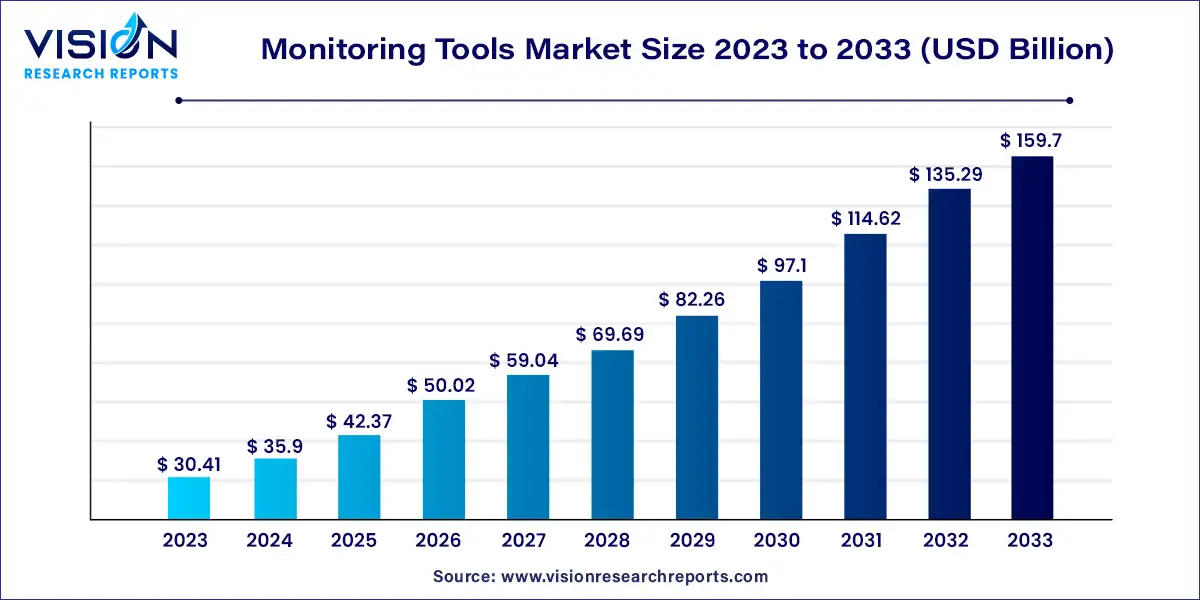

The global monitoring tools market size was estimated at around USD 30.41 billion in 2023 and it is projected to hit around USD 159.7 billion by 2033, growing at a CAGR of 18.04% from 2024 to 2033.

This market's evolution has been heavily influenced by technological advancements such as cloud computing, the Internet of Things (IoT), and the increasing complexity of IT environments. As a result, monitoring tool vendors have adapted and innovated to address these challenges, offering scalable, user-friendly solutions that cater to businesses of all sizes.

The monitoring tools Market has experienced robust growth due to several key drivers. Firstly, the ongoing digital transformation across industries, coupled with the migration to cloud-based infrastructures, has heightened the need for comprehensive monitoring solutions. These tools ensure the reliability and performance of digital assets. Secondly, the increasing complexity of IT environments, incorporating a mix of on-premises and cloud resources, necessitates unified monitoring to manage these intricacies effectively. Thirdly, the growing concern around cybersecurity threats has prompted organizations to invest in monitoring tools for threat detection and incident response.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 39% |

| Revenue Forecast by 2033 | USD 159.7 billion |

| Growth Rate from 2024 to 2033 | CAGR of 18.04% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The software segment has held 78% revenue share in 2023. Software represents the core technological solutions that enable organizations to monitor and analyze their IT infrastructure, applications, and security. Network monitoring software, for instance, empowers businesses to oversee the performance and health of their network components, while Application Performance Monitoring (APM) software focuses on tracking the efficiency and user experience of software applications. Additionally, Security Information and Event Management (SIEM) software plays a pivotal role in cybersecurity monitoring, aggregating and analyzing security data to detect and respond to threats.

The services segment is anticipated to expand at the fastest rate over the projected period. On the other hand, the Services component of the Monitoring Tools Market is equally indispensable. These services complement monitoring software by offering expertise, support, and customization. Service providers offer implementation and integration services to ensure that monitoring tools seamlessly integrate into an organization's existing IT infrastructure. Maintenance and support services ensure that the monitoring solutions remain up-to-date and effective, providing timely updates and technical assistance.

The on-premises segment has registered more than 61% revenue share in 2023. On-premises deployment involves installing and running monitoring tools within an organization's physical infrastructure. This approach provides businesses with complete control over their monitoring environment and data, which can be essential for industries with stringent data privacy or regulatory requirements. On-premises solutions are favored by organizations that prioritize data sovereignty, have legacy systems in place, or require customizations that may be challenging to achieve in a cloud environment.

Cloud-based deployment has gained significant traction in recent years due to its flexibility and scalability. These solutions are hosted on remote servers, managed by third-party providers, and accessed via the internet. Cloud-based monitoring tools are particularly appealing for businesses seeking to reduce infrastructure costs, as they eliminate the need for on-site hardware and extensive maintenance. Additionally, cloud-based solutions often come with built-in features for remote monitoring, making them suitable for geographically dispersed teams and remote work scenarios.

The security monitoring tools segment held the biggest revenue share of over 39% in 2023. Security Monitoring Tools and Infrastructure Monitoring Tools. Security Monitoring Tools are specialized solutions designed to safeguard an organization's digital assets against an ever-evolving landscape of cyber threats. These tools operate by continuously monitoring network traffic, system logs, and user behaviors to detect anomalies and potential security breaches. They play a critical role in threat detection, incident response, and compliance adherence, making them essential components of any comprehensive cybersecurity strategy. Security Information and Event Management (SIEM) tools, intrusion detection systems, and antivirus software are common examples of security monitoring tools.

In contrast, Infrastructure Monitoring Tools focus on the health and performance of an organization's IT infrastructure, encompassing servers, networks, databases, and cloud resources. These tools provide real-time insights into the availability, responsiveness, and resource utilization of various components, allowing businesses to proactively identify and address issues that could impact their operations. Infrastructure monitoring tools are instrumental in ensuring the reliability of digital services and optimizing resource allocation. Network monitoring software, server health monitors, and application performance monitoring (APM) tools are typical examples of infrastructure monitoring tools.

The IT & telecom segment has contributed more than 24% of revenue share in 2023. IT & Telecom sector stands as a prominent and pioneering user of monitoring tools. In this dynamic industry, real-time monitoring of network infrastructure, server performance, and application availability is critical. These tools play a pivotal role in ensuring the reliability and uninterrupted functioning of communication networks, data centers, and digital services. IT & Telecom companies rely on monitoring solutions to promptly detect and address issues, reducing downtime and enhancing the quality of their services. The fast-paced and highly competitive nature of this sector drives continuous innovation in monitoring tools to keep pace with evolving technology trends.

The BFSI segment is predicted to foresee significant growth in the forecast period. In parallel, the Banking, Financial Services, and Insurance (BFSI) sector have emerged as significant consumers of monitoring tools. In an industry where security, compliance, and uninterrupted service delivery are paramount, these tools provide invaluable support. Security monitoring tools help safeguard sensitive financial data and detect fraudulent activities in real-time, bolstering the industry's cybersecurity posture. Infrastructure monitoring tools ensure the resilience of critical banking systems, minimizing the risk of service disruptions that could have far-reaching financial implications.

North America has held the largest revenue share 38% in 2023. North America, specifically the United States and Canada, has been a pioneering force in the adoption of monitoring tools. The region boasts a mature IT infrastructure and a strong focus on cybersecurity, making it a substantial market for both security and infrastructure monitoring tools. Enterprises in North America prioritize advanced monitoring solutions to ensure data protection, compliance, and operational resilience.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia-Pacific region, encompassing countries like China, India, Japan, and Australia, represents a burgeoning market for monitoring tools. Asia-Pacific organizations are increasingly adopting both security and infrastructure monitoring tools to ensure reliable and secure digital services.

By Component

By Deployment

By Type

By Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Monitoring Tools Market

5.1. COVID-19 Landscape: Monitoring Tools Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Monitoring Tools Market, By Component

8.1. Monitoring Tools Market, by Component, 2024-2033

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Monitoring Tools Market, By Deployment

9.1. Monitoring Tools Market, by Deployment, 2024-2033

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Monitoring Tools Market, By Type

10.1. Monitoring Tools Market, by Type, 2024-2033

10.1.1. Infrastructure Monitoring Tools

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Application Performance Monitoring Tools

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Security Monitoring Tools

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Security Monitoring Tools

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Monitoring Tools Market, By Vertical

11.1. Monitoring Tools Market, by Vertical, 2024-2033

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Retail & E-commerce

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Healthcare

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. IT & Telecom

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Media & Entertainment

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Manufacturing

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Monitoring Tools Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 13. Company Profiles

13.1. Amazon Web Services Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Cisco Systems, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Dynatrace, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Google LLC

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. IBM Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Microsoft

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. NETSCOUT Systems, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. New Relic, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Riverbed Technology LLC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Splunk Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others