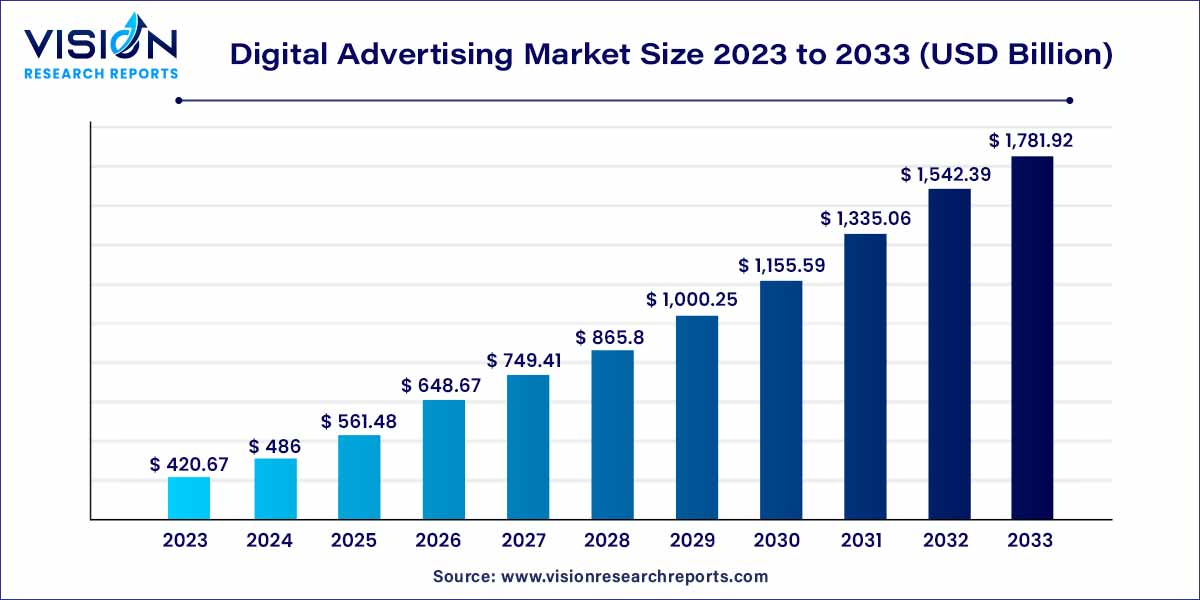

The global digital advertising market was estimated at USD 420.67 billion in 2023 and it is expected to surpass around USD 1,781.92 billion by 2033, poised to grow at a CAGR of 15.53% from 2024 to 2033. The digital advertising market is driven by the rapid growth of online consumer base, mobile device proliferation, data-driven targeting and personalization, and programmatic advertising efficiency.

The digital advertising market represents a dynamic and expansive sector within the broader realm of marketing, characterized by the use of digital channels and technologies to promote products and services. As businesses increasingly shift their focus to online platforms, the digital advertising landscape has witnessed significant growth and transformation.

The growth of the digital advertising market is propelled by several key factors. Firstly, the increasing penetration of digital devices and internet connectivity worldwide has expanded the potential reach of digital advertising campaigns. With a growing number of users engaging with online platforms, advertisers can connect with diverse global audiences more effectively. Secondly, the data-driven nature of digital advertising enables precise targeting, enhancing the relevance of ads for specific demographics and consumer segments. This data-driven approach, leveraging advanced analytics and artificial intelligence, contributes to improved campaign efficiency and return on investment. Additionally, the rising popularity of mobile devices has given prominence to mobile advertising, as consumers increasingly access content on smartphones and tablets. The dynamic evolution of social media platforms, incorporating new advertising formats and features, further fuels market growth. As businesses recognize the importance of digital presence, the digital advertising market continues to expand, driven by innovation, technological advancements, and the ever-changing preferences of the digital consumer.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 15.53% |

| Market Revenue by 2033 | USD 1,781.92 billion |

| Revenue Share of North America in 2023 | 33% |

| CAGR of Asia Pacific from 2024 to 2033 | 17.38% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Digital Advertising Market Drivers

Digital Advertising Market Restraints

The smartphone category capturing the largest share at nearly 45% in 2023. This was primarily driven by the abundant growth prospects presented by the smartphone platform. The surge in internet and smartphone accessibility, coupled with the escalating utilization of social media for advertising, serves as a catalyst for the segment's expansion. Additionally, the growing trend of consuming video content on smartphones, particularly via platforms like Instagram, YouTube, and TikTok, is poised to generate substantial growth opportunities throughout the forecast period.

The computer segment is projected to exhibit CAGR of 12.18% from 2024 to 2033. Computers are well-suited for more traditional settings, providing users with a high-quality, unobstructed, and consistent experience. Many consumers prefer browsing content and products on desktops due to their responsiveness and convenience. Businesses are increasingly directing their efforts towards connecting and engaging with users on computers by optimizing websites and applications for larger screens, thereby positively influencing market dynamics. Furthermore, computer users tend to participate in longer sessions, fostering deeper content consumption and heightened engagement, contributing positively to market growth.

The video segment is poised to take the lead in the global market for 2023, exhibiting the highest Compound Annual Growth Rate (CAGR) at over 17.08% from 2024 to 2033. This dominance is attributed to the substantial impact of video ad formats on audiences. Numerous businesses are opting for engaging video advertisements to establish brand awareness across various media channels, with a particular emphasis on popular social platforms like YouTube, Instagram, Facebook, and TikTok. Short video ads featuring how-to guides and customer testimonials assist companies in positioning their products effectively in the market. Additionally, video ads boast a broader reach, providing increased opportunities to connect with the target audience, thereby attracting consumers and expediting purchasing decisions.

On the other hand, the text segment is expected to showcase robust growth with a CAGR exceeding 16%.05 driven by the growing adoption of this advertising format by businesses aiming to promote their brand, products, services, or messages. The ease of launching these ads, requiring only copy and links to landing pages or existing web pages without the need for graphic design or image management, contributes to their popularity. Furthermore, their adaptability across desktop and mobile platforms ensures that advertisements reach a diverse audience, regardless of the device they use. These advantages associated with the text format are anticipated to fuel the growth of this segment in the coming years.

The search advertising segment emerged as the dominant force in the global market in 2023. Its prominence lies in the ability for businesses to meticulously track campaign performance, gauge success rates, and monitor user interactions with the ads. These tracking capabilities empower businesses to strategize new campaigns and make informed decisions regarding the keywords to incorporate into their advertisements. Various search engines provide advertisers with the tools to target specific details about their audience, including age, gender, and location, facilitating the creation of highly targeted ads. The advantages inherent in this form of digital advertising are instrumental in propelling the growth of the search advertising segment.

Concurrently, the interstitial advertising segment is anticipated to exhibit the CAGR of 16.08% from 2024 to 2033. Interstitial ads manifest as full-screen advertisements strategically placed at natural transition points within apps, such as after completing a task or between activities. Their distinctive and eye-catching format captures customers' attention, prompting immediate action. The heightened click-through rates associated with interstitial advertising contribute to a greater conversion rate, fueling the demand for this advertising format and driving segmental growth.

The retail segment claimed the largest market share in 2023 and is expected to continue its dominance throughout the forecast period. This is primarily attributed to the escalating use of digital channels, including websites, search engines, social media, and email, by retailers to promote their offerings and engage with customers. These digital channels enable retailers to connect with a broader target audience, personalize their communications, and enhance customer engagement. Notably, in August 2023, Walmart expanded its digital advertising capabilities across its stores, displaying targeted ads from third parties on screens in self-checkout lanes. This initiative allows brands to selectively promote their campaigns in specific stores or regions, further contributing to the growth of the retail segment.

Concurrently, the education segment is poised to experience the highest CAGR of 18.06% from 2024 to 2033. The increasing adoption of digital advertising by educational institutions aims to fortify their online presence, extend their reach,

In 2023, North America emerged dominated the market with the largest market share of 33%. This regional leadership can be attributed to the widespread adoption of smartphones, with the region experiencing relatively higher usage. Additionally, the surge in popularity of mobile streaming services, including Hulu, Amazon Prime, and Netflix, contributes significantly to creating lucrative opportunities for market expansion in North America. The region also benefits from factors such as the growing demand for e-commerce platforms, a substantial increase in online shopping activities, and the ability of digital advertising solutions to enhance the overall shopping experience. These factors collectively drive the growth of the digital advertising market in North America throughout the forecast period.

Conversely, the Asia Pacific region is anticipated to register a robust Compound Annual Growth Rate (CAGR) of 17.38% over the forcast period. This growth is fueled by the escalating demand for smartphones and the increasing penetration of the internet, particularly in key countries such as China, India, and Japan. Furthermore, the continuous proliferation of social media platforms and the growing trend of businesses collaborating with influencers to create brand awareness contribute to the favorable market conditions in the region. The presence of leading players, including Baidu, Inc., Tencent Holdings, Ltd., and Alibaba.com, further propels market growth. These companies boast user-friendly mobile applications and payment services, contributing to the overall growth of the digital advertising market in the Asia Pacific region.

By Platform

By Format

By Type

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Advertising Market

5.1. COVID-19 Landscape: Digital Advertising Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Advertising Market, By Platform

8.1. Digital Advertising Market, by Platform, 2024-2033

8.1.1. Computer

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Smartphone

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Advertising Market, By Format

9.1. Digital Advertising Market, by Format, 2024-2033

9.1.1. Text

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Image

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Video

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Advertising Market, By Type

10.1. Digital Advertising Market, by Type, 2024-2033

10.1.1. Search Advertising

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Banner Advertising

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Video Advertising

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Social Media Advertising

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Native Advertising

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Interstitial Advertising

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Digital Advertising Market, By End-user

11.1. Digital Advertising Market, by End-user, 2024-2033

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Automotive

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. IT & Telecommunication

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Healthcare

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Consumer Electronics

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Retail

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Media & Entertainment

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Education

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Others

11.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Digital Advertising Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Platform (2021-2033)

12.1.2. Market Revenue and Forecast, by Format (2021-2033)

12.1.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Platform (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Format (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Platform (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Format (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Platform (2021-2033)

12.2.2. Market Revenue and Forecast, by Format (2021-2033)

12.2.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Platform (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Format (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Platform (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Format (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Platform (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Format (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Platform (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Format (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Platform (2021-2033)

12.3.2. Market Revenue and Forecast, by Format (2021-2033)

12.3.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Platform (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Format (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Platform (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Format (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Platform (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Format (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Platform (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Format (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Platform (2021-2033)

12.4.2. Market Revenue and Forecast, by Format (2021-2033)

12.4.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Platform (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Format (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Platform (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Format (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Platform (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Format (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Platform (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Format (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Platform (2021-2033)

12.5.2. Market Revenue and Forecast, by Format (2021-2033)

12.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Platform (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Format (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Platform (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Format (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 13. Company Profiles

13.1. Adobe

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Amazon.com Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. AOL (Yahoo)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Baidu

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. ByteDance

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Dentsu Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Disruptive Advertising

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Globo

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. IAC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Meta

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others