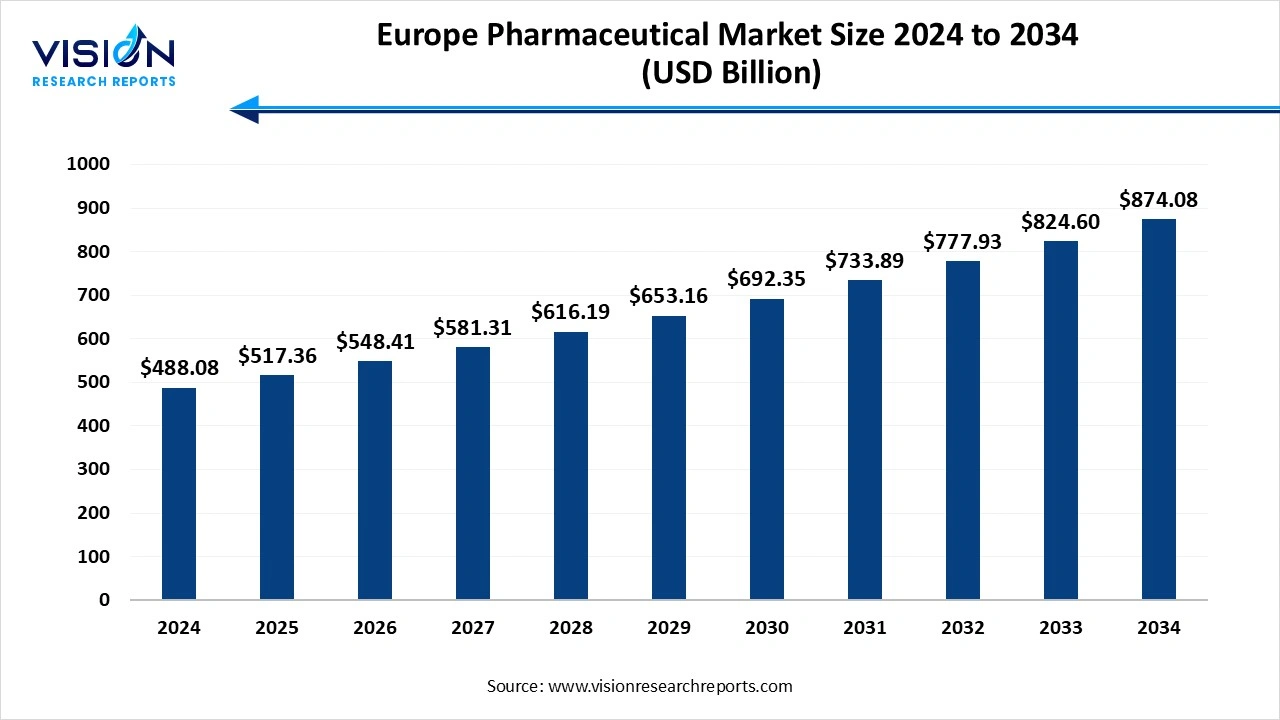

The U.S. Europe pharmaceutical market size was exhibited at around USD 488.08 billion in 2024 and it is projected to hit around USD 874.08 billion by 2034, growing at a CAGR of 6% from 2025 to 2034.

The Europe pharmaceutical market stands as one of the most mature and advanced healthcare markets globally, driven by strong research capabilities, supportive regulatory frameworks, and a high demand for innovative therapies. The region is home to several major pharmaceutical companies and research institutions that continue to shape the global drug development landscape. Factors such as aging populations, increasing prevalence of chronic diseases, and significant healthcare expenditure contribute to the steady demand for both branded and generic medications.

The growth of the Europe pharmaceutical market is primarily driven by the rising prevalence of chronic and lifestyle-related diseases such as diabetes, cardiovascular disorders, and cancer. With an aging population across much of the continent, there is a growing need for long-term treatment options, specialty drugs, and advanced healthcare services. Additionally, high public and private healthcare expenditures, along with strong reimbursement policies in countries like Germany, France, and the UK, support the continuous uptake of innovative pharmaceuticals.

Another key growth factor is the region’s increasing adoption of advanced technologies in drug development and patient care. The integration of artificial intelligence, genomics, and precision medicine has opened new avenues for personalized treatment strategies. Furthermore, the rising demand for biosimilars and generic drugs, driven by patent expirations and the need for cost-effective treatment options, is reshaping the market dynamics. The COVID-19 pandemic has also amplified the importance of pharmaceutical innovation, prompting faster regulatory approvals and expanded manufacturing capacities, especially for vaccines and antiviral drugs.

One of the prominent trends in the Europe pharmaceutical market is the growing shift toward personalized and precision medicine. As advancements in genomics and biomarker research accelerate, pharmaceutical companies are increasingly focusing on therapies tailored to individual patient profiles. This trend is especially noticeable in oncology, where targeted treatments are being developed to improve outcomes and reduce side effects. In parallel, there is rising adoption of biologics and biosimilars, which are transforming the treatment landscape for chronic diseases and complex conditions, offering effective alternatives to traditional drugs while helping manage healthcare costs.

Another major trend shaping the European pharmaceutical sector is digital transformation. From AI-powered drug discovery platforms to digital health tools for remote monitoring and adherence tracking, technology is becoming deeply embedded in every stage of the pharmaceutical value chain. Additionally, the growing emphasis on sustainability is influencing manufacturing practices, with companies investing in eco-friendly production methods and greener supply chains. Regulatory bodies are also supporting these transitions by promoting digital infrastructure and environmental compliance.

One of the key challenges facing the Europe pharmaceutical market is the complex and evolving regulatory landscape. While the European Medicines Agency (EMA) provides centralized drug approval processes, individual countries maintain their own pricing and reimbursement frameworks, which can delay product launches and create inconsistencies across markets. Pharmaceutical companies must navigate a patchwork of national regulations, cost-containment measures, and health technology assessments (HTAs), making market access more difficult and unpredictable.

Another significant challenge is the rising pressure to balance innovation with affordability. Governments and public health systems across Europe are increasingly focused on reducing healthcare expenditures, leading to tighter pricing controls, generic substitution policies, and budget caps. These cost-containment efforts can impact revenue potential, particularly for high-cost specialty drugs and biologics.

The conventional drugs (small molecules) held the largest market share, accounting for 55% in 2024. These small molecules are chemically synthesized and are commonly used in the treatment of widespread conditions such as hypertension, diabetes, bacterial infections, and mental health disorders. Their ease of administration, particularly in oral dosage forms, and well-documented safety profiles make them a preferred option for both prescribers and patients.

The biologics and biosimilars (large molecules) represent the fastest-growing segment throughout the forecast period. Biologics are complex, large-molecule therapies produced using living organisms, offering highly targeted treatment options for chronic and life-threatening diseases, including cancer, rheumatoid arthritis, and various autoimmune conditions. As the patents for many original biologic therapies expire, the market for biosimilars biological products that are highly similar to approved biologics is growing across the region. European regulatory bodies such as the European Medicines Agency (EMA) have established robust approval pathways for biosimilars.

The branded segment led the market with a revenue share of 67%, propelled by its focus on innovation and exclusivity in 2024. These drugs are typically developed through extensive R&D processes and are protected by patents, which allow pharmaceutical companies to establish strong market positions and recover high development costs. European countries, particularly Germany, France, and the UK, are home to leading pharmaceutical innovators, and the consistent demand for advanced therapies, especially in oncology, immunology, and neurology, continues to support the growth of branded products.

The generic segment is projected to register the highest CAGR over the forecast period, driven by a substantial wave of patent expirations in 2024. As patents for many high-cost branded drugs expire, generic alternatives are increasingly being introduced to the European market, offering comparable efficacy at a significantly lower cost. Regulatory support, coupled with cost-containment policies from national health authorities, is encouraging the adoption of generics across both public and private healthcare systems. Countries such as Spain, Italy, and Eastern European nations are witnessing a particularly strong uptake of generic drugs, which is helping to balance public health budgets while ensuring widespread patient access.

The prescription segment accounted for the largest share of the market, generating 87% of the total revenue. These medications are typically prescribed by healthcare professionals and are used to treat complex medical conditions that require medical supervision, such as cardiovascular diseases, cancer, diabetes, and autoimmune disorders. European countries benefit from robust healthcare infrastructures and reimbursement systems, which support the accessibility and affordability of prescription drugs.

The over-the-counter (OTC) pharmaceutical segment in Europe is projected to witness rapid growth throughout the forecast period. OTC drugs, including analgesics, cold and flu remedies, digestive aids, and dermatological products, are widely available across pharmacies and retail stores throughout Europe. Rising health awareness, a shift toward self-medication, and an expanding elderly population contribute to the steady growth of this segment. Regulatory initiatives in several European countries have also allowed the reclassification of certain drugs from prescription to OTC status, broadening consumer access.

The cancer segment led the market, capturing a revenue share of 19% in 2024. The increasing prevalence of various cancers, driven by aging populations, lifestyle factors, and environmental exposures, has led to a surge in demand for advanced oncology therapies. European countries are investing heavily in cancer research, with a strong emphasis on precision medicine, immunotherapies, and targeted biologics. Innovations such as immune checkpoint inhibitors, CAR-T cell therapies, and personalized treatment regimens have transformed the cancer care landscape.

The European anti-obesity drug market is also gaining momentum, reflecting growing concerns over obesity rates and related comorbidities such as type 2 diabetes, cardiovascular diseases, and metabolic disorders. As obesity increasingly becomes a public health crisis, especially in Western Europe, there is a rising demand for pharmacological interventions alongside lifestyle and dietary changes. The market is witnessing the development and approval of new-generation anti-obesity drugs that offer improved efficacy and safety profiles. Regulatory bodies in Europe are gradually showing a more favorable stance toward these therapies, encouraging pharmaceutical companies to invest in obesity drug pipelines.

The oral route of administration emerged as a key revenue contributor, accounting for 58% of the market share in 2024. Tablets, capsules, and oral suspensions are commonly prescribed for chronic and acute conditions such as hypertension, infections, diabetes, and mental health disorders. The widespread acceptance of oral medications among patients, coupled with advancements in drug formulation technologies that enhance bioavailability and patient compliance, has further cemented their dominance.

The geriatric segment is expected to be one of the fastest-growing sectors between 2025 and 2034. This route is essential for biologics, vaccines, oncology treatments, and emergency care drugs, where high precision and immediate efficacy are critical. The growth of the biologics and biosimilars market has significantly increased the demand for parenteral formulations across Europe. Hospitals, specialty clinics, and home healthcare services are key distribution channels for these products, especially as healthcare systems increasingly adopt home-based care for chronic conditions requiring long-term injectable therapies.

The adult segment accounted for the largest revenue share of 63% in 2024, primarily driven by the rising incidence of chronic conditions and lifestyle-related health concerns. Adults frequently require long-term medication for conditions such as hypertension, diabetes, depression, and respiratory disorders, which fuels consistent demand across a wide range of therapeutic categories. Increased awareness of preventive healthcare and wellness, combined with widespread access to healthcare services, has further supported the growth of pharmaceutical consumption among adults.

The geriatric segment is projected to be one of the fastest-growing sectors between 2025 and 2034. As life expectancy increases, age-related disorders such as Alzheimer’s disease, Parkinson’s disease, osteoporosis, and various forms of cancer are becoming more prevalent. The healthcare needs of the elderly are typically more complex, requiring multi-drug regimens and specialized therapies, particularly for chronic conditions and degenerative diseases.

The hospital pharmacies accounted for the largest revenue share among all segments, contributing 54% to the market in 2024. These institutions are integral in managing the supply of drugs used for inpatient care, emergency interventions, and chronic disease management within clinical settings. Hospital pharmacies are especially crucial in the distribution of biologics, oncology drugs, and injectable treatments that require close monitoring and professional administration. With increasing demand for advanced and personalized therapies, many European hospitals are enhancing their pharmacy infrastructure to handle more complex medications efficiently.

The others segment, comprising digital health platforms and tele-pharmacies, is projected to register the highest CAGR over the forecast period. Beyond hospital pharmacies, the distribution of pharmaceutical products is also supported by other channels, including retail pharmacies, online pharmacies, and direct-to-patient services. Retail pharmacies remain essential for dispensing prescription and over-the-counter drugs, particularly for common chronic and acute conditions. They serve as accessible points of care, offering patient counseling, medication adherence support, and health monitoring services.

By Molecule

By Product

By Type

By Disease

By Route of Administration

By Age Group

By Distribution Channel

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others