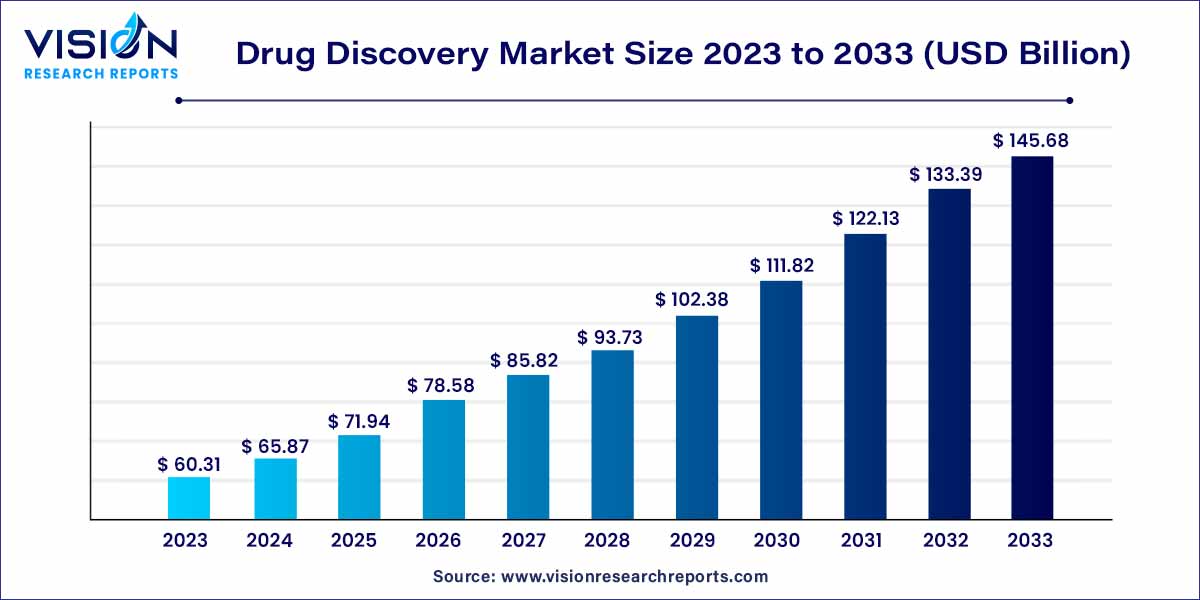

The global drug discovery market size was estimated at around USD 60.31 billion in 2023 and it is projected to hit around USD 145.68 billion by 2033, growing at a CAGR of 9.22% from 2024 to 2033. The drug discovery market is driven by an advancements in technology, innovative research methodologies, and an ever-growing understanding of biological systems.

The robust growth of the drug discovery market can be attributed to a confluence of key factors driving innovation and expansion. Advancements in technology, particularly the integration of artificial intelligence and machine learning, have significantly accelerated the drug discovery process. These technologies enhance the efficiency of target identification, lead optimization, and data analysis, thereby streamlining the research and development pipeline. Additionally, the growing understanding of genomics and molecular biology has unveiled new therapeutic targets, paving the way for novel drug candidates. Collaborations between pharmaceutical companies, biotech firms, and academic institutions have fostered a collaborative ecosystem, fostering the exchange of knowledge and resources. Moreover, the increasing prevalence of complex diseases, coupled with a rising global population, underscores the demand for innovative therapies, propelling the drug discovery market forward. As regulatory frameworks adapt to accommodate cutting-edge technologies, the industry is poised for sustained growth, with a focus on precision medicine and personalized treatment approaches shaping the future landscape.

The small molecule segment emerged as the market leader in 2023, driven by heightened demand for these drugs within the population. Small molecule drugs, characterized by their ability to easily impact cells and address diseases due to their compact size and weight, garnered increased attention. The growing awareness of the efficacy of small molecule drugs prompted manufacturers to make elevated investments in their development.

Conversely, the large molecule or biologics segment is anticipated to experience the most rapid growth throughout the forecast period. This acceleration is fueled by the increasing adoption of new manufacturing technologies, facilitating the production of biologics. Additionally, the heightened awareness among the population regarding the effective treatment capabilities of biologics, coupled with the surge in healthcare expenditure, is propelling the growth of the large molecule segment.

In 2023, the pharmaceutical companies segment emerged as the dominant force in the global drug discovery market. This dominance is a direct result of substantial investments made by leading pharmaceutical and biotechnology companies towards the development of new drugs. The escalating prevalence of chronic diseases and the expanding geriatric population have generated significant demand for innovative drugs, propelling the drug discovery market on a global scale. Furthermore, the rapid growth of the biopharmaceutical industry has been a substantial contributor to the overall market expansion.

Conversely, the Contract Research Organizations (CROs) segment is poised to be the most promising sector during the forecast period. The proliferation of numerous small and medium-sized CROs globally, driven by the increasing demand for CRO services among pharmaceutical companies, is a key factor fueling the growth of the drug discovery market. Research stands as a central activity in the drug discovery process, and smaller pharmaceutical companies with limited financial resources typically opt for CRO services, thus further accelerating the growth of this segment.

In 2023, North America emerged as the dominant region in the global drug discovery market, with the United States playing a pivotal role. The U.S., in particular, leads the world in research and development spending and holds the majority of patents for recently developed drugs. The heightened demand for advanced and innovative drugs, driven by an increased prevalence of chronic diseases in the region, has propelled the growth of the drug discovery market. Approximately half of the U.S. population is grappling with one or more chronic diseases, resulting in substantial healthcare expenditure. Furthermore, increasing awareness of biologics in North America is contributing to the market's growth. The region is also witnessing a surge in demand for generic drugs, immunotherapy drugs, and biosimilars, significantly impacting the drug discovery market.

Meanwhile, Asia Pacific is poised to be the most promising market in the coming years. This is attributed to the presence of numerous Contract Research Organizations (CROs) in the region. Countries like South Korea, India, and China are making substantial investments in the pharmaceutical industry, fostering the demand for biopharmaceutical products. Additionally, the rising geriatric population in the region is expected to drive future demand for drugs, as the elderly are more susceptible to chronic diseases. According to the United Nations, 80% of the global geriatric population is projected to reside in low and middle-income countries by 2050, signaling a potential surge in the drug discovery market's growth in the Asia Pacific region in the near future.

By Drug Type

By End User

By Technology

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others