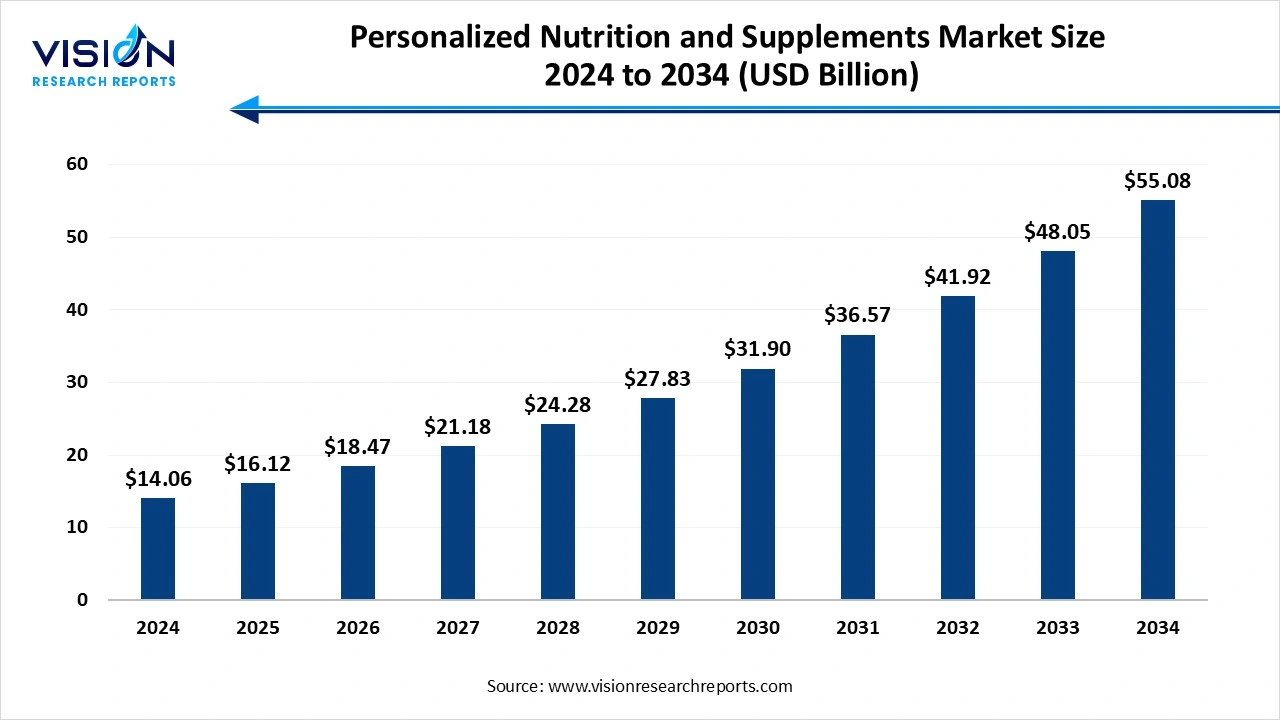

The global personalized nutrition and supplements market size was accounted at around USD 14.06 billion in 2024 and it is projected to hit around USD 55.08 billion by 2034, growing at a CAGR of 14.63% from 2025 to 2034.

The personalized nutrition and supplements market is rapidly evolving, driven by increasing consumer awareness of the link between diet, genetics, and overall health. Personalized nutrition involves tailoring dietary recommendations and supplement plans to an individual’s unique genetic makeup, lifestyle, metabolic profile, and health goals. This approach has gained significant traction as consumers seek more effective, science-backed solutions to manage weight, improve gut health, boost immunity, and prevent chronic diseases. Advancements in technology such as DNA testing, microbiome analysis, and AI-driven health apps have made personalized nutrition more accessible and scalable. Companies are leveraging these tools to offer customized supplement formulations, meal plans, and digital health coaching.

The growth of the personalized nutrition and supplements market is primarily driven by increasing consumer demand for health and wellness solutions that cater to individual needs. As people become more aware of the limitations of one-size-fits-all diets and supplements, there is a rising preference for products and services that consider personal factors such as genetics, microbiome, activity levels, and existing health conditions.

Technological advancements have significantly contributed to market expansion. The integration of AI, big data, wearable devices, and direct-to-consumer genetic testing has made it easier to gather and analyze individual health data, allowing companies to deliver highly customized recommendations and products. This has also empowered consumers to take control of their health, fueling demand for precision nutrition services.

One of the key challenges facing the personalized nutrition and supplements market is the complexity and cost of collecting and analyzing individual health data. Genetic testing, microbiome analysis, and continuous health monitoring require advanced technologies and infrastructure, which can be expensive and inaccessible for a large portion of the population.

Another challenge lies in the regulatory landscape, which remains underdeveloped for personalized nutrition. Since many personalized supplements fall into a gray area between food and medicine, they often face unclear or inconsistent regulatory oversight across different countries. This can hinder market entry and scalability for companies, especially startups.

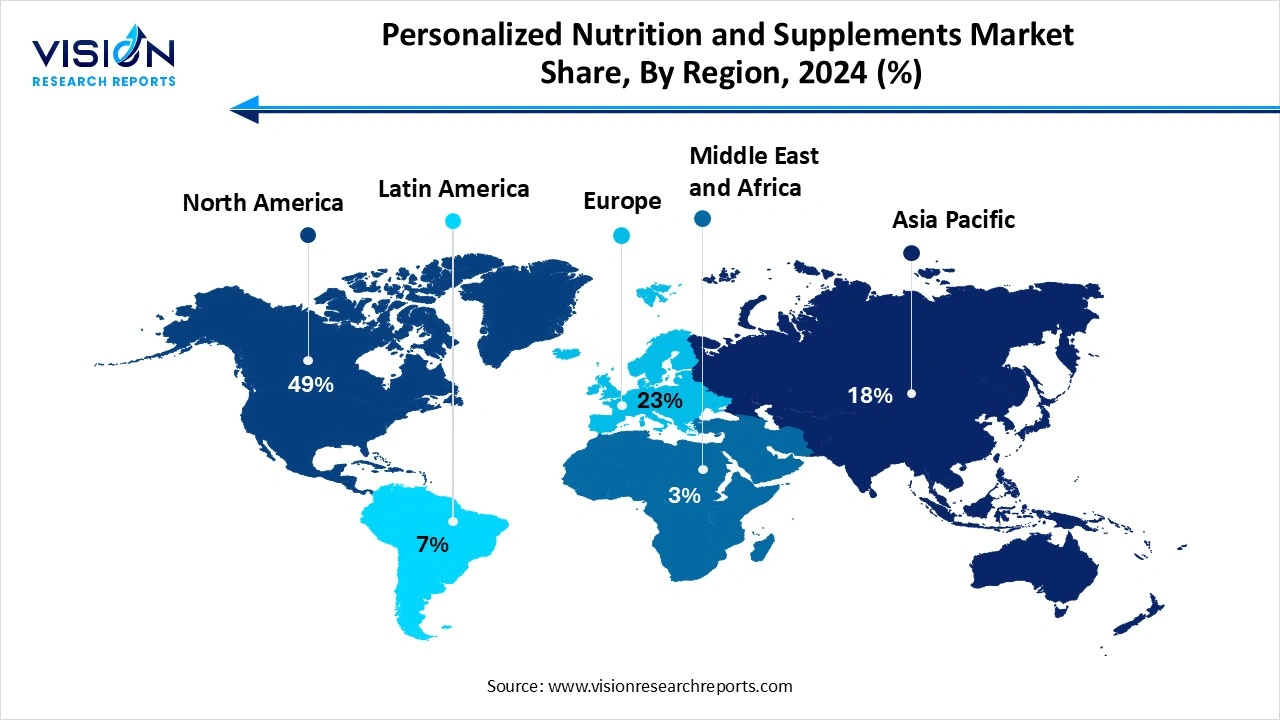

North America held the largest market share, accounting for 49% in 2024. North America dominates the global personalized nutrition and supplements market, largely due to its advanced healthcare infrastructure, strong consumer awareness, and early adoption of digital health technologies. The region is home to several key market players offering customized nutrition plans based on genetic, lifestyle, and biometric data. Increasing demand for preventive healthcare and chronic disease management has led to widespread use of DNA testing kits and AI-driven dietary apps, particularly in the United States and Canada.

The Asia Pacific personalized nutrition and supplements market is projected to register the fastest CAGR over the forecast period. The Asia Pacific region is projected to witness the fastest growth due to its large population, increasing internet penetration, and rising disposable incomes. In countries such as China, Japan, and India, the market is expanding rapidly with growing awareness of personalized health solutions and the increasing availability of digital health platforms.

The vitamins segment led the industry, capturing the largest revenue share at 32% of the total market in 2024. Vitamins play a crucial role as a foundational ingredient in the global personalized nutrition and supplements market. With increasing consumer interest in addressing specific health needs such as immunity, cognitive function, and energy metabolism, personalized vitamin formulations have gained widespread popularity. Companies are offering tailor-made vitamin blends based on an individual’s lifestyle, age, genetic predisposition, and dietary gaps, ensuring more effective outcomes compared to generic multivitamins.

Technological advancements, including home-based diagnostic kits and AI-powered health assessments, have streamlined the process of identifying individual vitamin needs. As a result, brands are able to deliver highly customized products through convenient channels such as subscription models and digital platforms. The versatility and essential nature of vitamins, combined with their compatibility in personalized formats, continue to make them one of the most in-demand ingredients within this evolving market landscape.

The tablets and capsules segment dominated the industry, representing the largest portion of overall revenue at 65% in 2024. These formats are preferred by both manufacturers and consumers for their ease of storage, longer shelf life, and ability to incorporate a wide range of active ingredients. Personalized supplement providers often use capsules to deliver targeted nutrient combinations based on individual health assessments, making them an ideal choice for custom formulations tailored to specific deficiencies or health goals.

The liquid segment is projected to experience the highest growth rate during the forecast period. They are especially favored for delivering high bioavailability and for use in products targeting children, the elderly, or those with difficulty swallowing pills. With advancements in flavor masking and formulation technologies, liquid formats are being integrated into personalized regimens, offering flexibility in dosage and the ability to include multiple nutrients in a single serving.

The supermarkets segment dominated the industry and accounted for the largest share of more than 44% of the overall revenue in 2024. These retail outlets often dedicate specific shelf space to wellness and health products, including customized vitamins and supplements. With the rise of in-store health consultations and on-site nutrition kiosks, supermarkets are beginning to integrate basic personalization services, bridging the gap between conventional retail and individualized health solutions.

The online pharmacies and e-commerce sites segment is projected to experience the highest CAGR during the forecast period. Ask ChatGPT Online pharmacies and e-commerce platforms have become dominant channels for the sale of personalized nutrition products due to their convenience, accessibility, and ability to support advanced personalization. Consumers can complete health assessments, receive customized recommendations, and subscribe to regular deliveries all from the comfort of their homes.

The adults segment captured the highest revenue share of 50% in 2024. Adults represent the largest consumer segment in the global personalized nutrition and supplements market, driven by their heightened focus on preventive health and wellness. With increasing awareness of lifestyle-related diseases, stress, and nutrient deficiencies, adults are actively seeking personalized solutions that align with their specific health goals, such as weight management, improved energy levels, and enhanced immunity.

Adults are drawn to the convenience and efficacy of personalized products, often opting for supplements based on genetic profiles, dietary habits, and fitness routines. The rising adoption of wearable health devices and mobile health apps among this age group further enables brands to offer dynamic and data-driven nutrition plans.

By Ingredient

By Dosage Form

By Distribution Channel

By Age Group

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Personalized Nutrition and Supplements Market

5.1. COVID-19 Landscape: Personalized Nutrition and Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Personalized Nutrition and Supplements Market, By Ingredient

8.1. Personalized Nutrition and Supplements Market, by Ingredient

8.1.1. Proteins & Amino Acid

8.1.1.1. Market Revenue and Forecast

8.1.2. Vitamins

8.1.2.1. Market Revenue and Forecast

8.1.3. Minerals

8.1.3.1. Market Revenue and Forecast

8.1.4. Probiotics

8.1.4.1. Market Revenue and Forecast

8.1.5. Herbal/Botanic

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Personalized Nutrition and Supplements Market, By Dosage Form

9.1. Personalized Nutrition and Supplements Market, by Dosage Form

9.1.1. Tablets/Capsules

9.1.1.1. Market Revenue and Forecast

9.1.2. Liquids

9.1.2.1. Market Revenue and Forecast

9.1.3. Powders

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Personalized Nutrition and Supplements Market, By Distribution Channel

10.1. Personalized Nutrition and Supplements Market, by Distribution Channel

10.1.1. Supermarkets/Hypermarkets

10.1.1.1. Market Revenue and Forecast

10.1.2. Specialty Stores

10.1.2.1. Market Revenue and Forecast

10.1.3. Retail Pharmacies

10.1.3.1. Market Revenue and Forecast

10.1.4. Online Pharmacies & E-Commerce Site

10.1.4.1. Market Revenue and Forecast

10.1.5. Breast

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Personalized Nutrition and Supplements Market, By Age Group

11.1. Personalized Nutrition and Supplements Market, by Age Group

11.1.1. Pediatric

11.1.1.1. Market Revenue and Forecast

11.1.2. Adults

11.1.2.1. Market Revenue and Forecast

11.1.3. Geriatric

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Personalized Nutrition and Supplements Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Ingredient

12.1.2. Market Revenue and Forecast, by Dosage Form

12.1.3. Market Revenue and Forecast, by Distribution Channel

12.1.4. Market Revenue and Forecast, by Age Group

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Ingredient

12.1.5.2. Market Revenue and Forecast, by Dosage Form

12.1.5.3. Market Revenue and Forecast, by Distribution Channel

12.1.5.4. Market Revenue and Forecast, by Age Group

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Ingredient

12.1.6.2. Market Revenue and Forecast, by Dosage Form

12.1.6.3. Market Revenue and Forecast, by Distribution Channel

12.1.6.4. Market Revenue and Forecast, by Age Group

12.2. Europe

12.2.1. Market Revenue and Forecast, by Ingredient

12.2.2. Market Revenue and Forecast, by Dosage Form

12.2.3. Market Revenue and Forecast, by Distribution Channel

12.2.4. Market Revenue and Forecast, by Age Group

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Ingredient

12.2.5.2. Market Revenue and Forecast, by Dosage Form

12.2.5.3. Market Revenue and Forecast, by Distribution Channel

12.2.5.4. Market Revenue and Forecast, by Age Group

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Ingredient

12.2.6.2. Market Revenue and Forecast, by Dosage Form

12.2.6.3. Market Revenue and Forecast, by Distribution Channel

12.2.6.4. Market Revenue and Forecast, by Age Group

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Ingredient

12.2.7.2. Market Revenue and Forecast, by Dosage Form

12.2.7.3. Market Revenue and Forecast, by Distribution Channel

12.2.7.4. Market Revenue and Forecast, by Age Group

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Ingredient

12.2.8.2. Market Revenue and Forecast, by Dosage Form

12.2.8.3. Market Revenue and Forecast, by Distribution Channel

12.2.8.4. Market Revenue and Forecast, by Age Group

12.3. APAC

12.3.1. Market Revenue and Forecast, by Ingredient

12.3.2. Market Revenue and Forecast, by Dosage Form

12.3.3. Market Revenue and Forecast, by Distribution Channel

12.3.4. Market Revenue and Forecast, by Age Group

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Ingredient

12.3.5.2. Market Revenue and Forecast, by Dosage Form

12.3.5.3. Market Revenue and Forecast, by Distribution Channel

12.3.5.4. Market Revenue and Forecast, by Age Group

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Ingredient

12.3.6.2. Market Revenue and Forecast, by Dosage Form

12.3.6.3. Market Revenue and Forecast, by Distribution Channel

12.3.6.4. Market Revenue and Forecast, by Age Group

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Ingredient

12.3.7.2. Market Revenue and Forecast, by Dosage Form

12.3.7.3. Market Revenue and Forecast, by Distribution Channel

12.3.7.4. Market Revenue and Forecast, by Age Group

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Ingredient

12.3.8.2. Market Revenue and Forecast, by Dosage Form

12.3.8.3. Market Revenue and Forecast, by Distribution Channel

12.3.8.4. Market Revenue and Forecast, by Age Group

12.4. MEA

12.4.1. Market Revenue and Forecast, by Ingredient

12.4.2. Market Revenue and Forecast, by Dosage Form

12.4.3. Market Revenue and Forecast, by Distribution Channel

12.4.4. Market Revenue and Forecast, by Age Group

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Ingredient

12.4.5.2. Market Revenue and Forecast, by Dosage Form

12.4.5.3. Market Revenue and Forecast, by Distribution Channel

12.4.5.4. Market Revenue and Forecast, by Age Group

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Ingredient

12.4.6.2. Market Revenue and Forecast, by Dosage Form

12.4.6.3. Market Revenue and Forecast, by Distribution Channel

12.4.6.4. Market Revenue and Forecast, by Age Group

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Ingredient

12.4.7.2. Market Revenue and Forecast, by Dosage Form

12.4.7.3. Market Revenue and Forecast, by Distribution Channel

12.4.7.4. Market Revenue and Forecast, by Age Group

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Ingredient

12.4.8.2. Market Revenue and Forecast, by Dosage Form

12.4.8.3. Market Revenue and Forecast, by Distribution Channel

12.4.8.4. Market Revenue and Forecast, by Age Group

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Ingredient

12.5.2. Market Revenue and Forecast, by Dosage Form

12.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.4. Market Revenue and Forecast, by Age Group

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Ingredient

12.5.5.2. Market Revenue and Forecast, by Dosage Form

12.5.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.5.4. Market Revenue and Forecast, by Age Group

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Ingredient

12.5.6.2. Market Revenue and Forecast, by Dosage Form

12.5.6.3. Market Revenue and Forecast, by Distribution Channel

12.5.6.4. Market Revenue and Forecast, by Age Group

Chapter 13. Company Profiles

13.1. Nestlé Health Science

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Herbalife Nutrition Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Amway Corp.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. DSM Nutritional Products

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Bayer AG

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Viome Life Sciences

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Care/of (by Bayer)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Persona Nutrition (Nestlé-owned)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Nutrigenomix Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Baze

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others