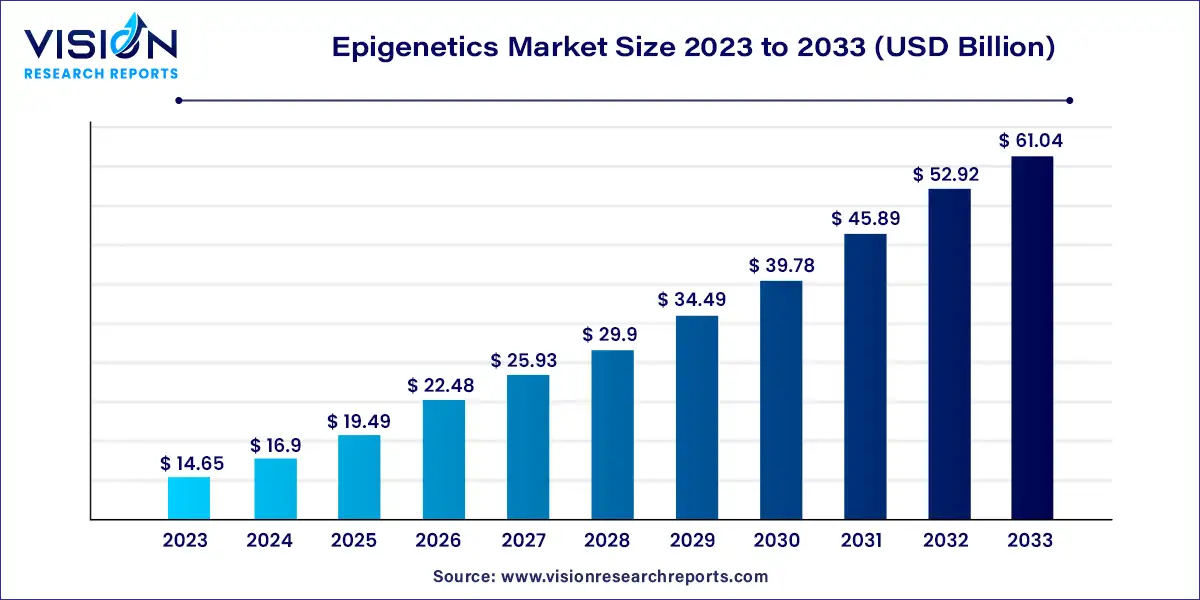

The global epigenetics market size was estimated at around USD 14.65 billion in 2023 and it is projected to hit around USD 61.04 billion by 2033, growing at a CAGR of 15.34% from 2024 to 2033.

The field of epigenetics has emerged as a pivotal area of study, garnering significant attention within the scientific and medical communities. Epigenetics explores the intricate mechanisms that regulate gene expression and cellular function, beyond the underlying DNA sequence. This dynamic interplay between genetic and environmental factors has profound implications for various aspects of health and disease.

The growth of the epigenetics market is driven by the technological advancements, particularly in high-throughput sequencing and epigenome profiling, have revolutionized research capabilities, driving innovation and discovery. Rising prevalence of chronic diseases, coupled with increasing understanding of epigenetic mechanisms in disease pathogenesis, has spurred interest in epigenetics as a promising avenue for therapeutic intervention. Moreover, the integration of epigenetics into drug discovery and personalized medicine initiatives has led to the identification of novel targets and tailored treatment approaches. Collaborative efforts among academia, industry, and government sectors have facilitated knowledge sharing and accelerated research progress.

In 2023, the reagents segment emerged as the dominant force in the industry, capturing 34% of the global revenue. This segment's significant market share can be primarily attributed to its widespread utilization in epigenetic research endeavors. Reagents constitute a fundamental component in epigenetics, particularly within the realms of histone and DNA modification. They play a pivotal role in elucidating and manipulating the intricate mechanisms of epigenetic regulation, which govern alterations in gene expression without modifying the underlying DNA sequence. These reagents serve as indispensable tools for comprehending epigenetic dynamics and hold promise for both research and potential therapeutic applications. Notably, numerous industry players, such as Promega Corporation, offer a diverse array of reagents and kits tailored for epigenetic investigations, further fueling the growth of this segment.

Conversely, the services segment is poised to exhibit the highest compound annual growth rate (CAGR) of 17.69% throughout the forecast period. Epigenetic services encompass a broad spectrum of offerings, including sequencing, analysis, and consultation services. Given the complexity of epigenetic analyses, which entail sophisticated techniques like ChIP-seq, bisulfite sequencing, and DNA methylation profiling, many researchers and institutions rely on specialized service providers for accurate and efficient execution. Moreover, the continuous evolution of high-throughput sequencing technologies and advanced epigenetic analysis tools creates a surging demand for services capable of harnessing these innovations to generate comprehensive and reliable epigenomic insights.

In 2023, the DNA methylation segment emerged as the market leader, commanding a significant revenue share of 46%. The prominence of DNA methylation in epigenetics is driven by its pivotal role in regulating gene expression. This epigenetic modification exerts influence over a plethora of biological processes, ranging from development and aging to disease onset and progression. Understanding the intricate patterns of DNA methylation holds profound implications for deciphering complex diseases like cancer and offers promising avenues for precision medicine applications, thereby fueling the demand for its study in both epigenetics research and therapeutic development.

On the other hand, the histone acetylation segment is poised to experience the most rapid compound annual growth rate (CAGR) of 18.19% from 2024 to 2033. This surge in growth can be attributed to the enhanced efficacy of the technology, facilitated by the development of innovative methods. Furthermore, a multitude of studies have underscored the potential therapeutic benefits of histone acetylation in various disorders, including solid tumors, inflammation, leukemia, and viral infections. As a result, the increasing recognition of histone acetylation's therapeutic potential is expected to drive its demand and contribute to the segment's accelerated growth trajectory in the coming years.

In 2023, the oncology segment emerged as the dominant force in the market, commanding a substantial revenue share of 70%. The demand for epigenetics within oncology stems from the intricate interplay between epigenetic alterations and the development of cancer. These changes play a pivotal role in evaluating tumor initiation, progression, and metastasis. Targeting these modifications presents promising avenues for innovative cancer treatments, including precision therapies tailored to individual patients. The exploration of epigenetic mechanisms in oncology holds significant promise for the development of novel diagnostics and more effective, personalized interventions for cancer patients, thus driving the demand within this field.

Conversely, the non-oncology segment is anticipated to witness the swiftest compound annual growth rate (CAGR) of 16.33% from 2024 to 2033. The understanding of epigenetic mechanisms extends beyond oncology to encompass a diverse array of conditions, including neurological disorders, cardiovascular diseases, metabolic disorders, autoimmune diseases, infectious diseases, rare diseases, aging, reproductive health, psychiatric disorders, drug development, precision medicine, regenerative medicine, environmental exposures, chronic inflammatory diseases, and geriatric medicine. This comprehensive exploration of epigenetics in non-oncological applications collectively contributes to the growth and development of the epigenetics market, opening up new avenues for research and therapeutic innovation across a broad spectrum of medical disciplines.

In 2023, the academic research segment emerged as the market leader, capturing a significant revenue share of 38%. This dominance can be attributed to the far-reaching implications of epigenetics across various fields, including medicine, biology, and genetics. The complexity inherent in epigenetic mechanisms presents intriguing avenues for exploration, fostering curiosity and driving academic interest. Furthermore, the potential of epigenetics to unravel mysteries surrounding diseases, development, and personalized medicine continues to fuel growth in academic research endeavors within this domain.

Conversely, the clinical research segment is poised to experience the most rapid compound annual growth rate (CAGR) of 16.40% over the forecast period. Contract research organizations (CROs) are increasingly incorporating epigenetic analyses into their research protocols due to the pivotal role of such analyses in identifying and validating therapeutic targets with precision—a critical step in the quest for effective treatments. Epigenetic insights provide a comprehensive understanding of how environmental factors influence gene expression, aiding in the identification of biomarkers and potential therapeutic interventions. CROs leverage these insights to enhance drug efficacy assessments, predict patient responses, and streamline preclinical studies, thereby driving growth within the clinical research segment.

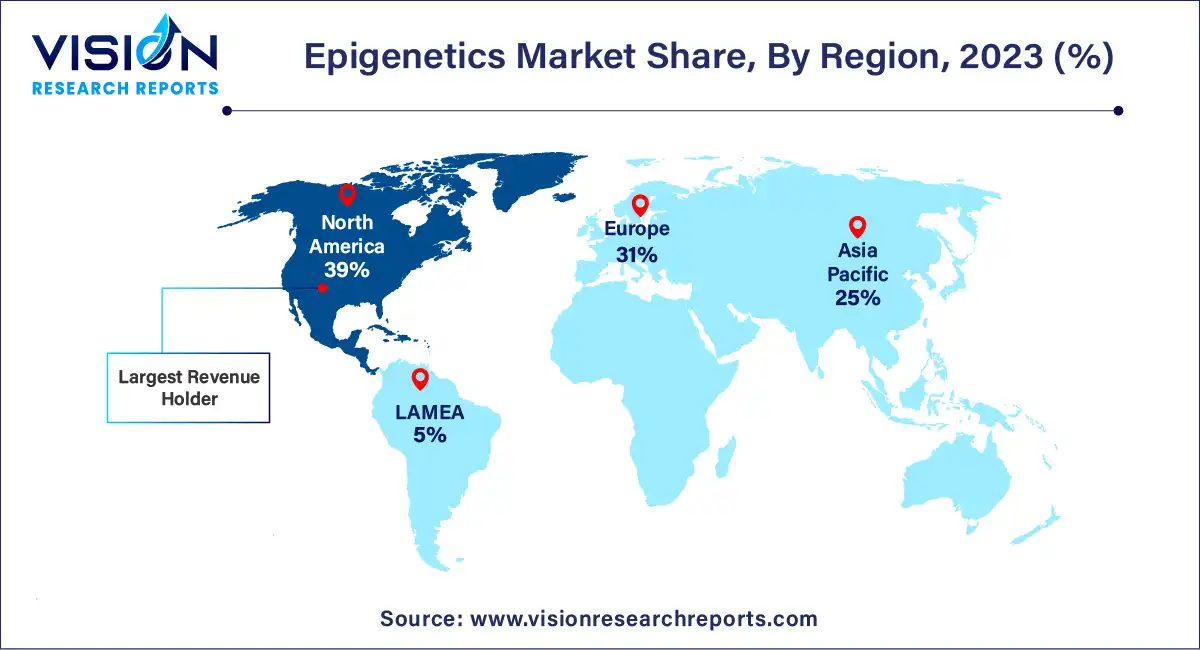

In 2023, North America emerged as the dominant force in the market, commanding a substantial share of 39%. The region's growth is fueled by several factors, including heightened public awareness, robust medical infrastructure, and significant investments in research and development (R&D). Moreover, the prevalence of chronic illnesses and considerable investments by market players in epigenetic research further amplify regional expansion, creating a conducive environment for continued growth. Additionally, the presence of key industry players like Thermo Fisher Scientific, Inc., Element Biosciences, Inc., Dovetail Genomics LLC., Illumina, Inc., and Promega Corporation in the U.S. market is expected to bolster regional expansion efforts.

Conversely, the Asia Pacific region is poised to experience the most rapid compound annual growth rate (CAGR) of 16.73% from 2024 to 2033. This growth trajectory is driven by increasing demand for genome editing technologies and the prevalence of genetic disorders and diseases across countries such as India and Australia. Furthermore, domestic companies offering epigenetics products and services are attracting investments and funding, further fueling regional growth. For instance, in August 2023, Epigenic Therapeutics, a China-based firm, secured USD 32 million in a Series A financing round. This company specializes in developing next-generation gene modulation therapy utilizing epigenome regulation to address prevalent disorders. The influx of investments among such industry players is anticipated to propel regional expansion efforts in the coming years.

By Product

By Technology

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Epigenetics Market

5.1. COVID-19 Landscape: Epigenetics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Epigenetics Market, By Product

8.1. Epigenetics Market, by Product, 2024-2033

8.1.1. Reagents

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Kits

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Instruments

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Enzymes

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Services

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Epigenetics Market, By Technology

9.1. Epigenetics Market, by Technology, 2024-2033

9.1.1. DNA Methylation

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Histone Methylation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Histone Acetylation

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Large non-coding RNA

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. MicroRNA modification

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Chromatin structures

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Epigenetics Market, By Application

10.1. Epigenetics Market, by Application, 2024-2033

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Oncology

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Epigenetics Market, By End-use

11.1. Epigenetics Market, by End-use, 2024-2033

11.1.1. Academic Research

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Clinical Research

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Hospitals & Clinics

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Pharmaceutical & Biotechnology Companies

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Other Users

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Epigenetics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Roche Diagnostics

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Thermo Fisher Scientific, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Eisai Co. Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Novartis AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Element Biosciences, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Dovetail Genomics LLC.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Illumina, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Promega Corporation.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Abcam plc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others