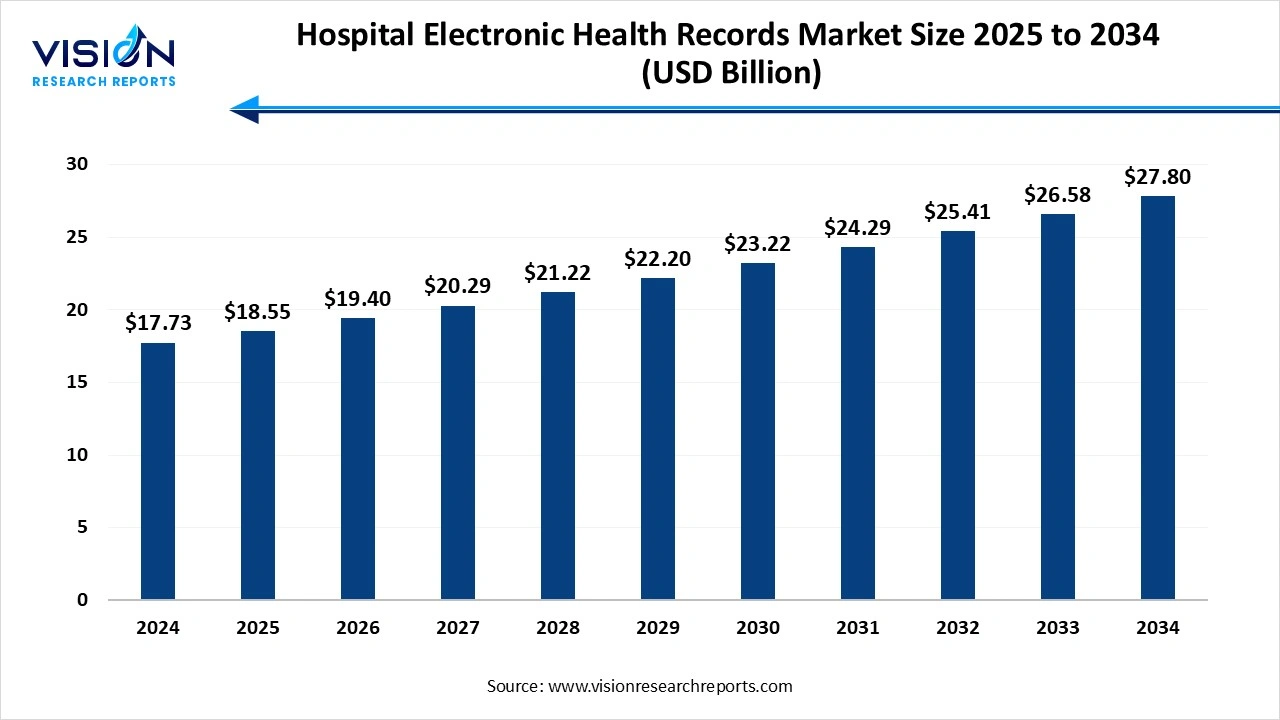

The global hospital electronic health records market size stood at USD 17.73 billion in 2024 and is estimated to reach USD 18.55 billion in 2025. It is projected to surge past USD 27.80 billion by 2034, registering a robust CAGR of 4.6% from 2025 to 2034. The digital technological advancement and government innovations are expanding the market growth.

The hospital electronic health records market comprises a digital tool used for the identification of patients' medical information that documents their entire healthcare journey, such as diagnosis, medical history, medication and immunization, X-rays laboratory results updated automatically. The market growth is driven by the global trends towards the digital transformation in electronic health records and their important role in maintaining patient data; their facility drives the market growth. The increasing prevalence of chronic disease, the need to manage long-term patient data more requirement for electronic health records. The government's innovation programs aim to encourage EHP adoption and implementation with standardization.

The government is actively promoting the increasing use of electronic health record systems and promoting health. The HITECH Act is a U.S. federal law that is a part of the American Recovery Reinvestment Act. Its primary aim is to promote the widespread adoption and meaningful use of electronic health records, strengthen the privacy and security protections, and improve the overall quality, safety, and efficiency of healthcare. The HER systems are becoming more sophisticated and user-friendly, incorporating features such as AI, machine learning, and cloud-based solutions. The adoption of web-based EHP and the expansion of telemedicine and remote patient monitoring solutions drive the market growth.

| Report Coverage | Details |

| Report Coverage | Details |

| Market Size in 2024 | USD 17.73 billion |

| Revenue Forecast by 2034 | USD 27.80 billion |

| Growth rate from 2025 to 2034 | CAGR of 4.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., McKesson Corporation, MEDITECH (Medical Information Technology, Inc.), athenahealth, Inc., eClinicalWorks, NextGen Healthcare, Inc., GE Healthcare, Siemens Healthineers |

High Cost, Data Security, and Privacy Concerns

The initial cost of purchasing, installing, and customizing HER software can be considerable. The ongoing cost for maintenance, upgrades, technical support, and staff training can hamper the market growth. The HER system stores sensitive data, making it a target for cyberattacks and data breaches. It requires significant investment in security measures and expertise.

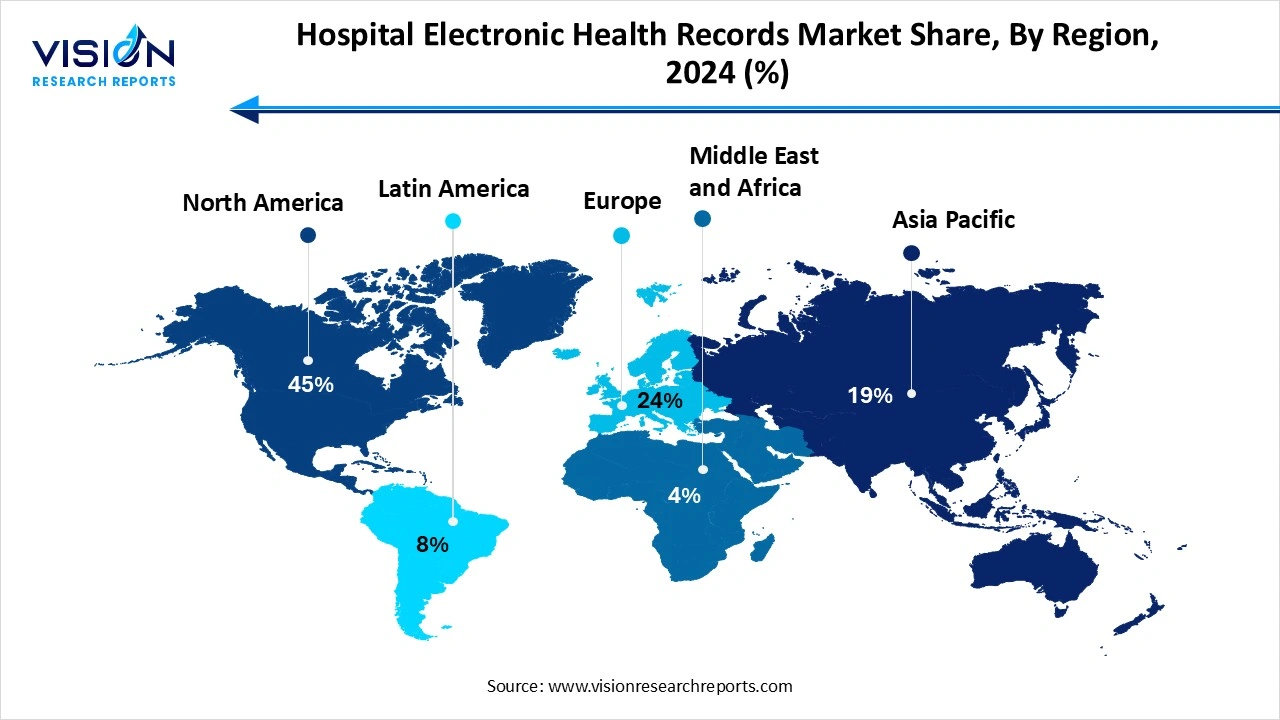

North America accounted for the highest revenue share, capturing 45% of the market in 2024. The government support and regulations, such as the HITECH Act, which incentivized EHR adoption. High adoption rates, with over 96% of non-federal acute care hospitals having accepted certified EHR systems, further drive this leadership.

The region boasts a strong healthcare IT infrastructure and is home to leading EHR vendors like Epic Systems and Cerner (now part of Oracle), fostering innovation. Additionally, a growing focus on interoperability, fueled by initiatives like the 21st Century Cures Act, enables seamless data exchange, improving patient care and efficiency. Lastly, increasing awareness of EHR benefits, including enhanced patient safety, streamlined workflows, and reduced costs, drives continued adoption.

Why is the Asia Pacific Significantly Growing in the Hospital Electronic Health Records Market?

Asia Pacific expects significant growth in the market during the forecast period. The government is innovating and recognizing the importance of EHRs for enhancing patient care, efficiency, and population health monitoring. India's Ayushman Bharat Digital Mission aims to create a unified digital health ecosystem and connect healthcare providers to a digital platform. The increase in AI integration and cloud-based EHR solutions, the rising burden of chronic disease and the aging population, and growing investment and strategic partnership in major players. Public-private partnerships and collaborations are contributing to the development and deployment of digital health solutions. The APAC healthcare IT market is attracting venture capital funding.

China Hospital Electronic Health Records Market Trends

China is growing in the hospital electronic health records market. The Chinese government's support for the policies has made digital health a strategic priority throughout initiatives such as Healthy China 2030, Internet Plus Medicine, and Health Framework Policy, driving market growth. The technological advancement of cloud-based solutions offers scalability, cost-effectiveness, and real-time data access for healthcare providers. The growing prevalence of chronic diseases and the increase in the aging population drive the market growth.

Why did the Cloud-based Hospital Electronic Health Records Segment Dominate the Hospital Electronic Health Records Market?

The cloud-based segment held the largest share of the market, accounting for 54% of the total revenue in 2024. The cloud-based systems allow healthcare professionals to access patient data from anywhere with an internet connection, facilitating collaboration and improving care coordination. The lower operational cost and cloud-based solution facilitate seamless sharing and exchange of patient data across different departments, and even different healthcare facilities, promoting better care for patients. The major EHR vendors are collaborating with cloud providers and healthcare organizations to develop a cloud-native EHR solution and improve data interoperability.

The web-based hospital electronic health records segment is the fastest-growing in the market during the forecast period. The growing government initiative and regulations, such as the U.S. HITECH Act and similar digital health strategies, promote the use of EHRs. The EHR system is web web-based version easy to handle and automate work processing, such as appointment scheduling and billing, driving the market. The more scalability and enhanced interoperability, and data sharing.

How the Acute Segment Held the Largest Share in the Hospital Electronic Health Records Market?

The acute segment held the largest revenue share of 46% in 2024, leading the market. The acute care hospitals are designed for immediate and short-term treatment of several injuries. The EHR system is essential for managing this complex data, ensuring seamless information exchange, and facilitating clinical decision support, improving the quality of patient care. In the U.S., acute care hospitals covered under the inpatient prospective payment system are eligible for the Medicare incentive payment system, further fuelling the adoption of EHRs in these settings.

The post-acute segment is projected to register the highest CAGR over the forecast period. EHRs play a crucial role in tracking patient progress, managing chronic conditions, and ensuring seamless communication between caregivers and healthcare providers. The growing focus on value-based care and regulatory requirements for accurate documentation are propelling the deployment of tailored EHR solutions in post-acute care. These systems are designed to accommodate the unique needs of long-term patient management, emphasizing interoperability and comprehensive data sharing across different care settings.

How the Professional Services Segment Held the Dominant Share in the Hospital Electronic Health Records Market?

The professional services segment held the largest share of the market in 2024, accounting for 33% of the total revenue. The hospitals rely on these services for expertise in deployment, customization to align with specific workflows, ensuring staff training, and managing change. Furthermore, professional services are crucial for achieving and maintaining regulatory compliance and providing the necessary long-term support for optimization and evolution of the EHR system.

The subscriptions segment is expected to witness substantial growth over the forecast period. The subscription model typically includes software maintenance, updates, and technical support as part of the package, reducing the burden on hospitals in the IT department. By offloading the EHR management and IT infrastructure to a cloud provider, hospitals can free up resources to focus on their core competencies, like patient care and clinical operations. (Source: Oracle)

How the Integrated Segment Held the Dominant Share in the Hospital Electronic Health Records Market?

The integrated segment led the accounting for a dominant market share of 79% in 2024. The Hospital EHR market because it creates a unified ecosystem, allowing seamless data exchange across departments. This comprehensive view supports faster, more accurate clinical decision-making, improving patient outcomes. By automating administrative tasks and streamlining workflows, integrated EHRs enhance operational efficiency and contribute to better financial performance. Finally, these systems are designed to help hospitals meet stringent regulatory requirements and improve overall patient safety.

The standalone segment is expected to witness substantial growth over the forecast period. Their cost-effectiveness and relatively quick deployment, especially appealing to smaller facilities or those with budget constraints. Their specialized functionality, tailored to the specific needs of various medical fields, also enhances efficiency and supports a more focused approach to patient care. Furthermore, standalone systems contribute to growing interoperability in the evolving healthcare landscape, allowing easier data exchange and customization compared to more rigid integrated solutions.

How the Medium Hospital Segment Held the Dominant Share in the Hospital Electronic Health Records Market?

The medium hospital segment led the capturing a market share of 42% in 2024. The medium-sized hospitals benefit significantly from the data management capabilities of EHRs, which help streamline operations and improve patient care coordination. The EHR solutions offer features such as advanced analysis and clinical decision support to enhance their clinical workflow and decision-making process. The many EHR solutions for medium-sized facilities offer robust integration with other healthcare IT systems, enabling seamless data exchange and interoperability.

The large hospital segment is projected to grow at the highest CAGR throughout the forecast period. Their complex operational needs require integrated solutions across numerous departments. They readily invest in advanced systems with features like analytics and clinical decision support to improve care quality and operational efficiency. The growing focus on interoperability is a key factor, as seamless data exchange enhances coordination and reduces errors. Large hospitals, with their financial resources and high patient volume, leverage these capabilities to advance towards a more data-driven and connected healthcare system.

How the Cardiology Segment Held the Dominant Share in the Hospital Electronic Health Records Market?

The cardiology segment held the largest revenue share in the market in 2024. The rising prevalence of cardiovascular diseases leading to hospitalization and mortality globally requires a robust system for managing patient data, diagnosis, and treatment planning to drive the EHR in cardiology. The specialized diagnostic tools, such as KNGs and echocardiograms, create a comprehensive digital record of patient information, avoid manual data entry, and facilitate quicker access to crucial information, improving clinical efficiency. The widespread use of web or cloud-based EHR systems offers advantages, such as flexibility and accessibility, reduced cost, enhanced data sharing, and improved patient care.

The ophthalmology segment is projected to witness the highest CAGR over the forecast period Ophthalmic EHR systems store visual field tests, retinal imaging, and surgery records, providing clinicians with comprehensive access to patient eye health data. The increasing patient data management, workflow efficiency, and care delivery with the increasing digitalization in healthcare. The ophthalmologist can access records and share patient data more easily with a digital EHR system. Enhanced data management through EHRs supports early diagnosis and effective treatment of eye conditions such as glaucoma, cataracts, and diabetic retinopathy. The growing demand for advanced eye care services and the integration of ophthalmology-specific features in EHR platforms are key factors contributing to the expanding use of these systems in hospital ophthalmology departments worldwide.

By Deployment

By Type

By Business Model

By Product

By Hospital Size

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Application Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hospital Electronic Health Records Market

5.1. COVID-19 Landscape: Hospital Electronic Health Records Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Hospital Electronic Health Records Market, By Deployment

8.1. Hospital Electronic Health Records Market, by Deployment

8.1.1. On-premise

8.1.1.1. Market Revenue and Forecast

8.1.2. Web-Based

8.1.2.1. Market Revenue and Forecast

8.1.3. Cloud-Based

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Hospital Electronic Health Records Market, By Type

9.1. Hospital Electronic Health Records Market, by Type

9.1.1. Acute

9.1.1.1. Market Revenue and Forecast

9.1.2. Outpatient

9.1.2.1. Market Revenue and Forecast

9.1.3. Post Acute

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Hospital Electronic Health Records Market, By Business Model

10.1. Hospital Electronic Health Records Market, by Business Model

10.1.1. Licensed Software

10.1.1.1. Market Revenue and Forecast

10.1.2. Technology Resale

10.1.2.1. Market Revenue and Forecast

10.1.3. Subscriptions

10.1.3.1. Market Revenue and Forecast

10.1.4. Professional Services

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Hospital Electronic Health Records Market, By Product

11.1. Hospital Electronic Health Records Market, by Product

11.1.1. Standalone

11.1.1.1. Market Revenue and Forecast

11.1.2. Integrated

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Hospital Electronic Health Records Market, By Hospital Size

12.1. Hospital Electronic Health Records Market, by Hospital Size

12.1.1. Large Hospital

12.1.1.1. Market Revenue and Forecast

12.1.2. Medium Hospital

12.1.2.1. Market Revenue and Forecast

12.1.3. Small Hospital

12.1.3.1. Market Revenue and Forecast

Chapter 13. Global Hospital Electronic Health Records Market, By Application

13.1. Hospital Electronic Health Records Market, by Application

13.1.1. Cardiology

13.1.1.1. Market Revenue and Forecast

13.1.2. Neurology

13.1.2.1. Market Revenue and Forecast

13.1.3. Radiology

13.1.3.1. Market Revenue and Forecast

13.1.4. Oncology

13.1.4.1. Market Revenue and Forecast

13.1.5. Mental and Behavioral Health

13.1.5.1. Market Revenue and Forecast

13.1.6. Nephrology and Urology

13.1.6.1. Market Revenue and Forecast

13.1.7. Gastroenterology

13.1.7.1. Market Revenue and Forecast

13.1.8. Pediatrics

13.1.8.1. Market Revenue and Forecast

13.1.9. General Medicine

13.1.9.1. Market Revenue and Forecast

13.1.10. Physical Therapy and Rehabilitation

13.1.10.1. Market Revenue and Forecast

13.1.11. Others

13.1.11.1. Market Revenue and Forecast

Chapter 14. Global Hospital Electronic Health Records Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Deployment

14.1.2. Market Revenue and Forecast, by Type

14.1.3. Market Revenue and Forecast, by Business Model

14.1.4. Market Revenue and Forecast, by Product

14.1.5. Market Revenue and Forecast, by Hospital Size

14.1.6. Market Revenue and Forecast, by Application

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Deployment

14.1.7.2. Market Revenue and Forecast, by Type

14.1.7.3. Market Revenue and Forecast, by Business Model

14.1.7.4. Market Revenue and Forecast, by Product

14.1.8. Market Revenue and Forecast, by Hospital Size

14.1.8.1. Market Revenue and Forecast, by Application

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Deployment

14.1.9.2. Market Revenue and Forecast, by Type

14.1.9.3. Market Revenue and Forecast, by Business Model

14.1.9.4. Market Revenue and Forecast, by Product

14.1.10. Market Revenue and Forecast, by Hospital Size

14.1.11. Market Revenue and Forecast, by Application

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Deployment

14.2.2. Market Revenue and Forecast, by Type

14.2.3. Market Revenue and Forecast, by Business Model

14.2.4. Market Revenue and Forecast, by Product

14.2.5. Market Revenue and Forecast, by Hospital Size

14.2.6. Market Revenue and Forecast, by Application

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Deployment

14.2.8.2. Market Revenue and Forecast, by Type

14.2.8.3. Market Revenue and Forecast, by Business Model

14.2.9. Market Revenue and Forecast, by Product

14.2.10. Market Revenue and Forecast, by Hospital Size

14.2.10.1. Market Revenue and Forecast, by Application

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Deployment

14.2.11.2. Market Revenue and Forecast, by Type

14.2.11.3. Market Revenue and Forecast, by Business Model

14.2.12. Market Revenue and Forecast, by Product

14.2.13. Market Revenue and Forecast, by Hospital Size

14.2.14. Market Revenue and Forecast, by Application

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Deployment

14.2.15.2. Market Revenue and Forecast, by Type

14.2.15.3. Market Revenue and Forecast, by Business Model

14.2.15.4. Market Revenue and Forecast, by Product

14.2.16. Market Revenue and Forecast, by Hospital Size

14.2.16.1. Market Revenue and Forecast, by Application

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Deployment

14.2.17.2. Market Revenue and Forecast, by Type

14.2.17.3. Market Revenue and Forecast, by Business Model

14.2.17.4. Market Revenue and Forecast, by Product

14.2.18. Market Revenue and Forecast, by Hospital Size

14.2.18.1. Market Revenue and Forecast, by Application

14.3. APAC

14.3.1. Market Revenue and Forecast, by Deployment

14.3.2. Market Revenue and Forecast, by Type

14.3.3. Market Revenue and Forecast, by Business Model

14.3.4. Market Revenue and Forecast, by Product

14.3.5. Market Revenue and Forecast, by Hospital Size

14.3.6. Market Revenue and Forecast, by Application

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Deployment

14.3.7.2. Market Revenue and Forecast, by Type

14.3.7.3. Market Revenue and Forecast, by Business Model

14.3.7.4. Market Revenue and Forecast, by Product

14.3.8. Market Revenue and Forecast, by Hospital Size

14.3.9. Market Revenue and Forecast, by Application

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Deployment

14.3.10.2. Market Revenue and Forecast, by Type

14.3.10.3. Market Revenue and Forecast, by Business Model

14.3.10.4. Market Revenue and Forecast, by Product

14.3.11. Market Revenue and Forecast, by Hospital Size

14.3.11.1. Market Revenue and Forecast, by Application

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Deployment

14.3.12.2. Market Revenue and Forecast, by Type

14.3.12.3. Market Revenue and Forecast, by Business Model

14.3.12.4. Market Revenue and Forecast, by Product

14.3.12.5. Market Revenue and Forecast, by Hospital Size

14.3.12.6. Market Revenue and Forecast, by Application

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Deployment

14.3.13.2. Market Revenue and Forecast, by Type

14.3.13.3. Market Revenue and Forecast, by Business Model

14.3.13.4. Market Revenue and Forecast, by Product

14.3.13.5. Market Revenue and Forecast, by Hospital Size

14.3.13.6. Market Revenue and Forecast, by Application

14.4. MEA

14.4.1. Market Revenue and Forecast, by Deployment

14.4.2. Market Revenue and Forecast, by Type

14.4.3. Market Revenue and Forecast, by Business Model

14.4.4. Market Revenue and Forecast, by Product

14.4.5. Market Revenue and Forecast, by Hospital Size

14.4.6. Market Revenue and Forecast, by Application

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Deployment

14.4.7.2. Market Revenue and Forecast, by Type

14.4.7.3. Market Revenue and Forecast, by Business Model

14.4.7.4. Market Revenue and Forecast, by Product

14.4.8. Market Revenue and Forecast, by Hospital Size

14.4.9. Market Revenue and Forecast, by Application

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Deployment

14.4.10.2. Market Revenue and Forecast, by Type

14.4.10.3. Market Revenue and Forecast, by Business Model

14.4.10.4. Market Revenue and Forecast, by Product

14.4.11. Market Revenue and Forecast, by Hospital Size

14.4.12. Market Revenue and Forecast, by Application

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Deployment

14.4.13.2. Market Revenue and Forecast, by Type

14.4.13.3. Market Revenue and Forecast, by Business Model

14.4.13.4. Market Revenue and Forecast, by Product

14.4.13.5. Market Revenue and Forecast, by Hospital Size

14.4.13.6. Market Revenue and Forecast, by Application

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Deployment

14.4.14.2. Market Revenue and Forecast, by Type

14.4.14.3. Market Revenue and Forecast, by Business Model

14.4.14.4. Market Revenue and Forecast, by Product

14.4.14.5. Market Revenue and Forecast, by Hospital Size

14.4.14.6. Market Revenue and Forecast, by Application

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Deployment

14.5.2. Market Revenue and Forecast, by Type

14.5.3. Market Revenue and Forecast, by Business Model

14.5.4. Market Revenue and Forecast, by Product

14.5.5. Market Revenue and Forecast, by Hospital Size

14.5.6. Market Revenue and Forecast, by Application

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Deployment

14.5.7.2. Market Revenue and Forecast, by Type

14.5.7.3. Market Revenue and Forecast, by Business Model

14.5.7.4. Market Revenue and Forecast, by Product

14.5.8. Market Revenue and Forecast, by Hospital Size

14.5.8.1. Market Revenue and Forecast, by Application

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Deployment

14.5.9.2. Market Revenue and Forecast, by Type

14.5.9.3. Market Revenue and Forecast, by Business Model

14.5.9.4. Market Revenue and Forecast, by Product

14.5.9.5. Market Revenue and Forecast, by Hospital Size

14.5.9.6. Market Revenue and Forecast, by Application

Chapter 15. Company Profiles

15.1. Epic Systems Corporation

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Allscripts Healthcare Solutions, Inc.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. McKesson Corporation

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. MEDITECH (Medical Information Technology, Inc.)

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. athenahealth, Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. eClinicalWorks

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. NextGen Healthcare, Inc.

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. GE Healthcare

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Siemens Healthineers

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others