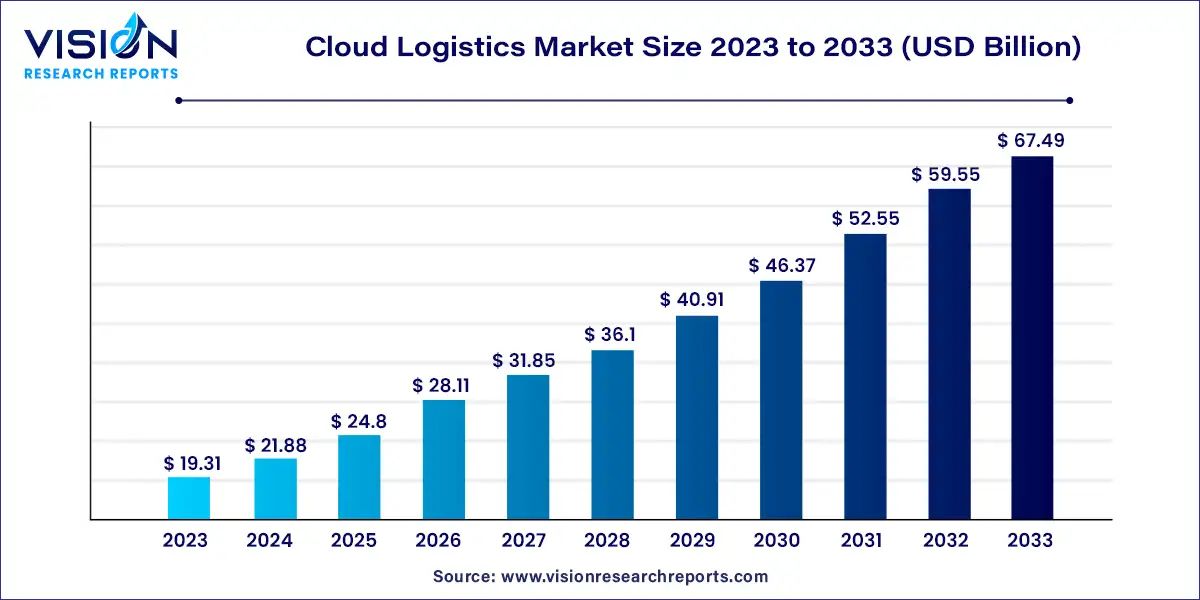

The global cloud logistics market size was estimated at around USD 19.31 billion in 2023 and it is projected to hit around USD 67.49 billion by 2033, growing at a CAGR of 13.33% from 2024 to 2033.

The growth of the cloud logistics market is driven by the scalability and flexibility offered by cloud-based solutions enable businesses to adapt swiftly to changing demand patterns and evolving industry requirements, driving operational agility. Real-time visibility into supply chain activities, facilitated by cloud technology, empowers organizations to make informed decisions, optimize processes, and enhance overall efficiency. Moreover, the cost-efficiency of cloud logistics solutions, with their subscription-based pricing models and reduced IT infrastructure investments, makes them highly attractive to businesses looking to streamline operations while minimizing expenses. Technological advancements, particularly in areas such as IoT, AI, and blockchain, continue to drive innovation within the cloud logistics space, unlocking new possibilities for optimization and value creation.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 28% |

| CAGR of Asia Pacific from 2024 to 2033 | 14.28% |

| Revenue Forecast by 2033 | USD 67.49 billion |

| Growth Rate from 2024 to 2033 | CAGR of 13.33% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The public segment dominated the market with a revenue share of 31% in 2023. A public-based cloud is an IT framework where a third-party provider manages and offers on-demand computing resources and infrastructure over the Internet. These services are accessible to various companies and individuals, who can rent them on a flexible basis, including options like Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). Payments can be made either on a monthly or pay-per-use model. Furthermore, a public-based cloud offers various benefits, including lower cost, high reliability, and near-unlimited scalability. Such benefits associated with public clouds are anticipated to propel the growth of the segment over the forecast period.

The private segment is anticipated to grow at the fastest CAGR of 14.37% over the forecast period. The segment’s growth is anticipated to be driven by an increased focus on data security. Furthermore, the growing adoption of private clouds has led to the emergence of various vendors offering private cloud solutions to government agencies. For instance, Microsoft Corp. provides Azure Government, a specialized cloud computing service that caters to US government agencies and their partners, ensuring top-notch security and protection. This offering utilizes hyper-scale cloud capabilities and emphasizes threat detection through machine learning. As a result, Azure Government enables seamless data transfer between devices and data centers for US government agencies.

The web-based OS segment dominated the market with a revenue share of 55% in 2023. Web-based software is accessed and operated through the internet using a web browser. It is purposely built to expedite and improve many areas of logistics management, such as transportation, inventory control, order monitoring, and supply chain coordination. This sort of software enables users to view and control logistics data and operations from any place with internet connectivity, allowing for more ease and flexibility in logistics management. Furthermore, web-based logistics software frequently provides real-time tracking and reporting capabilities, allowing for more effective decision-making and overall logistics efficiency.

The native OS segment is another crucial segment in the cloud logistics market. The segment is anticipated to grow at a CAGR of 13.95% from 2024 to 2033. Native OS is a logistics software developed and constructed for deployment and operation on cloud computing platforms. Native logistics software, as opposed to traditional software that has been retrofitted for cloud use, is designed from the ground up to leverage the advantages of cloud computing fully. Furthermore, such software is designed to leverage these technologies such as scalability, adaptability, and robustness. Furthermore, native logistics software can automatically adjust its computing resources in response to changing workloads, ensuring efficient handling of varying demands. This software can be accessed from any location with an internet connection and a web browser, enabling seamless remote management and user collaboration.

The large enterprise segment dominated the market with a revenue share of 68% in 2023. It is anticipated to remain prevalent over the forecast period owing to its heavy utilization. Logistics cloud is becoming a more popular option for large enterprises as they want to streamline their supply chain and logistics operations. Such solutions enable major organizations to grow their logistics operations as needed. Cloud-based solutions can rapidly and efficiently adapt to changing requirements, whether handling increasing demand during peak seasons or expanding into new areas. Advanced analytics and machine learning are used in supply chain systems to estimate demand, optimize routes, and identify possible supply chain issues. These insights allow large enterprises to make more informed decisions and improve operational efficiency.

The small & medium enterprises segment is expected to grow at a CAGR of 12.66% over the projected period. Cloud-based solutions provide SMEs with resources and capabilities that were previously only available to bigger organizations. The cloud-based supply chain is an appealing alternative for SMEs trying to optimize their logistics operations and stay competitive in a quickly expanding market because of its cost-effectiveness, scalability, real-time visibility, security, and innovation. Additionally, it offers significant cost-saving benefits for small and medium-sized businesses (SMEs). One of the most notable advantages is reducing hardware, software, and maintenance expenses, freeing up financial resources for other purposes. Moreover, cloud servers consume less electricity, resulting in lower energy costs. Additionally, SMEs can opt for a pay-as-you-go model, paying only for their specific services, eliminating the need for upfront investments in hardware or software. This cost-effective approach makes cloud platforms an attractive option for SMEs seeking to optimize their IT budgets and focus on core business operations.

The retail segment dominated the market with a revenue share of 24% in 2023. Cloud logistics are bringing significant benefits to the retail industry across multiple fronts. These advantages encompass cost reduction by minimizing infrastructure, storage, and computing expenses while providing immediate access to crucial operational and inventory data. As a result, cloud logistic is causing a comprehensive transformation in the retail sector, leading to more efficient inventory management, improved data security, enhanced user experiences, increased profitability, and better disaster management capabilities. Additionally, in November 2021, WPP, a UK-based creative transformation business, purchased Cloud Commerce Group. This UK-based firm supplies merchants with multi-channel e-commerce software for an undisclosed sum. This purchase demonstrates WPP's ongoing commitment to growing its client commerce offering.

Healthcare has emerged as a lucrative segment for the market accounting for a revenue share of 19% in 2023. These solutions provide real-time visibility into the healthcare supply chain, allowing medical institutions to manage medical equipment, medications, and other supplies and monitor inventory levels. This improved visibility aids in preventing stockouts and shortages, guaranteeing a steady supply of vital medical commodities. In addition, cloud platforms are especially beneficial for handling medicines and cold chain logistics, ensuring that temperature-sensitive drugs and vaccines are properly kept and transferred.

North America accounted for the highest market share of 28% in 2023. The market is anticipated to grow at a CAGR of over 13.65% from 2024 to 2033. The regional growth can be attributed to major platform providers such as IBM Corporation, Bwise, and Microsoft Corporation. Additionally, in April 2023, Synkrato, a California-based firm, introduced a logistics platform at MODEX 2023. This platform seamlessly integrates the metaverse, augmented reality (AR), artificial intelligence (AI), mobility, and the Internet of Things (IoT) into a comprehensive solution for supply-chain professionals. This holistic platform allows logistics experts to manage and optimize their logistics processes efficiently.

The Asia Pacific region is anticipated to grow at the fastest CAGR of 14.28% over the forecast period. Cloud logistic has grown rapidly in the Asia Pacific region, altering the supply chain and warehouse management environment for firms in various industries. Asia Pacific, being a dynamic and diversified market, has used cloud-based solutions to handle difficulties and profit from the benefits of the cloud supply chain. Furthermore, the Asia Pacific region has substantially increased e-commerce and digital transformation. Cloud platforms have played a critical part in e-commerce business growth, allowing for smooth order processing, fulfillment, and last-mile delivery.

By Type

By OS Type

By Enterprise Size

By Industry Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cloud Logistics Market

5.1. COVID-19 Landscape: Cloud Logistics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cloud Logistics Market, By Type

8.1. Cloud Logistics Market, by Type, 2024-2033

8.1.1. Public

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Private

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Hybrid

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Multi

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cloud Logistics Market, By OS Type

9.1. Cloud Logistics Market, by OS Type, 2024-2033

9.1.1. Native

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Web-based

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cloud Logistics Market, By Enterprise Size

10.1. Cloud Logistics Market, by Enterprise Size, 2024-2033

10.1.1. Large Enterprise

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small and Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cloud Logistics Market, By Industry Vertical

11.1. Cloud Logistics Market, by Industry Vertical, 2024-2033

11.1.1. Retail

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Consumer Electronics

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Healthcare

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Automotive

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Food & Beverage

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Cloud Logistics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by OS Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

Chapter 13. Company Profiles

13.1. Bwise

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. IBM Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Microsoft Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Oracle Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. SAP SE

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Thomson Reuters Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Trimble Transportation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Transplace (an Uber Freight Co.)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Descartes Systems Group

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. C. H. Robinson

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others