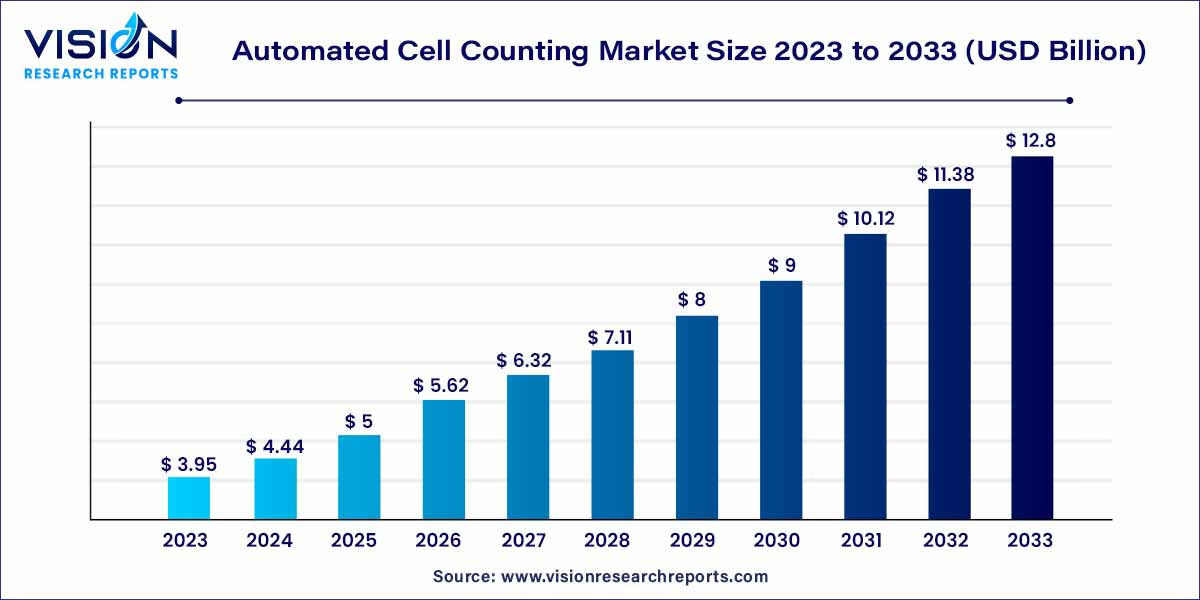

The global automated cell counting market size was estimated at around USD 3.95 billion in 2023 and it is projected to hit around USD 12.8 billion by 2033, growing at a CAGR of 12.48% from 2024 to 2033. Automated cell counters are devices used in pharmaceutical research, food quality monitoring, and medical diagnostics that count and analyze cells. They study cells with extreme consistency and precision using contemporary methods like digital imaging and flow cytometry.

The automated cell counting market is witnessing a robust trajectory, propelled by technological advancements and the growing significance of precise cell counting across diverse industries. This market, characterized by the integration of automation in cell counting processes, has become indispensable in various fields, ranging from life sciences research to pharmaceutical development.

The growth of the automated cell counting market is propelled by several key factors. Technological advancements, particularly the integration of artificial intelligence, image analysis, and machine learning, have significantly enhanced the accuracy and efficiency of cell counting processes. The expanding applications in research and development, such as drug discovery and cancer research, contribute to the market's upward trajectory. The burgeoning biopharmaceutical industry heavily relies on automated cell counting to ensure the quality and consistency of cell cultures, fostering market growth. Additionally, the rising significance of cell-based therapies, coupled with the need for precise cell counting in cancer diagnostics and treatment monitoring, further fuels market expansion. The development of point-of-care testing solutions, incorporating automated cell counting, addresses the demand for on-site and rapid cell counting in healthcare settings. While challenges such as initial investment costs exist, the market's sustained growth is anticipated through ongoing technological innovations and the exploration of untapped applications and markets.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.48% |

| Market Revenue by 2033 | USD 12.8 billion |

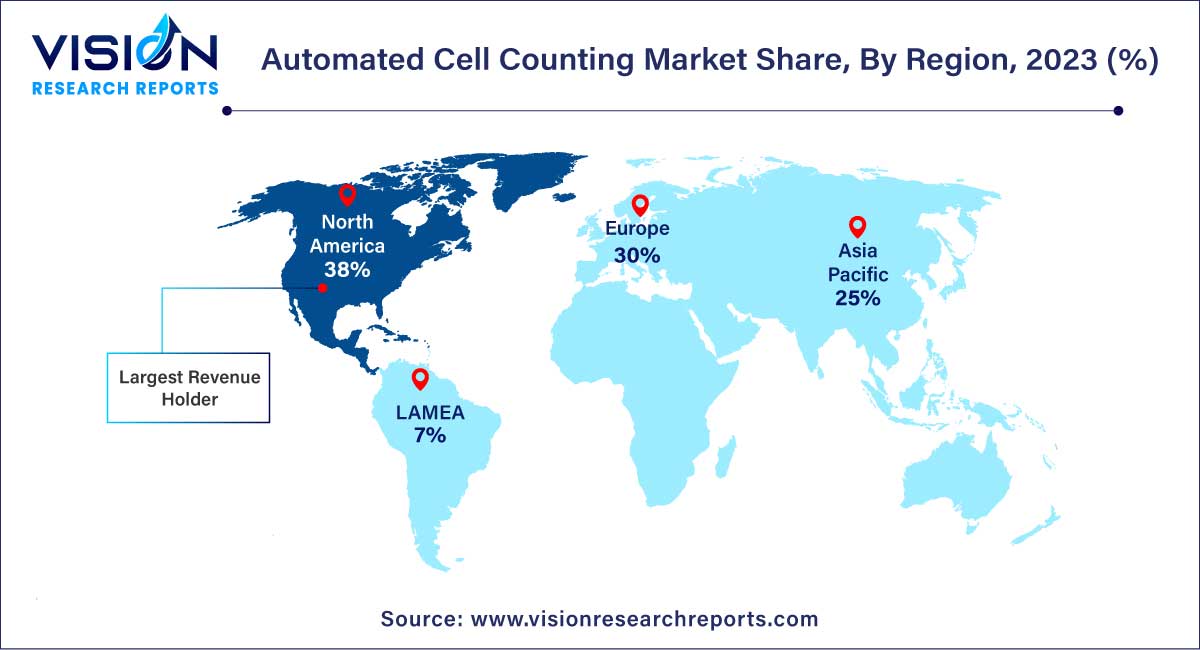

| Revenue Share of North America in 2023 | 38% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The consumables & accessories segment held the largest revenue share in 2023 and is expected to be the fastest CAGR during the forecast period. Consumables and accessories are growing in popularity due to their high usage volume. Furthermore, the introduction of new products drives market expansion. For example, eNuvio released a reusable 3D cell culture microplate in December 2020. Scientists will gain from this ecologically friendly equipment for a long time, according to eNuvio, both economically and scientifically.

The instruments segment accounted for a significant market share in 2023. Factors such as the expanding use of cell counting in research, diagnostics, and industrial applications are boosting the product demand & further driving the market growth. Cell counting instruments are progressively being used in numerous research areas such as cancer research, immunology, and neurology, indicating that the market segment has exponential development potential. As per the article published in November 2021, the novel cell counter called RapID Cell Counter allows for quick and reliable quantifications of cell density inside user-defined borders that can be separated into evenly partitioned segments. The requirement and effectiveness of cell counting instruments will contribute to increased consumption of these instruments, hence, propelling the segment's growth.

The cell line development application segment held a revenue share of 32% in 2023, accounting for the largest proportion of the market. Cell line development is an essential component of research and biological medicine production. Cell line generation is used in the lab to assess cytotoxicity and drug metabolism, as well as to examine gene function to develop vaccines, antibodies, and cell treatments. Thus, it will increase the demand for automated cell counting products and further boost the segment growth.

Stem cell research is expected to witness the fastest growth during the forecast period. The exponential growth is due to the increasing demand for mass manufacturing of human stem cells for therapeutic and research purposes. Stem cells are critical in areas including regenerative medicine, cancer treatment, and transplantation. Automated equipment makes it easier to precisely determine stem cell viability & nucleated cell concentration in cord blood and human bone marrow. Furthermore, features such as fluorescence imaging are becoming increasingly used to quantify GFP efficacy in stem cell transfection applications. For instance, in January 2023, Axion BioSystems launched the release of Omni Pro 12, the new product is intended to provide an automated solution for numerous users while also supporting live-cell imaging applications.

The pharmaceutical & biotechnology companies segment led the market in 2023, the biopharma industry's rising emphasis on cell-based research & drug discovery is driving up the popularity of automated cell counters. These technologies are a must-have for preclinical lab testing of novel drug candidates and vaccinations. They provide high-throughput effectiveness, proliferation, & cytotoxicity screening studies for therapeutic efficacy and toxicity evaluation. Several prominent pharmaceutical companies are implementing automated methods to speed R&D programs and minimize medication development costs and time. Growth in biopharmaceutical R&D for innovative cell & gene therapy & regenerative medicines, which requires precision cell counts, is also driving the market.

The hospitals & diagnostic laboratories segment is expected to witness significant growth during the forecast period. The increasing prevalence of infectious and chronic illnesses such as cancer, HIV/AIDS, septicemia, influenza, measles, malaria, cholera, & vector-borne diseases such as chikungunya & polio are driving the market. The increasing need for automated cell counting in the diagnosis and management of such fatal illnesses will drive the market growth. The World Health Organization (WHO) approximately 39.0 million individuals worldwide had HIV at the end of the year 2022. Furthermore, 680,000 people died from HIV-related causes in 2020. As a result, increased infectious disease rates are predicted to significantly enhance segment growth.

North America accounted for the largest revenue share of over 38% in 2023. The significant share of North America can be attributed to several factors, such as the availability of various major manufacturers of automated cell counting products in the region, advanced medical infrastructure, developed economies, significant players, and established supply channels. Furthermore, the incidence of diseases and the expanding elderly population have accelerated the race to produce innovative and efficacious remedies through the biopharmaceutical industry. This has increased demand for automated cell counters and is projected to continue generating revenue over the coming years.

The U.S. accounted for the largest revenue share in North America in 2023. The U.S. possesses a strong research and development infrastructure that fosters innovation in life sciences and biotechnology. Moreover, a high concentration of leading biotech and pharmaceutical companies, such as Thermo Fisher Scientific Inc, Bio-Rad laboratories, Inc, and Aglient Technologies, Inc. along with substantial investments in healthcare, contributes to a significant demand for advanced cell counting technologies.

Asia Pacific is expected to witness the fastest growth during the forecast period. This region's exponential CAGR can be linked to the local presence of some clinical research & biopharmaceutical companies, as well as stem cell research activities. Furthermore, the region's market is being driven primarily by the region's expanding elderly population, which is especially sensitive to chronic diseases. This has resulted in an exceptional surge in the usage of these devices due to an increase in the volume of clinical tests performed annually for elderly patients. Such factors are fueling the expansion of the market.

Japan accounted for the largest revenue share in the Asia Pacific region in 2023. The large share is due to its advanced technological infrastructure, strong emphasis on research and development, and well-established healthcare sector. Moreover, the stringent regulatory framework, coupled with high standards, ensures the quality and reliability of automated cell-counting products, fostering trust among users. Collectively, these factors establish Japan's leadership in the market within the Asia Pacific region.

The DeNovix CellDrop Automated Cell Counter is the first approved automated cell counter in the program; it obtained ACT Label certification through My Green Lab in October 2023.

To support the advancement of cell therapy manufacturing, Thermo Fisher Scientific will launch closed and automated cell separation and bead removal systems in October 2022. For scalable cell therapy manufacturing, a new method enhances cell purity, isolation efficiency, and target cell recovery.

Two specific nuclei counting apps for the CellDrop Automated Cell Counters were released by DeNovix Inc. in August 2022. These apps can differentiate intact cells from trash and isolate nuclei.

By Product

By Application

By End-use Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automated Cell Counting Market

5.1. COVID-19 Landscape: Automated Cell Counting Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automated Cell Counting Market, By Product

8.1. Automated Cell Counting Market, by Product, 2024-2033

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Consumables & Accessories

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automated Cell Counting Market, By Application

9.1. Automated Cell Counting Market, by Application, 2024-2033

9.1.1. Blood Analysis

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Stem Cell Research

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cell Line development

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automated Cell Counting Market, By End-use Channel

10.1. Automated Cell Counting Market, by End-use Channel, 2024-2033

10.1.1. Pharmaceutical & Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Hospitals & Diagnostic laboratories

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Research & Academic Institutes

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automated Cell Counting Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Thermo Fischer Scientific Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Countstar, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bio-Rad Laboratories, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. F. Hoffmann-La Roche Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Chemometec A/S.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Danaher

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Olympus Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. MERCK KGaA

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sysmex Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Agilent Technologies, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others