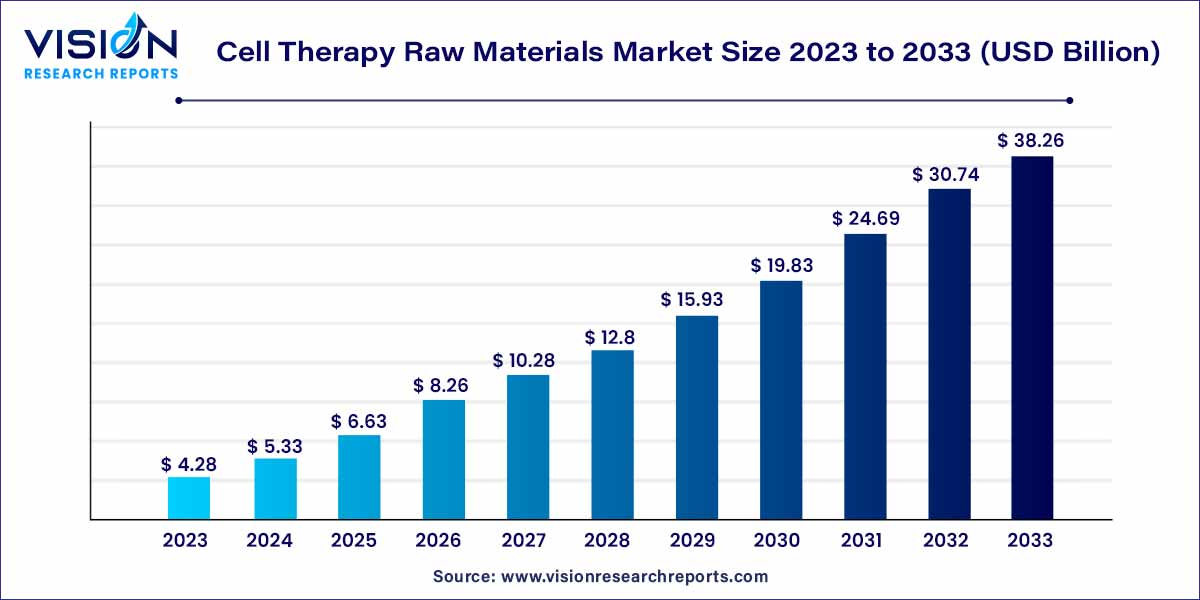

The global cell therapy raw materials market size was valued at USD 4.28 billion in 2023 and it is predicted to surpass around USD 38.26 billion by 2033 with a CAGR of 24.49% from 2024 to 2033.

The cell therapy raw materials market has emerged as a pivotal sector within the rapidly advancing field of regenerative medicine. Cell therapy, which involves the use of living cells to treat various medical conditions, has gained significant traction due to its potential to revolutionize healthcare. Essential to the successful development and application of these therapies are the raw materials that serve as the foundation for these groundbreaking treatments.

The growth of the cell therapy raw materials market is propelled by several key factors. Firstly, the increasing prevalence of chronic diseases and the aging global population have led to a rising demand for innovative and effective medical treatments, driving the need for advanced cell therapies. Additionally, continuous advancements in biotechnology and cell biology have spurred research and development activities, creating a demand for high-quality raw materials. The supportive regulatory environment, with regulatory agencies recognizing the potential of cell therapies, has encouraged investments and boosted market growth. Collaborative efforts between research institutions and industry players have fostered innovation, expanding the market for raw materials. Moreover, the trend towards personalized medicine, where cell therapies can be tailored to individual patients, has driven the demand for diverse and specialized raw materials. These factors, coupled with the focus on rigorous quality control and biosafety testing, are contributing significantly to the rapid growth of the cell therapy raw materials market.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 47% |

| CAGR of Asia Pacific from 2024 to 2033 | CAGR of 24.99% |

| Revenue Forecast by 2033 | USD 38.26 billion |

| Growth Rate from 2024 to 2033 | CAGR of 24.49% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The media segment held the largest market share of 26% in 2023. Cell culture media, enriched with essential nutrients, growth factors, and cytokines, provide the nurturing environment necessary for the growth and proliferation of cells used in therapies. These specialized media formulations are meticulously designed to support various cell types, ensuring their optimal health and functionality. Additionally, antibodies, which are vital components of the immune system, are employed in cell therapy research and development. Researchers utilize monoclonal antibodies to target specific cell surface markers, enabling the isolation and identification of desired cell populations. These antibodies are indispensable tools, facilitating the precise manipulation and characterization of cells, which is fundamental in the production of safe and effective cell therapies.

The antibodies segment is anticipated to grow at the CAGR of 27.59% from 2024 to 2033. The significance of media and antibodies in the cell therapy landscape cannot be overstated. Media formulations are tailored to specific cell types, ensuring the cells receive the necessary nutrients, vitamins, and minerals required for their growth and viability. These formulations also include crucial factors like growth hormones and cytokines, which stimulate cell proliferation and differentiation. Consequently, researchers and manufacturers rely on high-quality media to maintain the integrity and potency of therapeutic cells, ensuring their efficacy when administered to patients.

The biopharmaceutical & pharmaceutical companies segment generated the maximum market share of 55% in 2023. Biopharmaceutical & Pharmaceutical Companies and Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs). Biopharmaceutical and pharmaceutical companies, at the forefront of pioneering research and development, heavily rely on high-quality raw materials to drive their innovative cell therapy programs. These companies leverage cell therapy raw materials to conduct in-depth research, develop novel therapies, and eventually bring these groundbreaking treatments to the market. Their focus on optimizing cell culture media, cytokines, growth factors, and other critical components ensures the efficacy and safety of cell therapies intended for various medical applications.

The CMOs & CROs segment is anticipated to register the fastest CAGR of 25.23% over the forecast period. Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) serve as essential partners in the cell therapy ecosystem. CROs play a vital role in the early stages of research, offering specialized expertise in experimental design, data analysis, and clinical trials. They utilize high-quality cell therapy raw materials to conduct rigorous pre-clinical studies, ensuring the viability and potential of new therapeutic approaches. CMOs, on the other hand, step in during later stages, providing expertise in manufacturing, scale-up, and commercial production of cell therapies. These organizations rely on a consistent supply of top-tier raw materials to guarantee the reliability, consistency, and quality of the final cell therapy products that reach healthcare providers and, ultimately, patients.

North America dominated the market with a share of 47% in 2023. In North America, particularly in the United States, extensive research activities, coupled with substantial investments in biotechnology and healthcare, drive the market. The presence of numerous pharmaceutical and biotech companies, along with supportive government initiatives, fosters a robust environment for cell therapy research and development. The region's advanced infrastructure and well-established regulatory frameworks further contribute to its dominance in the global market.

Asia Pacific is anticipated to grow at the noteworthy CAGR of 24.99% over the forecast period. Asia-Pacific, with emerging economies like China, Japan, and South Korea, is witnessing rapid growth in the Cell Therapy Raw Materials Market. Increasing investments in research and development, coupled with a growing focus on biopharmaceuticals, drive the market in this region. Moreover, the presence of a vast patient pool and the rising prevalence of chronic diseases create a substantial demand for innovative cell therapies. Governments in these countries are also taking proactive measures to encourage research and development activities, further fueling market expansion.

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Therapy Raw Materials Market

5.1. COVID-19 Landscape: Cell Therapy Raw Materials Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Therapy Raw Materials Market, By Product

8.1. Cell Therapy Raw Materials Market, by Product, 2024-2033

8.1.1. Media

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Sera

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Cell Culture Supplements

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Antibodies

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Reagents & Buffers

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cell Therapy Raw Materials Market, By End-use

9.1. Cell Therapy Raw Materials Market, by End-use, 2024-2033

9.1.1. Biopharmaceutical & Pharmaceutical Companies

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. CROs & CMOs

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cell Therapy Raw Materials Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Thermo Fisher Scientific Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Merck KGaA

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Danaher

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sartorius Stedim Biotech

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Actylis.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ACROBiosystems

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. STEMCELL Technologies

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Grifols, S.A.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Charles River Laboratories

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. RoosterBio, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others