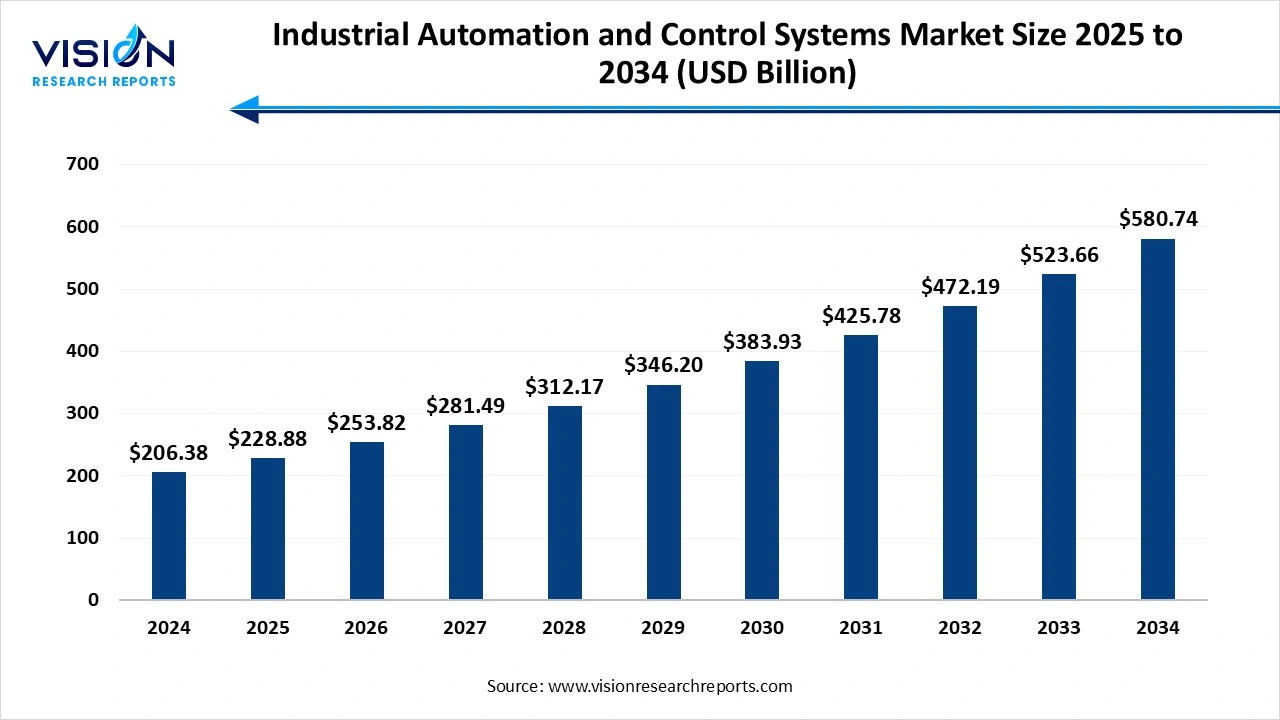

The industrial automation and control market size was estimated at USD 206.38 billion in 2024 and is expected to grow to USD 228.88 billion in 2025, ultimately reaching USD 580.74 billion by 2034, reflecting a remarkable CAGR of 10.9%. The rising adoption of industry and technological advancement in automation, and the expansion of the market growth.

The use of technology, systems, and control devices to operate, monitor, and manage industrial processes with minimal or no human intervention. It integrates hardware and software to improve efficiency, safety, accuracy, and productivity in manufacturing and other industrial procedures. The market growth is driven by the increasing trends towards smart manufacturing, integrating advanced technologies such as IoT, Internet of Things, Artificial Intelligence, and Big Data analytics into the manufacturing process. The rising demand for productivity and efficiency of automation.

The shift towards smart manufacturing and Industry 4.0 principles, integrating technologies such as Industrial Internet of Things, Artificial Intelligence, and big data analytics, is boosting the market growth. The advancement in robotics, machine learning is developing manufacturing processes, enhancing precision, reliability, and enabling features such as predictive maintenance and real-time monitoring. Automation systems perform tasks faster, more accurately, and consistently than manual labor, leading to higher productivity and efficiency. Increasing demand for operational efficiency in the automation business is facing pressure to streamline operations, reduce waste, and improve resource utilization. An automated system can ensure consistence product quality, minimize human error, and enhance accuracy in manufacturing.

| Report Coverage | Details |

| Market Size in 2024 | USD 206.38 billion |

| Revenue Forecast by 2034 | USD 580.74 billion |

| Growth rate from 2025 to 2034 | CAGR of 10.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

ABB Ltd., Emerson Electric Co., Honeywell International, Inc., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation, Inc., Schneider Electric, Siemens AG, Yokogawa Electric Corporation. |

IoT and 5G Integration Opportunity for Industrial Automation and Control Market

The increase in the use is revolutionizing communication and data exchange within the industrial environment. 5G network enables near-instantaneous communication between the device and the control system, drastically reducing delays in data transmission. 5G's high-speed, low-latency connectivity enables the creation of smart factories where machines, sensors, and systems communicate seamlessly in real-time. Leveraging 5G and IoT sensors, manufacturers can monitor the health and performance of equipment in real time. The fifth generation of mobile communication networks, characterized by ultra-low latency, high data rates and bandwidth, and large device connectivity.

High initial investment costs and cybersecurity risk in the Industrial Automation and Control market

The purchasing and installation of automated systems is costly, and small and medium-sized enterprises often struggle to afford these investments. The integration of new automation technology with existing infrastructure can be complex and expensive. The increasing connectivity in industrial systems, driven by Industry 4.0 and the industrial internet of things, creates more entry points for cyberattacks. Each connected device, sensor, or network point can be a potential target for malicious actors.

The Asia Pacific industrial automation and control systems market held the largest revenue share, exceeding 40% in 2024. The region in which a vast and expanding manufacturing base, rapid industrialization in the automotive sector, and expansion of market growth. The adoption of Industrial Internet of Things, artificial intelligence, and robotics in industrial settings drives the expansion of industrial automation. Governments across this region are actively promoting smart manufacturing and industrial automation through initiatives. The implementation of modern and efficient production methods is leading to an increasing demand for automation solutions.

China Industrial Automation and Control Market Trends

China is a major contributor to the industrial automation and control market. The large scale of automation solutions across various industries, and Government innovation towards automation and programs such as “China 2025” are aimed at upgrading the nation's manufacturing capabilities through digital transformation and investment in technologies like AI and IoT.

Why is North America Significantly Growing in the Industrial Automation and Control Market?

North America expects significant growth in the market during the forecast period. The growing adoption of Industry 4.0 and smart manufacturing initiatives. The rising demand for operational efficiency and productivity, high technology adoption, such as in automotive, aerospace, and electronics, is improving product efficiency and reducing operational costs, expanding the demand in the automotive market. The well-developed infrastructure and robust economic policies that favour digital transformation support widespread adoption. The major key players' ongoing investment in small factories drives the market growth.

United States Industrial Automation and Control Market Trends

The well-established manufacturing sectors, in automotive and technology, and the implementation of advanced automation technology, such as AI, IoT, and big data analytics, drive the market growth. In this region, early adoption and investing in advanced automation technologies, major industrial centers, and rising demand for automation sectors, such as manufacturing, healthcare, and logistics, boost the market growth.

Why did the Distributed Control System Segment Dominate the Industrial Automation and Control Market?

The distributed control system segment dominated the industrial automation and control market in 2024. The distributed control system excels in managing and coordinating complex industrial processes spread across large facilities. DCS systems are designed with built-in redundancy and fault tolerance, reducing downtime and the impact of component failure. The DCS offers high scalability and flexibility, allowing for easy expansion and modification of the control system as industrial requirements evolve. The DCS is widely used in industries such as oil and gas, chemicals, power generation, and water treatment, where continuous monitoring and control are essential.

The supervisory control and data acquisition (SCADA) segment is the fastest-growing in the industrial automation and control market during the forecast period. The essential role is in collecting and analysing real-time data from industrial processes, enabling operators to display and control operational efficiency. The increasing trend in industrial automation across various sectors, including manufacturing, oil and gas, and utilities, is driving the demand. The SCADA plays a major role in the development and management of smart grid and the integration of energy sources. The various applications, such as advancement in data analytics and AI, and cloud-based solutions, expansion of the market growth.

How the Connected Segment hold the Largest Share in the Industrial Automation and Control Market?

The connected segment held the largest revenue share in the industrial automation and control market in 2024. The shift towards Industry 4.0 and smart manufacturing, where connected devices and systems enable interoperability and real-time analytics for optimized production flows and enhanced operational efficiency. The connected system enhanced monitoring and real-time data exchange, improved production flexibility and safety standards, high connectivity, better data management, and integration of advanced technology drive the market growth. Connected device system leads to streamlined operations, minimized downtime, and optimized resource utilization.

The adoption of the connected segment is experiencing the fastest growth in the industrial automation and control market during the forecast period. The industries embrace the fourth industrial revolution 4.0, with its focus on smart factories, interconnected devices, and real-time analytics are essential, drive the market growth. The company improves efficiency and reduces downtime through predictive maintenance, enhanced monitoring, and optimizing production flow. The leverage of advancements in IoT, AI, and cloud computing.

The manufacturing sector segment dominated the industrial automation and control market in 2024. The increased efficiency, productivity, and reduced costs. Automation minimizes human error, enhances safety by assigning hazardous tasks to machines, and improves quality control by ensuring consistent product standards. The push towards Industry 4.0, integrating technologies like AI, IoT, and robotics, is transforming production with interconnected smart factories facilitating real-time data analysis and decision-making. Addressing labor shortages and rising labor costs further fuels automation adoption, while promoting greater flexibility, customization, and scalability to meet evolving market demands.

The healthcare sector segment is the fastest-growing in the market during the forecast period. The automation streamlines routine tasks, such as scheduling appointments, managing patient billing, processing insurance claims, and handling data entry, freeing up healthcare professionals to focus on patient care. The rising demand for accuracy and reducing errors, increasing patient pool and increasing prevalence of chronic disease, rising global population and growing prevalence of chronic disease, and increasing demand for healthcare services. The technological innovations, such as Artificial Intelligence and Machine Learning, enhance diagnostic accuracy, leading to better patient outcomes.

By Control System

By Component

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Control System Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Industrial Automation and Control Market

5.1. COVID-19 Landscape: Industrial Automation and Control Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Industrial Automation and Control Market, By Control System

8.1. Industrial Automation and Control Market, by Control System

8.1.1 DCS

8.1.1.1. Market Revenue and Forecast

8.1.2. PLC

8.1.2.1. Market Revenue and Forecast

8.1.3. SCADA

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Industrial Automation and Control Market, By Component

9.1. Industrial Automation and Control Market, by Component

9.1.1. HMI

9.1.1.1. Market Revenue and Forecast

9.1.2. Industrial Robots

9.1.2.1. Market Revenue and Forecast

9.1.3. Control Valves

9.1.3.1. Market Revenue and Forecast

9.1.4. Sensors

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Industrial Automation and Control Market, By End Use

10.1. Industrial Automation and Control Market, by End Use

10.1.1. Aerospace & Defense

10.1.1.1. Market Revenue and Forecast

10.1.2. Automotive

10.1.2.1. Market Revenue and Forecast

10.1.3. Chemical

10.1.3.1. Market Revenue and Forecast

10.1.4. Energy & Utilities

10.1.4.1. Market Revenue and Forecast

10.1.5. Food & Beverage

10.1.5.1. Market Revenue and Forecast

10.1.6. Healthcare

10.1.6.1. Market Revenue and Forecast

10.1.7. Manufacturing

10.1.7.1. Market Revenue and Forecast

10.1.8. Mining & Metal

10.1.8.1. Market Revenue and Forecast

10.1.9. Oil & Gas

10.1.9.1. Market Revenue and Forecast

10.1.10. Transportation

10.1.10.1. Market Revenue and Forecast

10.1.11. Others

10.1.11.1. Market Revenue and Forecast

Chapter 11. Global Industrial Automation and Control Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Control System

11.1.2. Market Revenue and Forecast, by Component

11.1.3. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Control System

11.1.4.2. Market Revenue and Forecast, by Component

11.1.4.3. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Control System

11.1.5.2. Market Revenue and Forecast, by Component

11.1.5.3. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Control System

11.2.2. Market Revenue and Forecast, by Component

11.2.3. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Control System

11.2.4.2. Market Revenue and Forecast, by Component

11.2.4.3. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Control System

11.2.5.2. Market Revenue and Forecast, by Component

11.2.5.3. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Control System

11.2.6.2. Market Revenue and Forecast, by Component

11.2.6.3. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Control System

11.2.7.2. Market Revenue and Forecast, by Component

11.2.7.3. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Control System

11.3.2. Market Revenue and Forecast, by Component

11.3.3. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Control System

11.3.4.2. Market Revenue and Forecast, by Component

11.3.4.3. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Control System

11.3.5.2. Market Revenue and Forecast, by Component

11.3.5.3. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Control System

11.3.6.2. Market Revenue and Forecast, by Component

11.3.6.3. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Control System

11.3.7.2. Market Revenue and Forecast, by Component

11.3.7.3. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Control System

11.4.2. Market Revenue and Forecast, by Component

11.4.3. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Control System

11.4.4.2. Market Revenue and Forecast, by Component

11.4.4.3. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Control System

11.4.5.2. Market Revenue and Forecast, by Component

11.4.5.3. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Control System

11.4.6.2. Market Revenue and Forecast, by Component

11.4.6.3. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Control System

11.4.7.2. Market Revenue and Forecast, by Component

11.4.7.3. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Control System

11.5.2. Market Revenue and Forecast, by Component

11.5.3. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Control System

11.5.4.2. Market Revenue and Forecast, by Component

11.5.4.3. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Control System

11.5.5.2. Market Revenue and Forecast, by Component

11.5.5.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1. ABB Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Emerson Electric Co.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Honeywell International, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Kawasaki Heavy Industries, Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Mitsubishi Electric Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. OMRON Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Rockwell Automation, Inc

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Schneider Electric

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Siemens AG.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Yokogawa Electric Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others