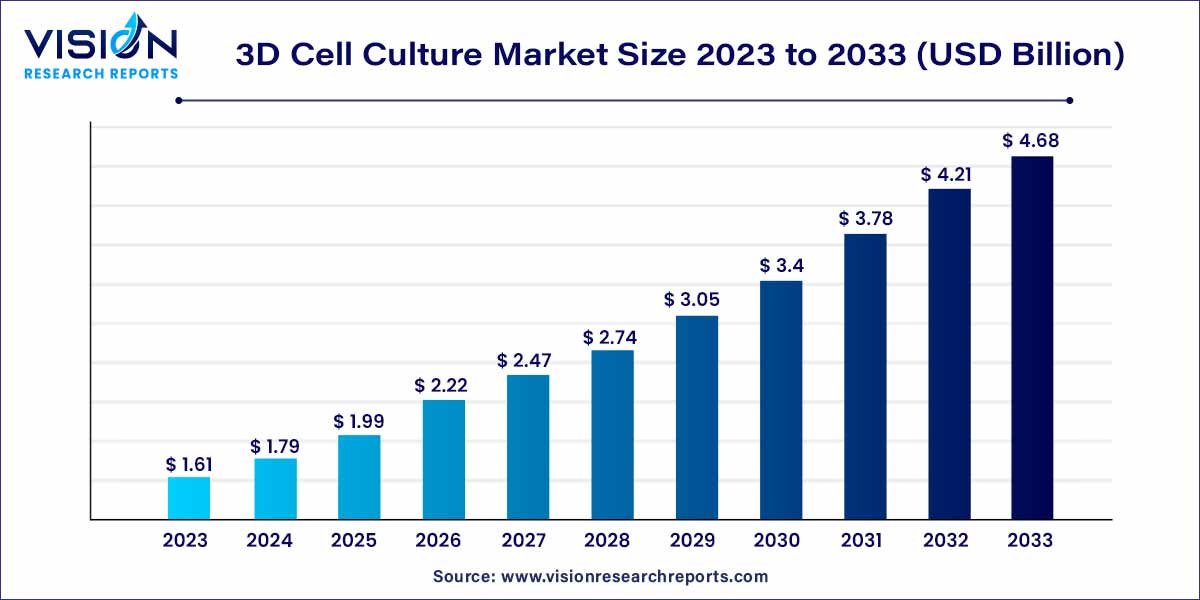

The global 3D cell culture market size was estimated at around USD 1.61 billion in 2023 and it is projected to hit around USD 4.68 billion by 2033, growing at a CAGR of 11.26% from 2024 to 2033. The industry is expected to rise as a result of increased efforts to create viable substitutes for animal testing as well as the availability of research funding programs.

In recent years, the 3D cell culture market has witnessed significant growth, marking a paradigm shift in cell culture techniques. This innovative approach, as opposed to traditional 2D cell culture, involves the cultivation of cells within a three-dimensional environment, closely mimicking the in vivo conditions. This advancement has garnered substantial attention across diverse scientific disciplines and industries.

The growth of the 3D cell culture market is propelled by several key factors. Firstly, the shift from traditional 2D cell cultures to 3D methodologies is driven by the enhanced biological relevance offered by the latter. Researchers benefit from a more accurate representation of in vivo conditions, resulting in findings that better reflect real-world scenarios. Secondly, the pharmaceutical industry has witnessed a surge in demand for 3D cell culture applications, particularly in drug discovery and development. The ability of 3D cultures to mimic cellular responses to potential drugs provides a crucial advantage in screening processes. Moreover, in the cancer research, the pivotal role played by 3D cell culture models in understanding tumor behavior, drug responses, and personalized medicine has contributed significantly to market growth. Ongoing technological advancements, including scaffold-based and scaffold-free systems, further expand the scope of 3D cell culture applications, fostering market development. Overall, the 3D cell culture market's growth is underpinned by its diverse applications, technological innovations, and the increasing recognition of its value across various scientific disciplines and industries.

The scaffold-based category dominated the market in 2023, holding the largest share at 49%. This segment is further categorized into hydrogels, polymeric scaffolds, micropatterned surfaced microplates, and nanofiber-based scaffolds. Anticipated drivers for segment growth include the expanding application of scaffold-based cultures in tissue engineering and regenerative medicine, advancements in scaffold materials and fabrication techniques, and increased research funding and collaboration. The use of hydrogels as a scaffold in 3D cell culture model studies enables the incorporation of biochemical and mechanical cues to mimic the native extracellular matrix.

On the other hand, the scaffold-free segment is poised to exhibit the highest CAGR throughout the forecast period. The accelerated growth of this segment is attributed to factors such as improved cellular interactions, increased throughput and scalability, rising demand for personalized medicine, and advancements in 3D culture model platforms and technologies. Furthermore, robust demand for scaffold-free systems within end-user sectors like the biopharmaceutical industry and research institutes further contributes to the segment's growth.

The market is categorized based on applications into cancer research, stem cell research & tissue engineering, drug development & toxicity testing, and others. In 2023, the stem cell research & tissue engineering segment held the leading market share. The dominance of this segment can be attributed to the growing demand for biopharmaceuticals, particularly due to the effectiveness of treatments like cell and gene therapy. Increased approvals resulting from a surge in innovation also contribute significantly to the growth of this segment.

Forecasts suggest that, based on current clinical success rates and the product pipeline, the U.S. FDA is expected to approve approximately 10 to 20 cell and gene therapy products annually by 2025. This positive outlook is complemented by technological advancements, supportive government legislation, and augmented funding for stem cell studies. For instance, in March 2023, the National Institute of Health granted Purdue University's research team USD 2.5 million for stem cell research, aiming to explore novel therapeutic approaches utilizing stem cells, particularly for life-threatening disorders.

In contrast, the cancer research segment is anticipated to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. The increasing prevalence of cancer and the benefits offered by 3D culture models in cancer research are pivotal factors driving the expansion of this segment. Additionally, the advantages of 3D media in modulating cell proliferation and morphology, capturing phenotypic heterogeneity, and providing flexibility further contribute to the overall growth of this segment.

The market is segmented based on end-use into biotechnology & pharmaceutical companies, academic & research institutes, hospitals, and others. In 2023, the biopharmaceutical & pharmaceutical companies segment held the largest market share. The dominance of this segment is attributed to the ongoing growth and commercial success of biopharmaceuticals, coupled with the strategic utilization of major pharmaceutical companies' portfolios. The 3D cell culture model provides advantages such as optimal oxygen and nutrient gradient formation, as well as realistic cellular interactions compared to traditional two-dimensional cellular media, making it a preferred method for drug discovery and development. These factors contribute to the increased adoption of 3D cell culture methodologies in the biopharmaceutical and pharmaceutical sectors, driving demand within this segment.

On the other hand, the academic & research institutes segment is poised to register the fastest CAGR during the forecast period. This anticipated growth is fueled by factors such as advancements in biomedical research, a surge in research activities, increasing collaboration between industry and academia, and substantial efforts from research institutions in drug modeling and drug screening. These dynamics collectively contribute to the accelerated expansion of the academic and research institutes segment in the 3D cell culture market.

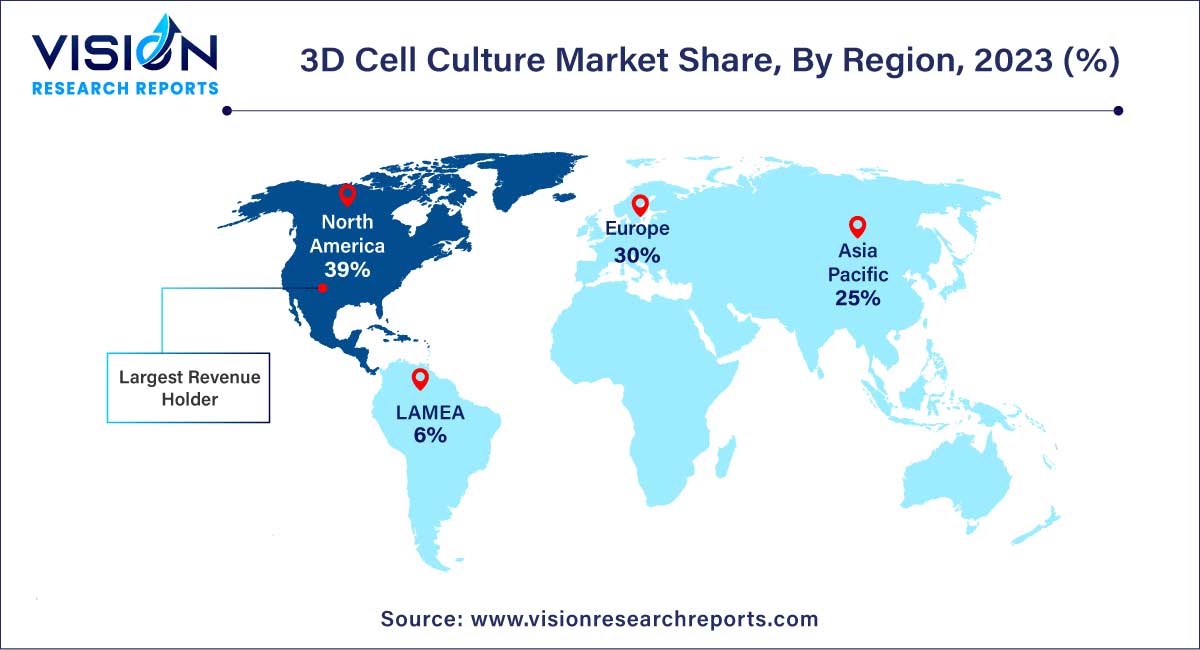

In 2023, North America emerged as the dominant force in the market, commanding a substantial 39% share. The region's market leadership is propelled by advanced healthcare infrastructure, well-established economies, the presence of key industry players, and strategic initiatives undertaken by them. Additionally, a supportive regulatory framework, governmental backing for the development of three-dimensional culture models, and a significant number of research organizations and universities engaged in various stem-cell-based approaches contribute to the robust performance of the regional market. Notably, in April 2023, the American Cancer Society (ACS) announced funding exceeding USD 45 million for 90 innovative Extramural Discovery Science (EDS) research projects at 67 institutes across the United States.

Meanwhile, the Asia Pacific region is poised for the fastest growth in the market from 2024 to 2033. Factors such as a high burden of chronic diseases, a thriving biotechnology sector, cost-effective operations, and increased investments by companies in the region propel the regional market forward. Furthermore, a growing demand for cellular therapies, the establishment of biobanks, and substantial research potential further contribute to the dynamic growth of the Asia Pacific market.

By Technology

By Application

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on 3D Cell Culture Market

5.1. COVID-19 Landscape: 3D Cell Culture Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global 3D Cell Culture Market, By Technology

8.1. 3D Cell Culture Market, by Technology, 2024-2033

8.1.1 Scaffold Based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Scaffold Free

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Bioreactors

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Microfluidics

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Bioprinting

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global 3D Cell Culture Market, By Application

9.1. 3D Cell Culture Market, by Application, 2024-2033

9.1.1. Cancer Research

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Stem Cell Research & Tissue Engineering

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Drug Development & Toxicity Testing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global 3D Cell Culture Market, By End Use

10.1. 3D Cell Culture Market, by End Use, 2024-2033

10.1.1. Biotechnology and Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Academic & Research Institutes

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Hospitals

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global 3D Cell Culture Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Merck KGaA.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. PromoCell GmbH.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Lonzab.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Corning Incorporated.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Avantor, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Tecan Trading AG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. REPROCELL Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CN Bio Innovations Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lena Biosciences

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others