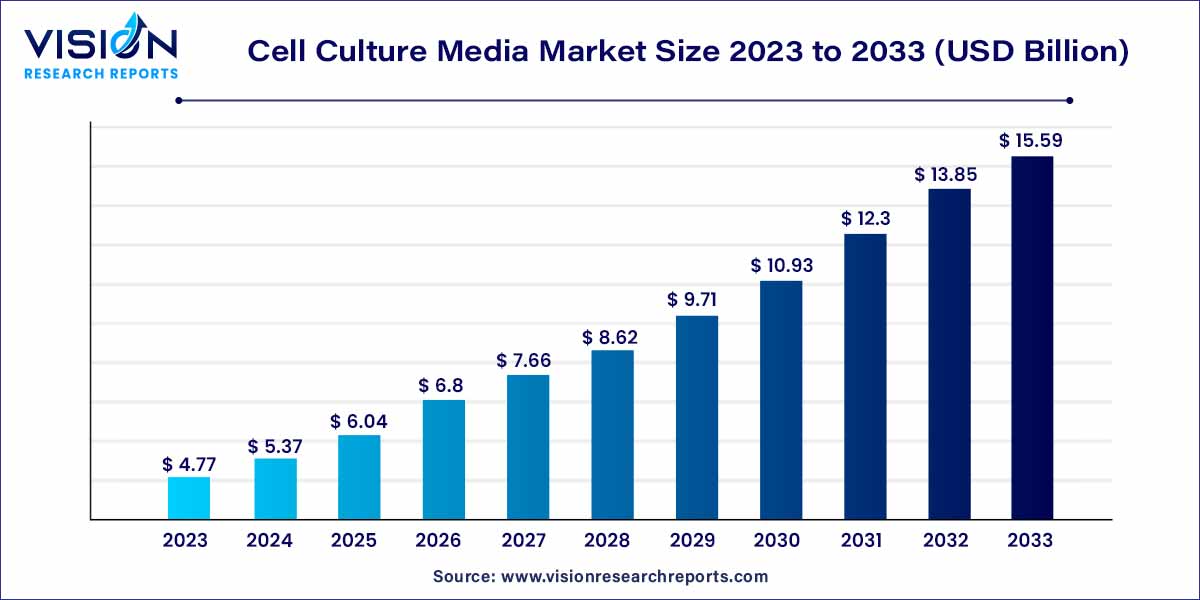

The global cell culture media market size was surpassed at USD 4.77 billion in 2023 and is expected to hit around USD 15.59 billion by 2033, growing at a CAGR of 12.57% from 2024 to 2033. The cell culture media market is driven by advancements in biotechnology, pharmaceutical research, and increasing demand for cell-based therapies.

The robust expansion of the cell culture media market can be attributed to several key growth factors. Firstly, advancements in biotechnology and pharmaceutical research have spurred the demand for sophisticated cell culture media, fostering enhanced cell growth and viability. Additionally, the increasing focus on personalized medicine and the development of novel biopharmaceuticals has driven substantial investments in research and development, propelling the market forward. Moreover, the application of cell culture media in biopharmaceutical production, cancer research, and stem cell studies has broadened, contributing to the market's sustained growth. The integration of advanced technologies like 3D cell culture and microfluidics has further augmented the efficiency and relevance of cell culture systems. Furthermore, favorable regulatory frameworks and increasing support for cell-based therapies create a conducive environment for market expansion, encouraging stakeholders to explore and invest in this dynamic sector.

The serum-free media (SFM) segment secured the highest market share, accounting for 37% in 2023. Serum-free media play a pivotal role as a valuable tool, enabling researchers to conduct specific applications or cultivate particular cell types without the need for serum. Utilizing serum-free media provides several advantages, including enhanced growth and productivity, consistent performance, improved control over physiological sensitivity, and a reduced risk of infection by serum-borne adventitious agents in the culture.

Furthermore, the adoption of serum-free alternatives aligns with the prioritization of animal welfare, emerging as a primary driver for their widespread use. The field of gene and cell therapy is experiencing rapid growth, with regulatory guidelines from the Food and Drug Administration (FDA) emphasizing tighter control over raw materials to ensure the reliable and safe manufacturing of drug products. Employing SFM presents an opportunity to develop more reproducible formulations, thereby minimizing batch-to-batch variability. This underscores the significance of serum-free media in meeting evolving industry demands and regulatory standards.

In 2023, the biopharmaceutical production segment emerged as the market leader, commanding a substantial revenue share of 43%. This dominance is attributed to the escalating demand within the biopharmaceutical industry for media that is not only more reproducible but also better-defined, addressing the need to accommodate increasing production levels while mitigating the risk of contamination in downstream processes.

Furthermore, the growth of this segment is propelled by strategic initiatives undertaken by key biopharmaceutical companies. A notable example occurred in July 2021, when Cytiva and Pall Corporation jointly invested USD 1.5 billion over a two-year period to meet the surging demand for biotechnology solutions. A significant portion of this investment, exceeding USD 400 million, is allocated for the development of culture media in powder or liquid form. Additionally, these companies plan to expand their operations in the United States, Austria, and the United Kingdom, further contributing to the growth of the biopharmaceutical production segment.

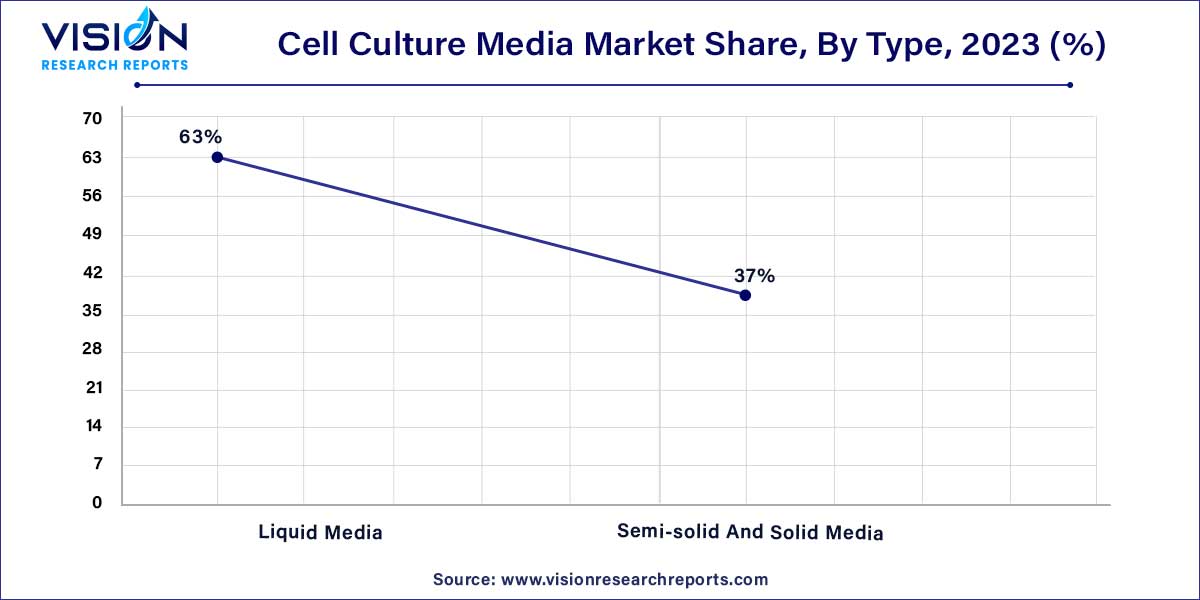

In 2023, the liquid media segment claimed the highest revenue share at 63%. This dominance can be attributed to a growing trend among both downstream and upstream manufacturers of biologics and biosimilars, who are increasingly transitioning from premixed powders to liquid media. This shift is motivated by factors such as rapid mycobacterial growth, high isolation rates, and the simplification of manufacturing processes. Liquid media not only eliminates certain process steps but also reduces the likelihood of hazardous exposure, offering a more flexible and straightforward approach to both manufacturing and development compared to powdered media.

Moreover, the adoption of ready-to-use liquid media eliminates the necessity for mixing containers, balances, and the installation of a water for injection (WFI) loop, which is typically required for mixing powdered media. The segment's growth is further propelled by strategic initiatives undertaken by manufacturers. For example, in June 2021, Sartorius inaugurated a new facility in Israel, dedicated to customized and specialty cell culture primarily for the advanced therapies market. This facility is poised to play a significant role as a production site for buffers and liquid cell culture, contributing to the momentum of the liquid media segment.

In 2023, the pharmaceutical and biotechnology companies segment emerged as the leader, securing the highest revenue share at 35%. The surge in demand for cell culture products is propelled by the ongoing expansion of manufacturing capacities in the biopharmaceutical sector. Notably, in September 2020, Cytiva announced a significant expansion of its manufacturing capacity, accompanied by extensive personnel recruitment to support the growth of the biotechnology industry. The company has earmarked an investment of approximately USD 500 million over five years to bolster its manufacturing capabilities.

Furthermore, the increasing number of clinical trials presents lucrative opportunities in the foreseeable future. In 2021, industry-sponsored trials in progress for regenerative medicine witnessed a notable increase of 100 compared to 2020, reaching a total of 1,320. This growth was complemented by an additional 1,328 regenerative medicine trials supported globally by non-industry entities such as government entities and academic centers. The expanding landscape of clinical trials signifies a heightened demand for cell culture products within the pharmaceutical and biotechnology companies segment.

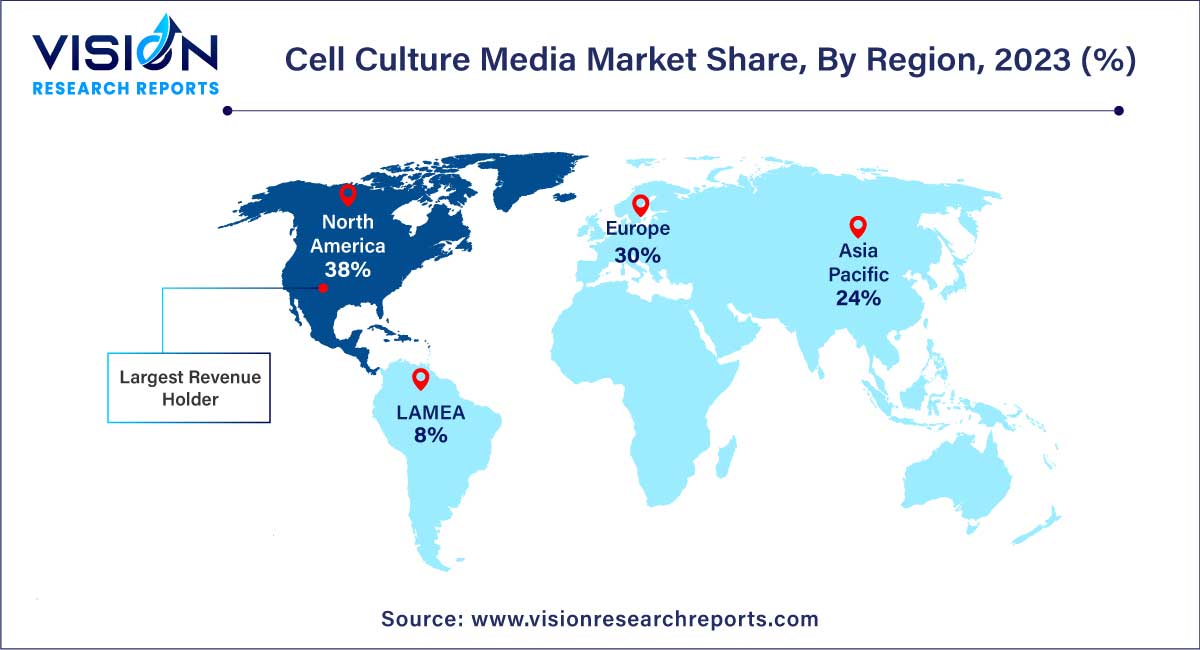

In 2023, North America emerged as the dominant force in the regional market, securing a substantial revenue share of 38%. This prominence can be attributed to the robust growth in the pharmaceutical and biotechnology industries, a surge in approvals for cell culture-based vaccines, and an increasing incidence of diseases such as cancer. The region also benefits from significant investments and funding directed towards cell-based research.

On the other hand, Asia Pacific is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) of 14.96% during the forecast period. This growth is driven by a heightened awareness of the advantages associated with the use of cell culture techniques. Additionally, strategic initiatives by key market players to expand their footprint in Asia Pacific countries, aiming to capture a substantial market share, are poised to present lucrative opportunities. For instance, in December 2021, Fujifilm Irvine Scientific, Inc. initiated the construction of a new bioprocessing center in China. The objective is to provide support for cell culture media optimization, particularly for the development of biotherapeutic drugs, vaccines, and advanced therapies. This move underlines the growing importance of the Asia Pacific region in the cell culture media market.

By Product

By Application

By Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Culture Media Market

5.1. COVID-19 Landscape: Cell Culture Media Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Culture Media Market, By Product

8.1. Cell Culture Media Market, by Product, 2024-2033

8.1.1. Serum-free Media

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Classical Media

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Stem Cell Culture Media

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Specialty Media

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.6. Chemically Defined Media

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Other Cell Culture Media

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cell Culture Media Market, By Application

9.1. Cell Culture Media Market, by Application e, 2024-2033

9.1.1. Biopharmaceutical Production

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Drug Screening And Development

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Tissue Engineering And Regenerative Medicine

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Other Applications

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cell Culture Media Market, By Type

10.1. Cell Culture Media Market, by Type, 2024-2033

10.1.1. Liquid Media

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Semi-solid And Solid Media

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cell Culture Media Market, By End-user

11.1. Cell Culture Media Market, by End-user, 2024-2033

11.1.1. Pharmaceutical And Biotechnology Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Hospitals And Diagnostic Laboratories

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Research And Academic Institutes

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Other End-users

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Cell Culture Media Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Merck KGaA

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. CYTIVA

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Sartorius AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. FUJIFILM Irvine Scientific, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Lonza Group AG

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. InvivoGen

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. STEMCELL Technologies Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. PromoCell GmbH

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Cell Biologics, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others