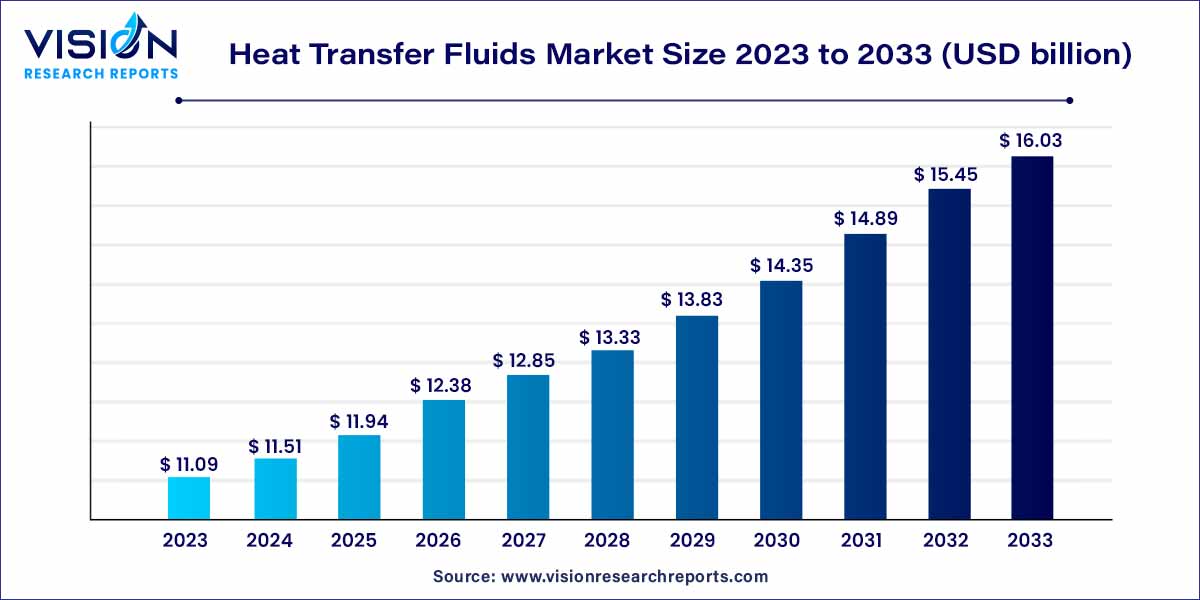

The global heat transfer fluids market was valued at USD 11.09 billion in 2023 and it is predicted to surpass around USD 16.03 billion by 2033 with a CAGR of 3.75% from 2024 to 2033. The heat transfer fluids market is driven by an advancement in fluid formulations, expanding applications in renewable energy, and increasing industrial demand for energy efficiency.

The heat transfer fluids market is characterized by a dynamic landscape driven by the growing demand for efficient heat transfer solutions across various industries. These fluids play a crucial role in transferring heat energy in processes ranging from manufacturing to renewable energy applications.

The heat transfer fluids market is poised for robust growth, fueled by several key factors. Firstly, the escalating demand for energy-efficient solutions across industries such as oil and gas, chemicals, and manufacturing is a primary driver. As businesses focus on optimizing thermal processes, the need for effective heat transfer fluids becomes paramount. Moreover, the market is witnessing a notable trend towards environmentally friendly options, driven by stringent regulations and a broader sustainability agenda. This shift towards eco-friendly formulations aligns with the industry's commitment to reducing environmental impact. Additionally, ongoing research and development efforts are contributing to the introduction of innovative heat transfer fluid solutions, aimed at enhancing efficiency and thermal stability. As a result, the competitive landscape is characterized by strategic collaborations, acquisitions, and product launches, indicating a concerted industry effort to stay ahead in the rapidly evolving market. In summary, the heat transfer fluids market's growth is underpinned by the imperative for energy efficiency, environmental considerations, and ongoing advancements in fluid formulations.

Glycol-based heat transfer fluids form the fastest-growing product category as they exhibit excellent antifreeze properties; the segment is expected to expand at the highest CAGR of 4.15% over the forecast period. Bio-based glycols are gaining prominence as crucial components in heat transfer fluid formulations, demonstrating compatibility with both high and low-temperature applications.

Alkylated aromatic compounds are typically designed for closed-loop heating systems following the Rankine cycle. Common operational domains include asphalt plants, gas processing, tank cleaning, and plastic production. These aromatic heat transfer fluids (HTFs) are employed in both vapor and liquid phases, offering excellent fluid properties and heat transfer capabilities, particularly for applications involving lower temperatures.

In 2023, the oil and gas segment held the largest revenue share of 23%. The intricacies of oil and gas processing demand specialized heat transfer fluids meticulously formulated to meet specific temperature requirements and ensure compatibility. These tailored products play a crucial role in various processes within the oil and gas industry, including recycling, production, refining, and transportation. Offshore platforms specifically utilize heat transfer liquids in the aqueous phase for regenerating glycols and facilitating facility heating, a process integral for removing water from the produced natural gas.

Within the chemical industry, reboilers function as heat exchangers, supplying heat to the bottoms of distillation columns. Their role is to boil liquids from the column's bottom, creating vapors that drive the separation process in the distillation column. Heat transfer fluids or steam are instrumental in facilitating this vaporization process. Moreover, these heat transfer products find application in critical components like tubes, pipes, bushes, and gaskets, which are responsible for transporting chemicals, fluids, and acids. Their properties, including chemical inertness and high thermal stability, make them indispensable for such applications.

Heat transfer fluids play a crucial role in the manufacturing processes of PET, polyester, nylon, and various synthetic fibers. These products are specifically formulated to ensure optimal efficiency across a broad spectrum of temperatures. High-quality heat transfer fluids, after refinement, offer stability at elevated temperatures, mitigating the risk of premature degradation when exposed to high heat conditions. Despite their significant contributions to processes involving synthetic fiber production, the application segment represented a modest share of approximately 9.26% of the market in 2023. This can be attributed to the sluggish growth in plastic production within developed countries during that period.

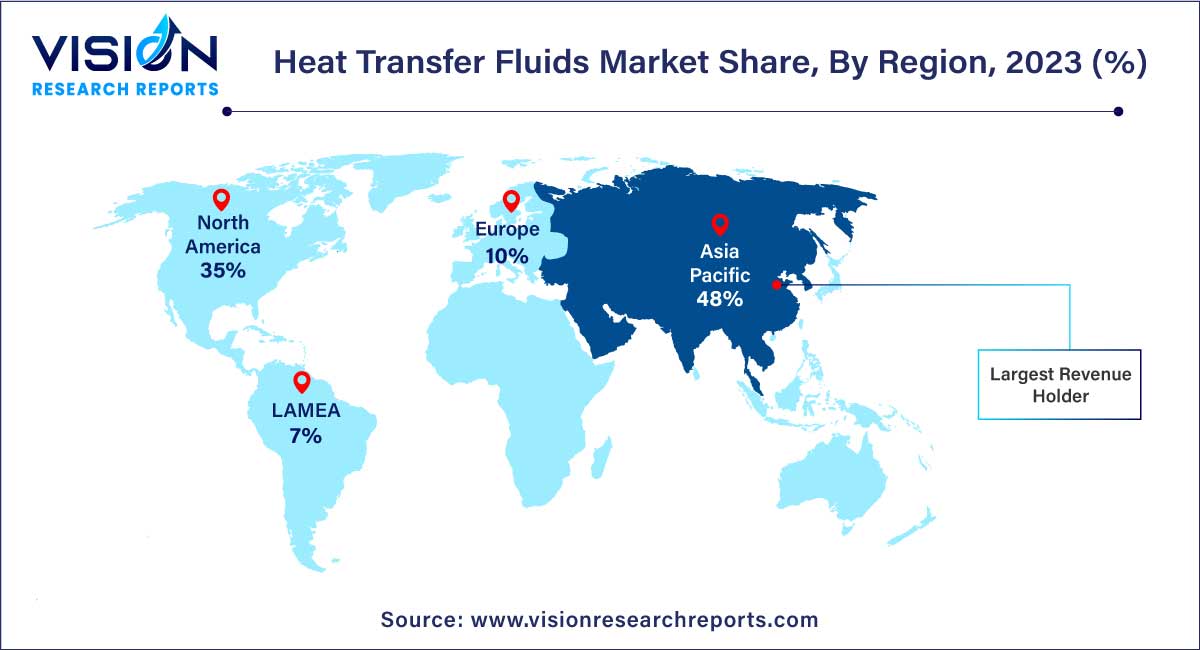

The Asia Pacific heat transfer fluid market stands as the dominant force, propelled by key macroeconomic indicators such as high per capita income and robust manufacturing output. In 2023, the region commanded a substantial market share of 48%. The escalating use of heating, ventilation, and air conditioning (HVAC) systems in the Asia Pacific region is a noteworthy contributor to this dominance. Factors driving this surge include the region's increasing population, evolving climatic conditions, rising urbanization, and demographic shifts in economic powerhouses like India and China. These influential factors are anticipated to fuel the continued growth of the Asia Pacific heat transfer fluid market.

Meanwhile, Mexico's chemical industry is witnessing significant investments and a consistent sourcing strategy for diverse raw materials, fortifying its foundational strength. The country's rapid industrialization, coupled with a burgeoning export market for chemicals to NAFTA countries, is poised to generate increased demand for heat transfer fluids. Furthermore, Mexico's robust presence in the plastic manufacturing industry adds an additional dimension to its role in the heat transfer fluid market.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Heat Transfer Fluids Market

5.1. COVID-19 Landscape: Heat Transfer Fluids Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Heat Transfer Fluids Market, By Product

8.1. Heat Transfer Fluids Market, by Product, 2024-2033

8.1.1. Silicone Fluids

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Aromatic Fluids

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Mineral Oils

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Glycol based Fluids

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Other (including molten salts & HFPE)

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Heat Transfer Fluids Market, By Application

9.1. Heat Transfer Fluids Market, by Application, 2024-2033

9.1.1. Oil & Gas

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Chemical Industry

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. CSP

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Food & Beverages

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Plastics

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Pharmaceuticals

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. HVAC

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Heat Transfer Fluids Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Dynalene, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Indian Oil Corporation Ltd. (IOCL)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. KOST USA, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Hindustan Petroleum Corporation Ltd. (HPCL)Delta Western, Inc. (DWI)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. British Petroleum (BP)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Huntsman Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Royal Dutch Shell Plc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Eastman Chemical Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Phillips 66

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Chevron Co.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others