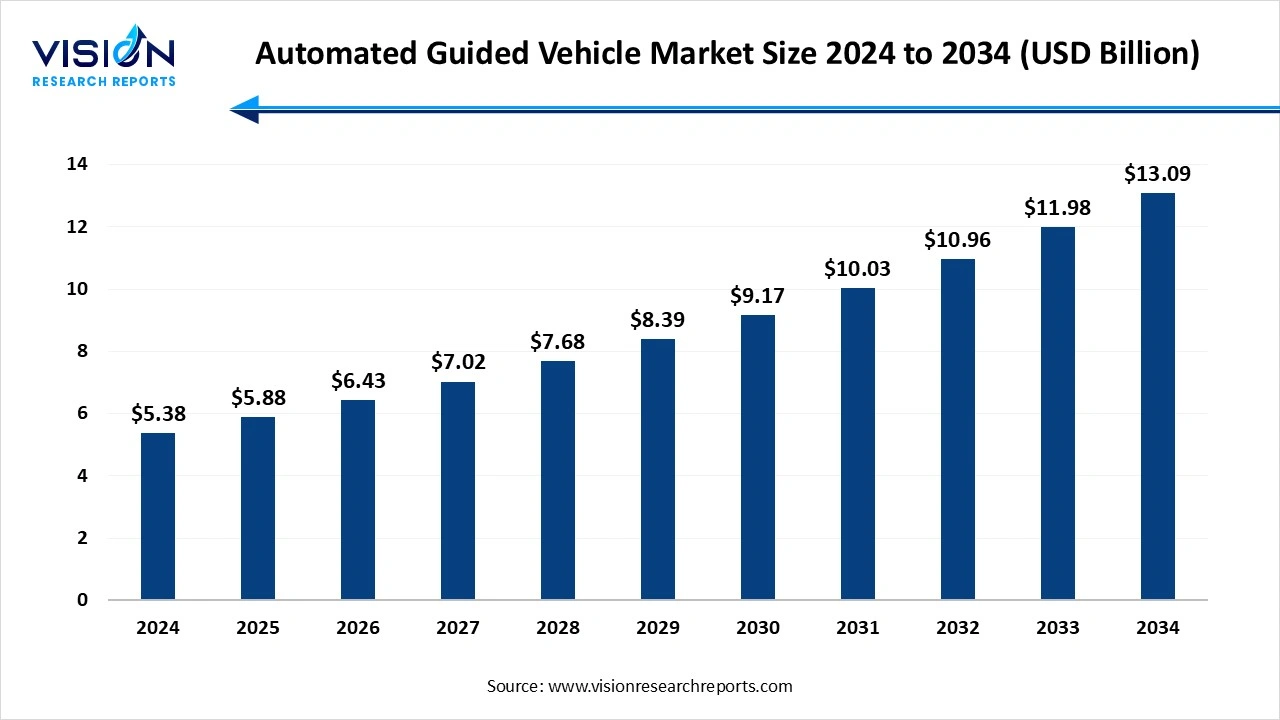

The global automated guided vehicle market size stood at USD 5.38 billion in 2024 and is estimated to reach USD 5.88 billion in 2025. It is projected to hit USD 13.09 billion by 2034, registering a robust CAGR of 9.3% from 2025 to 2034. The market growth of the global automated guided vehicle (AGV) market is primarily driven by the rising need for automation, productivity enhancement, and cost efficiency across industries such as manufacturing, logistics, and warehousing. Companies are increasingly adopting AGVs to streamline internal material flow, minimize manual labor, and improve overall operational safety.

The automated guided vehicle market has experienced significant growth, driven by the escalating demand for automation solutions in manufacturing, logistics, and warehousing sectors. With the relentless pursuit of operational excellence and cost optimization, businesses are increasingly adopting AGVs to streamline their internal logistics processes. The market is characterized by a diverse range of AGV types, including tow vehicles, unit load carriers, pallet trucks, and forklifts, catering to varying application requirements.

The growth of the automated guided vehicle (AGV) market is propelled by an increasing demand for operational efficiency and productivity gains across industries drives the adoption of AGVs. These autonomous vehicles streamline material handling processes, reducing manual labor and optimizing throughput. Secondly, the imperative to enhance workplace safety is a significant growth driver. AGVs operate autonomously, minimizing human intervention in hazardous environments, thereby mitigating the risk of accidents. Additionally, advancements in sensor technologies, artificial intelligence, and navigation algorithms have bolstered the capabilities of AGVs, enabling them to navigate complex environments with precision and adaptability. Moreover, the integration of AGVs into interconnected manufacturing ecosystems, facilitated by Industry 4.0 and the Internet of Things (IoT), further accelerates market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.38 billion |

| Revenue Forecast by 2034 | USD 13.09 billion |

| Growth rate from 2025 to 2034 | CAGR of 9.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Swisslog Holding AG, Egemin Automation Inc., Bastian Solutions, Inc., Daifuku Co., Ltd., Dematic, JBT, Seegrid Corporation, TOYOTA INDUSTRIES CORPORATION, Hyster-Yale Materials Handling, Inc., BALYO, E&K Automation GmbH, Kollmorgen, KMH Fleet Solutions, ELETTRIC80 S.P.A., Fetch Robotics, Inc., and inVia Robotics, Inc. |

North America held a dominant revenue share in 2024. The region's growing adoption of automated guided vehicles is propelled by its strong manufacturing and logistics sector, which is reliant on automation for efficient material handling. With the aging workforce and a shrinking labor pool, companies are turning to automation to increase efficiency and productivity. Additionally, e-commerce has led to a significant increase in the demand for automated guided vehicles. These systems can handle large volumes of orders efficiently, reducing the need for manual labor.

The AGV market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. The e-commerce industry has been growing considerably in emerging economies of Asia Pacific, such as China and India. For instance, in February 2023, Mitsubishi Electric Asia, a subsidiary of Mitsubishi Electric Corporation, launched a new Integrated Solutions Centre. The new center showcases the company’s advanced and comprehensive digital technologies to facilitate co-creation with clients and create next-generation integrated solutions.

The tow vehicle segment dominated the market in 2024 and accounted for a revenue share of over 39%, owing to high requirements for bulk movement of products into and out of warehouse areas.Tow vehicles, also known as tugger AGVs, are primarily used for towing multiple trailers or loads simultaneously within manufacturing plants, warehouses, and distribution centers. They are highly efficient in transporting bulk materials over long distances and are often utilized in just-in-time (JIT) production systems, where precise and timely delivery of materials is essential. These AGVs help reduce manual labor and operational downtime by enabling continuous movement of goods, enhancing productivity, and minimizing the risk of product damage. The increasing implementation of tow vehicles in automotive, electronics, and aerospace sectors highlights their importance in achieving operational efficiency and maintaining workflow consistency.

The forklift truck segment is expected to experience substantial growth over the forecast period. Automated forklift AGVs are designed to perform tasks such as pallet lifting, stacking, and shelving with high precision and safety. They eliminate the need for human intervention in repetitive and potentially hazardous lifting operations, thereby improving workplace safety standards. Equipped with advanced navigation systems like laser guidance, LiDAR, and vision-based sensors, these AGVs can navigate complex environments and handle varying load capacities with accuracy. The growing adoption of forklift AGVs in retail, food and beverage, and manufacturing industries is attributed to their ability to optimize storage space, reduce handling errors, and ensure faster inventory movement. As industries continue to embrace smart logistics and automation, both tow vehicles and forklift trucks are expected to remain vital components driving the growth and evolution of the global AGV market.

The laser guidance and natural navigation technologies are among the most advanced and widely adopted systems in the global automated guided vehicle (AGV) market, contributing significantly to the precision and flexibility of material handling operations. Laser-guided AGVs use laser scanners and reflectors placed throughout the facility to determine their exact position and navigate predefined routes. This technology ensures high accuracy, enabling AGVs to move safely and efficiently even in complex industrial environments. The key advantage of laser guidance lies in its superior positioning precision and adaptability, making it ideal for industries that require exact load handling and tight operational control, such as automotive manufacturing, electronics, and pharmaceuticals.

The natural navigation segment is expected to register the fastest CAGR over the forecast period. The vision guidance segment is expected to witness healthy growth during the study period. The need for intelligent and efficient routing contributes to the increasing adoption of automated vehicles. Computer vision and related software solutions allow AGVs to analyze the environment in real-time better, thereby boosting the demand for AGVs for operations in challenging environments, such as maneuvering significant components through narrow aisles

The logistics and warehousing segment dominated the market in 2024 and accounted market share in 2024. The logistics & warehousing segment has been further divided into transportation, cold storage, wholesale & distribution, and cross-docking. Enterprises upgrading their existing facilities and building new facilities are aggressively adopting modern retrieval and automated storage systems and other material handling equipment to save on labor costs and boost efficiency and productivity.

The assembly segment is expected to grow at the fastest CAGR over the forecast period. Modern retrieval and automated storage systems, as well as other material handling equipment, are rapidly adopted by businesses renovating their current facilities and establishing new ones to reduce labor costs and increase productivity and efficiency. For instance, in February 2021, SAFELOG GmbH, an automated transportation company, launched warehouse robots, SafeLogAGV L1 lifts which load up to 15000kg.

The ma

The manufacturing sector segment captured the maximum market share in 2024. AGVs are extensively used in manufacturing plants for transporting raw materials, components, and finished goods between different stages of the production process. Their integration helps reduce manual labor, minimize production downtime, and ensure a smooth flow of materials, which is essential for just-in-time (JIT) manufacturing and lean production systems. Industries such as automotive, electronics, and aerospace rely heavily on AGVs to maintain high productivity levels while enhancing workplace safety. The adoption of AGVs also supports digital transformation initiatives and Industry 4.0 objectives by enabling real-time monitoring, data collection, and intelligent process optimization.

The wholesale and distribution sector is another key area driving the expansion of the AGV market, particularly with the rapid growth of e-commerce and global trade. AGVs are increasingly being implemented in distribution centers and wholesale warehouses to handle large volumes of goods efficiently and accurately. These vehicles automate tasks such as picking, sorting, loading, and order fulfillment, significantly reducing manual dependency and operational errors. By ensuring faster and more reliable material movement, AGVs help businesses meet growing consumer expectations for quick and accurate deliveries. The technology’s ability to operate continuously without fatigue makes it ideal for high-demand logistics environments.

The hardware segment contributed the largest market share in 2024. These elements collectively determine the efficiency, precision, and safety of AGV operations. The growing demand for high-performance hardware solutions is driven by the increasing need for reliable automation in material handling, logistics, and manufacturing processes. Advanced sensors and LiDAR systems enable accurate navigation and obstacle detection, ensuring smooth and safe vehicle movement within dynamic environments. Battery technologies, particularly lithium-ion, are also evolving rapidly, offering longer operational life and reduced charging times, thereby enhancing the overall productivity of AGVs.

The services segment is expected to grow at the fastest CAGR during the forecast period. As AGV systems become more complex and integrated with digital platforms, the need for expert consultation and technical assistance has increased significantly. Service providers help companies customize AGV solutions to suit their specific operational needs, ensuring seamless integration with existing infrastructure and IT systems. Preventive maintenance and real-time monitoring services further enhance the reliability and uptime of AGVs, reducing unexpected breakdowns and operational disruptions.

The lead-acid batteries segment generated the maximum market share in 2024. These batteries are widely adopted across various industrial applications due to their ability to provide consistent power output and withstand demanding operating conditions. Lead-acid batteries are particularly favored in industries where budget constraints and predictable duty cycles make them a practical choice. However, their limitations, such as longer charging times, shorter lifespan, and the need for regular maintenance, have encouraged many industries to explore advanced alternatives. Despite this, lead-acid batteries continue to hold a steady presence in the AGV market, especially in applications where energy requirements are moderate and cost considerations are a priority. Their established supply chain and compatibility with traditional AGV systems further contribute to their ongoing use in manufacturing, warehousing, and logistics environments.

The lithium-ion batteries, segment is expected to grow at the fastest CAGR during the forecast period. These batteries offer a higher energy density compared to lead-acid alternatives, allowing AGVs to operate for extended periods without frequent recharging. Lithium-ion technology also supports opportunity charging, enabling vehicles to recharge during short operational breaks, which significantly enhances productivity and reduces downtime. The low maintenance requirements and improved safety features of lithium-ion batteries make them an attractive option for modern automated systems. As industries move toward more sustainable and efficient energy solutions, lithium-ion-powered AGVs are gaining widespread adoption across sectors such as e-commerce, automotive, and food and beverage. The growing focus on energy efficiency, environmental sustainability, and total cost of ownership continues to drive the shift toward lithium-ion battery integration in next-generation AGV systems worldwide.

The indoor mode segment registered the maximum market share in 2024. Indoor AGVs are designed to operate within controlled environments, performing tasks such as material transport, inventory handling, pallet movement, and assembly line support. They are equipped with advanced navigation technologies like laser guidance, magnetic tape, and natural navigation systems, which enable precise movement and obstacle detection in confined spaces. The demand for indoor AGVs is strongly driven by the rapid adoption of automation in industries such as automotive, electronics, and food and beverage, where consistent material flow and high productivity are essential.

The outdoor AGVs are gaining traction as industries increasingly seek automation solutions that extend beyond indoor operations to include yard management, container handling, and goods transportation across larger industrial campuses or ports. Designed to withstand varying environmental conditions such as temperature fluctuations, dust, and uneven surfaces, outdoor AGVs are built with robust materials and enhanced navigation systems that allow them to function efficiently in open and semi-structured environments. They are commonly used in logistics hubs, airports, seaports, and large-scale manufacturing sites to move heavy loads or transfer materials between storage and production areas. The integration of GPS, LiDAR, and vision-based navigation systems has significantly improved the performance and reliability of outdoor AGVs, enabling real-time tracking and autonomous route adjustment.

By Vehicle Type

By Navigation Technology

By Application

By Industry

By Component

By Battery Type

By Mode of Operation

By Regional

Automated Guided Vehicle Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automated Guided Vehicle Market, By Vehicle Type

7.1. Automated Guided Vehicle Market, by Vehicle Type

7.1.1. Tow Vehicle

7.1.1.1. Market Revenue and Forecast

7.1.2. Unit Load Carrier

7.1.2.1. Market Revenue and Forecast

7.1.3. Pallet Truck

7.1.3.1. Market Revenue and Forecast

7.1.4. Forklift Truck

7.1.4.1. Market Revenue and Forecast

7.1.5. Hybrid Vehicles

7.1.5.1. Market Revenue and Forecast

Chapter 8. Global Automated Guided Vehicle Market, By Navigation Technology

8.1. Automated Guided Vehicle Market, by Navigation Technology

8.1.1. Laser Guidance

8.1.1.1. Market Revenue and Forecast

8.1.2. Magnetic Guidance

8.1.2.1. Market Revenue and Forecast

8.1.3. Vision Guidance

8.1.3.1. Market Revenue and Forecast

8.1.4. Inductive Guidance

8.1.4.1. Market Revenue and Forecast

8.1.5. Natural Navigation

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Automated Guided Vehicle Market, By Application

9.1. Automated Guided Vehicle Market, by Application

9.1.1. Logistics and Warehousing

9.1.1.1. Market Revenue and Forecast

9.1.2. Assembly

9.1.2.1. Market Revenue and Forecast

9.1.3. Packaging

9.1.3.1. Market Revenue and Forecast

9.1.4. Trailer Loading and Unloading

9.1.4.1. Market Revenue and Forecast

9.1.5. Raw Material Handling

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Global Automated Guided Vehicle Market, By Industry

10.1. Automated Guided Vehicle Market, by Industry

10.1.1. Manufacturing Sector

10.1.1.1. Market Revenue and Forecast

10.1.2. Wholesale and Distribution Sector

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Automated Guided Vehicle Market, By Component

11.1. Automated Guided Vehicle Market, by Component

11.1.1. Hardware

11.1.1.1. Market Revenue and Forecast

11.1.2. Software

11.1.2.1. Market Revenue and Forecast

11.1.3. Services

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Automated Guided Vehicle Market, By Battery Type

12.1. Automated Guided Vehicle Market, by Battery Type

12.1.1. Lead Battery

12.1.1.1. Market Revenue and Forecast

12.1.2. Lithium-Ion Battery

12.1.2.1. Market Revenue and Forecast

12.1.3. Nickel-based Battery

12.1.3.1. Market Revenue and Forecast

12.1.4. Others

12.1.4.1. Market Revenue and Forecast

Chapter 13. Global Automated Guided Vehicle Market, By Mode of Operation

13.1. Automated Guided Vehicle Market, by Mode of Operation

13.1.1. Indoor

13.1.1.1. Market Revenue and Forecast

13.1.2. Outdoor

13.1.2.1. Market Revenue and Forecast

Chapter 14. Global Automated Guided Vehicle Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Vehicle Type

14.1.2. Market Revenue and Forecast, by Navigation Technology

14.1.3. Market Revenue and Forecast, by Application

14.1.4. Market Revenue and Forecast, by Industry

14.1.5. Market Revenue and Forecast, by Component

14.1.6. Market Revenue and Forecast, by Mode of Operation

14.1.7. Market Revenue and Forecast, by Battery Type

14.1.8. U.S.

14.1.8.1. Market Revenue and Forecast, by Vehicle Type

14.1.8.2. Market Revenue and Forecast, by Navigation Technology

14.1.8.3. Market Revenue and Forecast, by Application

14.1.8.4. Market Revenue and Forecast, by Industry

14.1.8.5. Market Revenue and Forecast, by Component

14.1.8.6. Market Revenue and Forecast, by Mode of Operation

14.1.8.7. Market Revenue and Forecast, by Battery Type

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Vehicle Type

14.1.9.2. Market Revenue and Forecast, by Navigation Technology

14.1.9.3. Market Revenue and Forecast, by Application

14.1.9.4. Market Revenue and Forecast, by Industry

14.1.9.5. Market Revenue and Forecast, by Component

14.1.9.6. Market Revenue and Forecast, by Mode of Operation

14.1.9.7. Market Revenue and Forecast, by Battery Type

14.2. Europe

14.2.1. Market Revenue and Forecast, by Vehicle Type

14.2.2. Market Revenue and Forecast, by Navigation Technology

14.2.3. Market Revenue and Forecast, by Application

14.2.4. Market Revenue and Forecast, by Industry

14.2.5. Market Revenue and Forecast, by Component

14.2.6. Market Revenue and Forecast, by Mode of Operation

14.2.7. Market Revenue and Forecast, by Battery Type

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Vehicle Type

14.2.8.2. Market Revenue and Forecast, by Navigation Technology

14.2.8.3. Market Revenue and Forecast, by Application

14.2.8.4. Market Revenue and Forecast, by Industry

14.2.8.5. Market Revenue and Forecast, by Component

14.2.8.6. Market Revenue and Forecast, by Mode of Operation

14.2.8.7. Market Revenue and Forecast, by Battery Type

14.2.9. Germany

14.2.9.1. Market Revenue and Forecast, by Vehicle Type

14.2.9.2. Market Revenue and Forecast, by Navigation Technology

14.2.9.3. Market Revenue and Forecast, by Application

14.2.9.4. Market Revenue and Forecast, by Industry

14.2.9.5. Market Revenue and Forecast, by Component

14.2.9.6. Market Revenue and Forecast, by Mode of Operation

14.2.9.7. Market Revenue and Forecast, by Battery Type

14.2.10. France

14.2.10.1. Market Revenue and Forecast, by Vehicle Type

14.2.10.2. Market Revenue and Forecast, by Navigation Technology

14.2.10.3. Market Revenue and Forecast, by Application

14.2.10.4. Market Revenue and Forecast, by Industry

14.2.10.5. Market Revenue and Forecast, by Component

14.2.10.6. Market Revenue and Forecast, by Mode of Operation

14.2.10.7. Market Revenue and Forecast, by Battery Type

14.2.11. Rest of Europe

14.2.11.1. Market Revenue and Forecast, by Vehicle Type

14.2.11.2. Market Revenue and Forecast, by Navigation Technology

14.2.11.3. Market Revenue and Forecast, by Application

14.2.11.4. Market Revenue and Forecast, by Industry

14.2.11.5. Market Revenue and Forecast, by Component

14.2.11.6. Market Revenue and Forecast, by Mode of Operation

14.2.11.7. Market Revenue and Forecast, by Battery Type

14.3. APAC

14.3.1. Market Revenue and Forecast, by Vehicle Type

14.3.2. Market Revenue and Forecast, by Navigation Technology

14.3.3. Market Revenue and Forecast, by Application

14.3.4. Market Revenue and Forecast, by Industry

14.3.5. Market Revenue and Forecast, by Component

14.3.6. Market Revenue and Forecast, by Mode of Operation

14.3.7. Market Revenue and Forecast, by Battery Type

14.3.8. India

14.3.8.1. Market Revenue and Forecast, by Vehicle Type

14.3.8.2. Market Revenue and Forecast, by Navigation Technology

14.3.8.3. Market Revenue and Forecast, by Application

14.3.8.4. Market Revenue and Forecast, by Industry

14.3.8.5. Market Revenue and Forecast, by Component

14.3.8.6. Market Revenue and Forecast, by Mode of Operation

14.3.8.7. Market Revenue and Forecast, by Battery Type

14.3.9. China

14.3.9.1. Market Revenue and Forecast, by Vehicle Type

14.3.9.2. Market Revenue and Forecast, by Navigation Technology

14.3.9.3. Market Revenue and Forecast, by Application

14.3.9.4. Market Revenue and Forecast, by Industry

14.3.9.5. Market Revenue and Forecast, by Component

14.3.9.6. Market Revenue and Forecast, by Mode of Operation

14.3.9.7. Market Revenue and Forecast, by Battery Type

14.3.10. Japan

14.3.10.1. Market Revenue and Forecast, by Vehicle Type

14.3.10.2. Market Revenue and Forecast, by Navigation Technology

14.3.10.3. Market Revenue and Forecast, by Application

14.3.10.4. Market Revenue and Forecast, by Industry

14.3.10.5. Market Revenue and Forecast, by Component

14.3.10.6. Market Revenue and Forecast, by Mode of Operation

14.3.10.7. Market Revenue and Forecast, by Battery Type

14.3.11. Rest of APAC

14.3.11.1. Market Revenue and Forecast, by Vehicle Type

14.3.11.2. Market Revenue and Forecast, by Navigation Technology

14.3.11.3. Market Revenue and Forecast, by Application

14.3.11.4. Market Revenue and Forecast, by Industry

14.3.11.5. Market Revenue and Forecast, by Component

14.3.11.6. Market Revenue and Forecast, by Mode of Operation

14.3.11.7. Market Revenue and Forecast, by Battery Type

14.4. MEA

14.4.1. Market Revenue and Forecast, by Vehicle Type

14.4.2. Market Revenue and Forecast, by Navigation Technology

14.4.3. Market Revenue and Forecast, by Application

14.4.4. Market Revenue and Forecast, by Industry

14.4.5. Market Revenue and Forecast, by Component

14.4.6. Market Revenue and Forecast, by Mode of Operation

14.4.7. Market Revenue and Forecast, by Battery Type

14.4.8. GCC

14.4.8.1. Market Revenue and Forecast, by Vehicle Type

14.4.8.2. Market Revenue and Forecast, by Navigation Technology

14.4.8.3. Market Revenue and Forecast, by Application

14.4.8.4. Market Revenue and Forecast, by Industry

14.4.8.5. Market Revenue and Forecast, by Component

14.4.8.6. Market Revenue and Forecast, by Mode of Operation

14.4.8.7. Market Revenue and Forecast, by Battery Type

14.4.9. North Africa

14.4.9.1. Market Revenue and Forecast, by Vehicle Type

14.4.9.2. Market Revenue and Forecast, by Navigation Technology

14.4.9.3. Market Revenue and Forecast, by Application

14.4.9.4. Market Revenue and Forecast, by Industry

14.4.9.5. Market Revenue and Forecast, by Component

14.4.9.6. Market Revenue and Forecast, by Mode of Operation

14.4.9.7. Market Revenue and Forecast, by Battery Type

14.4.10. South Africa

14.4.10.1. Market Revenue and Forecast, by Vehicle Type

14.4.10.2. Market Revenue and Forecast, by Navigation Technology

14.4.10.3. Market Revenue and Forecast, by Application

14.4.10.4. Market Revenue and Forecast, by Industry

14.4.10.5. Market Revenue and Forecast, by Component

14.4.10.6. Market Revenue and Forecast, by Mode of Operation

14.4.10.7. Market Revenue and Forecast, by Battery Type

14.4.11. Rest of MEA

14.4.11.1. Market Revenue and Forecast, by Vehicle Type

14.4.11.2. Market Revenue and Forecast, by Navigation Technology

14.4.11.3. Market Revenue and Forecast, by Application

14.4.11.4. Market Revenue and Forecast, by Industry

14.4.11.5. Market Revenue and Forecast, by Component

14.4.11.6. Market Revenue and Forecast, by Mode of Operation

14.4.11.7. Market Revenue and Forecast, by Battery Type

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Vehicle Type

14.5.2. Market Revenue and Forecast, by Navigation Technology

14.5.3. Market Revenue and Forecast, by Application

14.5.4. Market Revenue and Forecast, by Industry

14.5.5. Market Revenue and Forecast, by Component

14.5.6. Market Revenue and Forecast, by Mode of Operation

14.5.7. Market Revenue and Forecast, by Battery Type

14.5.8. Brazil

14.5.8.1. Market Revenue and Forecast, by Vehicle Type

14.5.8.2. Market Revenue and Forecast, by Navigation Technology

14.5.8.3. Market Revenue and Forecast, by Application

14.5.8.4. Market Revenue and Forecast, by Industry

14.5.8.5. Market Revenue and Forecast, by Component

14.5.8.6. Market Revenue and Forecast, by Mode of Operation

14.5.8.7. Market Revenue and Forecast, by Battery Type

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Vehicle Type

14.5.9.2. Market Revenue and Forecast, by Navigation Technology

14.5.9.3. Market Revenue and Forecast, by Application

14.5.9.4. Market Revenue and Forecast, by Industry

14.5.9.5. Market Revenue and Forecast, by Component

14.5.9.6. Market Revenue and Forecast, by Mode of Operation

14.5.9.7. Market Revenue and Forecast, by Battery Type

Chapter 15. Company Profiles

15.1. Bastian Solutions, Inc.

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Daifuku Co., Ltd.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Dematic

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. TOYOTA INDUSTRIES CORPORATION

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Hyster-Yale Materials Handling, Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. BALYO

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. E&K Automation GmbH

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Kollmorgen

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. KMH Fleet Solutions

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. ELETTRIC80 S.P.A.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others