The global esoteric testingmarket size was accounted at around USD 24.63 billion in 2024 and it is projected to hit around USD 75.82 billion by 2034, growing at a CAGR of 11.9% from 2025 to 2034. The market growth is driven by the increasing prevalence of chronic and rare diseases, the esoteric testing market is experiencing significant growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.63 billion |

| Revenue Forecast by 2034 | USD 75.82 billion |

| Growth rate from 2025 to 2034 | CAGR of 11.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Laboratory Corporation of America Holdings (LabCorp), Quest Diagnostics Incorporated, Mayo Clinic Laboratories, Opko Health, Inc. (BioReference Laboratories), ARUP Laboratories, Sonic Healthcare Limited, Fulgent Genetics, Inc., Myriad Genetics, Inc., Eurofins Scientific SE, Invitae Corporation |

The esoteric testing market refers to specialized laboratory tests that are not routinely performed and often require advanced instruments, methodologies, or expertise. These tests are primarily used for the detection of rare or complex diseases, including genetic disorders, infectious diseases, endocrinology, oncology, and toxicology cases. Unlike routine tests, esoteric diagnostics are usually ordered in low volumes but offer high value in terms of clinical insights and diagnostic precision. They are commonly outsourced to reference laboratories due to the high cost and specialized equipment required for processing.

The growth of the esoteric testing market is primarily driven by the increasing prevalence of complex and rare diseases, which require advanced diagnostic solutions for accurate identification and treatment. As healthcare providers focus more on precision medicine, esoteric tests particularly those involving molecular diagnostics, next-generation sequencing (NGS), and proteomics are becoming essential in clinical decision-making.

Another key growth factor is the continuous advancement in laboratory technologies and automation, which is enhancing the efficiency, sensitivity, and turnaround time of these specialized tests. The shift toward value-based care and the integration of AI and big data analytics in diagnostics are also facilitating faster and more informed diagnostics, improving patient outcomes.

The esoteric testing market faces several challenges, the foremost being the high cost of specialized tests and the sophisticated equipment required to perform them. Many healthcare facilities, especially in developing regions, lack the infrastructure or funding to implement these advanced diagnostics in-house. This often leads to outsourcing, which can result in longer turnaround times and logistical complexities.

Another significant challenge is the shortage of skilled professionals trained in molecular diagnostics and complex testing methodologies. Interpreting esoteric test results often requires a deep understanding of genomics, proteomics, or rare disease pathology, which is not widespread among general laboratory personnel. Moreover, the constant evolution of diagnostic technologies demands continuous training and certification, adding operational pressure on laboratories. These factors, combined with strict regulatory requirements, can slow market adoption and limit the scalability of esoteric testing services.

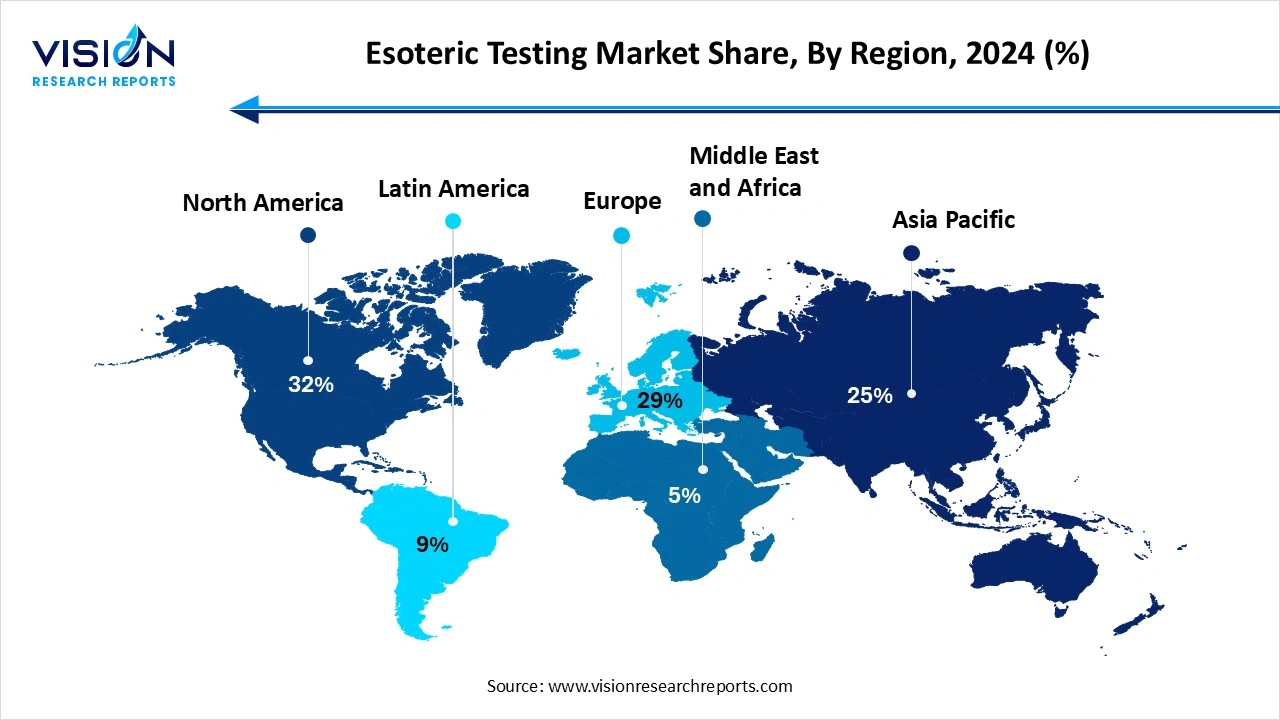

North America dominated the esoteric testing market, holding the largest share of 32% in the overall industry in 2024. The global esoteric testing market demonstrates significant regional variation, with North America holding the largest market share due to its advanced healthcare infrastructure, high adoption of precision medicine, and strong presence of major diagnostic companies. The United States, in particular, benefits from a well-established network of reference laboratories, robust investments in research and development, and favorable reimbursement policies for advanced diagnostic procedures.

The esoteric testing market in Asia Pacific is projected to expand at the highest CAGR of 13.5% during the forecast period. China, India, and Japan are investing heavily in genomic research and healthcare digitization, contributing to increased demand for complex diagnostic testing. Despite certain challenges like limited reimbursement frameworks and uneven access to specialized testing in rural areas, the region presents significant long-term growth potential.

The esoteric testing market in Asia Pacific is projected to expand at the highest CAGR of 13.5% during the forecast period. China, India, and Japan are investing heavily in genomic research and healthcare digitization, contributing to increased demand for complex diagnostic testing. Despite certain challenges like limited reimbursement frameworks and uneven access to specialized testing in rural areas, the region presents significant long-term growth potential.

The oncology testing segment led the market, accounting for a 29% share of the total revenue. As the global burden of cancer continues to rise, healthcare providers are increasingly turning to esoteric oncology tests that utilize molecular biomarkers and next-generation sequencing (NGS) technologies to detect mutations, tumor markers, and specific gene expressions. These tests offer valuable insights into the nature and progression of cancer, enabling personalized treatment approaches and improving patient outcomes. With the growing availability of precision medicine and targeted therapies, the demand for oncology-focused esoteric testing has surged, particularly in hospital-based laboratories and cancer research institutions.

The genetic testing segment is projected to witness the highest compound annual growth rate (CAGR) of 12.4% during the forecast period from 2025 to 2034. Driven by advancements in genomics and bioinformatics, genetic esoteric tests provide clinicians with a deeper understanding of a patient’s DNA, facilitating early diagnosis and preventive care. These tests are widely used in reproductive health, rare disease diagnostics, and pharmacogenomics. The growing awareness among patients, along with declining costs of sequencing technologies, is further accelerating the adoption of genetic testing worldwide.

The chemiluminescence immunoassay held the largest share of market revenue, emerging as the dominant technology in 2024. Among these, chemiluminescence immunoassay (CLIA) has emerged as a widely adopted technology due to its high sensitivity and specificity in detecting low-abundance biomarkers. CLIA utilizes a chemiluminescent reaction to produce light as a signal, which is then measured to determine the presence of specific antigens or antibodies in a sample. Its application spans across various disease areas, including infectious diseases, autoimmune disorders, and oncology, making it highly relevant in esoteric testing.

The enzyme-linked Immunosorbent Assay (ELISA) is projected to witness substantial growth throughout the forecast period. ELISA is commonly used to detect and quantify soluble substances such as proteins, hormones, and antibodies, and is extensively applied in areas such as endocrinology, immunology, and toxicology. In esoteric testing, ELISA is particularly valuable for rare disease diagnostics and complex biomarker assessments where standard tests fall short. The ability to customize assays for specific targets and its compatibility with a wide range of sample types further contribute to ELISA’s strong foothold in the market.

The independent and reference laboratories segment accounted for the highest revenue share, leading the market in 2024. These facilities often specialize in esoteric testing and are equipped with sophisticated technologies and highly skilled personnel to handle complex assays, such as genetic, molecular, and proteomic tests. As esoteric tests typically require expensive instrumentation and technical expertise, healthcare providers frequently outsource these tests to reference labs to ensure accurate results and cost efficiency.

The hospital-based laboratories are anticipated to experience notable growth over the forecast period. These labs are increasingly incorporating advanced testing capabilities in-house to support immediate clinical decision-making and reduce turnaround times. The integration of esoteric testing within hospital settings enables physicians to access real-time diagnostic data for managing complex and critical cases, such as cancer, rare genetic disorders, and infectious diseases. Additionally, the growing emphasis on personalized medicine and precision diagnostics is prompting hospitals to invest in specialized technologies and laboratory talent.

By Type

By Technology

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Esoteric Testing Market

5.1. COVID-19 Landscape: Esoteric Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Esoteric Testing Market, By Type

8.1. Esoteric Testing Market, by Type

8.1.1 Oncology testing

8.1.1.1. Market Revenue and Forecast

8.1.2. Infectious disease testing

8.1.2.1. Market Revenue and Forecast

8.1.3. Genetic testing

8.1.3.1. Market Revenue and Forecast

8.1.4. Endocrinology testing

8.1.4.1. Market Revenue and Forecast

8.1.5. Toxicology testing

8.1.5.1. Market Revenue and Forecast

8.1.6. Neurology testing

8.1.6.1. Market Revenue and Forecast

8.1.7. Others

8.1.7.1. Market Revenue and Forecast

Chapter 9. Global Esoteric Testing Market, By Technology

9.1. Esoteric Testing Market, by Technology

9.1.1. Chemiluminescence immunoassay

9.1.1.1. Market Revenue and Forecast

9.1.2. Enzyme-linked immunosorbent assay

9.1.2.1. Market Revenue and Forecast

9.1.3. Real time polymerase chain reaction

9.1.3.1. Market Revenue and Forecast

9.1.4. Flow cytometry

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Esoteric Testing Market, By End Use

10.1. Esoteric Testing Market, by End Use

10.1.1. Hospital-based laboratories

10.1.1.1. Market Revenue and Forecast

10.1.2. Independent and reference laboratories

10.1.2.1. Market Revenue and Forecast

10.1.3. Other

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Esoteric Testing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type

11.1.2. Market Revenue and Forecast, by Technology

11.1.3. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type

11.1.4.2. Market Revenue and Forecast, by Technology

11.1.4.3. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type

11.1.5.2. Market Revenue and Forecast, by Technology

11.1.5.3. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type

11.2.2. Market Revenue and Forecast, by Technology

11.2.3. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type

11.2.4.2. Market Revenue and Forecast, by Technology

11.2.4.3. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type

11.2.5.2. Market Revenue and Forecast, by Technology

11.2.5.3. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type

11.2.6.2. Market Revenue and Forecast, by Technology

11.2.6.3. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type

11.2.7.2. Market Revenue and Forecast, by Technology

11.2.7.3. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type

11.3.2. Market Revenue and Forecast, by Technology

11.3.3. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type

11.3.4.2. Market Revenue and Forecast, by Technology

11.3.4.3. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type

11.3.5.2. Market Revenue and Forecast, by Technology

11.3.5.3. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type

11.3.6.2. Market Revenue and Forecast, by Technology

11.3.6.3. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type

11.3.7.2. Market Revenue and Forecast, by Technology

11.3.7.3. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type

11.4.2. Market Revenue and Forecast, by Technology

11.4.3. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type

11.4.4.2. Market Revenue and Forecast, by Technology

11.4.4.3. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type

11.4.5.2. Market Revenue and Forecast, by Technology

11.4.5.3. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type

11.4.6.2. Market Revenue and Forecast, by Technology

11.4.6.3. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type

11.4.7.2. Market Revenue and Forecast, by Technology

11.4.7.3. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type

11.5.2. Market Revenue and Forecast, by Technology

11.5.3. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type

11.5.4.2. Market Revenue and Forecast, by Technology

11.5.4.3. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type

11.5.5.2. Market Revenue and Forecast, by Technology

11.5.5.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1. Laboratory Corporation of America Holdings (LabCorp).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Quest Diagnostics Incorporated.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Mayo Clinic Laboratories.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Opko Health, Inc. (BioReference Laboratories).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ARUP Laboratories.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sonic Healthcare Limited

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Fulgent Genetics, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Myriad Genetics, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Eurofins Scientific SE.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Invitae Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others