getting a real picture of individual cancer.

In May 2023 SOPHiA GENETICS announced that a private molecular laboratory, Natural State Laboratories, chose the former’s technology to expand their research capabilities and cancer testing. Natural State Laboratories is expected to start using SOPHiA DDM for in-house hereditary cancer testing.

Asia Pacific is expected to grow at the fastest CAGR of 8.35% during the forecast period. Improving healthcare infrastructure, awareness about women’s health disorders, government initiatives, and increased participation of women in the workforce are some of the factors poised to positively impact regional market growth. In November 2016, the Indian government launched the Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA) scheme to provide free health checkups to pregnant women. Under this scheme, women would be tested for anemia, high blood sugar (gestational diabetes); blood pressure, and hormonal disorders, and have access to free ultrasounds to track the health and development of a fetus.

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Women’s Health Diagnostics Market

5.1. COVID-19 Landscape: Women’s Health Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Women’s Health Diagnostics Market, By Application

8.1. Women’s Health Diagnostics Market, by Application, 2024-2033

8.1.1. Cancer

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Infectious disease

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Osteoporosis

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Pregnancy & fertility

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Prenatal

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Women’s Health Diagnostics Market, By End-use

9.1. Women’s Health Diagnostics Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Laboratory

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Home Care

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Women’s Health Diagnostics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. F. Hoffmann-la Roche Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Siemens Aktiengesellschaft

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Quest Diagnostics Incorporated

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Ge Healthcare

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Koninklijke Philips N.V.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Abbott Laboratories

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Becton, Dickinson, and Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Hologic, Inc

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others