The global glaucoma market size was surpassed at USD 8.95 billion in 2024 and it is projected to hit around USD 14.30 billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034. The market growth is driven by the rising prevalence of glaucoma, especially among the aging population, and increasing awareness about early diagnosis and treatment, the glaucoma market is experiencing steady growth.

| Report Coverage | Details |

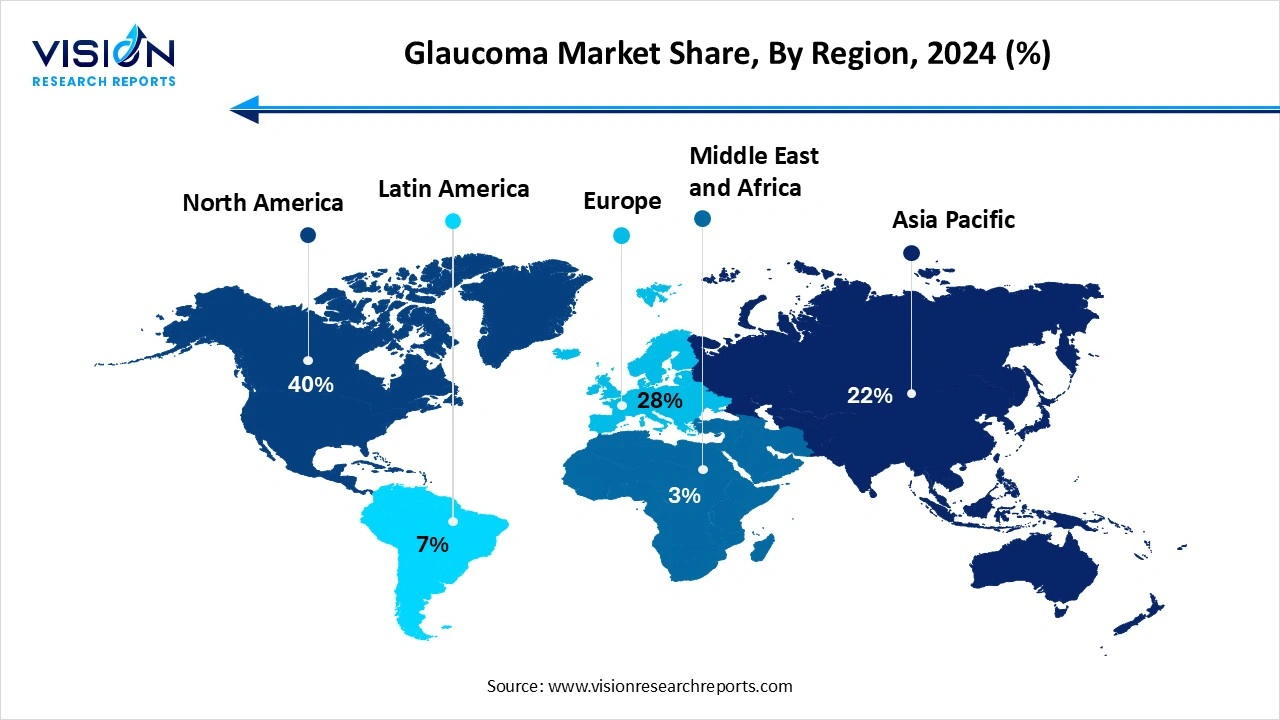

| Revenue Share of North America in 2024 | 40% |

| Revenue Forecast by 2034 | 14.30 billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered |

Novartis, Santen Pharmaceutical, New World Medical, Ellex Medical Lasers, Abbott Laboratories, Johnson & Johnson, Ziemer Ophthalmic SystemsTopcon, Lumenis, Allergan |

The global glaucoma market is experiencing steady growth, driven by the rising prevalence of the disease, increasing geriatric population, and growing awareness about early diagnosis and treatment. Glaucoma, a group of eye conditions that damage the optic nerve, is one of the leading causes of irreversible blindness worldwide. The market is witnessing advancements in diagnostic technologies and therapeutic approaches, including the development of novel drugs, laser therapies, and minimally invasive surgical options. Additionally, favorable reimbursement policies and increased healthcare expenditure in both developed and developing regions are contributing to market expansion.

The growth of the global glaucoma market is primarily driven by the increasing prevalence of glaucoma, particularly among the aging population. As the risk of developing glaucoma rises significantly with age, the expanding elderly demographic worldwide has become a major contributor to market growth. Additionally, the growing awareness about the importance of early detection and routine eye check-ups has led to a surge in diagnosis rates. Technological advancements in imaging and diagnostic tools, such as optical coherence tomography (OCT) and digital tonometry, have further supported the early identification and management of the disease.

Another significant growth factor is the continuous development of innovative treatment options. Pharmaceutical companies are investing heavily in research and development to introduce more effective and patient-friendly therapies, including sustained-release drug delivery systems and combination medications that improve adherence and outcomes.

One of the primary challenges facing the glaucoma market is the asymptomatic nature of the disease in its early stages, which often leads to late diagnosis and irreversible vision loss. Many individuals remain unaware they have glaucoma until significant damage has occurred, limiting the effectiveness of available treatments. This delayed detection is particularly common in low- and middle-income countries where access to regular eye exams and advanced diagnostic technologies is limited.

Another major challenge is poor patient adherence to long-term treatment regimens, especially in cases requiring daily use of eye drops. Many patients struggle with complex dosing schedules, side effects, or simply forget to take their medication consistently, leading to suboptimal disease control. Furthermore, the high cost of newer therapies and surgical interventions may not be affordable for all patients, even in developed countries, creating barriers to access.

North America holds a dominant position in the glaucoma market share of 40% in 2024, primarily due to its advanced healthcare systems, high awareness of eye health, and early adoption of innovative diagnostic and therapeutic technologies. The presence of key pharmaceutical companies and significant investment in research and development contribute further to the market’s growth in the region. The United States, in particular, accounts for a substantial share owing to its aging population and widespread availability of glaucoma treatment options, ranging from medications to surgical interventions.

The Asia Pacific region is emerging as the fastest-growing market, fueled by a large aging population, rising awareness, and improving access to healthcare services. Nations like China, India, and Japan are witnessing a surge in glaucoma diagnoses, leading to increased demand for effective treatment solutions. Additionally, growing investments in healthcare infrastructure and a shift toward regular eye screening are driving market expansion in the region.

The disease-type segment, open-angle glaucoma dominated the market in 2024. The dominance of this segment is driven by the high incidence among the aging population and growing awareness of early screening and treatment. Advancements in diagnostic technologies, such as tonometry and optical coherence tomography, have enhanced the ability to detect and monitor open-angle glaucoma effectively, leading to increased treatment rates. Pharmaceutical interventions, including prostaglandin analogs and beta-blockers, remain the primary line of treatment, while minimally invasive glaucoma surgeries are gaining traction for patients requiring surgical intervention.

The angle-closure glaucoma, although less common globally, poses a greater immediate risk of vision loss and is more prevalent in Asian populations. This form of glaucoma occurs when the drainage angle between the iris and cornea becomes blocked, leading to a sudden rise in intraocular pressure. The acute nature of this condition necessitates prompt medical attention, and as awareness and access to emergency eye care services improve, the diagnosis and treatment rates are also increasing. Advances in laser and surgical techniques, such as laser peripheral iridotomy and trabeculectomy, have significantly improved clinical outcomes for patients with angle-closure glaucoma.

The demand in the drug class segment is expected to rise due to the growing presence of prostaglandin analogs in the market in 2024. These medications work by increasing the outflow of aqueous humor from the eye, thereby reducing pressure on the optic nerve. Among the various options available for glaucoma treatment, prostaglandin analogs are often considered the first-line therapy, especially for patients with open-angle glaucoma. Their once-daily dosing regimen enhances patient compliance, which is crucial in chronic conditions requiring long-term management.

The demand for prostaglandin analogs continues to grow due to their favorable safety profile, minimal systemic side effects, and sustained effectiveness over prolonged use. Additionally, pharmaceutical companies are focusing on enhancing formulation stability and developing combination therapies that include prostaglandin analogs to further improve treatment outcomes. Despite the availability of alternative drug classes, prostaglandin analogs maintain a dominant position in the glaucoma therapeutics market, supported by a large patient base and physician preference.

Hospital pharmacies are expected to maintain the largest market share throughout the forecast period. Hospital pharmacies typically cater to individuals undergoing specialized ophthalmic evaluations or surgical procedures, making them an integral part of the glaucoma care continuum. These pharmacies are equipped with a wide range of prescription medications, including prostaglandin analogs, beta-blockers, and combination therapies, which are dispensed under the supervision of healthcare professionals. The hospital pharmacy segment benefits from direct physician interaction, ensuring accurate and immediate treatment initiation, especially in cases of acute glaucoma or post-surgical care.

The retail pharmacy segment is projected to witness the highest growth. As glaucoma is a chronic condition that demands ongoing pharmacological management, retail pharmacies offer an essential platform for repeat prescriptions and over-the-counter supportive eye care products. The ease of availability, coupled with pharmacist counseling, helps improve adherence to prescribed treatment regimens. Moreover, the expansion of retail pharmacy chains and integration of digital services such as e-prescriptions and home delivery are further enhancing patient access to glaucoma medications.

By Disease Type

By Drug Class

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Disease Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Glaucoma Market

5.1. COVID-19 Landscape: Glaucoma Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Glaucoma Market, By Disease Type

8.1. Glaucoma Market, by Disease Type, 2025-2034

8.1.1 Open Angle Glaucoma

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Angle Closure Glaucoma

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Glaucoma Market, By Drug Class

9.1. Glaucoma Market, by Drug Class, 2025-2034

9.1.1. Prostaglandins Analogs

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Beta-blockers

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Adrenergic Agonists

9.1.3.1. Market Revenue and Forecast (2025-2034)

9.1.4. Carbonic Anhydrase Inhibitors

9.1.4.1. Market Revenue and Forecast (2025-2034)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Glaucoma Market, By Distribution Channel

10.1. Glaucoma Market, by Distribution Channel, 2025-2034

10.1.1. Hospital Pharmacy

10.1.1.1. Market Revenue and Forecast (2025-2034)

10.1.2. Retail Pharmacy

10.1.2.1. Market Revenue and Forecast (2025-2034)

10.1.3. Online Pharmacy

10.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 11. Global Glaucoma Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.1.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.1.4.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.1.5.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.2.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.2.4.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.2.5.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.2.6.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.2.7.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.3.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.3.4.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.3.5.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.3.6.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.3.7.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.4.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.4.4.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.4.5.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.4.6.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.4.7.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.5.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.5.4.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Disease Type (2025-2034)

11.5.5.2. Market Revenue and Forecast, by Drug Class (2025-2034)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2025-2034)

Chapter 12. Company Profiles

12.1. Pfizer Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Santen Pharmaceutical Co., Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Novartis AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Alcon Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Akron Operating Company LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Thea Pharma

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. AbbVie, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bausch + Lomb Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Teva Pharmaceuticals Industries Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others