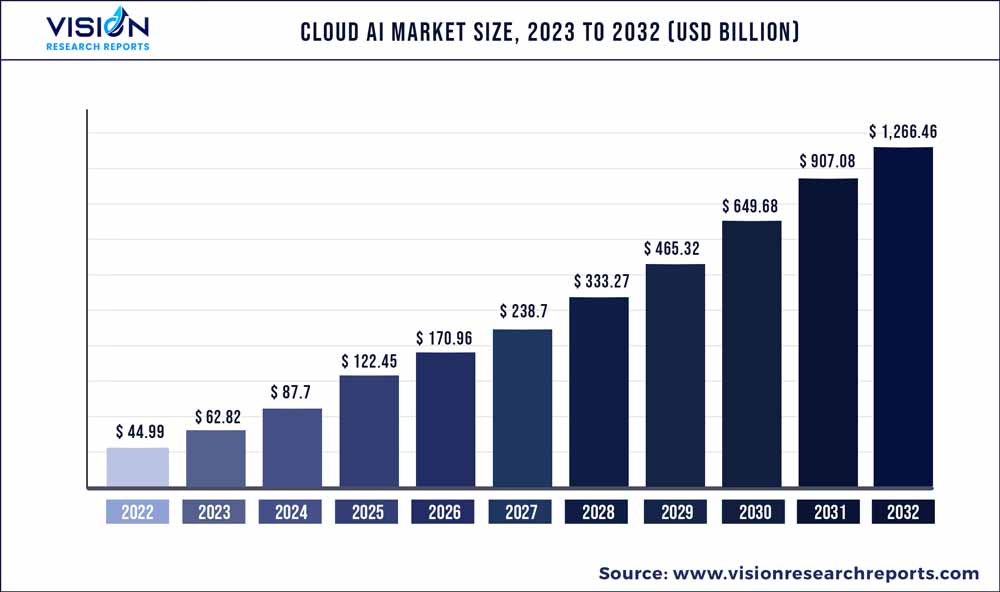

The global cloud AI market was valued at USD 44.99 billion in 2022 and it is predicted to surpass around USD 1,266.46 billion by 2032 with a CAGR of 39.62% from 2023 to 2032.

Key Pointers

Report Scope of the Cloud AI Market

| Report Coverage | Details |

| Market Size in 2022 | USD 44.99 billion |

| Revenue Forecast by 2032 | USD 1,266.46 billion |

| Growth rate from 2023 to 2032 | CAGR of 39.62% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Apple Inc.; Google Inc.; IBM Corp.; Intel Corp.; Microsoft Corp.; MicroStrategy Inc.; NVIDIA Corp.; Oracle Corp.; Qlik Technologies Inc.; Salesforce.com Inc.; ZTE Corp. |

The key factors propelling the growth of the market are the demand for intelligent virtual assistants, the adoption of AI to enhance customer service, and the growth of big data. Moreover, many big companies are investing and expanding, which drives market growth. The need to increase operational effectiveness in the manufacturing sector and the growth of cloud-based services & applications across various industries will also offer growth opportunities to the global market. Cloud computing and AI have become complementary technologies that can improve the lives of millions of people.

AI and cloud computing are combined and used in our everyday lives by digital assistants like Alexa from Amazon, Google Home, and Siri. More broadly, AI capabilities are used in business cloud computing to improve the strategic, effective, and insight-driven nature of business processes. By integrating data and applications into the cloud, cloud computing gives businesses more flexibility, agility, and cost savings. The advent of technologically innovative devices is one of the major factors fueling the growth of the market. For instance, the penetration of cloud DVR will expand as more smart Set-Top-Boxes (STBs) enter the market. A smart STB connects all devices over a home network, allowing media content to be played and streamed on the internet or any connected device.

Moreover, companies are integrating cloud-based technology with their product offerings. For instance, in March 2021, Velocix, a provider of carrier-grade video streaming and advertising technologies, increased its portfolio of fully controlled cloud-based applications. The IT & telecommunications sector has considerably contributed to the growth of the market as organizations across industries have increasingly turned to cloud-based AI solutions to efficiently manage their data and operations. Cloud AI solutions let companies examine enormous volumes of data, automate procedures, and enhance decision-making skills—all while spending less money. The IT and telecom industries have started to use AI to boost customer experience, optimize resource allocation, and increase network performance.

Telecom businesses use AI-enabled technologies to automate procedures, spot network issues before they become serious, and make tailored client suggestions. Governments and large-scale organizations worldwide have invested in various AI applications while devoting time and money to testing the technology. The U.S. government created AI.gov, an American AI Initiative, in February 2019, to focus on the Federal government’s resources with the development of AI to grow national prosperity, improve the quality of life of the citizens, and strengthen national & economic security. Moreover, Governments in the U.K. and Australia insist on using hybrid cloud solutions more frequently to upgrade the current IT infrastructure. The governments also demand a cost-benefit ratio that propels the market growth.

Technology Insights

The deep learning segment dominated the industry in 2022 with a revenue share of 36.49%. Voice assistants, chatbots, and other conversational interfaces are becoming popular among businesses. Natural Language Processing(NLP) technology enables these interfaces to understand and respond to natural language input, making them more user-friendly and effective. Recent advances in deep learning have enabled NLP models to achieve advanced performance in tasks, such as language translation and sentiment analysis. These models necessitate a large amount of data and computing power, which cloud AI services can provide. Cloud AI services, such as Amazon Web Services (AWS) and Microsoft Azure, have made it easier for businesses of all sizes to access NLP technology without large investments in hardware and expertise.

Deep learning is becoming increasingly popular for various applications, including NLP, picture & speech recognition, and predictive analytics. Cloud service providers make deep learning platforms and tools available, allowing data scientists and developers to create and train their neural networks. As businesses seek to automate procedures and gain insights from their data, the need for deep-learning solutions is anticipated to increase. Moreover, there is a growing trend toward using specialized hardware, such as Graphics Processing Units (GPUs) and Tensor Processing Units (TPUs), to accelerate the training of deep learning models in the cloud. This has led to the development of cloud-based deep learning platforms that leverage these hardware accelerators to provide faster and more efficient training.

Type Insights

The solution segment dominated the industry in 2022 with a share of 63.85%. The increased availability of cloud-based AI services from big tech companies like Amazon, Microsoft, and Google is a major driver boosting the market. These businesses make significant investments in creating cloud AI platforms and providing them as a service to companies of all kinds, making it simpler for businesses to access and use AI solutions without making expensive infrastructure and personnel investments. In general, as businesses increasingly leverage the potential of AI and machine learning to spur innovation and growth, the demand for cloud AI solutions is anticipated to increase.

The service segment is estimated to register the highest CAGR over the forecast period. The need for Al services is projected to increase as smart technology adoption increases significantly. These services use solution capabilities to accelerate business operations, and AI services are used by businesses to lower total operating expenses, boosting revenues. Artificial Intelligence As A Service, or AIAAS, is used by businesses to outperform cloud AI services, including integration, maintenance, and support.

Vertical Insights

The IT & telecommunications segment dominated the industry in 2022 with a share of around 19.03% of the overall revenue. Tremendous capabilities of the platform, which allow government organizations to scale massive tasks, including data mining, and directly impact public challenges, drive the use of cloud AI in government agencies. Also, the initial barriers to using cloud computing due to data privacy concerns are being removed. With the rise and acceptance of the cloud, AI, and many other technologies, the implementation of cloud AI has advanced in recent years. Several governmental organizations have taken advantage of the competition among Microsoft Azure, Amazon Web Services, and Google Cloud Platform to set up sizable server clusters, implement Hadoop and data lakes, and hire many data scientists.

Retailers are using AI to analyze customer data and provide personalized shopping experiences. Retailers can store and process massive amounts of customer data using cloud computing, allowing them to create targeted marketing campaigns and personalized product recommendations. Retailers use AI-powered inventory management solutions to optimize their supply chain, reduce waste, and improve product availability. Cloud-based AI solutions provide retailers with real-time data analysis, allowing them to predict demand, manage inventory levels, and automate order fulfillment.

Regional Insights

The North America region accounted for the highest revenue share of 34.69% in 2022. The region has many leading players, such as Apple Inc., Google Inc., IBM Corp., Intel Corp., and Microsoft Corp. High growth in the region is attributed to businesses across various industries that are early adopters of AI and machine learning technologies. It includes industries, such as healthcare, finance, and retail, using AI to improve operational efficiency, reduce costs, and drive innovation. North America has a large and highly skilled workforce, which is equipped to develop and implement AI solutions. Many universities and research institutions in North America are at the forefront of AI research and development, producing a steady stream of talented individuals driving innovation in the market.

Asia Pacific is expected to emerge as the fastest-growing region over the forecast period. The region’s growth is mainly attributed to heavy investments in cloud and AI technologies. The demand for increased operational effectiveness in the manufacturing sector and the use of cloud-based apps and services across multiple industries are growing in the APAC region. For instance, in October 2019, Amazon Web Services trained relevant government employees in India to develop a cloud-first approach to digital transformation and enhanced skill sets as part of the Indian government’s initiatives to deploy machine learning and AI-driven cloud models to make understanding of massive amounts of data.

Cloud AI Market Segmentations:

By Technology

By Type

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cloud AI Market

5.1. COVID-19 Landscape: Cloud AI Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cloud AI Market, By Technology

8.1. Cloud AI Market, by Technology, 2023-2032

8.1.1 Deep Learning

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Machine Learning

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Natural Language Processing

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Cloud AI Market, By Type

9.1. Cloud AI Market, by Type, 2023-2032

9.1.1. Solution

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Services

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Cloud AI Market, By Vertical

10.1. Cloud AI Market, by Vertical, 2023-2032

10.1.1. Healthcare

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Retail

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. BFSI

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. IT & Telecommunication

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Government

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Manufacturing

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Automotive & Transportation

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Cloud AI Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2020-2032)

11.1.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2020-2032)

11.2.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2020-2032)

11.3.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2020-2032)

11.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2020-2032)

11.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 12. Company Profiles

12.1. Apple Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Google Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. IBM Corp.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Intel Corp.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Microsoft Corp.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. MicroStrategy Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. NVIDIA Corp.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Oracle Corp.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Qlik Technologies Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Salesforce.com Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others