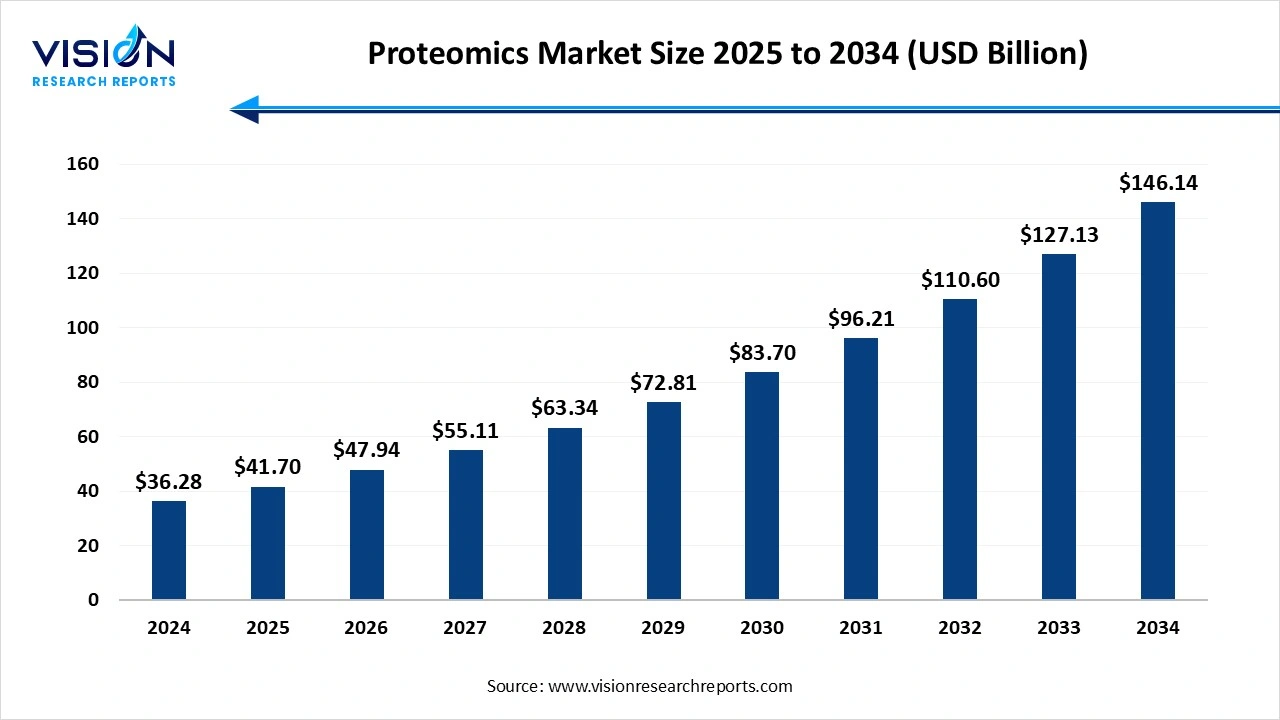

The global proteomics market size was worth USD 36.28 billion in 2024 and is estimated to reach USD 41.70 billion in 2025, and further expand to USD 146.14 billion by 2034, growing at a CAGR of 14.95% over the forecast period. The innovation in mass spectrometry and the rising demand for personalized medicine and advancement in technology and data analysis, expansion into drug discovery and development.

Proteomics is defined as the worldwide network of firms, research institutions, and end-users involved in the study and commercial application of proteomes, the entire set of proteins expressed by a biological system. This market includes the products and services that enable the large-scale analysis of protein functions, structures, interactions, and modifications. The market growth is driven by the need for early and accurate disease diagnosis is increasing the demand for proteomics in biomarker identification.

A panel of multiple biomarkers identified through proteomic analysis offers a more reliable diagnosis than a single marker. The development of proteomics-based liquid biopsies, which analyze proteins in easily accessible body fluids like blood and urine, offers the potential for non-invasive testing and personalized monitoring of disease progression. Rising expansion into drug discovery and development.

Proteomics is widely used by pharmaceutical and biotechnology firms to discover new drug targets and understand the underlying mechanisms of drug action. Identifying and validating potential therapeutic targets, proteomics accelerates the drug development pipeline, leading to more efficient preclinical studies and lead optimization. The increasing focus on developing complex biologics, such as monoclonal antibodies, relies on proteomics for characterizing their structure and ensuring quality.

| Report Coverage | Details |

| Market Size in 2024 | USD 36.28 billion |

| Revenue Forecast by 2034 | USD 146.14 billion |

| Growth rate from 2025 to 2034 | CAGR of 14.95% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

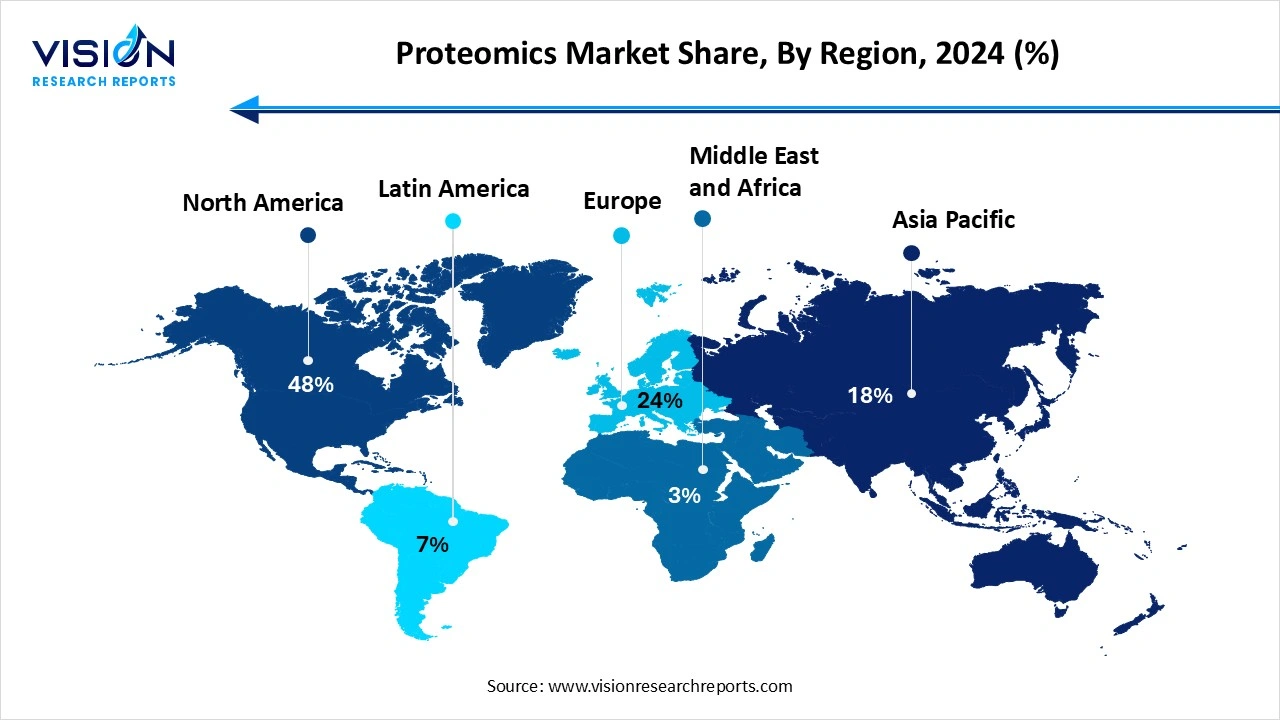

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | BioTools Inc., Illumina Inc., Danaher, Agilent Technologies Inc., Merck KGaA, Bio-Rad Laboratories Inc., Waters Corporation, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., and Bruker Corporation. |

AI and Machine Learning Integration: Artificial intelligence and machine learning are being used to analyze the massive and complex datasets generated by proteomic experiments, accelerating discovery and personalized medicine strategies. Innovations in mass spectrometry, chromatography, and single-cell proteomics are enhancing the speed, sensitivity, and accuracy of protein analysis.

Single-cell proteomics (SCP) represents a high-growth, innovative segment within the broader proteomics market, moving beyond bulk analysis to profile the protein expression of individual cells. While bulk proteomics averages the protein profiles of millions of cells, masking important cellular differences, SCP can detect and characterize proteins from single cells, revealing the functional heterogeneity critical to understanding biology and disease.

The advanced instruments, such as high-resolution mass spectrometers and high-throughput systems, can cost hundreds of thousands of dollars to acquire and maintain, creating a substantial financial barrier. The highly specialized expertise required for sample preparation, instrument operation, and data analysis hinders market growth.

North America led the global proteomics market, capturing a dominant revenue share of 48% in 2024. The region's strong healthcare facilities, well-established biomolecule infrastructure, and academic institutions drive innovation through robust academic and clinical research environments. The high prevalence of chronic and infectious diseases, particularly cancer, fuels the demand for advanced diagnostic tools that can identify disease-specific protein biomarkers.

United States Proteomics Market Trends

The developing individualized treatment plans by identifying disease biomarkers and understanding patient-specific protein expression profiles. The continuous innovation in mass spectrometry has increased sensitivity, resolution, and throughput, making protein analysis more comprehensive. The use of Artificial Intelligence to analyse the massive, complex datasets generated by proteomics research. Significant investment from the government and private sectors is fueling market expansion. The field is advancing to analyze proteins at the individual cell level, providing deeper insights into cellular diversity and disease mechanisms.

The Asia Pacific proteomics market is projected to record the fastest CAGR of 16.07% between 2025 and 2034. The growing incidence of chronic disease fuels demand for novel diagnostic and therapeutic solutions, boosting the use of proteomics. The expansion of pharmaceutical and biotechnology firms in countries such as India and China is also contributing to the growth of the proteomics market. The region's investment in scientific research, including life science and biotechnology sectors, fuels the market growth.

Why did the Reagents and Consumables Segment Dominate the Proteomics Market?

The reagents and consumables segment held the highest revenue share, accounting for 73% of the market in 2024. The reagents are required for the core activities in proteomics, including protein extraction, separation, labelling, and analysis. Specific kits are needed for preparing samples for analysis, ensuring accurate and reliable results. High demand and repeat purchases of materials are consumed with every experiment; they drive constant demand from research, clinics, and biotechnology labs.

The services segment is the fastest-growing in the Proteomics market during the forecast period. The proteomics research has become more complex, involving intricate protein interactions and larger datasets, many organizations lack the in-house expertise and advanced infrastructure to handle these tasks effectively. Rising demand for specialized expertise, cost-effectiveness, and efficiency. Continuous advancement in mass spectrometry and bioinformatics tools provides enhanced capabilities for protein analysis and management. Rising contract research organizations and personalized medicine.

How the Spectrometry Segment hold the Largest Share in the Proteomics Market?

The spectrometry segment held the leading revenue share of 32% in 2024. The high sensitivity and resolution, mass spectrometry make it a highly versatile technique applicable to various sample types and a wide range of proteomic applications, including protein identification and qualification, post-translational modification analysis. Continuous advancement in mass spectrometers' design, including advances in hybrid instruments, high-resolution systems, and ionization techniques, has significantly improved performance in terms of speed, accuracy, and sensitivity.

The next-generation sequencing (NGS) segment is experiencing the fastest growth in the market during the forecast period. The increased focus on personalized medicine and diagnostics, the deadline for sequencing costs, and technological advancements. The cost of DNA sequencing has drastically decreased, making NGS technology more accessible and attractive for a wider range of research and clinical applications. The integration of NGS with other omics technologies, such as transcriptomics and epigenomics, offers a holistic view of biological systems and can potentially lead to new insights in various fields. NGS is increasingly used in drug discovery and development to identify biomarkers, understand disease pathways, and assess drug efficacy and toxicity at the molecular level.

How the Drug Discovery Segment hold the Largest Share in the Proteomics Market?

The drug discovery segment led the proteomics market, accounting for the largest revenue share of 53% in 2024. The pharmaceutical firms' continuous investment in drug discovery and development, coupled with the vital role of proteomics in this process, significantly contributes to the segment's leading position. Efficiency and toxicity biomarkers, drug design, and lead optimization. Proteomics plays a crucial role in identifying and validating potential drug targets. It helps researchers understand protein structures, functions, and interactions, revealing proteins whose expression or activity changes in disease states.

The clinical diagnostics segment is experiencing the fastest growth in the market during the forecast period. The growing need for early and accurate diagnosis of diseases, such as cancer, cardiovascular disorders, and neurological conditions, and proteomics plays a crucial role in identifying disease-specific protein biomarkers. The emphasis on early disease detection and prevention, advancement in technology, and focus on personalized medicine. The potential for non-invasive detection of disease markers in body fluids like blood or urine makes proteomics attractive for routine diagnostic workflows.

By Product & Services

By Application

By Technology

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product & Services Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Proteomics Market

5.1. COVID-19 Landscape: Proteomics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Proteomics Market, By Product & Services

8.1. Proteomics Market, by Product & Services

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Reagents & Consumables

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Proteomics Market, By Application

9.1. Proteomics Market, by Application

9.1.1. Drug Discovery

9.1.1.1. Market Revenue and Forecast

9.1.2. Clinical Diagnostics

9.1.2.1. Market Revenue and Forecast

9.1.3. Others

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Proteomics Market, By Technology

10.1. Proteomics Market, by Technology

10.1.1. Next-generation Sequencing

10.1.1.1. Market Revenue and Forecast

10.1.2. Microarray Instruments

10.1.2.1. Market Revenue and Forecast

10.1.3. X-Ray Crystallography

10.1.3.1. Market Revenue and Forecast

10.1.4. Spectrometry

10.1.4.1. Market Revenue and Forecast

10.1.5. Chromatography

10.1.5.1. Market Revenue and Forecast

10.1.6. Protein Fractionation Systems

10.1.6.1. Market Revenue and Forecast

10.1.7. Electrophoresis

10.1.7.1. Market Revenue and Forecast

10.1.8. Surface Plasma Resonance (SPR) Systems

10.1.8.1. Market Revenue and Forecast

10.1.9. Other Technologies

10.1.9.1. Market Revenue and Forecast

Chapter 11. Global Proteomics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product & Services

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by Technology

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product & Services

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by Technology

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product & Services

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by Technology

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product & Services

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by Technology

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product & Services

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by Technology

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product & Services

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by Technology

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product & Services

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by Technology

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product & Services

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by Technology

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product & Services

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by Technology

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product & Services

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by Technology

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product & Services

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by Technology

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product & Services

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by Technology

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product & Services

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by Technology

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product & Services

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by Technology

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product & Services

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by Technology

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product & Services

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by Technology

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product & Services

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by Technology

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product & Services

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by Technology

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product & Services

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by Technology

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product & Services

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by Technology

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product & Services

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by Technology

Chapter 12. Company Profiles

12.1 Thermo Fisher Scientific Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Agilent Technologies Inc..

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Danaher Corporation (including SCIEX and Cytiva).

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Bio-Rad Laboratories Inc..

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Merck KGaA.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Bruker Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. GE HealthCare Technologies Inc..

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Waters Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. PerkinElmer Inc..

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Creative Proteomics

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others