Construction Robots, ABB, Advanced Construction Robots, BROKK GLOBAL, Ekso Bionics, Autonomous Solutions Inc., MX3D, Husqvarna AB, FBR Ltd, Conjet.

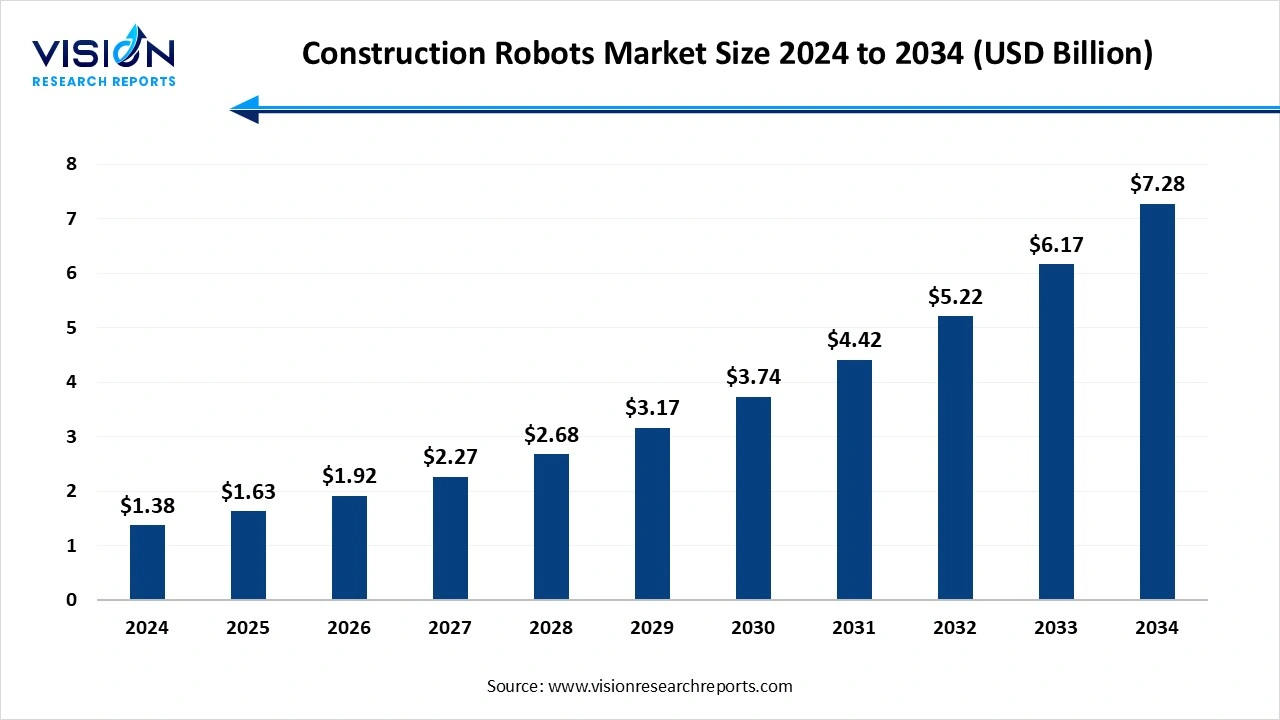

Construction Robots Market Size to Reach USD 7.28 Bn by 2034

The construction robots market size was valued at USD 1.38 billion in 2024 and is expected to grow USD 1.63 billion in 2025 to around USD 7.28 billion by 2034, expanding at a CAGR of 18.1% during the forecast period. The market growth is driven by increasing automation, adoption of AI and robotics for tasks like material handling and demolition, rising efficiency and safety demands, and supportive government initiatives worldwide.

The growth of the construction robots market is propelled by various key factors driving innovation and transformation within the construction industry. A primary catalyst is the substantial efficiency gains achieved through the automation of labor-intensive tasks. Construction robots contribute to faster project completion and resource optimization, thereby enhancing overall project efficiency. Furthermore, the paramount emphasis on safety in construction operations positions these robots as indispensable, as they can adeptly handle hazardous tasks, mitigating risks to human workers and ensuring compliance with stringent safety regulations. Another crucial growth factor lies in the cost-effectiveness of construction robots in the long term. Despite initial substantial investments, these robotic systems yield significant cost benefits through reduced labor expenses and minimized project delays. The continuous integration of artificial intelligence, machine learning, and advanced sensors further augments the technological landscape, allowing construction robots to adapt to dynamic environments and execute complex tasks with precision. As the industry continues to evolve, these growth factors collectively contribute to the sustained expansion of the construction robots market.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.38 billion |

| Revenue Forecast by 2034 | USD 7.28 billion |

| Growth rate from 2025 to 2034 | CAGR of 18.1% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

|

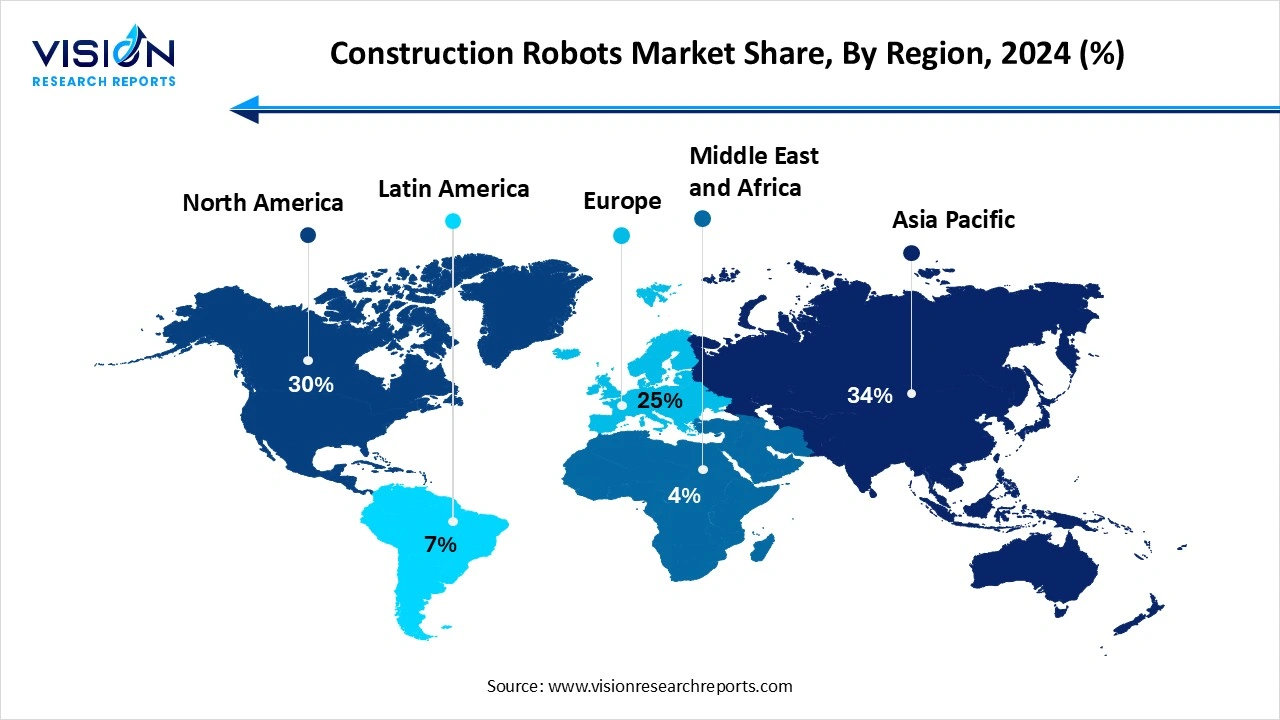

Asia Pacific dominated the market with a share of 34% in 2024 and is anticipated to retain its position over the forecast period. The increasing adoption of robotic automation and tools in this region is the major factor driving the growth. The region is likely to witness significant growth owing to the increasing government spending on the construction industry and increasing competition among the market players.

In addition, Asia Pacific has a high population resulting in the increasing demand for residential and industrial infrastructure, which makes Asia Pacific a promising region. For instance, instance in February 2022, Schindler announced the deployment of its Schindler R.I.S.E robot in the Asia Pacific region. Schindler R.I.S.E is an autonomous, self-climbing robot that is used for installation activities in elevator shafts.

In addition, increasing number of construction projects and construction firms in the Middle East Africa region due to the growing tourist population is expected to drive the regional market growth. Governments from countries such as MEA and Saudi Arabia are constantly undertaking investment and development initiatives in the infrastructure industry resulting in the growing demand for robotic automation in the construction sector.

The material handling segment accounted for the largest revenue share of 33% in 2024 and is expected to grow at the highest CAGR of 18.05% over the forecast period. The large production of construction robots worldwide, particularly in the Asia Pacific region, is a significant factor driving the growth of this segment. The growing adoption of automation in the construction industry for functions such as demolition, renovation, material handling, and printing applications is expected to drive the growth of the market. Construction robots are especially useful in demolition because they can be controlled wirelessly. The use of construction robots in demolition activities allows humans to remain at a safe distance and thus avoid the risk of injury.

The robotic arm segment contributed the largest market share in 2024. Construction industry trends such as refined construction, rapid construction, and standardized design have aided in the adoption of innovative technologies. Market players operating in the robotic arm segment have to constantly develop and design new and innovative products to cope with the increasing demand. For instance, in April 2021, PrintStones, an autonomous 3D printing and construction robot provider, announced the launch of a new variant of Baubot. The new robot is an autonomous construction assistant with a robotic arm mounted on top that carries out functions such as security, drywall, 3D printing, painting, welding, and bricklaying.

On other hand, traditional robot segment is expected to witness highest CAGR during forecast period. Increasing awareness of benefits brought about by adoption of robotic automation in construction industry has fueled demand for innovative construction robots and products. Traditional robot segment has witnessed significant new innovative products launched by market players to address evolving needs of construction industry. For instance, in October 2022, Built Robotics, provider of construction automation products, announced launch of its Exosystem platform in European market. Exosystem can transform excavators into autonomous robots.

The industrial segment had the largest market share in 2024 and is expected to grow at the highest CAGR over the forecast period. Rapid urbanization and industrialization across developing and underdeveloped countries due to foreign investments and the availability of abundant resources have fueled the demand for the construction robots market. Furthermore, various initiatives undertaken by the governments in the construction industry to provide employment opportunities to the population are expected to boost the demand for the market.

By Function

By Type

By End-use

By Region

Construction Robots Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Function Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Construction Robots Market

5.1. COVID-19 Landscape: Construction Robots Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Construction Robots Market, By Function

8.1. Construction Robots Market, by Function

8.1.1 Demolition

8.1.1.1. Market Revenue and Forecast

8.1.2. Bricklaying

8.1.2.1. Market Revenue and Forecast

8.1.3. Material Handling

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Construction Robots Market, By Type

9.1. Construction Robots Market, by Type

9.1.1. Traditional Robot

9.1.1.1. Market Revenue and Forecast

9.1.2. Robotic Arm

9.1.2.1. Market Revenue and Forecast

9.1.3. Exoskeleton

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Construction Robots Market, By End-use

10.1. Construction Robots Market, by End-use

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast

10.1.2. Residential

10.1.2.1. Market Revenue and Forecast

10.1.3. Commercial

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Construction Robots Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Function

11.1.2. Market Revenue and Forecast, by Type

11.1.3. Market Revenue and Forecast, by End-use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Function

11.1.4.2. Market Revenue and Forecast, by Type

11.1.4.3. Market Revenue and Forecast, by End-use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Function

11.1.5.2. Market Revenue and Forecast, by Type

11.1.5.3. Market Revenue and Forecast, by End-use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Function

11.2.2. Market Revenue and Forecast, by Type

11.2.3. Market Revenue and Forecast, by End-use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Function

11.2.4.2. Market Revenue and Forecast, by Type

11.2.4.3. Market Revenue and Forecast, by End-use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Function

11.2.5.2. Market Revenue and Forecast, by Type

11.2.5.3. Market Revenue and Forecast, by End-use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Function

11.2.6.2. Market Revenue and Forecast, by Type

11.2.6.3. Market Revenue and Forecast, by End-use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Function

11.2.7.2. Market Revenue and Forecast, by Type

11.2.7.3. Market Revenue and Forecast, by End-use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Function

11.3.2. Market Revenue and Forecast, by Type

11.3.3. Market Revenue and Forecast, by End-use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Function

11.3.4.2. Market Revenue and Forecast, by Type

11.3.4.3. Market Revenue and Forecast, by End-use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Function

11.3.5.2. Market Revenue and Forecast, by Type

11.3.5.3. Market Revenue and Forecast, by End-use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Function

11.3.6.2. Market Revenue and Forecast, by Type

11.3.6.3. Market Revenue and Forecast, by End-use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Function

11.3.7.2. Market Revenue and Forecast, by Type

11.3.7.3. Market Revenue and Forecast, by End-use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Function

11.4.2. Market Revenue and Forecast, by Type

11.4.3. Market Revenue and Forecast, by End-use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Function

11.4.4.2. Market Revenue and Forecast, by Type

11.4.4.3. Market Revenue and Forecast, by End-use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Function

11.4.5.2. Market Revenue and Forecast, by Type

11.4.5.3. Market Revenue and Forecast, by End-use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Function

11.4.6.2. Market Revenue and Forecast, by Type

11.4.6.3. Market Revenue and Forecast, by End-use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Function

11.4.7.2. Market Revenue and Forecast, by Type

11.4.7.3. Market Revenue and Forecast, by End-use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Function

11.5.2. Market Revenue and Forecast, by Type

11.5.3. Market Revenue and Forecast, by End-use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Function

11.5.4.2. Market Revenue and Forecast, by Type

11.5.4.3. Market Revenue and Forecast, by End-use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Function

11.5.5.2. Market Revenue and Forecast, by Type

11.5.5.3. Market Revenue and Forecast, by End-use

Chapter 12. Company Profiles

12.1. Construction Robots

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2 ABB

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Advanced Construction Robots

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BROKK GLOBAL

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. MX3D

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Husqvarna AB

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. FBR Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Conjet

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Autonomous Solutions Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Ekso Bionics

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others