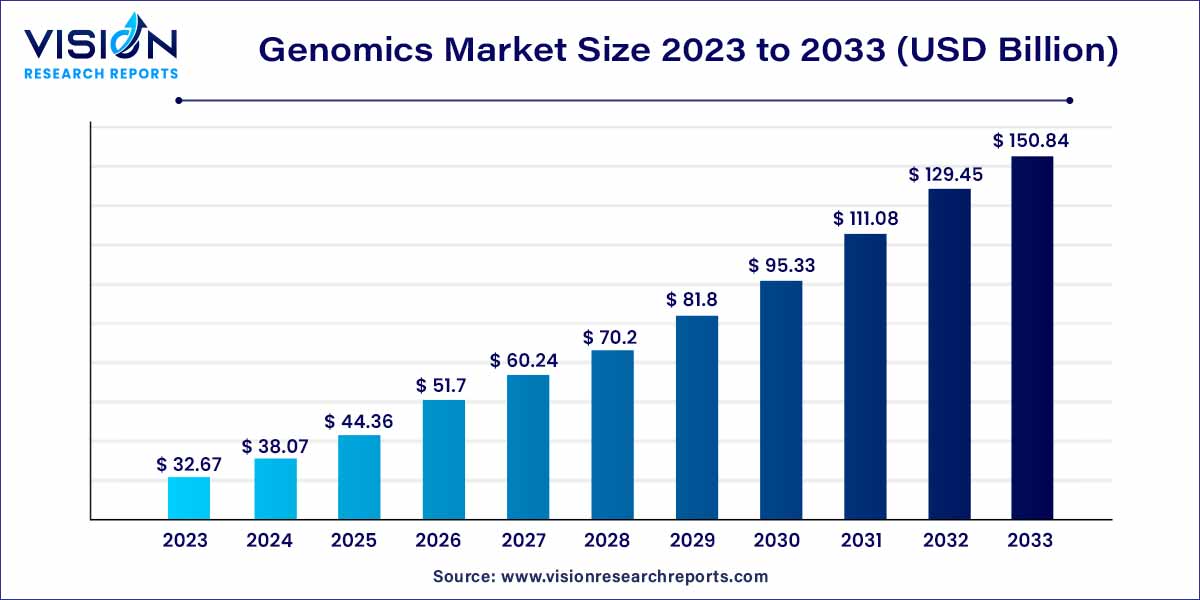

The global genomics market was estimated at USD 32.67 billion in 2023 and it is expected to surpass around USD 150.84 billion by 2033, poised to grow at a CAGR of 16.53% from 2024 to 2033. The expansion of the genomics market can be attributed to several factors, including the escalating demand for gene therapy, personalized medicine, and drug discovery.

The field of genomics has witnessed unprecedented growth, fueled by advancements in technology and a deeper understanding of the genetic code. As we stand on the cusp of a genomic revolution, the market reflects both the potential for groundbreaking discoveries and the challenges associated with harnessing this vast trove of genetic information.

In the dynamic landscape of the genomics market, several key growth factors propel its continual expansion. Foremost among these is the relentless progression of sequencing technologies, notably the advent of next-generation sequencing (NGS). This technological evolution has substantially mitigated costs, while simultaneously enhancing the speed and precision of genomic analysis. The surge in demand for personalized medicine, where treatments are tailored to individual genetic profiles, stands as another significant growth driver. This trend not only fosters more effective therapies but also underscores the pivotal role genomics plays in advancing medical practices. Moreover, increased investments in genomics research, both within academic spheres and the private sector, contribute substantially to the market's expansion. This synergistic combination of technological innovation, personalized medicine, and robust research initiatives positions the genomics market on a trajectory of sustained growth, promising groundbreaking discoveries and transformative impacts across diverse industries.

The functional genomics segment held a significant market share, accounting for 33% of total revenue in 2023. This dominance is attributed to research endeavors focused on comprehending specific phenotypical expressions in various disease conditions. Notably, many gene therapies for cancer leverage functional genomic technology. An illustrative example occurred in June 2020 when researchers at the European Molecular Biology Laboratory (EMBL) in Heidelberg enhanced the scalability and precision of functional genomics CRISPR/Cas9 gene-based screens using targeted single-cell RNA sequencing. This technology delves deeply into gene expression levels in individual cells, proving invaluable for the analysis of CRISPR/Cas9 functional genomics screens.

Looking ahead, the pathway analysis segment is poised to become the most lucrative by 2033. The application of pathway analysis in developing next-generation therapeutics has experienced remarkable growth. This surge is particularly notable with the advent of clinical genomics and personalized therapies. The increasing attention is attributed to the ability of genomics and personalized therapies to conduct thorough analyses of signaling pathways and disease networks.

In 2023, the market was dominated by the product segment, which encompasses two main categories: instruments or systems essential for nucleic acid sequence synthesis and sequencing, and consumables & reagents. The rise in personalized medicine preference and the cost reduction in DNA sequencing, attributed to the introduction of NGS technology, spurred the creation of innovative products and systems. The genomics market is experiencing increased competitiveness due to continual new product launches. For example, in June 2022, PerkinElmer unveiled the BioQule NGS System, an automated benchtop system designed for NGS that focuses on research-use only applications, streamlining library preparation.

Looking ahead, the service segment is projected to witness a steady Compound Annual Growth Rate (CAGR) by 2033. The primary factors fueling this growth include the high costs associated with products, the demand for specialized expertise in genomics, and end-users' concentration on core operations. Within genomics services, NGS-based services held a significant share, driven by the widespread adoption of Whole Genome Sequencing (WGS) and the utilization of sequence databases for disorder screening and prognosis. However, the current emphasis has shifted towards data processing and interpretation rather than the mere production of data, reflecting the evolving needs of development and application in the field.

In 2023, the pharmaceutical and biotechnology companies segment emerged as the market leader, primarily driven by the escalating demand for genomics in drug discovery. The surge in adoption of spatial genomics and transcriptomics technologies further fueled this dominance, with ongoing trials leveraging genomic knowledge for novel drug discovery. A notable example occurred in June 2022, when Illumina Inc. announced the presentation of seven abstracts on key oncology research at the American Society of Clinical Oncology (ASCO) 2022. This event aimed to discuss the transformative impact of comprehensive genomic profiling in precision medicine.

Concurrently, the hospital and clinic segment is anticipated to experience substantial growth throughout the forecast period. Numerous healthcare facilities now offer genomic sequencing services to patients, incorporating this technology into daily medical practices. Stanford Medicine is a noteworthy example, providing genomic sequencing services to patients with rare or unidentified genetic conditions. Partners HealthCare, based in the U.S., has taken a pioneering role by becoming the first hospital system to offer the general public services for genetic sequencing, analysis, and interpretation. This initiative, funded by the NIH, has enrolled over 200 patients and physicians, contributing to the study of the integration of whole-genome sequencing in clinical medicine.

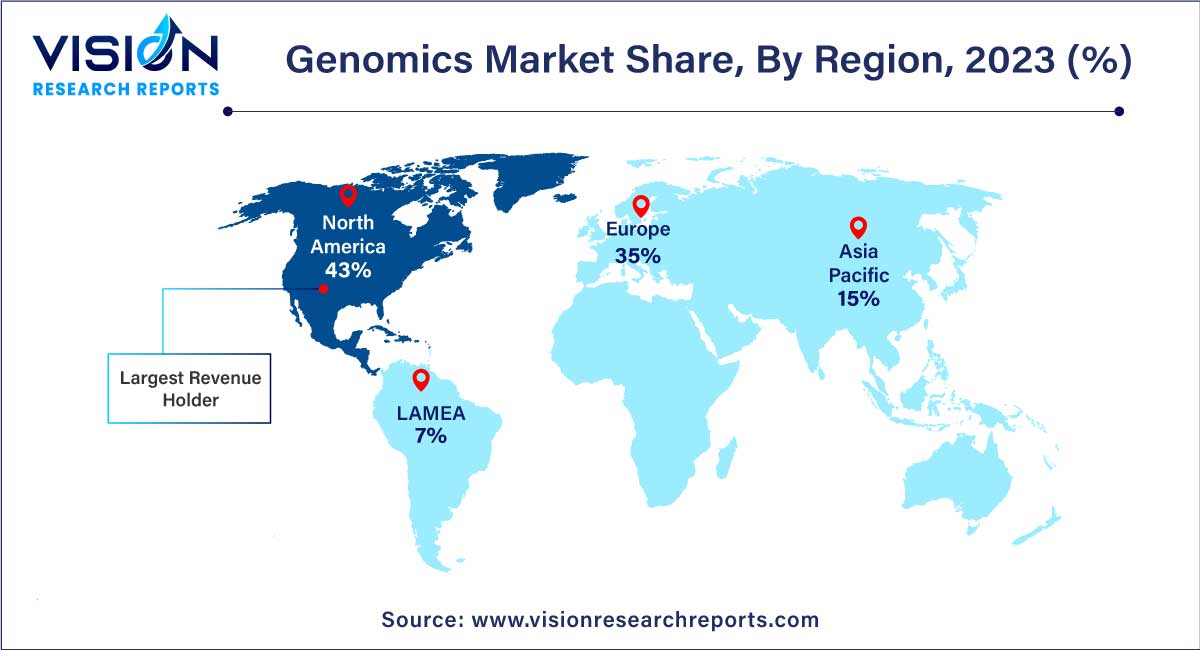

In 2023, North America emerged as the frontrunner, capturing the largest market share at 43%. This dominance is attributed to robust support from research institutes and pharmaceutical giants. The region has seamlessly integrated genomics into disease research and drug discovery, recognizing the profound impact of genetic expression on human health. Noteworthy advancements are continually unfolding, driven by collaborative initiatives. For example, in January 2022, Illumina, Inc. joined forces with Nashville Biosciences, LLC (a part of Vanderbilt University Medical Center in Tennessee) to leverage genomics in drug development and establish a premier clinico-genomic resource.

Meanwhile, Asia Pacific is anticipated to be the fastest-growing segment throughout the forecast period. This surge is propelled by the escalating demand for genomics applications in diagnostics and the urgent need for innovative therapeutic drugs to combat the rising incidence of diseases in the region. Several significant human genome sequencing projects are underway, with Genome Asia 100K standing out as a recent notable example. Encompassing the sequencing and analysis of 100,000 Asian genomes, this initiative aims to expedite population-specific medical advancements and precision medicine. The Genome Asia 100K project is poised to unveil new potential therapeutic drugs and enhance our understanding of the biology of diseases.

By Application & Technology

By Technology

By Deliverables

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Application & Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Genomics Market

5.1. COVID-19 Landscape: Genomics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Genomics Market, By Application & Technology

8.1. Genomics Market, by Application & Technology, 2024-2033

8.1.1 Functional Genomics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Epigenomics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pathway Analysis

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Biomarker Discovery

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Genomics Market, By Deliverables

9.1. Genomics Market, by Deliverables, 2024-2033

9.1.1. Products

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Services

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Genomics Market, By End-use

10.1. Genomics Market, by End-use, 2024-2033

10.1.1. Clinical Research

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Academic & Government Institutes

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Hospitals & Clinics

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Pharmaceutical & Biotechnology Companies

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Other End Users

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Genomics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.1.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.2.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.3.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.4.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.5.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Application & Technology (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Deliverables (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Agilent Technologies

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bio-Rad Laboratories, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BGI Genomics

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Color Genomics, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Danaher Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Eppendorf AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Eurofins Scientific

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. F. Hoffmann-La Roche Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. GE Healthcare

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Illumina, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others