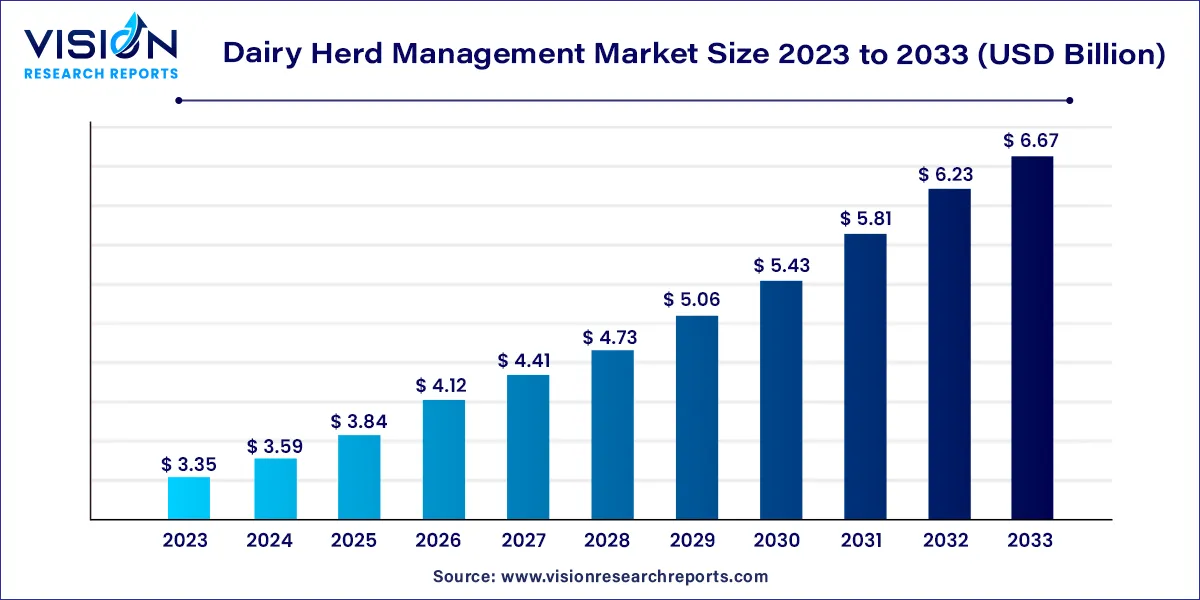

The global dairy herd management market size was surpassed at USD 3.35 billion in 2023 and is expected to hit around USD 6.67 billion by 2033, growing at a CAGR of 7.13% from 2024 to 2033.

The dairy industry, a cornerstone of agriculture, is undergoing a transformative phase, thanks to the integration of technology and data-driven solutions. Central to this evolution is the Dairy Herd Management (DHM) market, a sector dedicated to optimizing dairy farming practices through innovative tools and methodologies. This overview delves into the key facets of the Dairy Herd Management market, shedding light on its significance, growth drivers, and future prospects.

The dairy herd management market is experiencing remarkable growth driven by several key factors. Technological advancements, including IoT devices and sophisticated sensors, have revolutionized dairy farming by providing real-time data on animal health and behavior. This actionable information enables timely interventions, enhancing overall animal welfare. Additionally, the global demand for high-quality dairy products has pushed farmers to adopt Dairy Herd Management solutions to ensure consistent production standards. Moreover, the focus on sustainability and eco-friendly agricultural practices has led to the widespread adoption of DHM technologies. These systems optimize feeding practices and resource utilization, aligning with the principles of precision agriculture. As the industry recognizes the importance of data-driven decision-making, the dairy herd management market is set to expand further, fostering efficient, ethical, and sustainable dairy farming practices worldwide.

| Report Coverage | Details |

| Revenue Share of Europe in 2023 | 33% |

| CAGR of Asia Pacific from 2024 to 2033 | CAGR of 9.58% |

| Revenue Forecast by 2033 | USD 6.67 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.13% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The milk management systems segment accounted for the maximum revenue share of 64% in 2023. Milk management systems, a crucial component of dairy herd management, encompass a range of technologies designed to optimize milk production and quality. These systems utilize sensors and automation to monitor milk yield, fat content, and overall quality in real-time. By providing precise data, farmers can adjust feeding practices and address health concerns promptly, ensuring consistent high-quality milk production. This real-time data-driven approach not only maximizes productivity but also aligns dairy farms with the growing global demand for premium dairy products.

The breeding management segment is expected to grow at the fastest CAGR of 7.86% during the forecast period. Breeding Management within Dairy Herd Management focuses on optimizing reproductive cycles and enhancing genetic traits. Advanced techniques such as estrus synchronization and artificial insemination are employed to improve breeding efficiency, leading to higher calving rates and healthier herds. Data analytics and predictive algorithms play a pivotal role in breeding management, enabling farmers to identify optimal breeding periods and select superior genetic traits, thereby strengthening the overall herd quality. By integrating technology-driven breeding practices, dairy farms can achieve higher rates of successful insemination, resulting in a more productive and genetically superior herd.

The large-scale dairy farms segment contributed the largest market share of 67% in 2023. Large-scale dairy farms, characterized by their extensive herds and high milk production, rely heavily on Dairy Herd Management solutions for operational efficiency. These farms harness advanced technologies to monitor and manage large herds in real-time, ensuring optimal milk yield, health, and reproduction cycles. By integrating sophisticated data analytics, these systems enable large-scale farms to streamline their operations, minimize wastage, and maximize productivity. The seamless flow of accurate information aids in strategic decision-making, allowing these farms to meet the demands of a constantly evolving market.

The cooperative dairy farms segment is estimated to register the fastest CAGR of 7.36% during the forecast period. Cooperative dairy farms, often comprising smaller individual farms working collaboratively, benefit immensely from Dairy Herd Management solutions tailored to their unique structure. Cooperative farms rely on these technologies to enhance their collective bargaining power and market competitiveness. Through centralized data management, cooperative dairy farms can monitor the performance of individual farms within the group. This data-driven approach allows them to standardize practices, improve animal health, and optimize milk production collectively. By sharing resources and knowledge facilitated by dairy herd management systems, cooperative farms empower smaller-scale producers to achieve economies of scale, increase their efficiency, and maintain quality standards, thereby ensuring sustainability and profitability for all stakeholders involved.

Europe region led the market with the largest market share of 33% in 2023. In Europe, where dairy farming has deep-rooted traditions, dairy herd management technologies are embraced to ensure the sustainability and competitiveness of the industry. European farmers prioritize animal welfare and environmental conservation, aligning seamlessly with the capabilities of DHM systems. The emphasis on organic and sustainable farming practices positions Dairy Herd Management as a critical tool, allowing farmers to optimize resource utilization and reduce the environmental impact of their operations.

Asia Pacific is anticipated to grow at the noteworthy CAGR of 9.58% during the forecast period. Asia-Pacific, home to a vast and diverse agricultural landscape, experiences a varied adoption rate of dairy herd management solutions. Countries like India and China, with large dairy farming sectors, are witnessing a surge in demand for these technologies. Small-scale and cooperative dairy farms in these regions are increasingly adopting DHM systems to improve productivity and quality. Additionally, government initiatives and subsidies further encourage the adoption of dairy herd management technologies, enabling farmers to modernize their practices and meet the rising demand for dairy products in densely populated markets.

By Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Dairy Herd Management Market

5.1. COVID-19 Landscape: Dairy Herd Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Dairy Herd Management Market, By Type

8.1. Dairy Herd Management Market, by Type, 2024-2033

8.1.1. Milk Management Systems

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Feeding/Nutrition Management Systems

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Animal Waste Management Systems

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Breeding Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Dairy Herd Management Market, By End-use

9.1. Dairy Herd Management Market, by End-use, 2024-2033

9.1.1. Small-scale Dairy Farms

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Large-scale Dairy Farms

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cooperative Dairy Farms

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Dairy Herd Management Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Alta Genetics Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. DeLaval

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. GEA Group Aktiengesellschaft

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Lely

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Afimilk Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BouMatic

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Herdlync

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Dun & Bradstreet, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. SUM-IT

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. VAS

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others