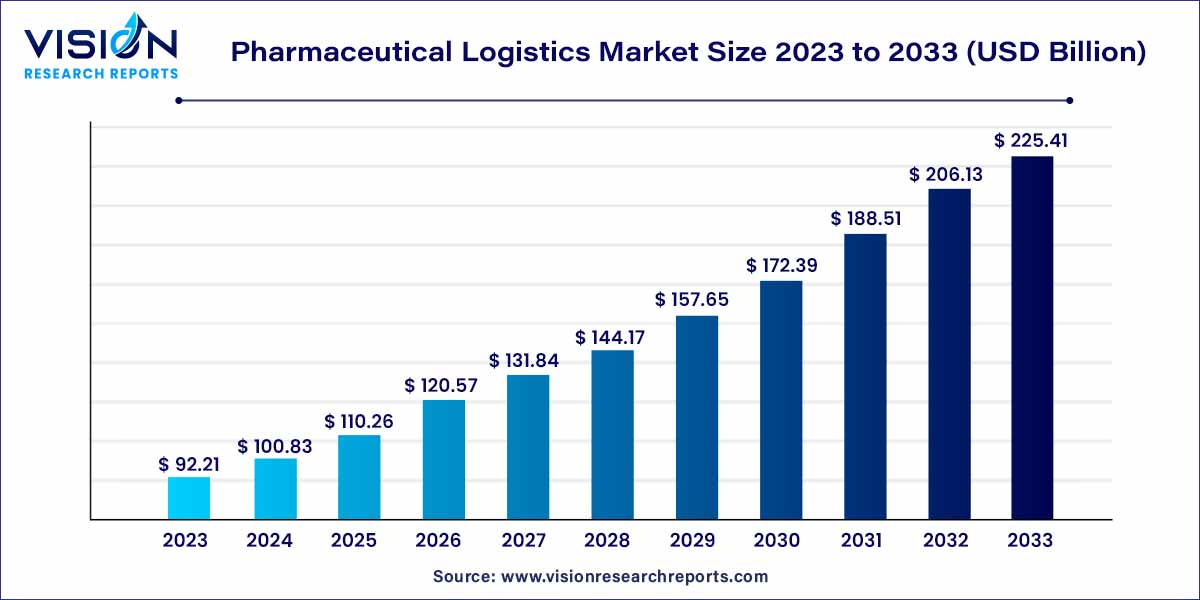

The global pharmaceutical logistics market size was estimated at around USD 92.21 billion in 2023 and it is projected to hit around USD 225.41 billion by 2033, growing at a CAGR of 9.35% from 2024 to 2033. The pharmaceutical logistics market is driven by the rise in cold chain logistics demand, outsourcing and complex supply chains, globalization of the pharmaceutical industry, and technological advancements.

The pharmaceutical logistics market plays a crucial role in ensuring the efficient and secure transportation of pharmaceutical products from manufacturers to end-users. This intricate supply chain involves the storage, handling, and distribution of sensitive pharmaceutical goods, demanding a high level of precision, compliance, and reliability.

The pharmaceutical logistics market is witnessing robust growth driven by several key factors. One of the primary drivers is the increasing globalization of the pharmaceutical industry, leading to expanded production and distribution networks. Additionally, the growing trend of outsourcing manufacturing processes has heightened the complexity of logistics, creating opportunities for specialized pharmaceutical logistics providers. The stringent regulatory environment governing the pharmaceutical sector, with a focus on compliance with Good Distribution Practices (GDP), is another crucial factor fueling market growth. The rise in demand for cold chain logistics solutions, equipped with advanced temperature monitoring systems, is driven by the escalating need to transport temperature-sensitive pharmaceutical products such as vaccines and biologics. Moreover, technological advancements, including the integration of IoT-enabled tracking devices, enhance visibility and traceability within the supply chain, addressing concerns related to product integrity. As the pharmaceutical industry continues to evolve, these growth factors underscore the importance of a reliable and efficient pharmaceutical logistics infrastructure to meet the increasing demands of a dynamic and globalized market.

In terms of value, it is projected that the cold chain logistics segment will command a significant market share by 2033, experiencing substantial growth from 2024 to 2033. This growth is driven by the escalating demand for temperature-controlled products, exemplified by the continuous distribution of COVID-19 vaccines. The precise temperature control logistics services required for these vaccines are crucial to ensure their efficacy.

Moreover, stringent government regulations mandating accurate temperature maintenance for highly temperature-sensitive pharmaceutical products are anticipated to propel the growth of this segment throughout the forecast period. The increasing adoption of telematics in cold chain pharmaceutical logistics is aiding companies in improving the efficiency, connectivity, and safety of transported cargoes.

Given that a majority of biological and medical products necessitate a temperature-controlled environment during manufacturing and distribution, this practice becomes essential to uphold the effectiveness and quality of medicines. Consequently, pharmaceutical companies are opting for temperature-controlled transportation and cold storage systems. On the other hand, the non-cold chain segment is poised to secure a substantial share over the next seven years, driven by the growing demand for non-cold chain pharmaceutical medicines and other related products.

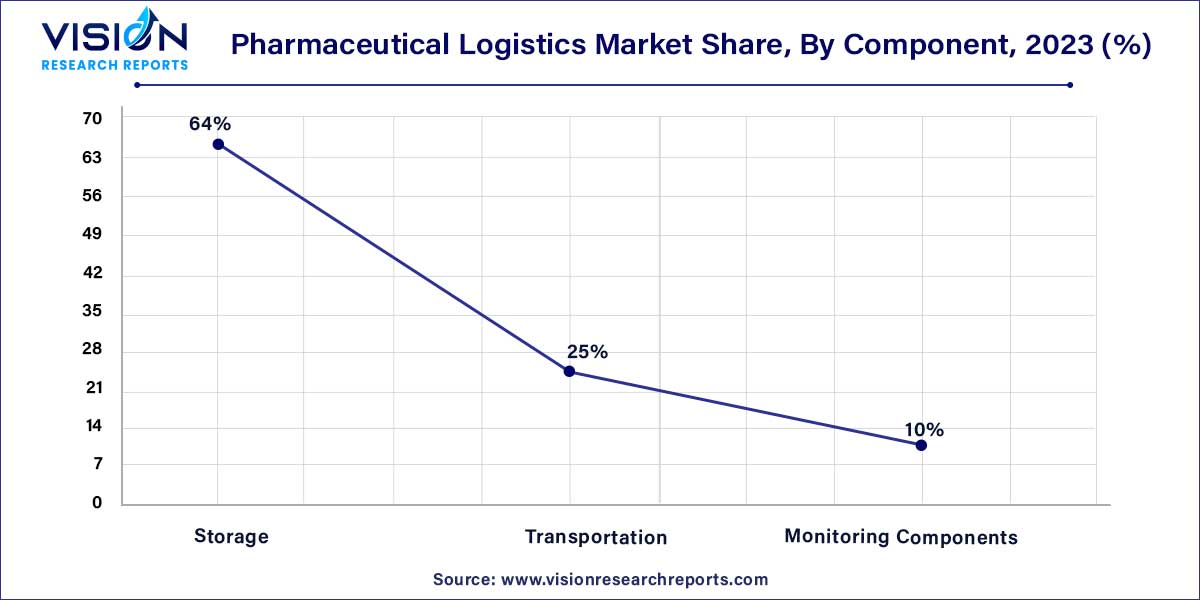

In 2023, the storage segment secured the largest market share, surpassing 64%. This dominance can be attributed to the rapidly increasing demand for both generic and branded pharmaceutical products, necessitating substantial storage facilities. These facilities play a crucial role in preserving the efficacy of pharmaceuticals post-production and facilitating their distribution through various channels to distributors and retailers.

Moreover, the ongoing COVID-19 pandemic has heightened the demand for storage facilities with precise temperature control to store vaccines at their required temperature during the logistics phase. This factor is expected to further propel the growth of the storage segment in the years to come. Additionally, shifts in consumer lifestyles and dietary patterns are contributing to an increased demand for temperature-sensitive protein and nutritional supplements. This evolving consumer preference is anticipated to drive the demand for the storage segment throughout the forecast period.

Anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2033, the monitoring components segment is driven by the escalating need to ensure the efficiency, integrity, and safety of cold chain products. This segment comprises hardware and software components. Simultaneously, the transportation segment is poised for substantial growth throughout the forecast period.

Within the transportation segment, further categorization includes sea freight logistics, air freight logistics, and overland logistics. The increasing adoption of sea-based pharmaceutical logistics is a significant contributor to the overall market growth. Sea freight logistics services are particularly adept at handling sensitive large molecule biologics and personalized medicines, further fueling the expansion of the pharmaceutical logistics market.

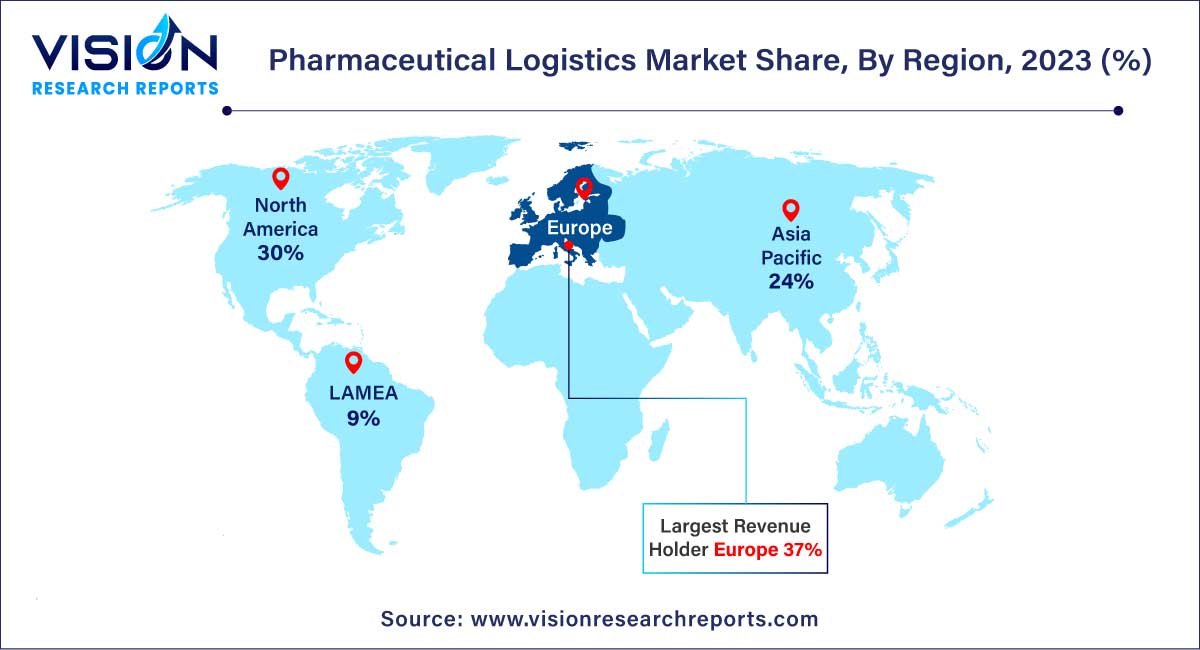

In 2023, Europe commanded a substantial market share exceeding 37%, and this share is anticipated to experience significant growth from 2024 to 2033. The robust market presence is attributed to the noteworthy expansion of pharmaceutical product trades within key European countries, including Germany, the U.K., France, Nordics, and others. Moreover, the domestic region has witnessed increased production and demand for various categories of pharmaceutical products, particularly Over-The-Counter (OTC) medicines, contributing to the market's substantial share.

On the other hand, the Asia Pacific region is poised to emerge as the fastest-growing segment, driven by rapid economic growth in emerging countries such as China and India. The escalating demand for OTC medicines within a vast population is expected to propel the pharmaceutical logistics market in the Asia Pacific region. Furthermore, the pharmaceutical industry is experiencing a geographical shift in production and sales locations, with market players identifying lucrative opportunities in developing economies in Asia and South America. This shift is expected to stimulate market growth in these regions.

By Type

By Component

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pharmaceutical Logistics Market

5.1. COVID-19 Landscape: Pharmaceutical Logistics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pharmaceutical Logistics Market, By Type

8.1. Pharmaceutical Logistics Market, by Type, 2024-2033

8.1.1. Cold Chain Logistics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-cold Chain Logistics

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Pharmaceutical Logistics Market, By Component

9.1. Pharmaceutical Logistics Market, by Component, 2024-2033

9.1.1. Storage

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Transportation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Monitoring Components

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Software

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Pharmaceutical Logistics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Component (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Component (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Component (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Component (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Component (2021-2033)

Chapter 11. Company Profiles

11.1. Agility

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Air Canada

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. CEVA Logistics

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DB Schenker

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Deutsche Post AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. FedEx

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. LifeConEx

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Marken

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. United Parcel Service of America, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. VersaCold Logistics Services

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others