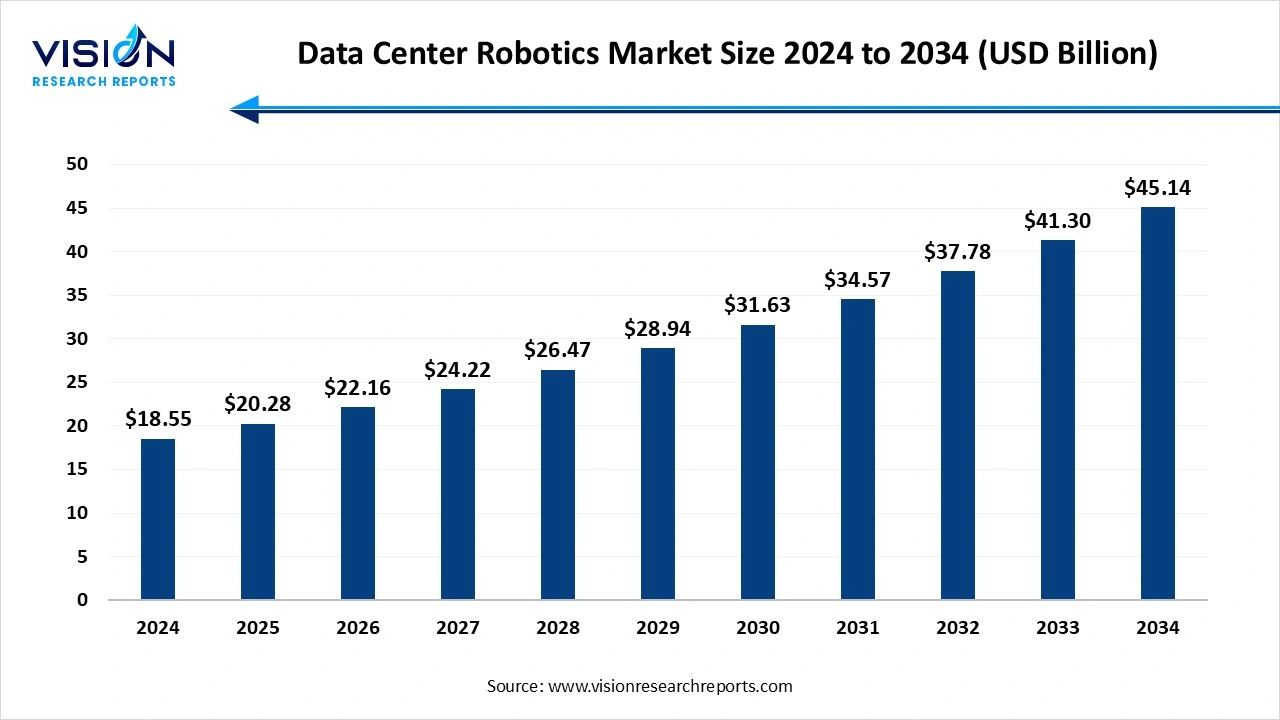

The data center robotics market size stood at USD 18.55 billion in 2024 and is estimated to reach USD 20.28 billion in 2025. It is projected to hit USD 45.14 billion by 2034, registering a robust CAGR of 9.3% from 2025 to 2034.

The Data center robotics market represents a transformative force within the data center industry, redefining the way data infrastructure is managed and operated. In this section, we will provide a comprehensive overview of this market, shedding light on its key components, growth drivers, and the pivotal role it plays in the contemporary digital landscape.

The data center robotics market is experiencing remarkable growth driven by several key factors. One of the primary drivers is the exponential increase in data generation and storage needs. With the digital transformation of businesses, there's a pressing demand for efficient data handling solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 18.55 billion |

| Revenue Forecast by 2034 | USD 45.14 billion |

| Growth rate from 2025 to 2034 | 9.3% |

| Base Year | 2024 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | 365 Data Centers, ABB, Amazon Web Services, BMC Software, China Telecom, Cisco Systems, ConnectWise, Digital Realty, Equinix, Hewlett Packard Enterprise, Huawei Technologies, Microsoft, NTT Communications, Rockwell Automation, Siemens, and Verizon. |

The hardware segment held the largest revenue share of 45% in 2023. The hardware component comprises an array of sensors, actuators, motors, and mechanical components that enable the robots to navigate, interact with the data center environment, and perform tasks with precision. These hardware components are designed to withstand the demanding and often mission-critical nature of data center operations.

The software segment is predicated to grow at a CAGR of 22.84% over the forecast period. The software component encompasses a wide range of applications, algorithms, and programming that govern the behavior of robotic systems within data centers. Artificial intelligence (AI) and machine learning (ML) play a pivotal role in the software segment, enabling robots to make informed decisions, adapt to changing conditions, and optimize data center operations autonomously.

The on-premise segment held the highest revenue share of 54% in 2023. On-premises deployment, on the other hand, entails the installation of robotic systems within the physical confines of the data center facility. This approach provides organizations with greater control and customization over their robotic solutions, addressing specific operational needs. While it may require a more substantial initial investment in hardware and infrastructure, on-premises deployment offers a high level of security and latency control, critical for certain data center applications.

The cloud segment is expected to register growth at a CAGR of 20.85% over the forecast period. Cloud-based deployment has gained prominence due to its flexibility and agility. Organizations are increasingly turning to cloud-based Data Center Robotics solutions to harness the power of remote management, scalability, and rapid deployment.

The large enterprise segment has held 64% revenue share in 2023. Large enterprises, often with extensive data center infrastructure, have been at the forefront of adopting data center robotics. These organizations recognize the importance of scalability, operational efficiency, and the need for seamless management of substantial data loads. Robotics play a vital role in addressing these concerns by automating complex tasks such as equipment installation, maintenance, and system monitoring.

The Small and Medium Enterprises (SMEs) is predicated to grow at a CAGR of 23.57% through 2033. Small and Medium Enterprises (SMEs) are increasingly recognizing the advantages of data center robotics as well. While SMEs may have smaller data center footprints compared to their larger counterparts, they face similar challenges in terms of resource optimization and operational efficiency.

The industrial robots segment accounted for the largest revenue share in 2023, contributing 38% of the overall revenue in the data center robotics market. Industrial robots are characterized by their precision, strength, and ability to perform repetitive and demanding tasks with high accuracy. Within data center environments, industrial robots are employed for tasks requiring heavy lifting, intricate component assembly, and routine maintenance of server racks and equipment.

The collaborative robots segment is predicted to grow at a CAGR of 23.45% between 2024 and 2033. Collaborative robots, or cobots, are engineered to work alongside human operators, fostering a synergistic relationship between man and machine. These robots are designed with advanced sensors and safety features that allow them to operate safely in close proximity to humans.

The IT and telecom segment captured over 19% of revenue share in 2023. In the Information Technology and Telecom sector, the adoption of data center robotics has become imperative to meet the escalating demands for data processing and storage. Data centers are the backbone of these industries, and they rely on robotics to ensure seamless operations. Robotic systems are deployed for tasks such as server maintenance, equipment installation, and cable management, enabling these sectors to maintain high levels of efficiency and uptime. With the increasing volume of data generated in IT and telecom, robotics plays a pivotal role in optimizing resource utilization and enhancing service delivery.

The Retail & E-commerce segment is anticipated to grow at a CAGR of 26.74% during the forecast period. The Retail and E-commerce industry has undergone a digital revolution, and data centers are at the heart of this transformation. In this dynamic sector, data center robotics are deployed to manage inventory, optimize supply chains, and enhance customer experiences. Robotics systems assist in order fulfillment, warehouse management, and even autonomous delivery in the e-commerce segment. In retail, data center robotics are bridging the gap between physical and digital commerce, creating seamless omnichannel experiences.

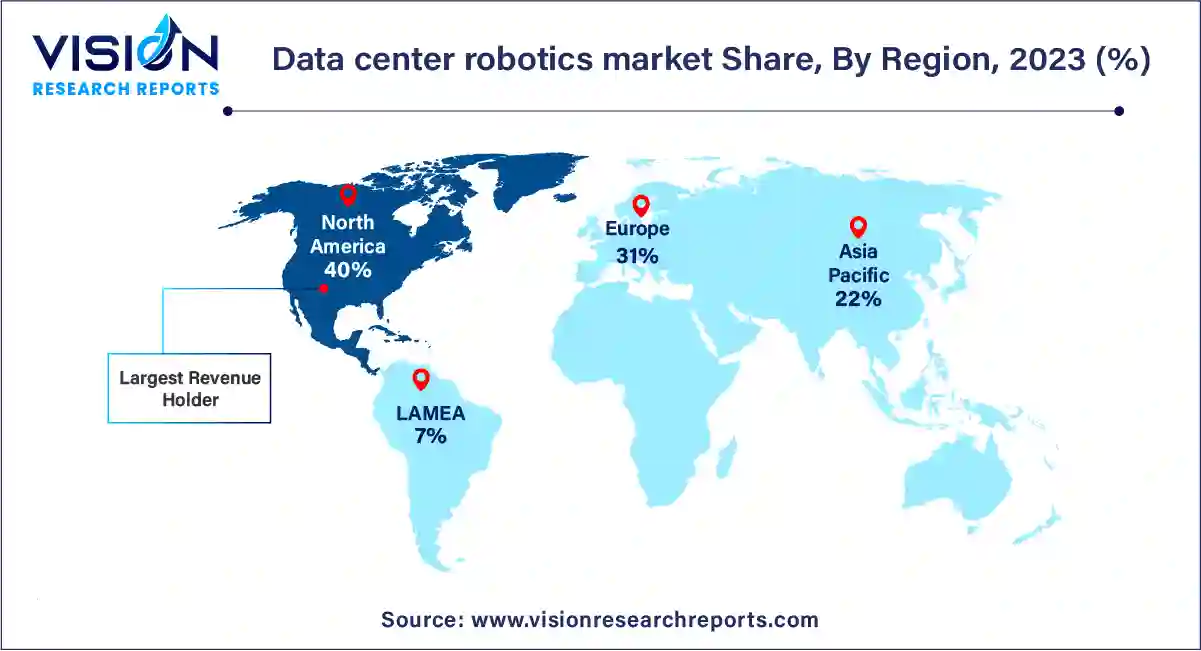

North America held the largest market share of 40% in 2023. North America stands as a prominent hub for data center robotics innovation and implementation. The region is home to a multitude of data center facilities, both large-scale and hyperscale, driven by the extensive digitalization of businesses and the rapid growth of cloud computing. In response to the critical need for efficient data management, North American data centers have actively embraced robotics solutions. These technologies play a pivotal role in optimizing operations, reducing downtime, and enhancing overall infrastructure reliability.

Asia Pacific is expected to expand at a remarkable CAGR of 22.28% between 2024 and 2033. The Asia Pacific region is experiencing a rapid surge in data center growth, propelled by the expansion of digital services, e-commerce, and cloud adoption. This heightened demand for data processing and storage capacity has led to the increased deployment of data center robotics in the region. Robotics technologies are used to optimize supply chains, enhance maintenance processes, and meet the escalating expectations of consumers in this digitally connected region.

By Component

By Deployment

By Enterprise Size

By Robot Type

By Vertical

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others