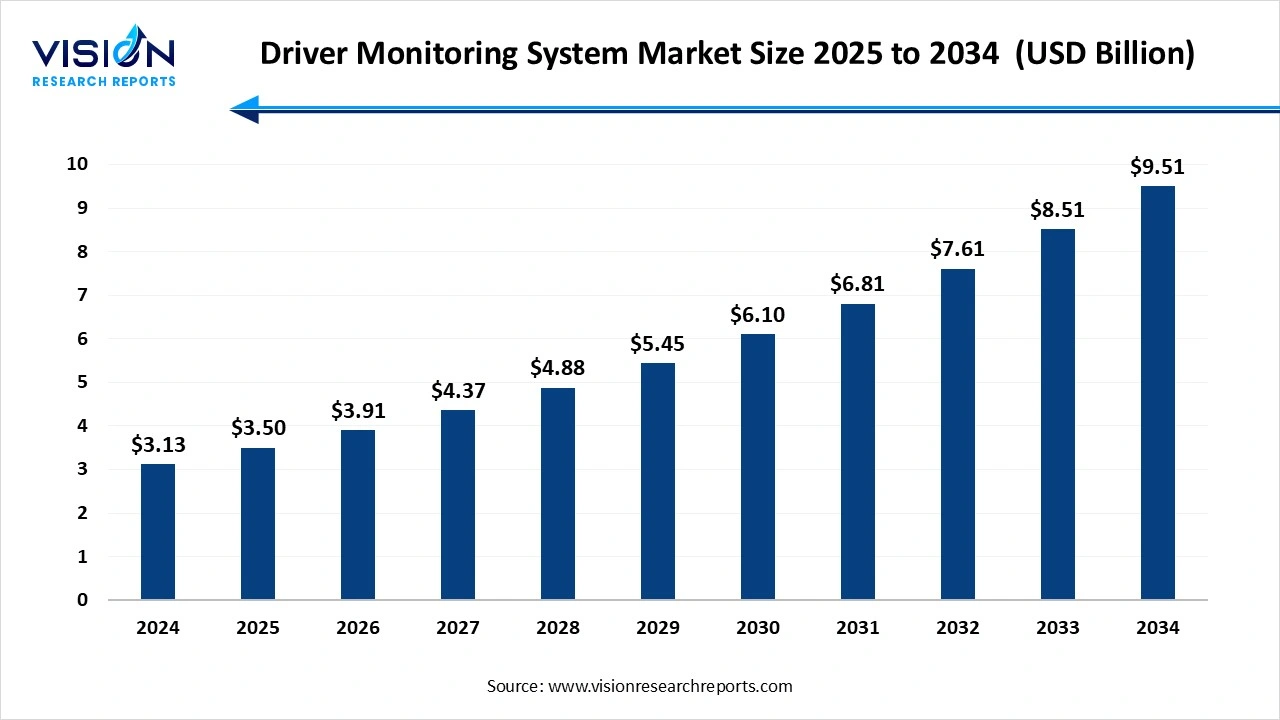

The global driver monitoring system market size was surpassed at around USD 3.13 billion in 2024 and it is projected to hit around USD 9.51 billion by 2034, growing at a CAGR of 11.75% from 2025 to 2034. The market growth is driven by rising concerns over road safety and increasing government regulations mandating advanced driver assistance systems, the Driver Monitoring System market is experiencing significant growth.

The Driver Monitoring System (DMS) market is experiencing significant growth due to rising concerns over road safety and the increasing integration of advanced driver assistance systems (ADAS) in modern vehicles. These systems utilize technologies such as infrared cameras, facial recognition, and eye-tracking sensors to monitor driver behavior, detect drowsiness, distraction, or inattention, and alert the driver or initiate corrective actions. Regulatory bodies across North America, Europe, and Asia are mandating the inclusion of driver monitoring features in new vehicles, which is further accelerating market adoption.

The growth of the Driver Monitoring System (DMS) market is primarily driven by increasing government regulations focused on improving road safety and reducing traffic-related fatalities. Several regions, especially Europe and North America, have introduced mandates requiring the inclusion of advanced safety technologies like DMS in both passenger and commercial vehicles. These systems play a critical role in detecting fatigue, distraction, or impaired driving behavior, allowing for timely alerts or interventions.

Another key factor propelling market growth is the rising adoption of semi-autonomous and autonomous vehicles. As cars become more automated, the need for continuous driver awareness monitoring becomes essential to ensure safe transitions between manual and autonomous control. Furthermore, advancements in artificial intelligence, computer vision, and sensor technologies are enhancing the accuracy and responsiveness of DMS solutions.

One of the major challenges faced by the Driver Monitoring System (DMS) market is the concern surrounding privacy and data security. Since DMS relies on continuous monitoring of a driver's facial expressions, eye movement, and head position, there is growing apprehension among consumers about how this data is captured, stored, and used. Misuse or breaches of such sensitive biometric data can lead to legal and reputational risks for automotive companies.

Another key challenge is the high cost of implementation and integration, particularly in mid-range and economy vehicles. Advanced DMS requires high-precision sensors, real-time processing units, and AI algorithms, which can significantly increase vehicle production costs. For many OEMs, balancing performance with affordability remains a complex task, especially in price-sensitive markets.

North America held a 35% share of the global driver monitoring system market in 2024. The United States, in particular, has witnessed increasing emphasis on in-cabin monitoring systems as part of broader vehicle safety strategies. Stringent safety regulations, such as those enforced by the National Highway Traffic Safety Administration (NHTSA), have prompted automotive manufacturers to integrate DMS into new vehicle models. In addition, the region’s well-established automotive infrastructure, technological innovation, and consumer preference for feature-rich vehicles are contributing to market growth.

The Asia Pacific region is expected to witness the fastest growth in the driver monitoring system market due to rising vehicle production, growing safety awareness, and expanding middle-class populations. Countries like China, Japan, and South Korea are at the forefront, with domestic automotive giants increasingly adopting DMS in response to both consumer demand and government safety initiatives. In China, the rapid development of smart vehicles and supportive policies for intelligent transportation systems are creating new opportunities for DMS providers.

The software segment held the largest market share, accounting for 54% in 2024. Powered by artificial intelligence and machine learning algorithms, the software analyzes driver behavior patterns to identify potential risks and trigger alerts or vehicle interventions when necessary. This segment is gaining momentum due to the continuous evolution of real-time analytics, emotion recognition, and predictive behavior modeling. Software upgrades also allow for remote improvements in system performance, reducing the need for physical modifications.

The hardware segment is projected to register the fastest CAGR during the period from 2025 to 2034. Hardware components such as cameras, sensors, and infrared LED detectors are integrated into the vehicle’s dashboard or steering column to monitor the driver’s eye movements, head position, and facial expressions. These physical devices are essential for ensuring accurate input to the system, enabling it to detect signs of fatigue, distraction, or inattention. With the rising demand for enhanced vehicle safety, advancements in sensor accuracy, miniaturization, and cost-effectiveness are driving the growth of the hardware segment.

The camera-based DMS segment dominated the driver monitoring system industry with the largest market share in 2024. These systems use inward-facing cameras, often integrated with infrared sensors, to monitor key indicators such as eye movement, blink rate, head position, and gaze direction. By analyzing these visual cues, camera-based DMS can accurately determine if a driver is drowsy, distracted, or inattentive, and respond with visual or audio alerts. The growing incorporation of these systems in mid- and high-end vehicles, along with favorable regulatory mandates in regions such as Europe and North America, is driving strong market growth.

The biometric DMS segment is anticipated to experience substantial CAGR growth over the forecast period. These systems utilize sensors embedded in steering wheels, seats, or wearables to track vital parameters such as heart rate, skin temperature, and respiration. Biometric DMS can provide deeper insights into a driver's emotional and physical condition, enabling the system to detect stress, fatigue, or even medical emergencies. While still emerging, this technology is gaining attention for its potential to complement camera-based systems and offer a more comprehensive monitoring solution.

The driver state monitoring segment captured the largest share of the driver monitoring system market. These systems use camera-based technology and advanced algorithms to track eye movement, head position, and facial expressions, helping detect signs of fatigue, distraction, or drowsiness. When abnormal behavior is identified, visual or auditory alerts are triggered to prompt corrective action, thereby reducing the risk of accidents caused by impaired driver performance. With regulatory bodies in multiple regions mandating the inclusion of such safety features in new vehicles, the demand for driver state monitoring solutions has seen substantial growth.

The driver identification and authentication segment is projected to record a notable CAGR between 2025 and 2034. This feature is particularly relevant in shared mobility, fleet management, and connected vehicle environments, where confirming driver identity is critical for both security and personalization. Using facial recognition or biometric sensors, the system can automatically identify the driver upon entry, adjust vehicle settings based on stored preferences, and prevent unauthorized access. This not only enhances security but also contributes to a more seamless and customized driving experience.

The passenger vehicles segment held the largest share of the driver monitoring system industry in 2024. The integration of DMS in passenger cars is being driven by growing awareness of road safety, rising adoption of semi-autonomous driving technologies, and the implementation of regulatory mandates in various regions. Automotive manufacturers are incorporating camera-based and AI-powered systems to enhance in-cabin safety, particularly in premium and mid-range models. As consumers become more inclined toward vehicles equipped with intelligent driver assistance systems, the inclusion of DMS has become a key differentiating factor.

The commercial vehicles segment is anticipated to witness a notable CAGR during the forecast period from 2025 to 2034. Fleets, including trucks, buses, and delivery vehicles, often operate under demanding conditions where driver fatigue and distraction can lead to significant safety risks and financial losses. As a result, fleet operators are increasingly investing in DMS solutions to monitor driver behavior in real time and ensure compliance with safety standards. These systems help fleet managers track driver attentiveness, generate behavior reports, and implement corrective training when necessary.

By Component

By Technology

By Functionality

By Vehicle Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Driver Monitoring System Market

5.1. COVID-19 Landscape: Driver Monitoring System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Driver Monitoring System Market, By Component

8.1. Driver Monitoring System Market, by Component

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast

8.1.2. Software

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Driver Monitoring System Market, By Technology

9.1. Driver Monitoring System Market, by Technology

9.1.1. Camera-based DMS

9.1.1.1. Market Revenue and Forecast

9.1.2. Infrared LED-based DMS

9.1.2.1. Market Revenue and Forecast

9.1.3. Steering Angle Sensor-based DMS

9.1.3.1. Market Revenue and Forecast

9.1.4. Biometric DMS

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Driver Monitoring System Market, By Functionality

10.1. Driver Monitoring System Market, by Functionality

10.1.1. Driver State Monitoring

10.1.1.1. Market Revenue and Forecast

10.1.2. Driver Identification & Authentication

10.1.2.1. Market Revenue and Forecast

10.1.3. Occupant Monitoring System (OMS)

10.1.3.1. Market Revenue and Forecast

10.1.4. Driver Behavior Analysis

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Driver Monitoring System Market, By Vehicle Type

11.1. Driver Monitoring System Market, by Vehicle Type

11.1.1. Passenger Vehicles

11.1.1.1. Market Revenue and Forecast

11.1.2. Commercial Vehicles

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Driver Monitoring System Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component

12.1.2. Market Revenue and Forecast, by Technology

12.1.3. Market Revenue and Forecast, by Functionality

12.1.4. Market Revenue and Forecast, by Vehicle Type

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component

12.1.5.2. Market Revenue and Forecast, by Technology

12.1.5.3. Market Revenue and Forecast, by Functionality

12.1.5.4. Market Revenue and Forecast, by Vehicle Type

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component

12.1.6.2. Market Revenue and Forecast, by Technology

12.1.6.3. Market Revenue and Forecast, by Functionality

12.1.6.4. Market Revenue and Forecast, by Vehicle Type

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component

12.2.2. Market Revenue and Forecast, by Technology

12.2.3. Market Revenue and Forecast, by Functionality

12.2.4. Market Revenue and Forecast, by Vehicle Type

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component

12.2.5.2. Market Revenue and Forecast, by Technology

12.2.5.3. Market Revenue and Forecast, by Functionality

12.2.5.4. Market Revenue and Forecast, by Vehicle Type

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component

12.2.6.2. Market Revenue and Forecast, by Technology

12.2.6.3. Market Revenue and Forecast, by Functionality

12.2.6.4. Market Revenue and Forecast, by Vehicle Type

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component

12.2.7.2. Market Revenue and Forecast, by Technology

12.2.7.3. Market Revenue and Forecast, by Functionality

12.2.7.4. Market Revenue and Forecast, by Vehicle Type

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component

12.2.8.2. Market Revenue and Forecast, by Technology

12.2.8.3. Market Revenue and Forecast, by Functionality

12.2.8.4. Market Revenue and Forecast, by Vehicle Type

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component

12.3.2. Market Revenue and Forecast, by Technology

12.3.3. Market Revenue and Forecast, by Functionality

12.3.4. Market Revenue and Forecast, by Vehicle Type

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component

12.3.5.2. Market Revenue and Forecast, by Technology

12.3.5.3. Market Revenue and Forecast, by Functionality

12.3.5.4. Market Revenue and Forecast, by Vehicle Type

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component

12.3.6.2. Market Revenue and Forecast, by Technology

12.3.6.3. Market Revenue and Forecast, by Functionality

12.3.6.4. Market Revenue and Forecast, by Vehicle Type

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component

12.3.7.2. Market Revenue and Forecast, by Technology

12.3.7.3. Market Revenue and Forecast, by Functionality

12.3.7.4. Market Revenue and Forecast, by Vehicle Type

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component

12.3.8.2. Market Revenue and Forecast, by Technology

12.3.8.3. Market Revenue and Forecast, by Functionality

12.3.8.4. Market Revenue and Forecast, by Vehicle Type

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component

12.4.2. Market Revenue and Forecast, by Technology

12.4.3. Market Revenue and Forecast, by Functionality

12.4.4. Market Revenue and Forecast, by Vehicle Type

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component

12.4.5.2. Market Revenue and Forecast, by Technology

12.4.5.3. Market Revenue and Forecast, by Functionality

12.4.5.4. Market Revenue and Forecast, by Vehicle Type

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component

12.4.6.2. Market Revenue and Forecast, by Technology

12.4.6.3. Market Revenue and Forecast, by Functionality

12.4.6.4. Market Revenue and Forecast, by Vehicle Type

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component

12.4.7.2. Market Revenue and Forecast, by Technology

12.4.7.3. Market Revenue and Forecast, by Functionality

12.4.7.4. Market Revenue and Forecast, by Vehicle Type

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component

12.4.8.2. Market Revenue and Forecast, by Technology

12.4.8.3. Market Revenue and Forecast, by Functionality

12.4.8.4. Market Revenue and Forecast, by Vehicle Type

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component

12.5.2. Market Revenue and Forecast, by Technology

12.5.3. Market Revenue and Forecast, by Functionality

12.5.4. Market Revenue and Forecast, by Vehicle Type

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component

12.5.5.2. Market Revenue and Forecast, by Technology

12.5.5.3. Market Revenue and Forecast, by Functionality

12.5.5.4. Market Revenue and Forecast, by Vehicle Type

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component

12.5.6.2. Market Revenue and Forecast, by Technology

12.5.6.3. Market Revenue and Forecast, by Functionality

12.5.6.4. Market Revenue and Forecast, by Vehicle Type

Chapter 13. Company Profiles

13.1. Aptiv PLC

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Robert Bosch GmbH

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Continental AG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Denso Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Valeo SA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Seeing Machines Limited

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Tobii AB

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Veoneer Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Panasonic Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. NXP Semiconductors N.V.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others