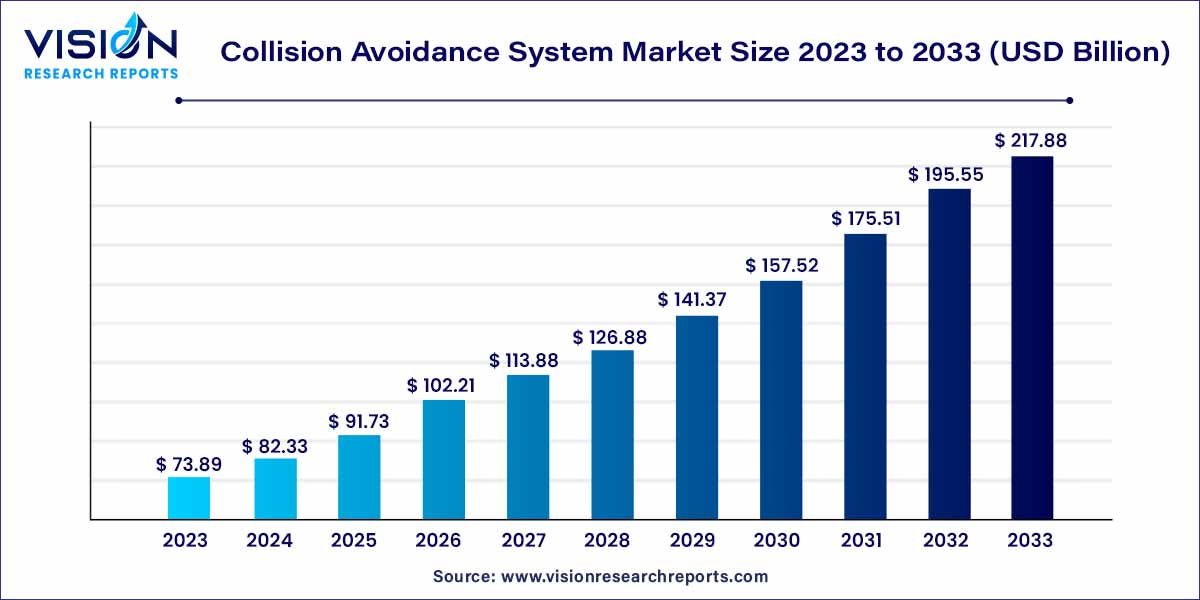

The global collision avoidance system market size was estimated at around USD 73.89 billion in 2023 and it is projected to hit around USD 217.88 billion by 2033, growing at a CAGR of 11.42% from 2024 to 2033.

Collision avoidance systems, encompassing a range of technologies such as sensors, radar, cameras, and artificial intelligence, are designed to detect and prevent potential collisions on the road. By offering real-time warnings to drivers or autonomously taking corrective actions, CAS plays a pivotal role in mitigating accidents and saving lives.

The collision avoidance system market is experiencing robust growth, propelled by several key factors. Firstly, the escalating concerns regarding road safety have driven the demand for advanced safety technologies, leading to widespread adoption of collision avoidance systems. Secondly, rapid advancements in sensor technologies, artificial intelligence, and machine learning have significantly enhanced the accuracy and effectiveness of these systems, making them more reliable for consumers. Additionally, stringent government regulations mandating the integration of advanced safety features in vehicles have further accelerated market growth. Furthermore, insurance companies offering reduced premiums for vehicles equipped with collision avoidance systems have incentivized consumers to invest in these safety solutions, stimulating market expansion. Lastly, the increasing global vehicle sales have naturally expanded the potential customer base for Collision Avoidance Systems, driving the market forward. These combined factors indicate a promising future for the Collision Avoidance System market, with sustained growth anticipated in the coming years.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.42% |

| Market Revenue by 2033 | USD 217.88 billion |

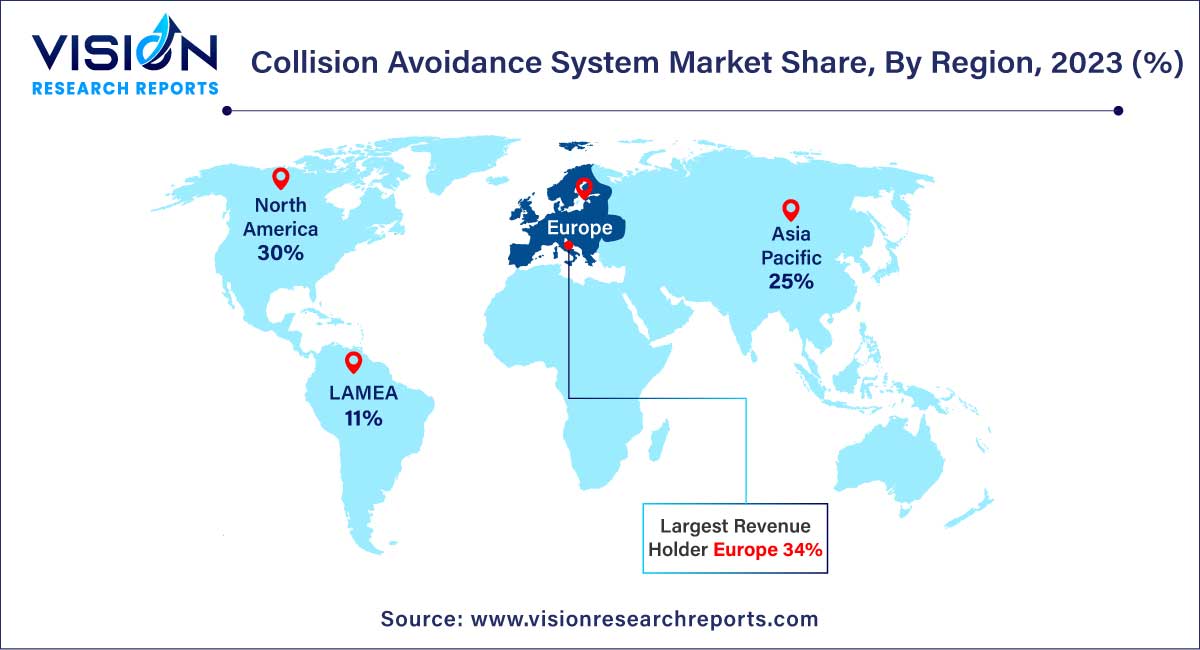

| Revenue Share of Europe in 2023 | 34% |

| CAGR of Asia Pacific from 2024 to 2033 | 14.02% |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The radar segment held a largest market share of 45% in 2023. Radar systems, utilizing radio waves, play a pivotal role in detecting nearby objects, vehicles, and obstacles by analyzing the reflected signals. These systems offer excellent accuracy in measuring the speed and distance of objects, enabling Collision Avoidance Systems to assess potential collision risks effectively. With continuous innovations, radar-based Collision Avoidance Systems have become more sophisticated, providing real-time data to vehicles, thereby enhancing their ability to make rapid and informed decisions to prevent collisions.

The LiDAR segment is predicted to grow at the remarkable CAGR of 16.15% over the forecast period. LiDAR technology, which employs laser pulses to create detailed 3D maps of the surrounding environment, has emerged as a key player in the Collision Avoidance System market. LiDAR sensors offer high-resolution imaging, allowing vehicles to perceive their surroundings with exceptional clarity and precision. This technology provides a comprehensive view of the vehicle's surroundings, including intricate details such as pedestrians, cyclists, and road obstacles. By leveraging LiDAR data, collision avoidance systems can accurately detect and identify potential collision threats, enabling timely warnings or autonomous interventions, thereby significantly improving road safety.

The adaptive cruise control (ACC) segment dominated the market with a revenue share of 29% in 2023. Adaptive Cruise Control, a sophisticated system, utilizes sensors and radar technology to maintain a safe following distance from the vehicle ahead. Unlike traditional cruise control, ACC automatically adjusts the vehicle's speed to match the flow of traffic, ensuring a constant safe gap between vehicles. This application not only enhances driving comfort but also plays a crucial role in collision avoidance. By monitoring the speed and distance of vehicles in the same lane, ACC enables smooth acceleration and deceleration, reducing the risk of rear-end collisions significantly.

The blind spot detection (BSD) segment is anticipated to grow at the noteworthy CAGR of 13.85% over the forecast period. Blind Spot Detection (BSD) addresses a common driver challenge by utilizing sensors and cameras to monitor areas around the vehicle that are typically not visible to the driver. These blind spots pose significant risks, especially during lane changes and merging maneuvers. BSD systems provide real-time alerts, usually in the form of visual or audible warnings, whenever a vehicle enters the driver's blind spot. By alerting the driver about the presence of nearby vehicles, BSD enhances situational awareness, reducing the likelihood of collisions during lane changes and preventing potential accidents.

Europe accounted for the highest market share of 34% in 2023. In Europe, a focus on reducing road accidents and fatalities, coupled with supportive government initiatives, has propelled the Collision Avoidance System market. European countries have been at the forefront of implementing advanced safety technologies, making Collision Avoidance Systems a standard feature in many vehicles. The region's robust automotive industry and a proactive approach to adopting cutting-edge technologies have further accelerated market expansion. Moreover, collaborations between automotive manufacturers and technology providers have led to the development of tailored Collision Avoidance Systems to suit the specific requirements of European markets.

Asia Pacific is projected to grow at the fastest CAGR of 14.05% over the forecast period. Asia-Pacific, with its rapidly growing automotive sector and increasing vehicle sales, presents a significant growth opportunity for Collision Avoidance System providers. Countries like China, Japan, and South Korea are witnessing a surge in demand for advanced safety features, driven by rising disposable incomes and a growing awareness of road safety. In addition, the integration of Collision Avoidance Systems in commercial vehicles, such as trucks and buses, is gaining traction, addressing concerns related to road accidents and improving overall transportation safety.

By Technology

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Collision Avoidance System Market

5.1. COVID-19 Landscape: Collision Avoidance System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Collision Avoidance System Market, By Technology

8.1. Collision Avoidance System Market, by Technology, 2024-2033

8.1.1. Radar

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Camera

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Ultrasound

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. LiDAR

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Collision Avoidance System Market, By Application

9.1. Collision Avoidance System Market, by Application, 2024-2033

9.1.1. Adaptive Cruise Control (ACC)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Blind Spot Detection (BSD)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Forward Collision Warning System (FCWS)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Lane Departure Warning System (LDWS)

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Parking Assistance

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Collision Avoidance System Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Continental AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BorgWarner Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. DENSO CORPORATION

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Analog Devices, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Murata Manufacturing Co., Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. NXP Semiconductors (Freescale Semiconductor, Inc.)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Infineon Technologies AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Panasonic Holdings Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Robert Bosch Manufacturing Solutions GmbH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. ZF Friedrichshafen AG (TRW automotive)

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others