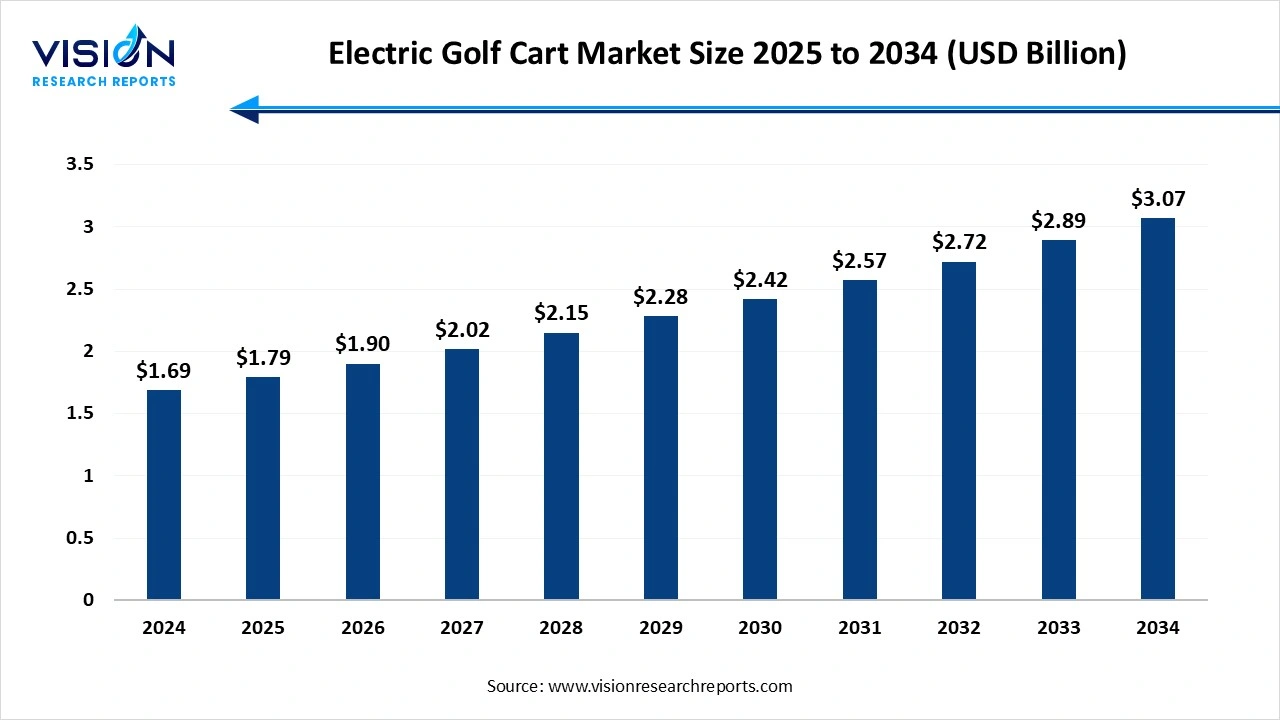

The global electric golf cart market size was accounted at around USD 1.69 billion in 2024 and it is projected to hit around USD 3.07 billion by 2034, growing at a CAGR of 6.15% from 2025 to 2034. The market growth is driven by the rising adoption of eco-friendly transportation solutions and expanding golf tourism, the electric golf cart market is experiencing steady growth.

The electric golf cart market has witnessed significant growth in recent years, driven by rising environmental awareness, advancements in battery technology, and increased demand for sustainable transportation solutions in golf courses, resorts, and urban mobility applications. These carts, powered by rechargeable electric batteries, offer quiet operation, low maintenance costs, and zero emissions, making them an attractive alternative to gasoline-powered vehicles. In addition to their traditional use in golf courses, electric golf carts are increasingly being adopted for personal and commercial use in gated communities, airports, hotels, and industrial facilities.

The growth of the electric golf cart market is primarily driven by the increasing focus on eco-friendly and energy-efficient transportation solutions. As environmental regulations tighten and consumers become more conscious of reducing carbon emissions, the demand for electric vehicles including golf carts has risen significantly. Their low noise levels, cost-effective operation, and minimal maintenance make them ideal for not only golf courses but also for other applications such as residential complexes, resorts, and industrial campuses.

Another major factor fueling market growth is the advancement in battery technology. The development of lithium-ion and other high-performance battery systems has improved the range, charging time, and overall efficiency of electric golf carts. Manufacturers are increasingly integrating smart features, such as GPS tracking, Bluetooth connectivity, and automatic braking systems, to enhance user experience and safety.

One of the key challenges faced by the electric golf cart market is the limited range and battery life of the vehicles. Although battery technology has advanced, many electric golf carts still struggle with restricted operational range, especially under heavy usage or in hilly terrains. This limitation makes them less suitable for extended applications or larger commercial facilities without frequent recharging.

Another challenge is the lack of adequate charging infrastructure, particularly in developing regions. While golf courses and resorts may provide dedicated charging stations, expanding the use of electric golf carts into residential or industrial settings often requires additional investment in charging networks.

North America dominated the global electric golf cart market with a revenue share of 39% in 2024. Battery electric vehicles dominate the market due to their zero-emission capabilities, lower operational costs, and minimal maintenance requirements. These vehicles rely solely on rechargeable batteries for power, making them an environmentally friendly option, especially suitable for golf courses, resorts, residential areas, and other locations where clean and quiet transportation is essential.

Asia Pacific emerged as a lucrative market for electric golf carts in 2024, driven by expanding golf infrastructure, urban adoption of low-speed EVs, and strong government support. Countries like India, China, and Japan are seeing rising use in resorts, campuses, and gated communities. Notably, Saera Electric Auto launched an advanced electric golf cart in India in December 2022, underscoring regional investment in electric mobility and the market’s growth potential.

The battery electric vehicle (BEV) segment held the dominant share of 69% in 2024. These vehicles rely solely on rechargeable batteries for power, making them an environmentally friendly option, especially suitable for golf courses, resorts, residential areas, and other locations where clean and quiet transportation is essential. The increasing availability of advanced battery technologies, particularly lithium-ion battery, has significantly enhanced the performance, range, and charging efficiency of BEVs, further boosting their adoption across multiple sectors.

The plug-in hybrid electric vehicle (PHEV) segment is projected to witness the highest CAGR from 2025 to 2034. PHEVs combine a battery-powered electric motor with an internal combustion engine, allowing users to switch between power sources based on their needs. This flexibility is particularly advantageous in regions with limited charging infrastructure or for applications that require longer operating hours without downtime for recharging. Although they emit some pollutants compared to BEVs, PHEVs offer extended range and reliability, which appeal to consumers seeking both environmental benefits and operational flexibility.

The 1 to 4 seater segment held the largest market share in 2024. The 1 to 4-seater segment holds a significant share of the market, driven by its suitability for personal and recreational use. These compact vehicles are widely used in golf courses, resorts, gated communities, and campuses where maneuverability, ease of use, and efficient transportation of a small number of passengers are crucial. Their lower cost, lightweight design, and enhanced energy efficiency make them ideal for users seeking convenient mobility solutions for short distances.

The 5-seater and above segment is anticipated to register a notable CAGR throughout the forecast period. These larger carts are commonly used in airports, amusement parks, hotels, and large industrial facilities to transport groups of people efficiently. Their ability to reduce the number of trips needed for moving passengers makes them cost-effective and time-saving.

The golf course segment held the largest share of the market in 2024. Golf courses continue to represent a dominant application area for electric golf carts, owing to their fundamental requirement for quiet, efficient, and non-polluting vehicles. These carts are an essential component of golf course operations, facilitating smooth movement of players and equipment across large areas. Their environmental benefits, low maintenance requirements, and improved battery performance make them a preferred choice for golf course operators aiming to enhance player convenience while aligning with sustainability goals.

The commercial use segment is projected to experience a notable CAGR from 2025 to 2034. These vehicles are increasingly being deployed in airports, hotels, resorts, theme parks, factories, and campuses to move personnel and goods over short distances. The versatility, compact size, and low noise levels of electric golf carts make them ideal for indoor and outdoor commercial applications.

By Propulsion

By Seating Capacity

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Propulsion Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric Golf Cart Market

5.1. COVID-19 Landscape: Electric Golf Cart Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric Golf Cart Market, By Propulsion

8.1. Electric Golf Cart Market, by Propulsion

8.1.1 Battery Electric Vehicle (BEV)

8.1.1.1. Market Revenue and Forecast

8.1.2. Plug-in Hybrid Electric Vehicle (PHEV)

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Electric Golf Cart Market, By Seating Capacity

9.1. Electric Golf Cart Market, by Seating Capacity

9.1.1. 1 to 4 Seater

9.1.1.1. Market Revenue and Forecast

9.1.2. 5 Seater and Above

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Electric Golf Cart Market, By Application

10.1. Electric Golf Cart Market, by Application

10.1.1. Golf Course

10.1.1.1. Market Revenue and Forecast

10.1.2. Personal Use

10.1.2.1. Market Revenue and Forecast

10.1.3 Commercial Use

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Electric Golf Cart Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Propulsion

11.1.2. Market Revenue and Forecast, by Seating Capacity

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Propulsion

11.1.4.2. Market Revenue and Forecast, by Seating Capacity

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Propulsion

11.1.5.2. Market Revenue and Forecast, by Seating Capacity

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Propulsion

11.2.2. Market Revenue and Forecast, by Seating Capacity

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Propulsion

11.2.4.2. Market Revenue and Forecast, by Seating Capacity

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Propulsion

11.2.5.2. Market Revenue and Forecast, by Seating Capacity

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Propulsion

11.2.6.2. Market Revenue and Forecast, by Seating Capacity

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Propulsion

11.2.7.2. Market Revenue and Forecast, by Seating Capacity

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Propulsion

11.3.2. Market Revenue and Forecast, by Seating Capacity

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Propulsion

11.3.4.2. Market Revenue and Forecast, by Seating Capacity

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Propulsion

11.3.5.2. Market Revenue and Forecast, by Seating Capacity

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Propulsion

11.3.6.2. Market Revenue and Forecast, by Seating Capacity

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Propulsion

11.3.7.2. Market Revenue and Forecast, by Seating Capacity

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Propulsion

11.4.2. Market Revenue and Forecast, by Seating Capacity

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Propulsion

11.4.4.2. Market Revenue and Forecast, by Seating Capacity

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Propulsion

11.4.5.2. Market Revenue and Forecast, by Seating Capacity

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Propulsion

11.4.6.2. Market Revenue and Forecast, by Seating Capacity

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Propulsion

11.4.7.2. Market Revenue and Forecast, by Seating Capacity

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Propulsion

11.5.2. Market Revenue and Forecast, by Seating Capacity

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Propulsion

11.5.4.2. Market Revenue and Forecast, by Seating Capacity

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Propulsion

11.5.5.2. Market Revenue and Forecast, by Seating Capacity

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Textron Inc. (E-Z-GO)

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Yamaha Motor Co., Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Club Car (a subsidiary of Ingersoll Rand Inc.)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4 STAR EV Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Marshell Electric Vehicle Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. JH Global Services, Inc. (Bintelli Electric Vehicles)

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Kandi Technologies Group, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others