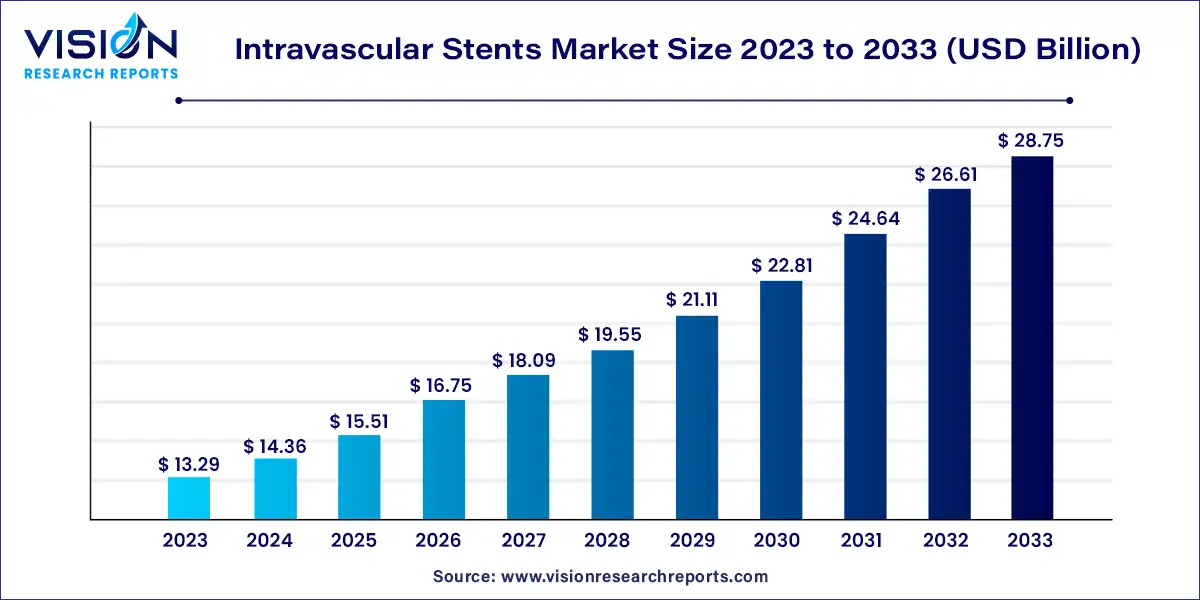

The global intravascular stents market size was valued at USD 13.29 billion in 2023 and it is expected to surpass around USD 28.75 billion by 2033, poised to grow at a CAGR of 8.02% from 2024 to 2033.

The development and evolution of intravascular stents have significantly contributed to the advancement of minimally invasive procedures for the treatment of coronary artery disease, peripheral arterial disease, and other vascular complications. These stents, when deployed via catheterization techniques, serve to widen narrowed or blocked vessels, restoring blood flow and reducing the risk of serious cardiovascular events.

The intravascular stents market is experiencing robust growth driven by several key factors. Firstly, the rising incidence of cardiovascular diseases, including coronary artery disease and peripheral arterial disease, continues to fuel the demand for intravascular stents as a vital treatment option. Secondly, ongoing technological advancements in stent design and materials have significantly improved their performance, leading to better patient outcomes and expanded applications. Moreover, the aging global population contributes to the market's growth, as elderly individuals are more susceptible to cardiovascular conditions. Additionally, the adoption of minimally invasive procedures and a growing awareness of their benefits among patients further propel market expansion. These converging factors collectively make the Intravascular Stents Market a dynamic and promising sector within the medical device industry.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 45% |

| Revenue Forecast by 2033 | USD 28.75 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.02% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The drug-eluting stents (DES) segment generated the largest revenue share of 60% in 2023. Drug-Eluting Stents (DES) have emerged as a cornerstone of modern stent technology. These stents are engineered with a specialized drug-coated layer designed to release medication gradually over time. This drug-elution process serves a crucial purpose: it inhibits the proliferation of cells in the treated blood vessel, reducing the risk of restenosis – the re-narrowing of the vessel post-stent placement. DES have proven highly effective in reducing restenosis rates and have significantly improved the long-term outcomes of patients undergoing stent procedures. Their scope extends to complex coronary lesions and cases where minimizing restenosis is critical.

The bioabsorbable stent segment is predicted to grow substantially in the forecast period. Bioabsorbable Stents represent a newer and innovative category within the Intravascular Stents Market. These stents are designed to be gradually absorbed by the body over time, leaving behind no permanent metallic implant. The scope of bioabsorbable stents lies in providing temporary support to the treated blood vessel during the initial healing process. As the stent dissolves, the vessel returns to its natural state. This feature is particularly beneficial for certain patients, as it eliminates the long-term presence of a metallic stent in the body and offers the potential for reduced long-term complications. Bioabsorbable stents are typically used in less complex coronary lesions and have shown promise in selected cases.

The balloon-expanding stents segment has captured the largest revenue share of 55% in 2023. Balloon-expandable Stents require the use of an inflatable balloon during deployment. These stents are mounted onto a balloon-tipped catheter and are delivered to the target site. Upon reaching the desired location, the balloon is inflated, causing the stent to expand and press against the vessel wall. This mode of delivery is well-suited for coronary artery interventions, where precise stent placement and controlled expansion are crucial. Balloon-expandable stents offer a high degree of accuracy and are commonly used in coronary artery stenting procedures.

The self-expanding stents segment is predicted to grow at a significant CAGR over the forecast period. Self-expanding Stents, as the name suggests, are designed to expand on their own once deployed within a blood vessel. They are typically constructed with a flexible mesh-like structure made from materials like nitinol, which possesses shape memory properties. The stent is compressed onto a catheter before insertion and, once in position, is released to expand to its predetermined size. This mode of delivery is particularly advantageous in treating complex anatomies, such as those found in peripheral artery disease, where vessels may have irregular shapes or varying diameters. Self-expanding stents conform to the vessel walls, ensuring a secure fit and maintaining patency over time.

The coronary stents segment accounted for the largest share of 79% of the market in 2023. Coronary Stents are a pivotal component of cardiovascular care, focusing on the treatment of coronary artery diseases. These stents are specifically designed for placement within the coronary arteries, which supply oxygenated blood to the heart muscle. Coronary artery diseases, such as atherosclerosis, can lead to the narrowing or blockage of these arteries, necessitating intervention to restore blood flow. Coronary Stents are instrumental in this context, as they provide mechanical support to keep the arteries open and maintain adequate blood supply to the heart muscle. Within the category of coronary stents, there are further distinctions, including Drug-Eluting Stents (DES) and Bare-Metal Stents (BMS), each with its own advantages and considerations in coronary interventions.

The peripheral stent segment is projected to experience significant growth during the forecast period. Peripheral Stents, on the other hand, are designed for use in the peripheral vascular system, encompassing arteries and veins outside the coronary circulation. The peripheral vascular system includes vessels throughout the body, such as those in the legs, arms, kidneys, and carotid arteries. Peripheral stents are used to treat conditions like peripheral artery disease (PAD), which often involves the narrowing or blockage of these peripheral vessels. These stents aim to restore blood flow, alleviate symptoms, and prevent complications associated with reduced blood circulation. Like coronary stents, peripheral stents also come in various types, including Self-expanding Stents and Balloon-expandable Stents, chosen based on the specific vascular anatomy and clinical scenario.

The hospital & cardiac centers segment held a significant market share of 76%. Hospitals & Cardiac Centers are at the forefront of cardiovascular care, providing a comprehensive range of diagnostic, interventional, and surgical services. These institutions are equipped with state-of-the-art facilities, advanced imaging technologies, and a multidisciplinary team of healthcare professionals specializing in cardiology and vascular medicine. Hospitals and Cardiac Centers are the primary locations for complex interventional procedures, such as coronary artery stenting and peripheral artery interventions. Their capability to handle acute and critical cases, along with the availability of specialized expertise, makes them essential in the treatment of cardiovascular diseases. Within these settings, patients have access to a wide array of stent types and interventional options, ensuring that their cardiovascular conditions are managed with the utmost precision and care.

The ambulatory care centers segment is expected to experience substantial market growth during the forecast period. Ambulatory Surgical Centers, also known as outpatient or day surgery centers, offer an alternative care environment for certain intravascular stent procedures. These centers focus on providing same-day surgical and interventional services, allowing patients to undergo stent placements and other procedures without requiring an extended hospital stay. Ambulatory Surgical Centers are particularly suitable for less complex interventions, such as select peripheral artery stent placements and some diagnostic procedures. They offer the advantages of convenience, reduced costs, and shorter recovery times for patients who do not require the resources of a full-scale hospital. This setting aligns well with the growing trend towards minimally invasive interventions and patient-centered care.

North America accounted for the largest share of 45% in 2023. North America stands as a significant player in the Intravascular Stents Market. The United States, in particular, is a hub for cutting-edge medical technology and innovation. High disease prevalence, particularly related to cardiovascular conditions, drives the demand for intravascular stents. Robust healthcare infrastructure, reimbursement systems, and a strong focus on research and development contribute to the growth of the market in this region.

The Asia-Pacific region, including countries like China and India, offers immense growth potential. Rapid urbanization, lifestyle changes, and an aging population have led to a rising burden of cardiovascular diseases. Intravascular stents have gained traction as a preferred treatment option. Increasing healthcare investments, expanding healthcare access, and a burgeoning middle class are driving market growth in this region.

By Type

By Mode of Delivery

By Product

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Intravascular Stents Market

5.1. COVID-19 Landscape: Intravascular Stents Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Intravascular Stents Market, By Type

8.1. Intravascular Stents Market, by Type, 2024-2033

8.1.1. Drug Eluting Stents (DES)

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Bare Metal Stents (BMS)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Bioabsorbable Stents

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Intravascular Stents Market, By Mode of Delivery

9.1. Intravascular Stents Market, by Mode of Delivery, 2024-2033

9.1.1. Self-expanding Stents

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Balloon-expandable Stents

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Intravascular Stents Market, By Product

10.1. Intravascular Stents Market, by Product, 2024-2033

10.1.1. Coronary Stents

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Peripheral Stents

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Neurovascular Stents

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Intravascular Stents Market, By End Use

11.1. Intravascular Stents Market, by End Use, 2024-2033

11.1.1. Hospitals & Cardiac Centers

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Ambulatory Surgical Centers

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Intravascular Stents Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.1.3. Market Revenue and Forecast, by Product (2021-2033)

12.1.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.2.3. Market Revenue and Forecast, by Product (2021-2033)

12.2.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.3.3. Market Revenue and Forecast, by Product (2021-2033)

12.3.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.4.3. Market Revenue and Forecast, by Product (2021-2033)

12.4.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.5.3. Market Revenue and Forecast, by Product (2021-2033)

12.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Mode of Delivery (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 13. Company Profiles

13.1. Boston Scientific Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Medtronic

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Terumo Medical

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Abbott

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Biotronik

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Lifetech

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. iVascular SLU

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Stryker

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Cook Medical

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Microport Scientific Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others