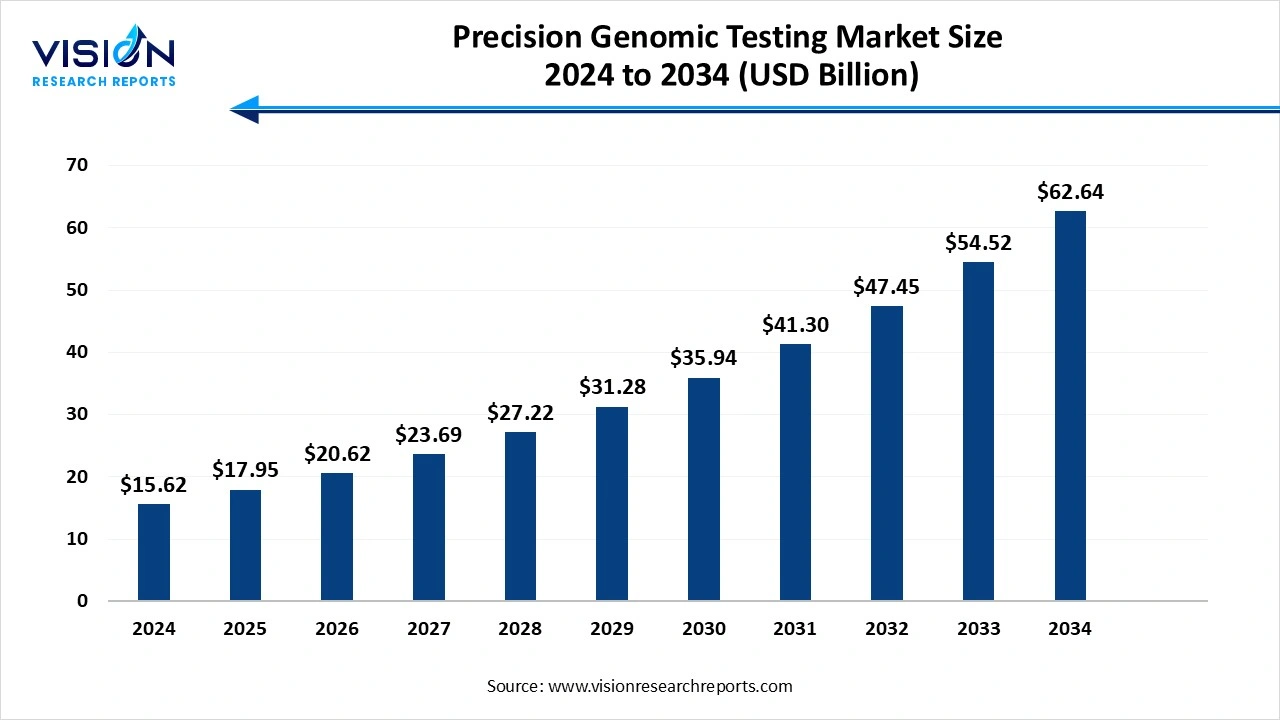

The global precision genomic testing market size was valued at USD 15.62 billion in 2023 and is anticipated to reach around USD 62.64 billion by 2033, growing at a CAGR of 14.90% from 2025 to 2034. Market growing is driven by the rising demand for personalized medicine, increasing prevalence of genetic disorders, and advancements in next-generation sequencing technologies, the Precision Genomic Testing Market is experiencing significant growth.

The precision genomic testing market is experiencing robust growth due the technological advancements, such as the development of next-generation sequencing (NGS) and high-throughput genomic platforms, are enhancing the accuracy and efficiency of genomic testing. These innovations enable more detailed and reliable genetic analysis, driving demand for precision diagnostics. Additionally, the increasing prevalence of genetic disorders and chronic diseases has heightened the need for precise and personalized medical interventions, further fueling market growth. Rising healthcare expenditures, particularly in developed economies, support the adoption of advanced genomic technologies, while expanding genomic databases contribute valuable insights into genetic variations and their health implications.

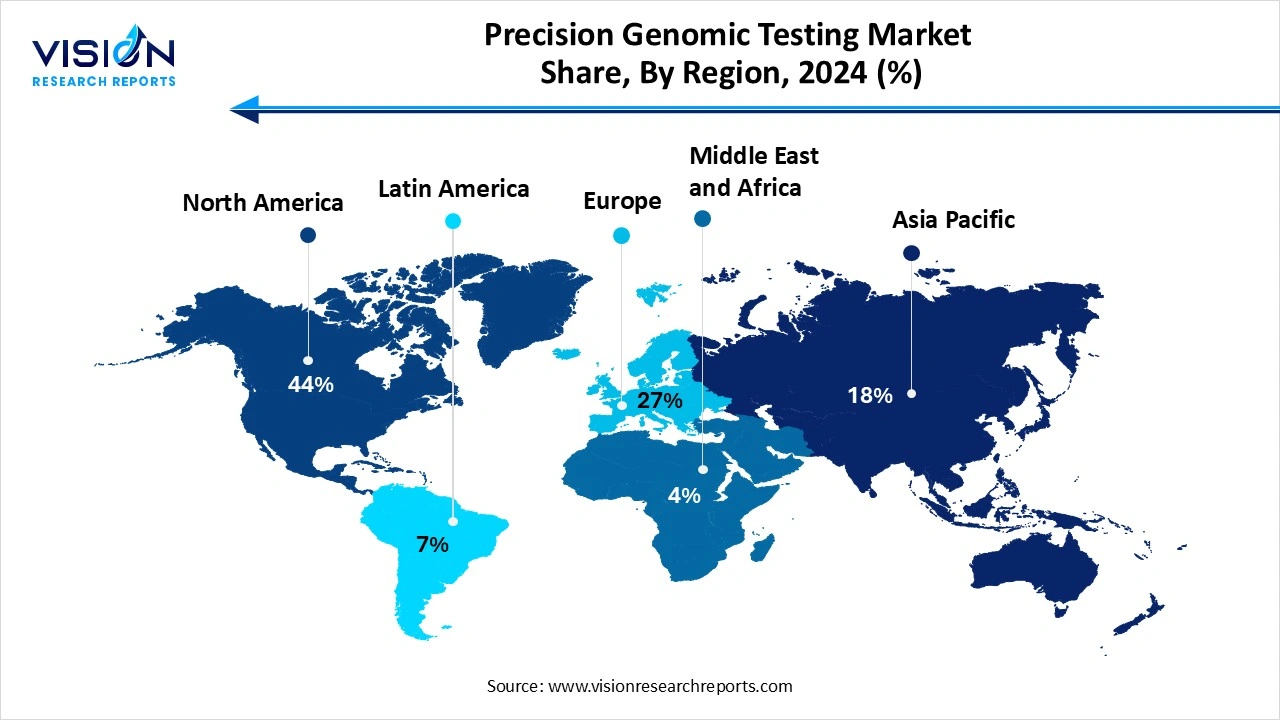

North America led the precision genomic testing market, capturing a dominant share of 43% in 2024. led by key players like Illumina, Thermo Fisher Scientific, and QIAGEN. Innovations in NGS technologies and bioinformatics are driving market growth, enabling improved genomic analysis and personalized medicine applications. For instance, in June 2022, Labcorp recognized the growing significance of precision medicine and committed to expanding access to targeted and personalized treatments. These advancements support North America's leadership in genomic research and clinical applications, fostering collaborations between academic institutions, healthcare providers, and biotechnology firms.

| Attribute | North America |

| Market Value | USD 5.59 Billion |

| Growth Rate | 14.68% CAGR |

| Projected Value | USD 22.01 Billion |

The U.S. precision genomic testing market is set to grow over the forecast period, driven by increased collaborations between industry leaders and research institutions. For example, in May 2023, Pfizer and Thermo Fisher Scientific Inc. announced a partnership to expand the local availability of NGS-based testing for lung and breast cancer patients. Such collaborations stimulate innovation and expedite the development of advanced genomic technologies, enhancing diagnostic capabilities and personalized treatment options.

Europe Precision Genomic Testing Market Trends

The precision genomic testing market in Europe is expected to grow, supported by substantial investments in research and development. Increased funding is promoting advancements in genomic technologies and fostering innovation in diagnostics and personalized medicine across the continent.

In the UK, the market is projected to expand due to technological advancements. For instance, in June 2024, The Royal Marsden NHS Foundation Trust and Automata Technologies introduced robotic technology to aid genomic testing for cancer patients. This collaboration utilizes NGS and CRISPR gene editing technologies to enhance the accuracy and efficiency of genetic analysis for personalized medicine applications.

In Germany, the market is expected to grow due to advancements in genomic sequencing technologies. For example, in April 2023, CENTOGENE launched CentoGenome, a new whole genome sequencing solution designed to diagnose rare and neurodegenerative diseases. This innovative tool provides healthcare professionals with extensive diagnostic information, potentially speeding up access to treatment options.

Asia Pacific Precision Genomic Testing Market Trends

The Asia Pacific precision genomic testing market is anticipated to witness significant expansion, with a projected CAGR of 20.29% between 2025 and 2034. driven by significant investments in research and development. These investments are fostering technological innovations in genomic sequencing and diagnostics, enhancing the region's capabilities in personalized medicine and healthcare solutions.

In China, the market is expected to grow, supported by global expansion efforts and strategic partnerships. For example, in December 2023, Illumina and HaploX launched the first NextSeq genetic sequencing system in China. This milestone highlights their strategic partnership and enhances access to advanced genomic technologies, supporting China’s aim to strengthen its position in personalized medicine and global healthcare innovation.

The consumables segment held the largest market share, accounting for 46% in 2024. This growth is driven by the introduction of new products and technological advancements. Key players are launching innovative consumables, such as reagents, kits, and assay components, specifically designed for genomic sequencing and analysis. Recent innovations include enhanced sample preparation techniques and high-throughput sequencing technologies that boost the efficiency and precision of genomic testing. For example, in May 2024, QIAGEN released a new library preparation kit aimed at advancing multiomics studies and precision medicine. This kit simplifies the preparation of DNA and RNA libraries for next-generation sequencing (NGS), including whole genome sequencing (WGS) and whole transcriptome sequencing, and enables streamlined target enrichment from a single sample.

The services segment is projected to register the highest CAGR of 15.28% in the market from 2025 to 2034. Companies are broadening their offerings to include genetic counseling, genomic data interpretation, and clinical trial support, catering to healthcare providers, pharmaceutical companies, and research institutions seeking expert advice on genomic testing strategies.

The oncology segment led the market, capturing a significant share of 32% in 2024. driven by advancements in cancer genomics. Innovations such as liquid biopsy techniques, comprehensive genomic profiling, and targeted therapy development are improving early detection, diagnosis, and personalized cancer treatment. For instance, in November 2023, Illumina Inc. launched its latest distributed liquid biopsy, TruSight Oncology, a research assay for noninvasive comprehensive genomic profiling of circulating tumor DNA from blood. This assay offers an alternative when tissue testing is not possible or complements tissue-based tests.

The neurological disorders segment is projected to register the highest CAGR of 15.58% during the forecast period from 2025 to 2034. thanks to advancements in genomic technologies and increased investment. For example, in May 2023, the NIH announced a USD 140 million initiative to study genetic variation in normal human cells and tissues. Technologies like NGS and CRISPR are enabling more precise identification of genetic mutations linked to neurological conditions such as Alzheimer's, Parkinson's, and epilepsy. The substantial investment in research and development is further advancing specialized genomic tests, enhancing early diagnosis, personalized treatment options, and overall patient care in this segment.

The next-generation sequencing segment accounted for the largest market share at 33% in 2024. fueled by ongoing innovation and strategic partnerships. Advances in NGS technology are enhancing sequencing speed, accuracy, and cost-effectiveness, supporting comprehensive genomic profiling. Collaborations between biotech firms, research institutions, and healthcare providers are accelerating the development and adoption of NGS-based tests. For example, in January 2023, QIAGEN and Helix partnered to advance NGS companion diagnostics for hereditary disorders, utilizing Helix's Laboratory Platform and QIAGEN’s NGS expertise. These partnerships facilitate the translation of cutting-edge research into clinical applications, driving market growth and improving personalized medicine approaches.

The microarray technology segment is projected to experience the fastest CAGR of 15.48% throughout the forecast period. driven by technological advancements. Modern microarray platforms offer higher resolution and greater accuracy, enabling thorough analysis of genetic variations and gene expression. These improvements facilitate the identification of disease-associated genes and biomarkers, promoting the use of microarray-based tests in research and clinical settings. The continuous evolution of microarray technology is expanding its applications in personalized medicine and supporting robust growth in this market segment.

The hospitals and clinics held the largest revenue share in the market, accounting for 51% in 2024. supported by increased funding and the growing prevalence of genetic disorders. Government initiatives and private investments are enhancing the infrastructure and capabilities of healthcare facilities. As the incidence of genetic disorders rises, hospitals and clinics are increasingly adopting precision genomic testing to provide accurate diagnoses and personalized treatment plans. This trend is driving the expansion of genomic testing services within clinical settings.

The diagnostic laboratories segment is expected to witness the highest CAGR during the forecast period. driven by technological advancements, ongoing research, and increased demand for clinical testing of genetic disorders. Diagnostic labs are integrating sophisticated genomic technologies, such as NGS and advanced bioinformatics, to enhance diagnostic accuracy and efficiency. This sector's growth is fueled by the need for precise genetic analysis in disease diagnosis and treatment planning, addressing the increasing incidence of genetic disorders and supporting personalized medicine approaches.

By Product

By Application

By Technology

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Precision Genomic Testing Market

5.1. COVID-19 Landscape: Precision Genomic Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Precision Genomic Testing Market, By Product

8.1. Precision Genomic Testing Market, by Product

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast

8.1.2. Equipment

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Precision Genomic Testing Market, By Application

9.1. Precision Genomic Testing Market, by Application

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast

9.1.2. Cardiovascular Diseases

9.1.2.1. Market Revenue and Forecast

9.1.3. Neurological Disorders

9.1.3.1. Market Revenue and Forecast

9.1.4. Reproductive Health

9.1.4.1. Market Revenue and Forecast

9.1.5. Rare Diseases

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Global Precision Genomic Testing Market, By Technology

10.1. Precision Genomic Testing Market, by Technology

10.1.1. Next-Generation Sequencing

10.1.1.1. Market Revenue and Forecast

10.1.2. Polymerase Chain Reaction

10.1.2.1. Market Revenue and Forecast

10.1.3. Microarray Technology

10.1.3.1. Market Revenue and Forecast

10.1.4. Sanger Sequencing

10.1.4.1. Market Revenue and Forecast

10.1.5. CRISPR/Cas Systems

10.1.5.1. Market Revenue and Forecast

10.1.6. Others

10.1.6.1. Market Revenue and Forecast

Chapter 11. Global Precision Genomic Testing Market, By End Use

11.1. Precision Genomic Testing Market, by End Use

11.1.1. Hospitals and Clinics

11.1.1.1. Market Revenue and Forecast

11.1.2. Diagnostic Laboratories

11.1.2.1. Market Revenue and Forecast

11.1.3. Research & Academic Institutes

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Precision Genomic Testing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product

12.1.2. Market Revenue and Forecast, by Application

12.1.3. Market Revenue and Forecast, by Technology

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product

12.1.5.2. Market Revenue and Forecast, by Application

12.1.5.3. Market Revenue and Forecast, by Technology

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product

12.1.6.2. Market Revenue and Forecast, by Application

12.1.6.3. Market Revenue and Forecast, by Technology

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product

12.2.2. Market Revenue and Forecast, by Application

12.2.3. Market Revenue and Forecast, by Technology

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product

12.2.5.2. Market Revenue and Forecast, by Application

12.2.5.3. Market Revenue and Forecast, by Technology

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product

12.2.6.2. Market Revenue and Forecast, by Application

12.2.6.3. Market Revenue and Forecast, by Technology

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product

12.2.7.2. Market Revenue and Forecast, by Application

12.2.7.3. Market Revenue and Forecast, by Technology

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product

12.2.8.2. Market Revenue and Forecast, by Application

12.2.8.3. Market Revenue and Forecast, by Technology

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product

12.3.2. Market Revenue and Forecast, by Application

12.3.3. Market Revenue and Forecast, by Technology

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product

12.3.5.2. Market Revenue and Forecast, by Application

12.3.5.3. Market Revenue and Forecast, by Technology

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product

12.3.6.2. Market Revenue and Forecast, by Application

12.3.6.3. Market Revenue and Forecast, by Technology

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product

12.3.7.2. Market Revenue and Forecast, by Application

12.3.7.3. Market Revenue and Forecast, by Technology

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product

12.3.8.2. Market Revenue and Forecast, by Application

12.3.8.3. Market Revenue and Forecast, by Technology

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product

12.4.2. Market Revenue and Forecast, by Application

12.4.3. Market Revenue and Forecast, by Technology

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product

12.4.5.2. Market Revenue and Forecast, by Application

12.4.5.3. Market Revenue and Forecast, by Technology

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product

12.4.6.2. Market Revenue and Forecast, by Application

12.4.6.3. Market Revenue and Forecast, by Technology

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product

12.4.7.2. Market Revenue and Forecast, by Application

12.4.7.3. Market Revenue and Forecast, by Technology

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product

12.4.8.2. Market Revenue and Forecast, by Application

12.4.8.3. Market Revenue and Forecast, by Technology

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product

12.5.2. Market Revenue and Forecast, by Application

12.5.3. Market Revenue and Forecast, by Technology

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product

12.5.5.2. Market Revenue and Forecast, by Application

12.5.5.3. Market Revenue and Forecast, by Technology

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product

12.5.6.2. Market Revenue and Forecast, by Application

12.5.6.3. Market Revenue and Forecast, by Technology

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Illumina, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Color Genomics, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Amgen, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. 24 genetics

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Circle DNA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. F. Hoffmann-La Roche Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Thermo Fisher Scientific Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. AncestryDNA

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Agilent Technologies, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. QIAGEN N.V.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others