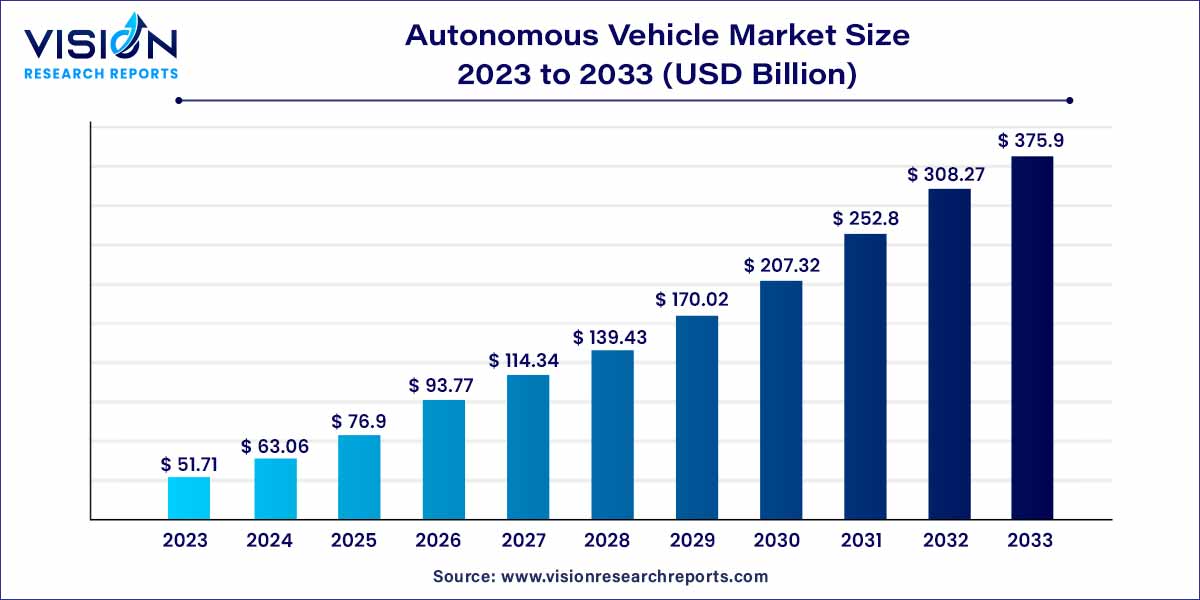

The global autonomous vehicle market size was estimated at around USD 51.71 billion in 2023 and it is projected to hit around USD 375.9 billion by 2033, growing at a CAGR of 21.94% from 2024 to 2033.

The autonomous vehicle market is witnessing a paradigm shift in the automotive industry, driven by technological advancements and a collective push toward safer, more efficient transportation. Autonomous vehicles, also known as self-driving cars, represent a revolutionary leap forward in mobility solutions. This overview delves into key aspects of the autonomous vehicle market, providing insights into its current state and future prospects.

The growth of the autonomous vehicle market is propelled by a confluence of factors driving technological innovation and societal change. Advances in sensor technologies, artificial intelligence, and machine learning are key contributors, enhancing the capabilities of autonomous vehicles and bolstering their safety features. The growing emphasis on sustainability and environmental consciousness is another pivotal factor, as autonomous vehicles offer the potential to optimize traffic flow and reduce overall emissions through more efficient driving patterns. Additionally, increased investments from major industry players and collaborations between automotive and technology companies play a crucial role in accelerating the development and deployment of autonomous technologies. As regulatory frameworks evolve to accommodate these innovations, the market is poised for expansion, reshaping the future of transportation and mobility services.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 375.9 billion |

| Growth Rate from 2024 to 2033 | CAGR of 21.94% |

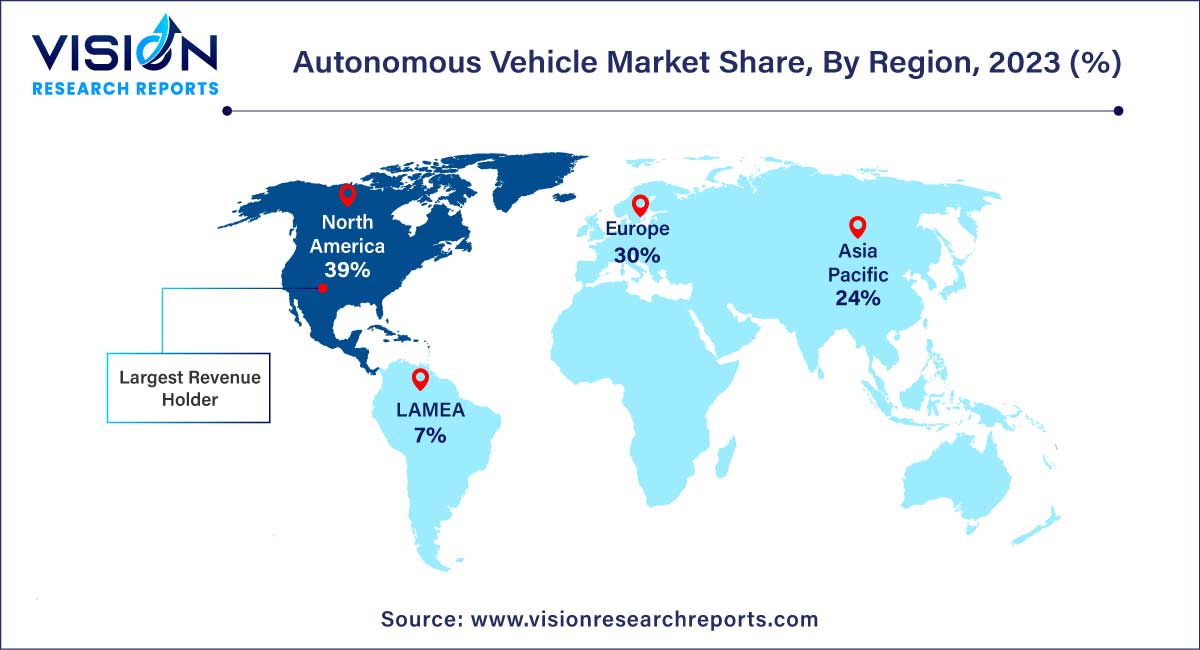

| Revenue Share of North America in 2023 | 39% |

| CAGR of Asia Pacific from 2024 to 2033 | 25.05% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The passenger vehicle segment held the largest revenue share of 72% in 2023. Consumer preferences are shifting towards transportation options that are not only more convenient but also prioritize safety and efficiency. Autonomous vehicles emerge as a promising solution, offering the allure of hands-free and stress-free commuting. This particularly resonates with individuals seeking a more relaxed and productive travel experience. Ongoing advancements in autonomous vehicle technology, encompassing improved sensors, AI algorithms, and connectivity, have played a pivotal role in making autonomous passenger vehicles more practical and dependable. These continuous enhancements instill a sense of confidence in the safety and performance of such vehicles, further fueling consumer interest.

Simultaneously, the commercial vehicle segment is experiencing substantial growth. Industries such as commercial transportation, logistics, and delivery services are increasingly recognizing the advantages of integrating autonomous technology into their operations. The potential to streamline commercial logistics, optimize supply chains, and meet escalating customer demands is driving the adoption of autonomous solutions within commercial fleets. A burgeoning ecosystem comprising technology developers, manufacturers, and investors is actively committed to advancing autonomous systems tailored for commercial use. Ongoing innovation and increased investment within this sector are poised to propel the development and deployment of more sophisticated autonomous commercial vehicles.

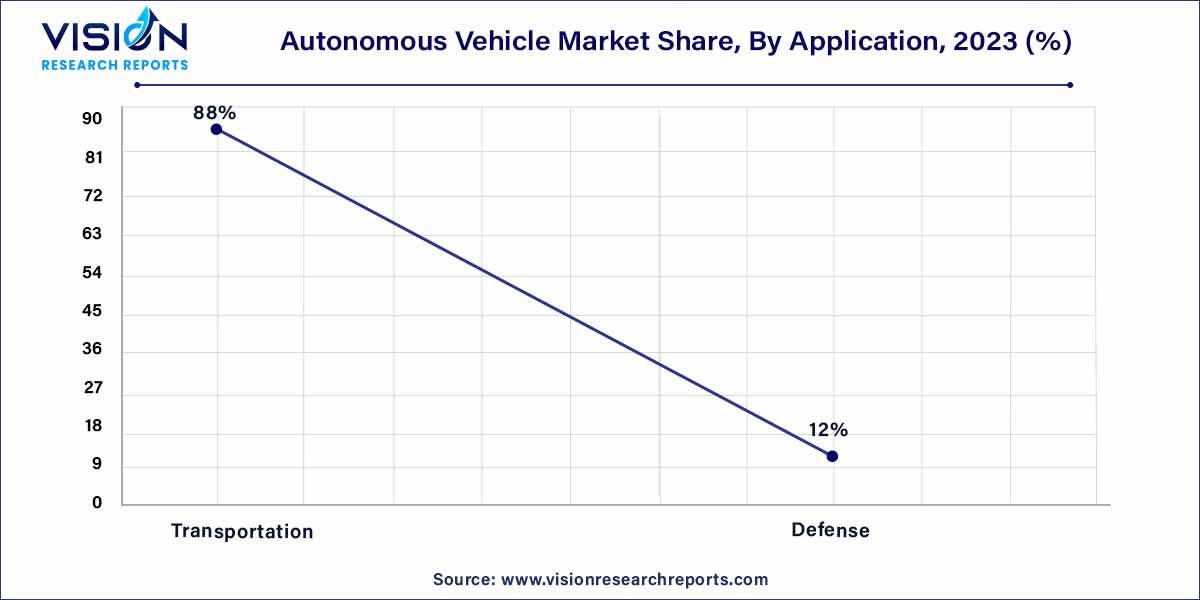

The transportation segment had the largest market share of 88% in 2023. primarily due to its substantial potential for innovation and efficiency. Autonomous technology, with its pledge to revolutionize the movement of goods and people, stands as a transformative force in the transportation sector. By providing safer and more efficient transportation solutions, it is reshaping traditional approaches to travel and logistics. Industries such as logistics, shipping, and ridesharing are actively adopting autonomous vehicles to streamline operations, cut costs, and address the escalating demand for reliable transportation. The sector's focus on enhanced logistics, improved safety, and cost-effectiveness propels the dominance of autonomous vehicles in the transportation industry.

Simultaneously, the growth of the defense segment within the market is propelled by an increasing emphasis on developing unmanned military systems. Governments globally are prioritizing the enhancement of national security while minimizing risks to human personnel in conflict zones. These autonomous vehicles offer a range of advantages, including reconnaissance, logistics support, and even combat capabilities, making them indispensable components of modern defense strategies. The demand for dependable, high-tech autonomous solutions continues to surge as nations strive to fortify their military capabilities through advanced and unmanned systems.

The Level 1 segment contributed the largest market share of 48% in 2023. This dominance can be attributed to the prevalence of basic driver assistance features, categorically known as Level 1 autonomy, which includes functionalities like adaptive cruise control and lane-keeping assistance. The popularity of Level 1 autonomy is grounded in its user-friendly nature and widespread integration into contemporary vehicles. These systems provide essential safety and convenience without requiring extensive infrastructure modifications or incurring significant expenses. Furthermore, automakers' widespread adoption of Level 1 autonomy as standard or optional features across various car models enhances accessibility for consumers, solidifying their prevalence in the market.

Concurrently, the Level 4 & 5 segment is positioned for notable growth in the autonomous vehicle market. These higher levels of automation empower vehicles to operate without human intervention, representing a significant leap in autonomous capabilities. The increasing interest in Levels 4 & 5 can be attributed to technological advancements in sensors, artificial intelligence, and computing power, ensuring enhanced safety and more reliable self-driving capabilities. Industries and consumers alike are recognizing the potential benefits, including increased safety, efficiency, and convenience, thereby fueling the substantial growth of these higher-level autonomous vehicles.

North America region dominated the market with the largest market share of 39% in 2023. The region's prominence is attributed to its extensive infrastructure, notably exemplified in areas such as California's Silicon Valley, providing an optimal testing environment for autonomous vehicles and related technologies. The well-established infrastructure and supportive ecosystem in North America play a pivotal role in advancing and adopting autonomous systems. The region's population generally exhibits a receptiveness to innovative technologies, creating a substantial market for autonomous vehicles, drones, and other autonomous systems. This consumer demand and acceptance act as catalysts for further developments in the field.

Meanwhile, the Asia-Pacific region is anticipated to experience the fastest CAGR of 25.05% from 2024 to 2033. Countries within Asia Pacific, including China, Japan, and South Korea, grapple with densely populated cities confronting transportation challenges. Autonomous vehicles are perceived as a viable solution to address congestion, enhance mobility, and improve transportation efficiency in these urban centers. Furthermore, Asia Pacific's emphasis on electric and connected vehicles aligns seamlessly with the trajectory of autonomous vehicles. The region's dedication to clean energy has stimulated interest in autonomous technologies, fostering a growing market for these innovative vehicles.

By Type

By Level of Autonomy

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Autonomous Vehicle Market

5.1. COVID-19 Landscape: Autonomous Vehicle Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Autonomous Vehicle Market, By Type

8.1. Autonomous Vehicle Market, by Type, 2024-2033

8.1.1 Passenger Vehicle

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commercial Vehicle

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Autonomous Vehicle Market, By Level of Autonomy

9.1. Autonomous Vehicle Market, by Level of Autonomy, 2024-2033

9.1.1. Level 1

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Level 2

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Level 3

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Level 4 & 5

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Autonomous Vehicle Market, By Application

10.1. Autonomous Vehicle Market, by Application, 2024-2033

10.1.1. Transportation

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Defense

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Autonomous Vehicle Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Level of Autonomy (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. AB Volvo.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bayerische Motoren Werke AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ford Motor Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. General Motors.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hyundai Motor Group.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mercedes-Benz AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Renault SA.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Tesla, Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Toyota Motor Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Volkswagen Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others