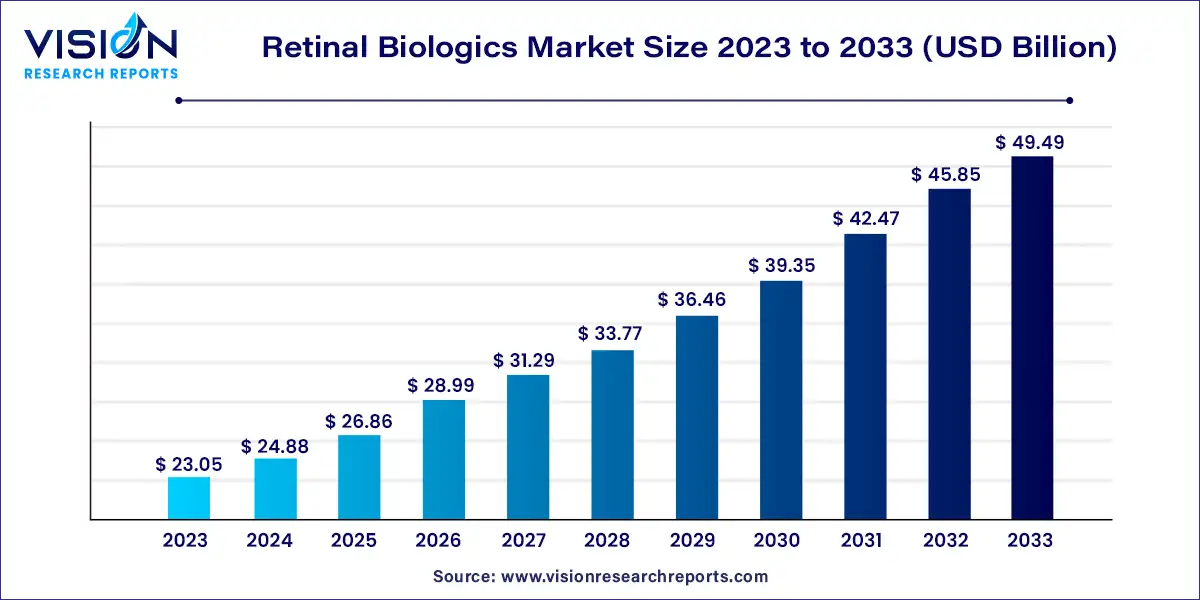

The global retinal biologics market size was estimated at USD 23.05 billion in 2023 and it is expected to surpass around USD 49.49 billion by 2033, poised to grow at a CAGR of 7.94% from 2024 to 2033.

The retinal biologics market represents a dynamic sector within the broader field of ophthalmology therapeutics. This niche market is characterized by innovative biologic treatments targeting various retinal diseases, offering new hope to patients and reshaping treatment paradigms.

The growth of the retinal biologics market is driven by an increasing prevalence of retinal diseases, such as age-related macular degeneration (AMD) and diabetic retinopathy, is driving demand for innovative treatment options. Technological advancements in biotechnology, particularly in recombinant DNA technology and protein engineering, have enabled the development of targeted biologic therapies tailored to specific disease mechanisms. Additionally, the shift towards personalized medicine has led to the exploration of individualized treatment approaches, further propelling market growth.

The retinal biologics market is categorized by drug class, with two main segments: TNF-a Inhibitor and VEGF-A Antagonist. As of 2023, the VEGF-A Antagonist segment dominated the market, largely due to an uptick in product approvals within this category.

For instance, in January 2022, the U.S. FDA granted approval to Faricimab-svoa (marketed as Vabysmo), a treatment targeting wet age-related macular degeneration and diabetic macular edema. This medication leverages both VEGF-A and Ang-2 effects. Such advancements in drug development are expected to drive growth within the VEGF-A Antagonist segment throughout the forecast period.

Segmented by indication, the market includes macular degeneration, diabetic retinopathy, uveitis, and others. In 2023, the macular degeneration segment captured the highest revenue share, driven by a surge in drug launches targeting this condition and the escalating global prevalence of macular degeneration. For example, a study published by the National Library of Medicine in September 2022 projected that approximately 300 million individuals worldwide will be affected by age-related macular degeneration (AMD) by the year 2040.

Categorized by distribution channels, the market comprises retail pharmacies, hospital pharmacies, and online pharmacies. Hospital pharmacies dominated the market share in 2023. The segment is projected to expand during the forecast period due to several associated benefits.

These advantages include enhanced access to patients' medical records and a wide array of medications, including specialized treatments that are typically administered within a controlled medical environment.

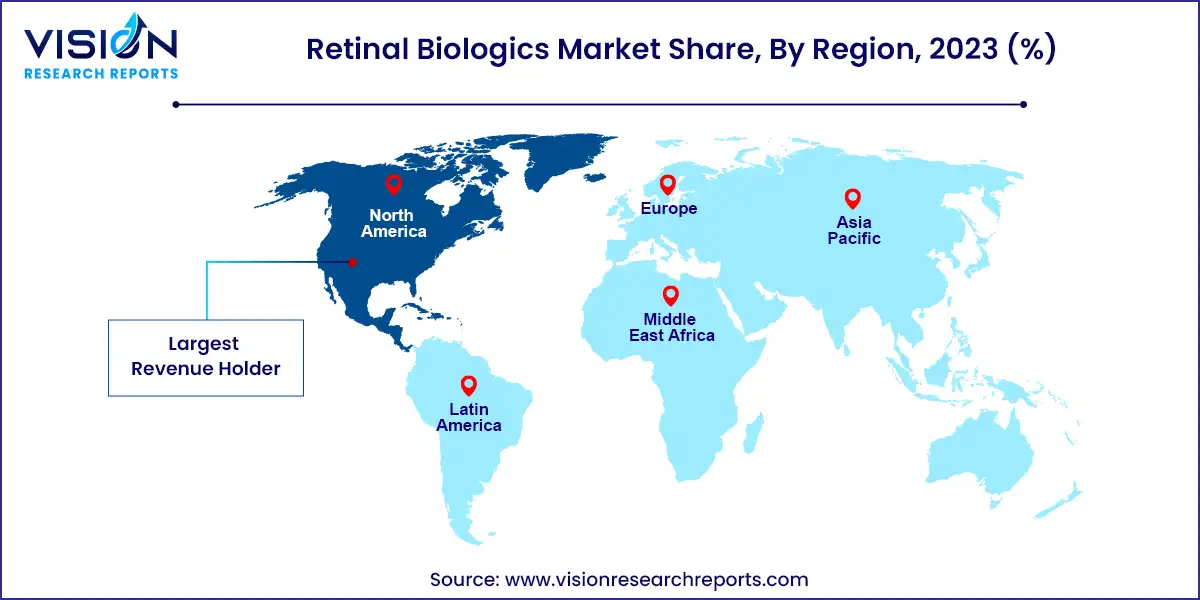

North America emerged as the dominant market player in 2023. The region's strong foothold is expected to further propel market growth, bolstered by the presence of major industry players. Moreover, key players in North America are implementing diverse strategies such as acquisitions, product launches, and partnerships to fortify their position in the region.

For example, in June 2020, Novartis announced an update to the label of Beovu approved by the U.S. FDA. This update includes a new subsection focusing on retinal vasculitis or retinal vascular occlusion under 'Warnings and Precautions'. Additionally, in September 2021, the U.S. FDA granted approval for the first biosimilar, Byooviz, designed for the treatment of macular degeneration disease

By Disease Indication

By Drug Class

By End-Users

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others