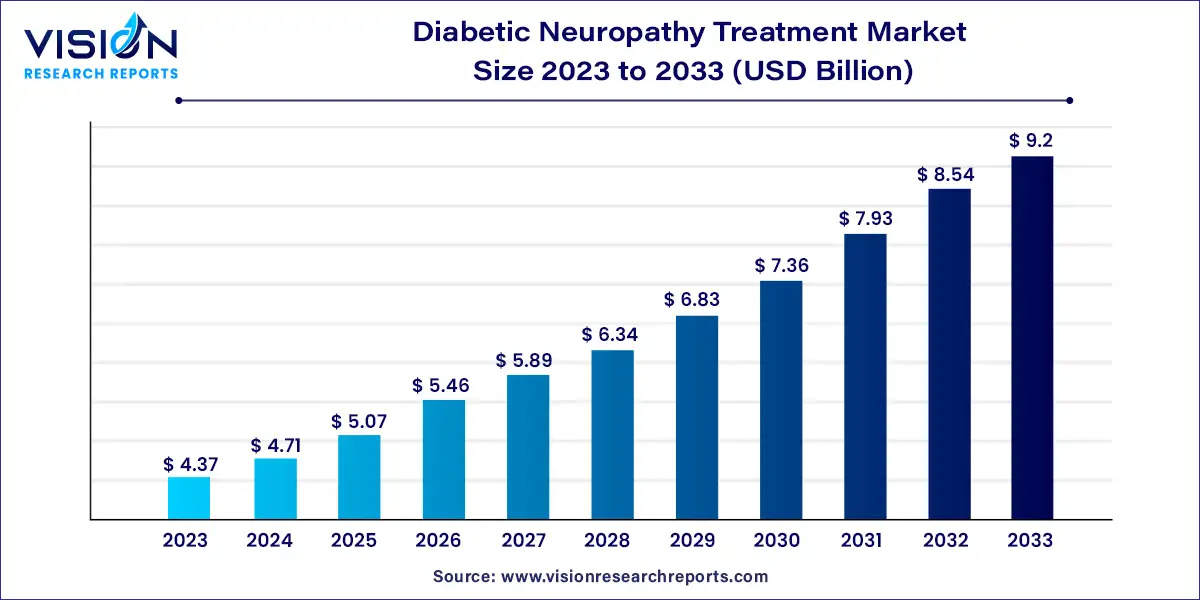

The global diabetic neuropathy treatment market was surpassed at USD 4.37 billion in 2023 and is expected to hit around USD 9.2 billion by 2033, growing at a CAGR of 7.73% from 2024 to 2033.

Diabetic neuropathy, a common complication of diabetes, poses significant challenges to patients and healthcare providers alike. As the prevalence of diabetes continues to rise globally, the demand for effective treatments for diabetic neuropathy escalates correspondingly. This article provides an overview of the diabetic neuropathy treatment market, shedding light on key aspects such as market size, growth drivers, treatment options, and emerging trends.

The diabetic neuropathy treatment market is poised for substantial growth, driven by several key factors. Firstly, the rising prevalence of diabetes globally, coupled with an aging population and sedentary lifestyles, contributes to an increased incidence of diabetic neuropathy, thus boosting the demand for effective treatment options. Additionally, heightened awareness about the complications associated with diabetic neuropathy among patients and healthcare professionals alike fuels the market expansion. Moreover, advancements in healthcare infrastructure and technology, along with growing investment in research and development activities, are propelling the development of innovative treatment modalities. These factors collectively create a conducive environment for the growth of the diabetic neuropathy treatment market, offering opportunities for pharmaceutical companies, medical device manufacturers, and healthcare providers to address the unmet medical needs of patients and improve treatment outcomes.

In 2023, the peripheral neuropathy segment emerged as the market leader, capturing the largest revenue share at 64%. This dominance can be attributed to several factors. Peripheral neuropathy stands out as the most prevalent form of diabetic neuropathy, affecting a significant portion of diabetic patients. According to a 2021 study published by the NIH, approximately 2.4% of the general population experiences peripheral neuropathy, a figure that rises to 8% among older age groups. With such widespread prevalence, there is an increasing demand for treatments and management strategies tailored specifically to peripheral neuropathy. Furthermore, research cited in a July 2021 article from ScienceDirect reveals that peripheral neuropathy is particularly prevalent among diabetic patients, accounting for approximately 40.3% of cases, with type 2 diabetic patients being more susceptible than those with type 1 diabetes.

On the other hand, the autonomic neuropathy segment is projected to experience the fastest Compound Annual Growth Rate (CAGR) over the forecast period. This acceleration is largely driven by factors such as an aging population, which is more prone to diabetes and its associated complications, including autonomic neuropathy. This form of neuropathy affects various bodily systems, including cardiovascular, gastrointestinal, genitourinary, and sudomotor systems. In older individuals with diabetes, the confluence of aging and diabetes exacerbates nerve damage, resulting in a higher prevalence of autonomic neuropathy.

In 2023, the non-steroidal anti-inflammatory drugs (NSAIDs) segment emerged as the market leader, capturing the largest revenue share at 39%. NSAIDs are favored in the treatment of diabetic neuropathy primarily due to their efficacy in pain management and their widespread prescription as a first-line treatment. These drugs function by reducing inflammation and inhibiting prostaglandin synthesis, thereby alleviating the pain and discomfort associated with diabetic neuropathy. Additionally, NSAIDs are readily available over the counter and generally more affordable compared to other treatment options, making them a preferred choice for many patients. Common NSAIDs such as ibuprofen and naproxen have demonstrated effectiveness in alleviating mild to moderate pain resulting from diabetic neuropathy.

On the other hand, the opioid segment is projected to experience moderate growth with a Compound Annual Growth Rate (CAGR) over the forecast period. Opioids serve as potent analgesics, offering more robust pain relief for patients with severe diabetic neuropathy-related pain when compared to alternatives like NSAIDs. This strong pain-relieving effect makes opioids particularly appealing to individuals experiencing intense discomfort. For instance, a 2021 publication from the NIH indicates that opioid analgesics are typically considered as secondary or tertiary options for managing moderate-to-severe neuropathic pain.

In 2023, the hospital pharmacies segment emerged as the market leader, commanding the largest revenue share of 48%. This dominance is attributed to the high hospitalization rate associated with diabetic neuropathy. Hospital pharmacies offer a centralized system for managing medications, facilitating specialized care for patients with diabetic neuropathy. This centralized approach ensures better organization and availability of necessary medications and treatments. Moreover, government support plays a pivotal role in driving the growth of hospital pharmacies. For example, initiatives and grants from organizations like the FIP (International Pharmaceutical Federation) Hospital Pharmacy Section (HPS) encourage innovative research in hospital pharmacy practices. The strategic plan developed by the HPS for the period 2022-2027 aims to advance hospital pharmacy practices globally and contribute to the realization of FIP Development Goals (DGs) across various dimensions.

On the other hand, the others segment, which includes online/e-pharmacies, is expected to witness the fastest Compound Annual Growth Rate (CAGR) over the forecast period. The convenience of ordering medications online and having them delivered directly to one's doorstep has significantly boosted the popularity of e-pharmacies. This level of convenience is particularly attractive to individuals with mobility limitations or those residing in remote areas, as it eliminates the need to visit a physical pharmacy.

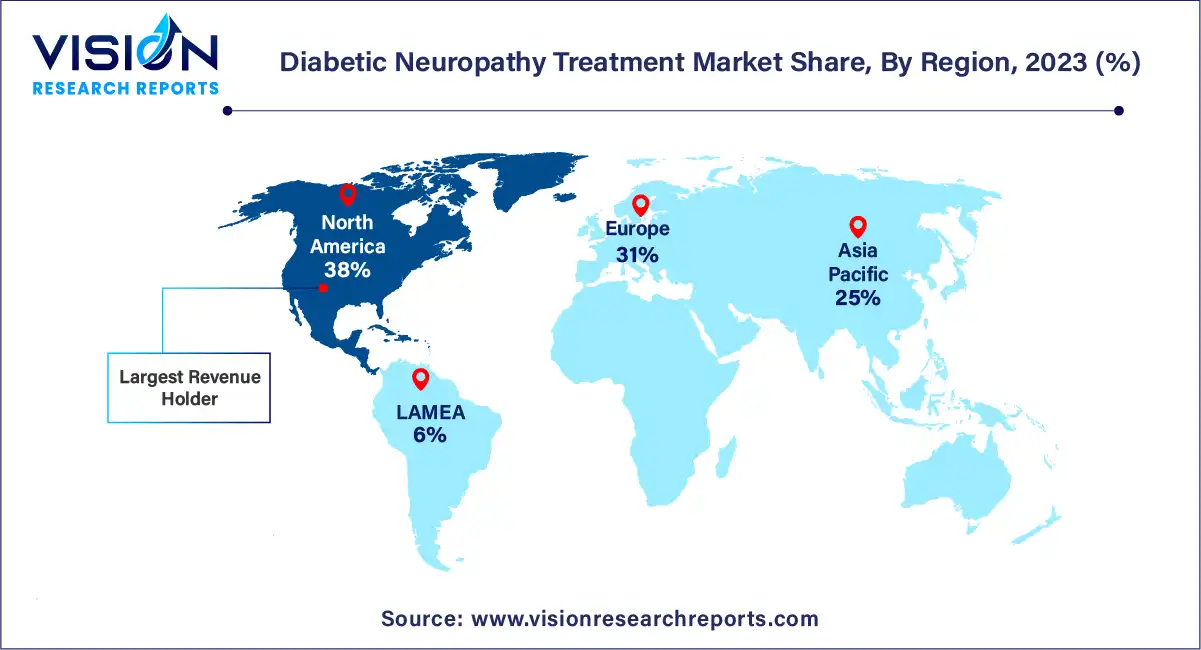

In 2023, North America emerged as the dominant force in the diabetic neuropathy treatment market, commanding a revenue share of 38%. This regional supremacy is driven by various factors, including advanced healthcare infrastructure and high healthcare spending, fostering a conducive environment for the adoption of innovative treatments for diabetic neuropathy. Market leaders such as Abbott, Pfizer Inc., Eli Lilly, and Johnson & Johnson have operational bases in North America, further bolstering market growth. Additionally, the completion of Neuralace Medical's Painful Diabetic Neuropathy (PDN) label expansion study and the potential FDA clearance for its non-invasive treatment could usher in transformative changes in the North American diabetic neuropathy market.

Meanwhile, the diabetic neuropathy treatment market in Asia Pacific is poised for significant growth, with a noteworthy Compound Annual Growth Rate (CAGR) projected over the forecast period. This growth can be attributed to several factors, including a rising geriatric population, increasing target populations, a surge in collaborations for the development of novel drugs, geographic expansion of key market players, and active involvement of government and nonprofit organizations in the market space. These factors collectively contribute to the expanding footprint of diabetic neuropathy treatment options across the Asia Pacific region.

By Disorder Type

By Drug Class

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Disorder Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Diabetic Neuropathy Treatment Market

5.1. COVID-19 Landscape: Diabetic Neuropathy Treatment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Diabetic Neuropathy Treatment Market, By Disorder Type

8.1. Diabetic Neuropathy Treatment Market, by Disorder Type, 2024-2033

8.1.1 Peripheral Neuropathy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Autonomic Neuropathy

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Proximal Neuropathy

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Focal Neuropathy

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Diabetic Neuropathy Treatment Market, By Drug Class

9.1. Diabetic Neuropathy Treatment Market, by Drug Class, 2024-2033

9.1.1. Capsaicin

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Opioid

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Non-Steroidal Anti-inflammatory Drugs (NSAIDs)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Antidepressants

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Other

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Diabetic Neuropathy Treatment Market, By Distribution Channel

10.1. Diabetic Neuropathy Treatment Market, by Distribution Channel, 2024-2033

10.1.1. Hospitals Pharmacies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Retail Pharmacies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Other

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Diabetic Neuropathy Treatment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Disorder Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Abbott.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Eli Lilly and Company.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Pfizer. Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Janssen Pharmaceuticals, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Lupin Pharmaceuticals.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Astellas Pharma Inc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Glenmark Pharmaceuticals Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Boehringer Ingelheim GmbH

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Novartis.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others