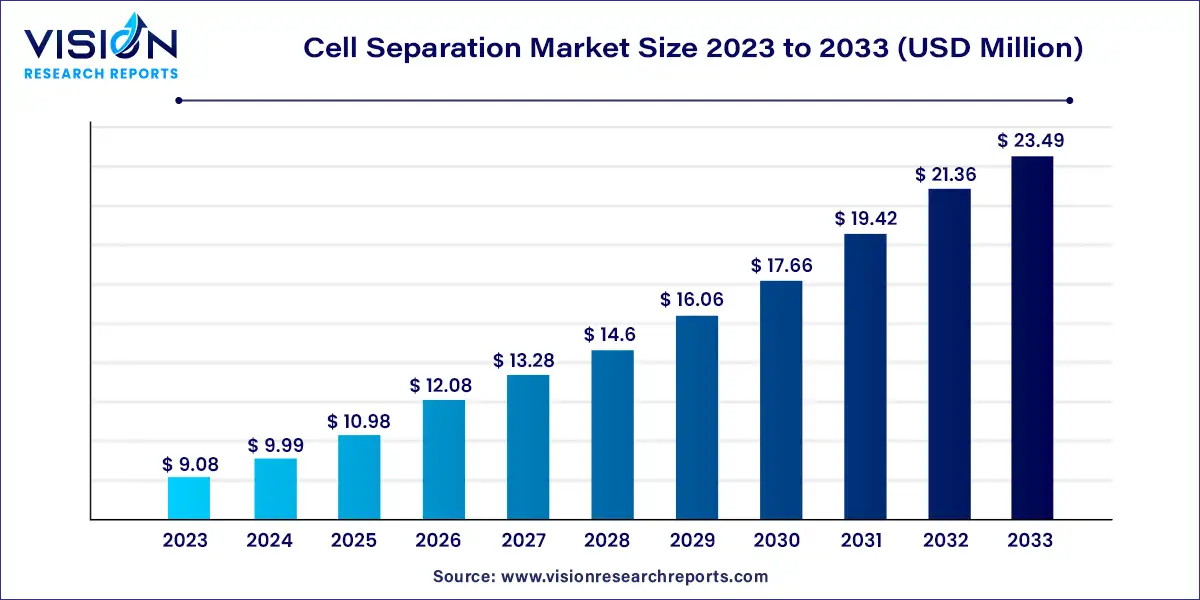

The global cell separation market was valued at USD 9.08 billion in 2023 and it is predicted to surpass around USD 23.49 billion by 2033 with a CAGR of 9.97% from 2024 to 2033.

The cell separation market encompasses a diverse array of techniques and technologies aimed at isolating specific cell populations from complex mixtures. This process is fundamental in various applications, ranging from basic research to clinical diagnostics and personalized medicine. With a relentless pursuit of precision and efficiency, the market continues to witness notable growth and innovation.

The growth of the cell separation market is driven by an increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases has fueled the demand for advanced cell separation technologies to support diagnostic and therapeutic endeavors. Additionally, the rising adoption of cell-based therapies and regenerative medicine approaches has driven significant investment in research and development within the field. Moreover, technological advancements, including the development of high-throughput and automated systems, have enhanced the efficiency and scalability of cell separation processes, catering to the growing demands of the biotechnology and pharmaceutical industries.

In 2023, the consumables segment emerged as the dominant force in the market, capturing the largest revenue share at 62%. This segment's stronghold was primarily attributed to frequent purchases of consumables. Moreover, heightened investments in research and development by pharmaceutical and biopharmaceutical firms, particularly for the advancement of cutting-edge biologics like monoclonal antibodies and vaccines, propelled the growth of this segment.

Technological advancements in instruments are enabling more efficient cell separation in research, diagnostics, and therapeutic applications. Consequently, the instruments industry is poised for significant growth in the forecast period. Nonetheless, the high cost associated with instruments is projected to somewhat impede market expansion. To gain a competitive edge, companies are increasingly focusing on developing sustainable technologies. For example, in March 2022, Element Biosciences unveiled details about its upcoming Aviti DNA sequences.

In 2023, the animal cells segment claimed the largest revenue share, accounting for 54% of the market. This significant share was propelled by the increasing focus of governmental bodies, private enterprises, and healthcare institutions on the exploration and development of new drugs. Animal cells play a pivotal role in drug discovery and development processes, serving to evaluate the efficacy, pharmacokinetics, and initial toxicity of emerging drug compounds.

Meanwhile, the human cell segment is projected to demonstrate the most rapid growth rate, anticipated at 12.47% from 2024 to 2033. This surge is attributed to heightened attention towards human and cancer research, coupled with the diverse applications of isolated human cells in biopharmaceutical advancements, clinical trials, and scientific investigations. Additionally, favorable reimbursement policies associated with personalized medicine initiatives in developed nations are fostering increased demand for human cell isolation technologies.

In 2023, the centrifugation segment emerged as the market leader, commanding a substantial revenue share of 43%. This dominance can be attributed to the widespread adoption of centrifugation techniques across academic institutions, research laboratories, and the biotechnology and biopharmaceutical sectors. Centrifugation stands as a cornerstone process in various applications, with density gradient centrifugation and differential centrifugation emerging as the most commonly employed methods for cell isolation and separation.

Meanwhile, the surface marker technique is poised to experience the fastest growth rate, projected at 12.38% from 2024 to 2033. This notable expansion is fueled by increased investments in manufacturing infrastructure by industry players, coupled with advancements in product development. Manufacturers are actively leveraging advanced surface markers in their production processes to ensure enhanced quality of the final products.

In 2023, the biomolecule isolation segment emerged as the market leader, commanding a significant share of 30%. This segment exhibited robust growth momentum and is expected to maintain its position as the fastest-growing segment, with a projected compound annual growth rate (CAGR) of 11.44% from 2024 to 2033. The predominant factor driving its prominence is the increasing emphasis on the production of biopharmaceuticals, including biosimilars, monoclonal antibodies, and recombinant proteins. Moreover, heightened government funding for new drug development initiatives further propels market expansion.

Concurrently, the cancer research segment is forecasted to experience lucrative growth, with a projected CAGR of 10.17% from 2024 to 2033. This growth can be attributed to rising investments in cell-based research by both companies and research laboratories. Several public-private partnerships are channeling substantial investments into cancer research, driven by the escalating global incidence of cancer, thereby stimulating demand for innovative cell separation solutions.

In 2023, the segment comprising biotechnology and biopharmaceutical companies emerged as the market leader, capturing a significant revenue share of 43%. This segment is poised to maintain its dominance throughout the study period. These companies are deeply engaged in extensive research and development (R&D) endeavors aimed at pioneering new-generation therapeutics, which necessitate the utilization of advanced cell separation techniques. Additionally, the escalating research activities undertaken by commercial entities to develop efficient vaccines and therapeutics for COVID-19 are anticipated to fuel substantial demand for cell separation solutions, thereby fostering continued growth within this segment.

Meanwhile, the segment encompassing research laboratories and institutes is forecasted to demonstrate steady growth, with an estimated compound annual growth rate (CAGR) of 9.28% from 2024 to 2033. This growth trajectory can be attributed to the increasing R&D initiatives spearheaded by research institutions, particularly in the fields of oncology and neuroscience, aimed at the development of novel therapies. Furthermore, the proliferation of research institutes and laboratories worldwide is expected to serve as a key driver of segment expansion. For instance, in April 2022, Curate Biosciences forged a collaboration with the City of Hope, a prominent cancer research and treatment organization in the U.S., to evaluate the efficacy of its Curate Cell Processing System.

In 2023, North America emerged as the dominant force in the global market, commanding the largest revenue share at 40%. This prominence can be attributed to several factors, including the presence of well-established pharmaceutical and biotechnology industries, particularly in the United States. The region also exhibits a high adoption rate of technologically advanced solutions, further bolstering its market position. Moreover, the extensive research activities conducted by research universities in North America, particularly in the field of cell therapies, have spurred significant demand for cell separation solutions.

Conversely, Asia Pacific is forecasted to experience the fastest growth, with a projected growth rate of 15.66% from 2024 to 2033. This rapid expansion is driven by the burgeoning pharmaceutical and biotechnology industries in emerging economies such as China and India. Additionally, the region's growth is fueled by increased healthcare expenditure and the expanding market penetration of major global players in key Asia Pacific countries. Furthermore, ongoing initiatives in stem cell and gene therapy research in countries like Japan, China, and South Korea have further propelled the demand for cell separation solutions in the region.

By Product

By Cell Type

By Technique

By Application

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Separation Market

5.1. COVID-19 Landscape: Cell Separation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Separation Market, By Product

8.1. Cell Separation Market, by Product, 2024-2033

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cell Separation Market, By Cell Type

9.1. Cell Separation Market, by Cell Type, 2024-2033

9.1.1. Human Cells

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Animal Cells

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cell Separation Market, By Technique

10.1. Cell Separation Market, by Technique, 2024-2033

10.1.1. Centrifugation

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Surface Marker

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Filtration

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cell Separation Market, By Application

11.1. Cell Separation Market, by Application, 2024-2033

11.1.1. Biomolecule Isolation

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Cancer Research

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Stem Cell Research

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Tissue Regeneration

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. In Vitro Diagnostics

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Therapeutics

11.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Cell Separation Market, By End-Use

12.1. Cell Separation Market, by End-Use, 2024-2033

12.1.1. Research laboratories and institutes

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Biotechnology and biopharmaceutical companies

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Hospitals and diagnostic laboratories

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Cell banks

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Cell Separation Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Technique (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.7. Market Revenue and Forecast, by End-Use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.7. Market Revenue and Forecast, by Application (2021-2033)

13.2.8. Market Revenue and Forecast, by End-Use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.10. Market Revenue and Forecast, by Application (2021-2033)

13.2.11. Market Revenue and Forecast, by End-Use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.13. Market Revenue and Forecast, by End-Use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.15. Market Revenue and Forecast, by End-Use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.7. Market Revenue and Forecast, by End-Use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.9. Market Revenue and Forecast, by End-Use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.7. Market Revenue and Forecast, by End-Use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.9. Market Revenue and Forecast, by End-Use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.5.3. Market Revenue and Forecast, by Technique (2021-2033)

13.5.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.5. Market Revenue and Forecast, by End-Use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.7. Market Revenue and Forecast, by End-Use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Cell Type (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-Use (2021-2033)

Chapter 14. Company Profiles

14.1. Thermo Fisher Scientific, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. BD

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Danaher

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Terumo Corp.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. STEMCELL Technologies Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Bio-Rad Laboratories, Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Merck KGaA

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Agilent Technologies, Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Corning Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Akadeum Life Sciences

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others