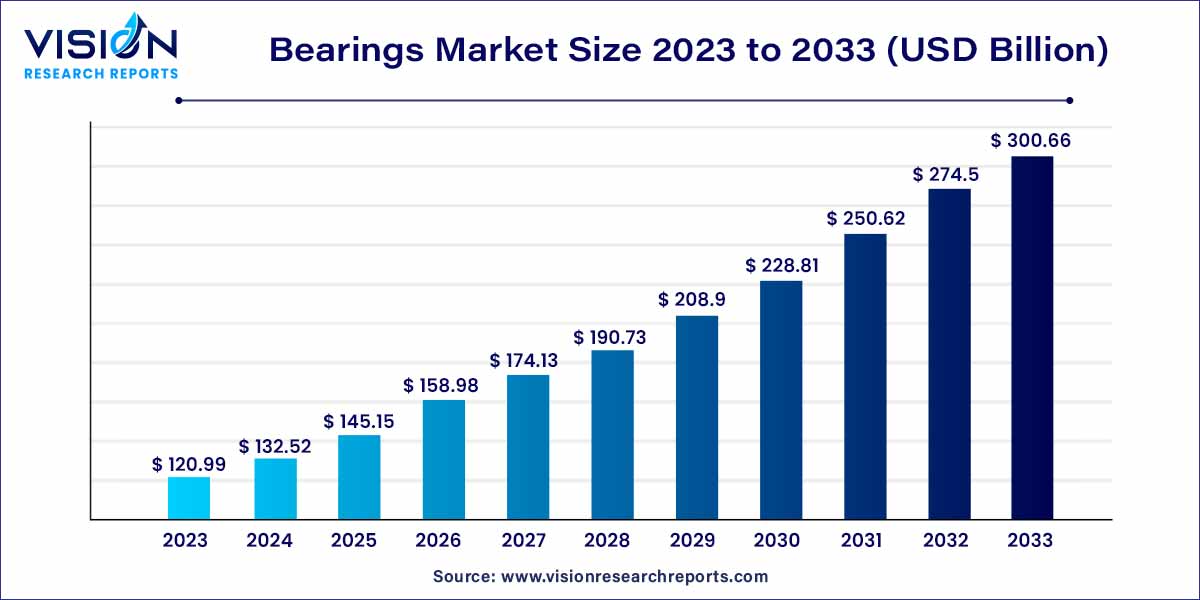

The global bearing market size was estimated at around USD 120.99 billion in 2023 and it is projected to hit around USD 300.66 billion by 2033, growing at a CAGR of 9.53% from 2024 to 2033. The bearing market is driven by an industrial automation, rising automotive production, infrastructure development, and increased demand for renewable energy.

The bearings market serves as a crucial component within various industries, facilitating the smooth rotation and movement of machinery and equipment. Bearings are mechanical components designed to reduce friction between moving parts, enabling efficient transmission of power and supporting the load. This market overview aims to provide insights into the current landscape, trends, and key factors shaping the bearings industry.

The bearings market is experiencing robust growth driven by several key factors. One significant contributor is the rapid expansion of industrial automation across various sectors. As industries increasingly adopt automated processes, there is a growing demand for precision-engineered machinery and equipment, thereby fueling the need for high-performance bearings. Furthermore, the surge in automotive production worldwide is a notable growth driver. With the automotive industry witnessing a shift towards electric and fuel-efficient vehicles, there is a heightened requirement for advanced bearings to support these technological advancements. Additionally, infrastructure development projects, including construction, transportation, and energy sectors, continue to drive the demand for bearings. As these industries rely heavily on machinery and equipment fitted with bearings, the market experiences sustained growth. Moreover, ongoing technological advancements in bearing materials, designs, and lubrication technologies are enhancing performance, durability, and efficiency, further bolstering market expansion. These growth factors collectively contribute to the positive trajectory of the bearings market, positioning it for continued advancement in the foreseeable future.

Based on product, the bearings market is segmented into ball, roller, plain bearing, and others. The roller bearings segment accounted for the largest revenue share of more than 46% in 2023. The segment is also estimated to continue its supremacy and emerge as the fastest-growing segment in the coming years. These products reduce rotational friction, support radial and axial loads, and can sustain limited axial loads and heavy radial loads more efficiently than their counterparts. The widespread espousal of roller bearings by several industries, such as capital equipment, automobiles, home appliances, and aerospace, is estimated to positively impact product demand.

The report also covers the ball and other bearings. Ball bearings have a smaller surface contact and, therefore, help to reduce friction to a great extent. They can also be used with thrust and radial loadings, ascribed to which, these products are increasingly being used in both four and two-wheeled automobiles. Hence the segment is anticipated to witness healthy growth over the forecast period.

Plain bearings, also known as sleeve bearings, are the most preliminary type of bearings with no rolling components. They are used for sliding, oscillating, rotating, and reciprocating motions. In sliding applications, they are used as bearing strips, slide bearings, and wear plates. Due to greater contact area and conformability, plain bearings offer greater resistance to high shock loads and load capacity as compared to roller bearings. Such benefits offered over their counterparts make plain bearing a preferred option in applications where greater resistance to damage from oscillatory movements is requisite. The demand for plain bearings is expected to register a steady growth rate over the forecast period.

In 2023, the automotive segment dominated the market and accounted for 50% of the market share. The high share of this segment can be attributed to high automotive production, globally. Also, the demand for vehicles with technologically advanced solutions is escalating, thus leading to a rise in vehicle manufacturing that necessitates instrumented products. The growth in demand for highly advanced vehicles and the subsequent increase in the capabilities of the vehicles has escalated the demand for bearing in the automotive industry. Additionally, the automotive aftermarket segment is also anticipated to boost at a subsequently higher CAGR over the forecast period, thereby further bolstering the demand for bearings.

The railway and aerospace segment is anticipated to emerge as the fastest-growing segment by 2033. This growth can be attributed to growing interest in travel activities, the growing need to renew aging fleets owing to stringent environmental legislation, and fuel price pressure coupled with the availability of improved ways to assist global and local transportation systems. Demand from the railway segment is also anticipated to rise on account of accelerated railway construction in developing countries. Further, surging demand for small single-aisle aircraft and helicopters from emerging economies is anticipated to further drive the growth of the segment.

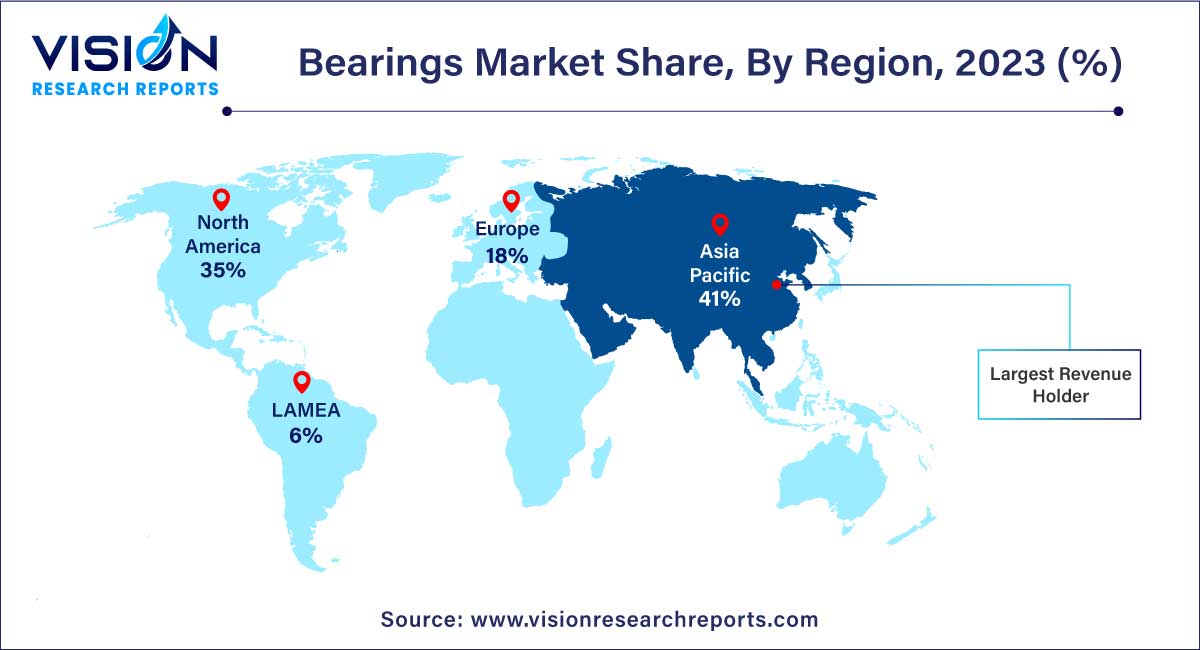

Asia Pacific dominated the market and accounted for a revenue share of 41% in 2023. The region is also anticipated to witness the fastest growth in terms of revenue, accounting for over USD 98.20 billion by 2033. China is one of the major markets, and sale in the country is expected to catapult over the foreseeable years stimulated by the rapid expansion of machinery and motor vehicle production coupled with a strong aftermarket for industrial equipment and motor vehicle repair. Moreover, the robust construction and mining equipment market in India is estimated to facilitate market growth through 2033.

In Europe, the market is anticipated to witness favorable growth during the forecast period, owing to sustainable economic growth and increased investment. Furthermore, in the mature markets of the U.S., Western Europe, and Japan, the demand is driven by the rebounding production of motor vehicles and a healthy fixed investment environment. Increased sales of high-value bearings, such as large-diameter, custom-built used in heavy machinery and wind turbines, are also expected to drive the market in North America. In the Middle East and Africa, the rapid development of city infrastructures is positively influencing overall growth.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bearings Market

5.1. COVID-19 Landscape: Bearings Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bearings Market, By Product

8.1. Bearings Market, by Product, 2024-2033

8.1.1. Ball Bearings

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Roller Bearings

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Plain Bearings

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Bearings Market, By Application

9.1. Bearings Market, by Application, 2024-2033

9.1.1. Automotive

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Agriculture

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Electrical

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Mining & Construction

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Railway & Aerospace

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Automotive Aftermarket

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Bearings Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Brammer PLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Harbin Bearing Manufacturing Co., Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. HKT Bearings Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. JTEKT Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. NBI Bearings Europe

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. NSK Global

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. NTN Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. RBC Bearings Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rexnord Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. RHP Bearings

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others