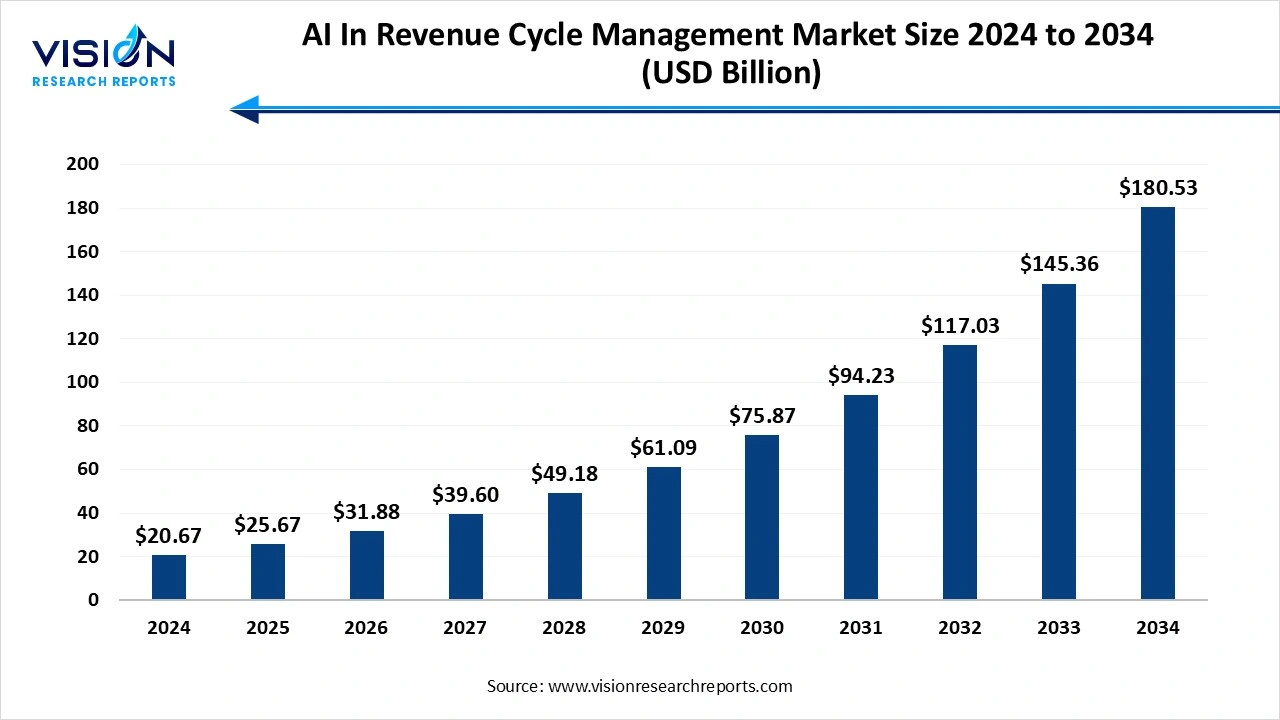

The global AI in revenue cycle management market size stood at USD 20.67 billion in 2024 and is estimated to reach USD 25.67 billion in 2025. It is projected to hit USD 180.53 billion by 2034, registering a robust CAGR of 24.2% from 2025 to 2034. The rising demand for automation in coding, billing, and claim processing. It enhances data accuracy and insights, and improves patient experience and compliance with healthcare regulations.

The AI in revenue cycle management is the use of artificial intelligence technologies to automate, streamline, and optimize the financial and administrative tasks of healthcare organizations. It applies advanced algorithms, machine learning (ML), and natural language processing (NLP) to handle the complex and often error-prone processes involved in managing and collecting payments for medical services.

The high claim denial rates are a major challenge in healthcare, impacting cash flow and increasing operational costs. AI-driven predictive analytics identify and prevent potential claim denials before submission, leading to higher first-pass acceptance rates and faster reimbursements.

| Report Coverage | Details |

| Market Size in 2024 | USD 20.67 billion |

| Revenue Forecast by 2034 | USD 180.53 billion |

| Growth rate from 2025 to 2034 | CAGR of 24.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

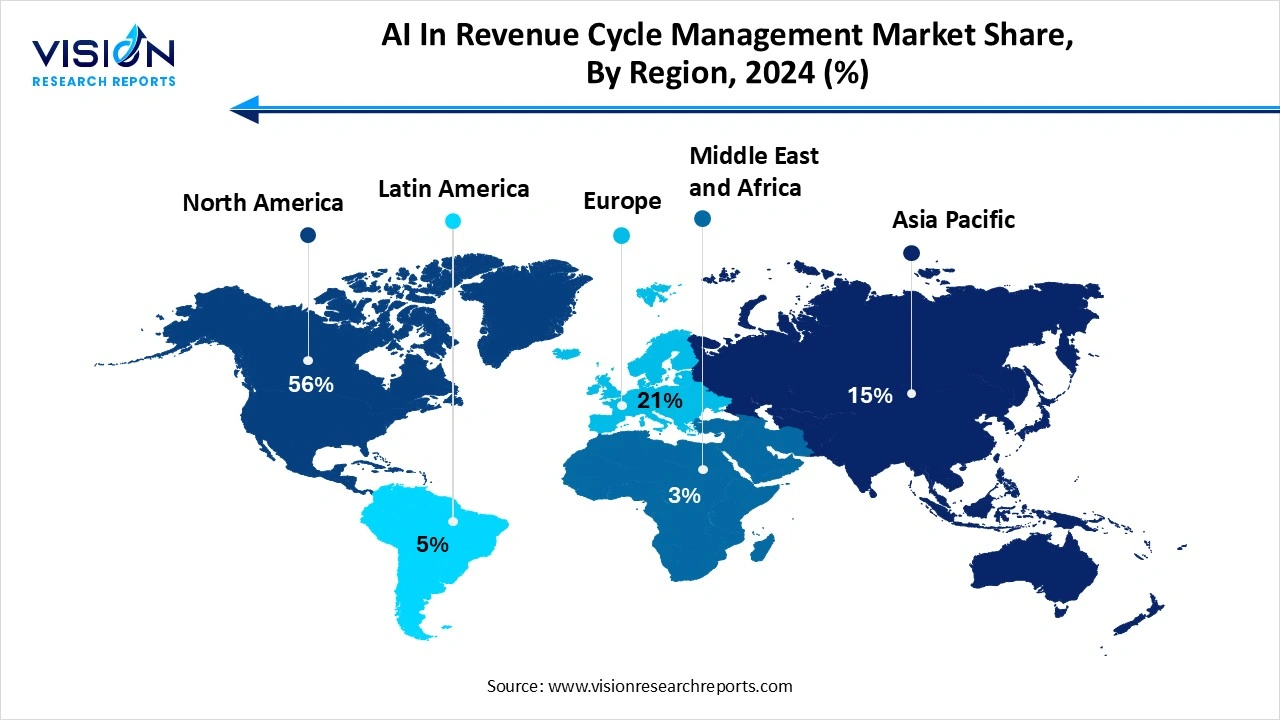

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Optum (UnitedHealth Group), Cerner Corporation (now part of Oracle), Epic Systems Corporation, McKesson Corporation, Change Healthcare, Athenahealth (a Veritas Capital portfolio company), Waystar, R1 RCM Inc., IBM Watson Health, Cognizant Technology Solutions. |

The AI-powered solutions can analyze historical claims data to identify patterns and predict the likelihood of a claim being denied before it is even submitted. By flagging these "high-risk" claims, the system enables staff to proactively fix issues, leading to higher first-pass claim acceptance rates.

The handling of sensitive patient and financial data raises concerns around cybersecurity and compliance with regulations, such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation), which are crucial for protecting patient data, but they were not specifically designed for modern AI systems. This creates complexities in ensuring that AI algorithms and processes comply with these evolving regulations.

North America led the global market for AI in revenue cycle management, capturing more than 56% of the total share in 2024. The early AI adoption and high healthcare spending. This leadership is further strengthened by strong government support for digital health and significant investments in AI RCM solutions. The region's focus on reducing administrative costs and streamlining complex billing processes fuels the rapid expansion of AI applications. While challenges like data security and integration exist, AI is fundamentally transforming RCM efficiency and profitability.

United States AI In Revenue Cycle Management Market Trends

The rise in automation tasks, such as medical coding, billing, claim processing, and denials management, is leading to faster processing times, fewer errors, and improved cash flow. AI uses predictive analytics to identify potential issues before claims are submitted, significantly reducing the high rate of denied claims in the healthcare industry. There is a growing demand for unified platforms that combine various RCM functions with AI, offering greater data visibility and operational consistency, which will fuel the market growth.

Asia Pacific expects significant growth in AI in the Revenue Cycle Management market during the forecast period. The Asia Pacific region's modernization of healthcare systems and the adoption of digital technologies like EHRs and cloud-based platforms are fueling demand for AI-driven RCM. The region is experiencing rapid digitalization, with increasing adoption of AI-driven technologies. This includes integrating AI with EHRs and cloud platforms to improve real-time data processing and decision-making. The shift towards cloud-based solutions and Software-as-a-Service (SaaS) models is also gaining traction, offering benefits like lower cost of ownership and scalability.

Why did the Services Segment Dominate the AI In Revenue Cycle Management Market?

The services segment led the market, capturing more than 68% of the total revenue share in 2024. The AI in the RCM market stems from the intricate nature of medical billing and the need for specialized expertise. Healthcare providers, particularly smaller ones, benefit from outsourcing RCM functions to leverage AI for improved efficiency, error reduction, and optimized revenue collection. This trend is driven by the complexities of healthcare regulations, payment models, and the advantages offered by AI-powered solutions in ensuring compliance and enhancing financial performance. In essence, the Services segment's lead highlights the growing reliance on expert providers to manage RCM complexities and maximize the benefits of AI in the healthcare industry.

The Software AI in the Revenue Cycle Management segment is the fastest-growing in the AI in Revenue Cycle Management market during the forecast period. The ability to automate complex administrative tasks like billing and claims processing. This automation significantly increases operational efficiency and accuracy, which in turn reduces costly claim denials and speeds up reimbursements for healthcare providers. Additionally, AI-powered software provides valuable predictive analytics and data-driven insights, empowering healthcare organizations to optimize financial performance and improve cash flow. Ultimately, this technological shift helps healthcare facilities reduce administrative burdens, lower costs, and enhance the overall financial health of their operations.

How the Integration Segment hold the Largest Share in the AI in Revenue Cycle Management Market?

The integrated segment led the market, accounting for more than 71% of the total revenue share in 2024. It's a unified platform that streamlines operations and data flow across all financial activities. By automating administrative tasks, integrated solutions improve efficiency, accuracy, and overall financial performance for healthcare providers. This holistic approach minimizes claim denials, accelerates payments, and provides comprehensive data analytics, making it the preferred choice over standalone systems. Ultimately, integrated AI platforms reduce costs and enhance revenue, solidifying their leading market position.

The integrated segment is experiencing the fastest growth in the market during the forecast period. The integrated AI platforms for revenue cycle management (RCM) are built to continuously adapt to changing healthcare regulations and payer rules through machine learning. This dynamic updating helps providers remain compliant and significantly lowers the frequency of claim denials. The scalability of these solutions allows them to be tailored for any healthcare organization, from small clinics to extensive hospital networks, based on specific operational requirements.

How the Claims Management Segment hold the Largest Share in the AI in Revenue Cycle Management Market?

The claims management segment held the largest revenue share in the AI in revenue cycle management market in 2024. The high volume, complexity, and direct impact on revenue. AI addresses the significant administrative burden by automating repetitive tasks, such as claim submission and eligibility verification. Its ability to predict and prevent denials before submission ensures cleaner claims and faster, higher reimbursements. This automation frees up staff to focus on more complex cases, making claims management a critical and high-return application for AI in healthcare.

The claim management segment is experiencing the fastest growth in the market during the forecast period. The complexity of billing codes and payer requirements continues to increase; AI-driven claims management solutions are becoming indispensable in helping healthcare organizations optimize cash flow and maintain financial stability.

How the Web-Based Segment hold the Largest Share in the AI in Revenue Cycle Management Market?

The web-based segment led the market, accounting for over 53% of total revenue in 2024. Their affordability, accessibility, and ease of integration. Lower costs, remote access, and seamless updates make it attractive for healthcare providers. While cloud-based solutions offer advanced features, web-based platforms provide immediate benefits and faster deployment. This market leadership is driven by the practical advantages offered to healthcare organizations.

The cloud-deployed segment is experiencing the fastest growth in the market during the forecast period. The superior scalability and cost-efficiency. Compared to expensive on-premise systems, the subscription-based cloud model democratizes access to advanced AI tools for healthcare providers of all sizes. This flexibility, accelerated by the need for remote solutions during the COVID-19 pandemic, streamlines critical processes like claims management and billing. Ultimately, cloud-based AI optimizes revenue capture, reduces administrative costs, and improves financial outcomes for healthcare organizations.

How the Physician Back-Office Segment hold the Largest Share in the AI in Revenue Cycle Management Market?

The physician back-office segment held the largest share of revenue, contributing more than 38% to the total in 2024. The high volumes of practices are facing significant economic pressure. They increasingly outsource RCM to combat rising costs and complex regulations, driving demand for AI to automate tasks like claims processing and billing. This focus on efficiency allows practices to improve revenue and concentrate on patient care, cementing the segment's market dominance.

The Hospitals segment is experiencing the fastest growth in the market during the forecast period. Their large-scale and complex billing needs. Facing billions in potential revenue loss from denials, they invest in AI to automate processes, improve cash flow, and ensure accuracy and compliance. Hospitals also have the resources and infrastructure to adopt integrated, sophisticated AI platforms. Ultimately, AI helps them overcome administrative burdens and financial pressures, allowing for better focus on patient care.

By Product

By Type

By Application

By Delivery Mode

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI In Revenue Cycle Management Market

5.1. COVID-19 Landscape: AI In Revenue Cycle Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI In Revenue Cycle Management Market, By Product

8.1. AI In Revenue Cycle Management Market, by Product

8.1.1. Software

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global AI In Revenue Cycle Management Market, By Type

9.1. AI In Revenue Cycle Management Market, by Type

9.1.1. Integrated

9.1.1.1. Market Revenue and Forecast

9.1.2. Standalone

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global AI In Revenue Cycle Management Market, By Application

10.1. AI In Revenue Cycle Management Market, by Application

10.1.1. Medical Coding and Charge Capture

10.1.1.1. Market Revenue and Forecast

10.1.2. Claims Management

10.1.2.1. Market Revenue and Forecast

10.1.3. Payment Posting & Remittance

10.1.3.1. Market Revenue and Forecast

10.1.4 Financial Analytics & KPI Monitoring

10.1.4.1. Market Revenue and Forecast

10.1.5 Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global AI In Revenue Cycle Management Market, By Delivery Mode

11.1AI In Revenue Cycle Management Market, by Delivery Mode

11.1.1. Web-based

11.1.1.1. Market Revenue and Forecast

11.1.2. Cloud-based

11.1.2.1. Market Revenue and Forecast

11.1.3. On-premise

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global AI In Revenue Cycle Management Market, By End Use

12.1. AI In Revenue Cycle Management Market, by End Use

12.1.1. Physician Back Offices

12.1.1.1. Market Revenue and Forecast

12.1.2. Hospitals

12.1.2.1. Market Revenue and Forecast

12.1.3. Diagnostic Laboratories

12.1.3.1. Market Revenue and Forecast

12.1.4. Other

12.1.4.1. Market Revenue and Forecast

Chapter 13. Global AI In Revenue Cycle Management Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product

13.1.2. Market Revenue and Forecast, by Type

13.1.3. Market Revenue and Forecast, by Application

13.1.4. Market Revenue and Forecast, by Delivery Mode Size

13.1.5. Market Revenue and Forecast, by End Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product

13.1.6.2. Market Revenue and Forecast, by Type

13.1.6.3. Market Revenue and Forecast, by Application

13.1.6.4. Market Revenue and Forecast, by Delivery Mode

13.1.7. Market Revenue and Forecast, by End Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product

13.1.8.2. Market Revenue and Forecast, by Type

13.1.8.3. Market Revenue and Forecast, by Application

13.1.8.4. Market Revenue and Forecast, by Delivery Mode

13.1.8.5. Market Revenue and Forecast, by End Use

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product

13.2.2. Market Revenue and Forecast, by Type

13.2.3. Market Revenue and Forecast, by Application

13.2.4. Market Revenue and Forecast, by Delivery Mode

13.2.5. Market Revenue and Forecast, by End Use

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product

13.2.6.2. Market Revenue and Forecast, by Type

13.2.6.3. Market Revenue and Forecast, by Application

13.2.7. Market Revenue and Forecast, by Delivery Mode

13.2.8. Market Revenue and Forecast, by End Use

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product

13.2.9.2. Market Revenue and Forecast, by Type

13.2.9.3. Market Revenue and Forecast, by Application

13.2.10. Market Revenue and Forecast, by Delivery Mode

13.2.11. Market Revenue and Forecast, by End Use

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product

13.2.12.2. Market Revenue and Forecast, by Type

13.2.12.3. Market Revenue and Forecast, by Application

13.2.12.4. Market Revenue and Forecast, by Delivery Mode

13.2.13. Market Revenue and Forecast, by End Use

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product

13.2.14.2. Market Revenue and Forecast, by Type

13.2.14.3. Market Revenue and Forecast, by Application

13.2.14.4. Market Revenue and Forecast, by Delivery Mode

13.2.15. Market Revenue and Forecast, by End Use

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product

13.3.2. Market Revenue and Forecast, by Type

13.3.3. Market Revenue and Forecast, by Application

13.3.4. Market Revenue and Forecast, by Delivery Mode

13.3.5. Market Revenue and Forecast, by End Use

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product

13.3.6.2. Market Revenue and Forecast, by Type

13.3.6.3. Market Revenue and Forecast, by Application

13.3.6.4. Market Revenue and Forecast, by Delivery Mode

13.3.7. Market Revenue and Forecast, by End Use

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product

13.3.8.2. Market Revenue and Forecast, by Type

13.3.8.3. Market Revenue and Forecast, by Application

13.3.8.4. Market Revenue and Forecast, by Delivery Mode

13.3.9. Market Revenue and Forecast, by End Use

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product

13.3.10.2. Market Revenue and Forecast, by Type

13.3.10.3. Market Revenue and Forecast, by Application

13.3.10.4. Market Revenue and Forecast, by Delivery Mode

13.3.10.5. Market Revenue and Forecast, by End Use

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product

13.3.11.2. Market Revenue and Forecast, by Type

13.3.11.3. Market Revenue and Forecast, by Application

13.3.11.4. Market Revenue and Forecast, by Delivery Mode

13.3.11.5. Market Revenue and Forecast, by End Use

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product

13.4.2. Market Revenue and Forecast, by Type

13.4.3. Market Revenue and Forecast, by Application

13.4.4. Market Revenue and Forecast, by Delivery Mode

13.4.5. Market Revenue and Forecast, by End Use

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product

13.4.6.2. Market Revenue and Forecast, by Type

13.4.6.3. Market Revenue and Forecast, by Application

13.4.6.4. Market Revenue and Forecast, by Delivery Mode

13.4.7. Market Revenue and Forecast, by End Use

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product

13.4.8.2. Market Revenue and Forecast, by Type

13.4.8.3. Market Revenue and Forecast, by Application

13.4.8.4. Market Revenue and Forecast, by Delivery Mode

13.4.9. Market Revenue and Forecast, by End Use

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product

13.4.10.2. Market Revenue and Forecast, by Type

13.4.10.3. Market Revenue and Forecast, by Application

13.4.10.4. Market Revenue and Forecast, by Delivery Mode

13.4.10.5. Market Revenue and Forecast, by End Use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product

13.4.11.2. Market Revenue and Forecast, by Type

13.4.11.3. Market Revenue and Forecast, by Application

13.4.11.4. Market Revenue and Forecast, by Delivery Mode

13.4.11.5. Market Revenue and Forecast, by End Use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product

13.5.2. Market Revenue and Forecast, by Type

13.5.3. Market Revenue and Forecast, by Application

13.5.4. Market Revenue and Forecast, by Delivery Mode

13.5.5. Market Revenue and Forecast, by End Use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product

13.5.6.2. Market Revenue and Forecast, by Type

13.5.6.3. Market Revenue and Forecast, by Application

13.5.6.4. Market Revenue and Forecast, by Delivery Mode

13.5.7. Market Revenue and Forecast, by End Use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product

13.5.8.2. Market Revenue and Forecast, by Type

13.5.8.3. Market Revenue and Forecast, by Application

13.5.8.4. Market Revenue and Forecast, by Delivery Mode

13.5.8.5. Market Revenue and Forecast, by End Use

Chapter 14. Company Profiles

14.1. Optum (UnitedHealth Group)

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2 Cerner Corporation (now part of Oracle)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Epic Systems Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. McKesson Corporation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Change Healthcare

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Athenahealth (a Veritas Capital portfolio company)

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Waystar

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. R1 RCM Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. IBM Watson Health

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Cognizant Technology Solutions

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others