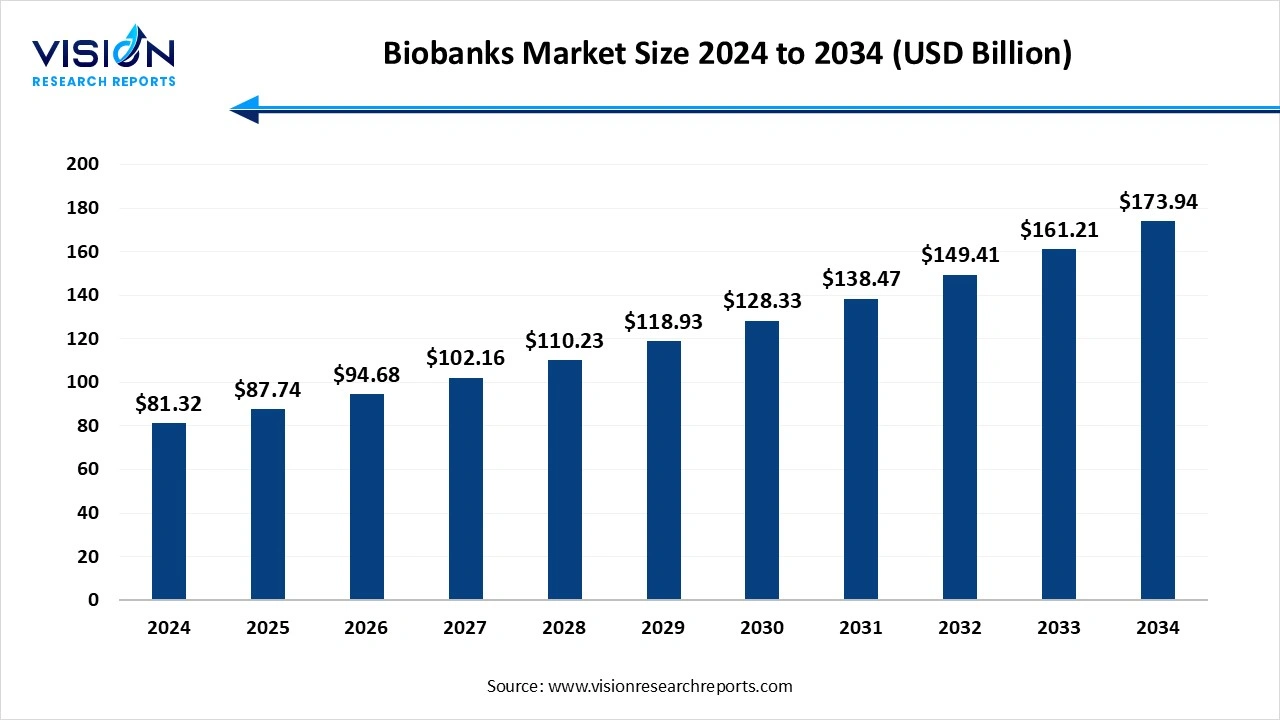

The global biobanks market size stood at USD 81.32 billion in 2024 and is estimated to reach USD 87.74 billion in 2025. It is projected to surge past USD 173.94 billion by 2034, registering a robust CAGR of 7.9% from 2025 to 2034. The rising precision of personalized medicine, the continuously escalating cell and gene therapy pipeline, and the increasing incidence of chronic diseases.

Biobanks are crucial to advancing biomedical science by systematically collecting, storing, and distributing high-quality human biological samples. These repositories of tissues, fluids, and genetic material are managed with strict ethical standards and enable collaborative research efforts. By providing scientists with access to these vital resources, biobanks accelerate the development of new treatments and our overall understanding of human health and disease.

As research and development in regenerative medicine and stem cell technologies increase, so does the demand for high-quality biospecimens and the need for well-managed biobanks to support these therapies.

| Report Coverage | Details |

| Market Size in 2024 | USD 81.32 billion |

| Revenue Forecast by 2034 | USD 173.94 billion |

| Growth rate from 2025 to 2034 | CAGR of 7.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Thermo Fisher Scientific, BioStorage Technologies, Qiagen, Brooks Life Sciences, PerkinElmer, Cryoport, Biomatrica, LGC Limited, Analytik Jena, HudsonAlpha Institute for Biotechnology. |

Adopting eco-friendly practices in biobanking, such as energy-efficient equipment, offers cost savings and aligns with environmental goals. Regulations like the EU Green Deal promote greener solutions. Energy-efficient freezers reduce consumption and costs. The Asia-Pacific region is experiencing rapid biobanking market growth due to investments, healthcare infrastructure development, and a focus on personalized medicine. The AIG Hospital launched a biobank in Southern India to collect a large number of samples.

High upfront and ongoing expenses for specialized facilities, equipment, and expert personnel significantly constrain the biobanking market. These substantial costs create a barrier to entry for smaller organizations and threaten the long-term financial sustainability of public biobanks that rely on unstable funding. The inability to fully recover costs from distributed samples necessitates new funding models, such as hybrid public-private partnerships, to ensure continued operation

The European biobanking industry dominated the market, capturing the largest revenue share of 37% in 2024. There is a strong focus on personalized medicine and genomics, alongside the expansion of regenerative medicine. Rising chronic disease burdens necessitate robust biobanks, further propelled by continuous technological advancements. Significant investments, collaborative initiatives, and supportive regulatory frameworks also play a crucial role. This combination ensures a steady demand for high-quality biospecimens, underpinning the market's continued expansion.

Germany Biobanks Market Trends

The rising prevalence of chronic diseases increases the need for biobanking services. Navigating ethical and regulatory frameworks, such as GDPR and national bioethical standards, presents challenges. Government funding, like support for the Nationale Kohorte, and research collaborations, are driving market growth. The market includes both global and regional companies.

Asia Pacific expects significant growth in the biobanks market during the forecast period. The region's growing healthcare infrastructure, surge in government subsidies, events, and private investment in the life science and biobanking sectors within the region. The rising number of chronic diseases requires well-annotated biological samples for understanding and developing effective treatments. The advanced technologies, such as automation storage systems and bioinformatics platforms, are rising in sample management and data analysis.

Why did the Services Segment Dominate the Biobanks Market?

The services segment dominated the market, capturing the highest revenue share and is expected to experience the fastest growth rate during the forecast period in 2024. The indispensable role in advancing biomedical research and personalized medicine. This is driven by the growing demand for high-quality biological samples and the increasing complexity of modern research, which requires specialized support. Services like sample collection, processing, storage, and data management are critical for ensuring the integrity and usability of biospecimens. Additionally, increasing investments and regulatory demands for quality assurance further solidify the services segment's market leadership.

The product segment is the fastest-growing in the Biobanks market during the forecast period. The increasing demands for efficient, reliable operations. LIMS solutions enhance sample management, traceability, and data integrity, reducing manual errors and improving research outcomes. Furthermore, they are crucial for ensuring compliance with stringent regulatory and ethical standards. Overall, LIMS optimizes biobank functionality, supporting advancements in medical research and personalized medicine.

How the Human Tissues Segment hold the Largest Share in the Biobanks Market?

The human tissues segment accounted for the highest revenue share, representing 37% of the total market in 2024. The extensive use in disease research, drug development, and personalized medicine. This is driven by its essential role in understanding human biology and creating therapies, particularly for chronic diseases like cancer. The growing emphasis on regenerative medicine and advancements in technology also increases demand for preserved tissue samples. Ultimately, the human tissue segment's largest market share is a result of its critical utility in both foundational and innovative medical research.

The human organs segment is experiencing the fastest growth in the market during the forecast period. The broad therapeutic potential of stem cells in regenerative medicine and drug development, the rising number of clinical trials demonstrating the safety and efficacy of stem cell treatments, is bolstering confidence in these therapies. Additionally, the trend of personalized medicine, where biobanks are crucial for storing patient-specific samples for tailored treatments, also fuels demand. Advancements in genomics and personalized medicine are driving the demand for high-quality biospecimens, including stem cells, for research and development of targeted therapies.

How the Physical or Real Biobanks Segment hold the Largest Share in the Biobanks Market?

The physical or real biobanks segment led the market, capturing the highest revenue share of 76% in 2024. The established networks and direct storage of biospecimens, the physical biobanks segment currently dominates the market. These hubs provide the high-quality samples and reliable infrastructure vital for traditional biomedical research and clinical trials. However, the emerging virtual biobanks are experiencing faster growth by improving access to data and enabling greater collaboration. This means that while physical biobanks currently hold the largest market share, virtual models are rapidly gaining ground.

The physical or real biobanks segment is experiencing the fastest growth in the market during the forecast period. The tangible or physical biobanks are dedicated facilities for the collection, processing, and long-term preservation of biological materials. They use advanced technologies like ultra-low temperature freezers and liquid nitrogen tanks to maintain strict environmental conditions, ensuring the viability of samples such as tissues, blood, and DNA. By following rigorous protocols for handling, quality assurance, and regulatory compliance, these biobanks guarantee that all biological specimens remain intact and uncontaminated for future clinical or research purposes.

How the Therapeutic Application Segment hold the Largest Share in the Biobanks Market?

The therapeutics application segment dominated the market, accounting for the highest revenue share of 38% in 2024. The central role in advancing personalized and regenerative medicine. Biobanks provide essential biological samples and data for developing targeted treatments and innovative therapies. This dominance is further fueled by the rising prevalence of chronic diseases and increasing investments in drug discovery. Biobanks are crucial for conducting clinical trials, identifying biomarkers, and facilitating the development of advanced treatments. Their contribution is essential for accelerating research and improving patient outcomes in various disease areas.

The therapeutic application segment is experiencing the fastest growth in the market during the forecast period. The biobanks are crucial for the development of new treatments and drugs, as they provide essential biological samples for preclinical research. By enabling pharmaceutical companies and researchers to screen and evaluate potential therapeutics, such as targeted and regenerative therapies, biobanks help optimize treatment regimens. Access to a wide variety of annotated samples also allows for a deeper understanding of patient variability, accelerating the path to effective and safe medical innovations.

By Product & Services

By Biospecimen Type

By Biobanks Type

By Application Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biobanks Market

5.1. COVID-19 Landscape: Biobanks Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biobanks Market, By Product & Services

8.1. Biobanks Market, by Product & Services

8.1.1. Product

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Biobanks Market, By Biospecimen Type

9.1. Biobanks Market, by Biospecimen Type

9.1.1. Human Tissues

9.1.1.1. Market Revenue and Forecast

9.1.2. Human Organs

9.1.2.1. Market Revenue and Forecast

9.1.3. Stem Cells

9.1.3.1. Market Revenue and Forecast

9.1.4. Other Biospecimens

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Biobanks Market, By Biobanks Type

10.1. Biobanks Market, by Biobanks Type

10.1.1. Physical/Real Biobanks

10.1.1.1. Market Revenue and Forecast

10.1.2. Virtual Biobanks

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Biobanks Market, By Application Type

11.1. Biobanks Market, by Application Type

11.1.1. Therapeutics

11.1.1.1. Market Revenue and Forecast

11.1.2. Drug Discovery & Clinical Research

11.1.2.1. Market Revenue and Forecast

11.1.3. Clinical Diagnostics

11.1.3.1. Market Revenue and Forecast

11.1.4. Other Applications

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Biobanks Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product & Services

12.1.2. Market Revenue and Forecast, by Biospecimen Type

12.1.3. Market Revenue and Forecast, by Biobanks Type

12.1.4. Market Revenue and Forecast, by Application Type

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product & Services

12.1.5.2. Market Revenue and Forecast, by Biospecimen Type

12.1.5.3. Market Revenue and Forecast, by Biobanks Type

12.1.5.4. Market Revenue and Forecast, by Application Type

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product & Services

12.1.6.2. Market Revenue and Forecast, by Biospecimen Type

12.1.6.3. Market Revenue and Forecast, by Biobanks Type

12.1.6.4. Market Revenue and Forecast, by Application Type

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product & Services

12.2.2. Market Revenue and Forecast, by Biospecimen Type

12.2.3. Market Revenue and Forecast, by Biobanks Type

12.2.4. Market Revenue and Forecast, by Application Type

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product & Services

12.2.5.2. Market Revenue and Forecast, by Biospecimen Type

12.2.5.3. Market Revenue and Forecast, by Biobanks Type

12.2.5.4. Market Revenue and Forecast, by Application Type

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product & Services

12.2.6.2. Market Revenue and Forecast, by Biospecimen Type

12.2.6.3. Market Revenue and Forecast, by Biobanks Type

12.2.6.4. Market Revenue and Forecast, by Application Type

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product & Services

12.2.7.2. Market Revenue and Forecast, by Biospecimen Type

12.2.7.3. Market Revenue and Forecast, by Biobanks Type

12.2.7.4. Market Revenue and Forecast, by Application Type

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product & Services

12.2.8.2. Market Revenue and Forecast, by Biospecimen Type

12.2.8.3. Market Revenue and Forecast, by Biobanks Type

12.2.8.4. Market Revenue and Forecast, by Application Type

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product & Services

12.3.2. Market Revenue and Forecast, by Biospecimen Type

12.3.3. Market Revenue and Forecast, by Biobanks Type

12.3.4. Market Revenue and Forecast, by Application Type

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product & Services

12.3.5.2. Market Revenue and Forecast, by Biospecimen Type

12.3.5.3. Market Revenue and Forecast, by Biobanks Type

12.3.5.4. Market Revenue and Forecast, by Application Type

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product & Services

12.3.6.2. Market Revenue and Forecast, by Biospecimen Type

12.3.6.3. Market Revenue and Forecast, by Biobanks Type

12.3.6.4. Market Revenue and Forecast, by Application Type

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product & Services

12.3.7.2. Market Revenue and Forecast, by Biospecimen Type

12.3.7.3. Market Revenue and Forecast, by Biobanks Type

12.3.7.4. Market Revenue and Forecast, by Application Type

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product & Services

12.3.8.2. Market Revenue and Forecast, by Biospecimen Type

12.3.8.3. Market Revenue and Forecast, by Biobanks Type

12.3.8.4. Market Revenue and Forecast, by Application Type

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product & Services

12.4.2. Market Revenue and Forecast, by Biospecimen Type

12.4.3. Market Revenue and Forecast, by Biobanks Type

12.4.4. Market Revenue and Forecast, by Application Type

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product & Services

12.4.5.2. Market Revenue and Forecast, by Biospecimen Type

12.4.5.3. Market Revenue and Forecast, by Biobanks Type

12.4.5.4. Market Revenue and Forecast, by Application Type

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product & Services

12.4.6.2. Market Revenue and Forecast, by Biospecimen Type

12.4.6.3. Market Revenue and Forecast, by Biobanks Type

12.4.6.4. Market Revenue and Forecast, by Application Type

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product & Services

12.4.7.2. Market Revenue and Forecast, by Biospecimen Type

12.4.7.3. Market Revenue and Forecast, by Biobanks Type

12.4.7.4. Market Revenue and Forecast, by Application Type

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product & Services

12.4.8.2. Market Revenue and Forecast, by Biospecimen Type

12.4.8.3. Market Revenue and Forecast, by Biobanks Type

12.4.8.4. Market Revenue and Forecast, by Application Type

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product & Services

12.5.2. Market Revenue and Forecast, by Biospecimen Type

12.5.3. Market Revenue and Forecast, by Biobanks Type

12.5.4. Market Revenue and Forecast, by Application Type

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product & Services

12.5.5.2. Market Revenue and Forecast, by Biospecimen Type

12.5.5.3. Market Revenue and Forecast, by Biobanks Type

12.5.5.4. Market Revenue and Forecast, by Application Type

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product & Services

12.5.6.2. Market Revenue and Forecast, by Biospecimen Type

12.5.6.3. Market Revenue and Forecast, by Biobanks Type

12.5.6.4. Market Revenue and Forecast, by Application Type

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. BioStorage Technologies

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Qiagen

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Brooks Life Sciences

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. PerkinElmer

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Cryoport

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Biomatrica

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. LGC Limited

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Analytik Jena

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. HudsonAlpha Institute for Biotechnology

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others