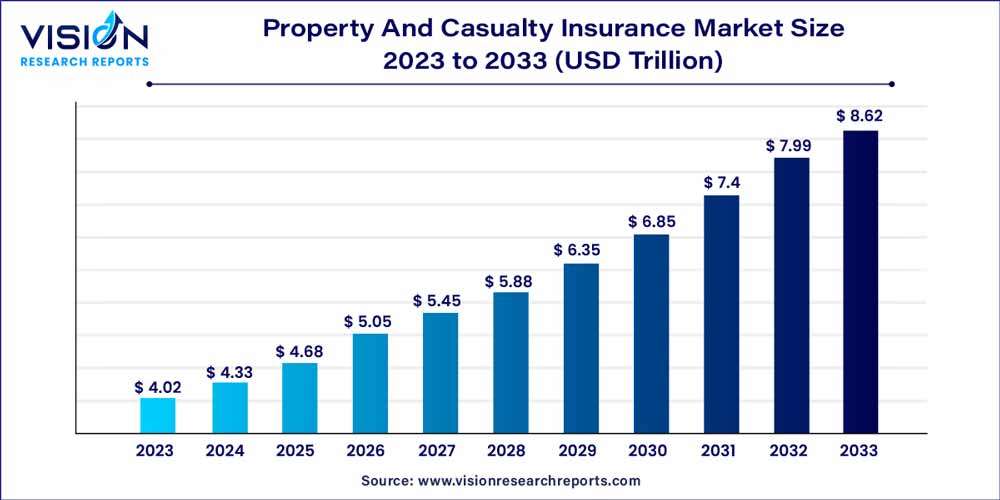

The global property and casualty insurance market size was estimated at around USD 4.02 trillion in 2023 and it is projected to hit around USD 8.62 trillion by 2033, growing at a CAGR of 7.94% from 2024 to 2033.

The property and casualty insurance market plays a pivotal role in safeguarding individuals, businesses, and assets against a diverse array of risks. This comprehensive overview aims to delve into the key facets of this dynamic industry, shedding light on its structure, trends, challenges, and future prospects.

The growth of the property and casualty insurance market is propelled by several key factors. Firstly, technological advancements play a pivotal role, as the integration of artificial intelligence and data analytics enhances underwriting processes and refines risk assessment methods. Additionally, the industry's adaptation to the evolving digital landscape, with the prevalence of online platforms and mobile applications, contributes to streamlined policy transactions and improved customer engagement. Furthermore, the increasing frequency and severity of climate-related risks, such as natural disasters, create a demand for comprehensive coverage, prompting insurers to reassess risk models. As the market continues to evolve, the customization of insurance products based on data-driven insights and consumer preferences is anticipated to drive growth, offering tailored solutions to meet diverse needs. Overall, these factors collectively contribute to the dynamic expansion and evolution of the property and casualty insurance market.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 8.62 trillion |

| Growth Rate from 2024 to 2032 | CAGR of 7.94% |

| Revenue Share of North America in 2023 | 31% |

| Base Year | 2022 |

| Forecast Period | 2024 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Homeowners insurance segment held the largest revenue share of 38% in 2023. Its paramount role in offering vital protection to homeowners against unforeseen risks and potential financial losses significantly propels the growth of this segment. This insurance type typically encompasses coverage for damages to the insured property resulting from events like fire, theft, vandalism, and natural disasters. Additionally, it extends liability coverage, safeguarding homeowners from legal and medical expenses in case of injuries or property damage for which they may be held accountable.

The importance of homeowners insurance transcends merely shielding individuals' most valuable asset—their homes. It plays a pivotal role in fostering financial resilience and stability. In a dynamic and unpredictable environment where unforeseen events can disrupt lives and livelihoods, homeowners insurance stands as a critical safety net, promoting enhanced security.

Renters insurance, on the other hand, serves as a fundamental means to protect the possessions and financial interests of tenants. This insurance type provides coverage for personal belongings within a rented dwelling, guarding against perils such as fire, theft, and natural disasters. Beyond property coverage, renters insurance frequently incorporates liability protection, shielding policyholders from potential legal and medical expenses arising from incidents within the rented premises.

In 2023, the Brokers segment secured the largest market revenue share, underlining its crucial role as a vital intermediary facilitating the connection between insurers and policyholders. This growth is attributed to brokers serving as key players in offering personalized guidance and expertise, assisting individuals in navigating the intricate landscape of insurance options to find coverage aligned with their specific needs.

Brokers contribute to a sense of trust and transparency by providing clients with a comprehensive understanding of available policies, coverage details, and potential risks. Furthermore, they act as advocates for policyholders during claims, ensuring a smoother and more efficient resolution process. The significance of the broker distribution channel lies in its capacity to bridge the gap between insurance providers and consumers, enhancing accessibility, and facilitating informed decision-making.

The Tied Agents and Branches segment is expected to register the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This segment establishes a direct and tangible link between insurers and policyholders, with tied agents exclusively representing specific insurance companies, and branch offices serving as localized points of contact, providing a physical presence within communities. This channel promotes a personalized and accessible approach to insurance through face-to-face interactions, fostering trust between agents and clients. Tied agents and branches possess a nuanced understanding of local market dynamics, enabling them to tailor insurance solutions to the unique needs and risks of the community they serve. This localized approach enhances customer engagement, encourages brand loyalty, and ensures a seamless communication channel for policyholders.

In 2023, the Individuals end-user segment had the largest market share, showcasing its paramount importance as a representative of the diverse and varied needs of individual policyholders. This segment encompasses a broad spectrum of consumers seeking insurance coverage for personal assets, including homes, automobiles, and personal liability. Individuals within this segment rely on insurance to safeguard their financial well-being and assets against unforeseen events such as accidents, natural disasters, or theft. The significance of the individual end-user segment lies not only in its sheer scale but also in the critical role it plays in driving demand for insurance products. As insurers tailor policies to cater to the unique requirements and preferences of individual consumers, they contribute to the overall resilience and stability of the market.

The Businesses segment is anticipated to witness the fastest Compound Annual Growth Rate (CAGR) over the forecast period. Serving as a linchpin for the protection of commercial enterprises, this segment encompasses a diverse array of businesses seeking insurance coverage to mitigate risks associated with property damage, liability, and business interruption. Businesses, ranging from small enterprises to large corporations, rely on insurance to protect their assets, operations, and financial stability. The importance of the business end-user segment is evident in its role in fostering economic resilience. By providing coverage tailored to the unique risks faced by businesses, insurers contribute to the continuity of operations and financial security for enterprises, thereby supporting broader economic stability.

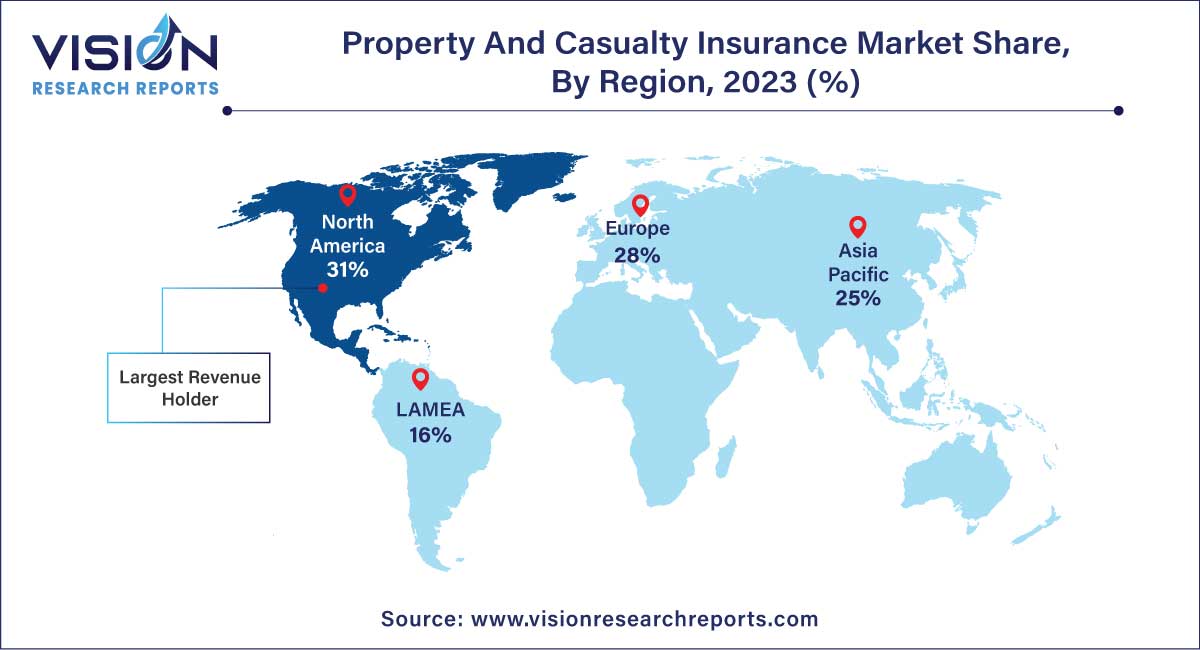

In 2023, North America dominated the market with the largest market share of 31%. This significant presence is attributed to the pivotal role of property & casualty insurance in safeguarding homes, businesses, and assets against diverse risks, including natural disasters, accidents, and liabilities. The economic vitality of the region is intricately linked to the resilience of businesses, and property & casualty insurance serves as a crucial safety net, ensuring their continuity in the face of unforeseen events. Furthermore, the insurance industry significantly contributes to overall economic stability by absorbing and mitigating the financial impact of disasters and accidents.

The Asia Pacific region is poised to experience the fastest CAGR during forecast period. With its extensive geographical expanse and varied economic landscapes, the importance of robust insurance coverage becomes evident, given the region's susceptibility to natural disasters such as earthquakes, typhoons, and floods. Notably, in China, the world's most populous country, property & casualty insurance plays an integral role in safeguarding homes and businesses against a wide range of risks, contributing significantly to the resilience of its rapidly growing economy.

By Product Type

By Distribution Channel

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Property And Casualty Insurance Market

5.1. COVID-19 Landscape: Property And Casualty Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Property And Casualty Insurance Market, By Product Type

8.1. Property And Casualty Insurance Market, by Product Type, 2024-2033

8.1.1 Homeowners Insurance

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Renters Insurance

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Condo Insurance

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Landlord Insurance

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Property And Casualty Insurance Market, By Distribution Channel

9.1. Property And Casualty Insurance Market, by Distribution Channel, 2024-2033

9.1.1. Tied Agents and Branches

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Brokers

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Property And Casualty Insurance Market, By End-user

10.1. Property And Casualty Insurance Market, by End-user, 2024-2033

10.1.1. Individuals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Governments

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Businesses

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Property And Casualty Insurance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 12. Company Profiles

12.1. State Farm Mutual Automobile Insurance Company.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Berkshire Hathaway Specialty Insurance.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Progressive Casualty Insurance Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Allstate Insurance Company.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Chubb.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Liberty Mutual Insurance Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. The Travelers Indemnity Company.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. USAA Insurance Company

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CNA Financial Corp.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Farmers Insurance Group of Companies

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others