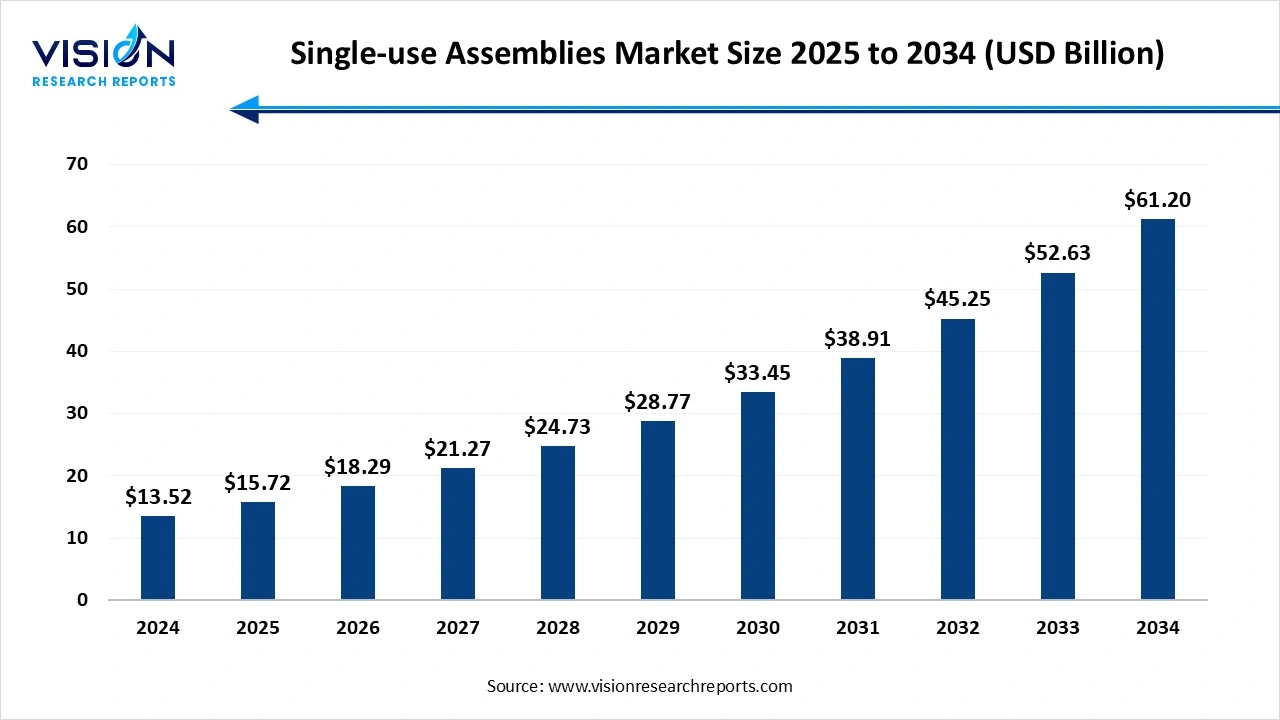

The global single-use assemblies market size was accounted at USD 13.52 billion in 2024 and it is projected to hit around USD 61.20 billion by 2034, growing at a CAGR of 16.3% from 2025 to 2034. The market growth is driven by the growing demand for biologics and personalized medicines, the Single-use Assemblies Market is experiencing robust growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.52 billion |

| Revenue Forecast by 2034 | USD 61.20 billion |

| Growth rate from 2025 to 2034 | CAGR of 16.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Danaher Corporation (Cytiva and Pall Corporation), Saint-Gobain Life Sciences, Repligen Corporation, Parker Hannifin Corporation, Avantor, Inc., Entegris, Inc., Corning Incorporated |

The global single-use assemblies market has witnessed significant growth in recent years, driven by increasing adoption of single-use technologies in biopharmaceutical manufacturing. These assemblies, which include tubing, connectors, filters, and sensors, are pre-assembled and sterilized for immediate use, reducing the risk of contamination and cross-contact. They offer operational flexibility, lower labor costs, and faster turnaround times, making them ideal for small-batch and multi-product facilities. With the growing demand for biologics, vaccine, and cell and gene therapies, single-use assemblies are becoming indispensable in streamlining production processes and maintaining high standards of sterility and quality assurance.

The growth of the single-use assemblies market is primarily driven by the rising demand for biopharmaceuticals, including monoclonal antibodies, vaccines, and cell and gene therapies. As these therapies often require highly sterile and flexible manufacturing environments, single-use assemblies provide an ideal solution by reducing the risk of cross-contamination and eliminating the need for extensive cleaning procedures. This not only improves operational efficiency but also accelerates the production timeline, which is critical for time-sensitive therapies.

Another key growth factor is the increasing reliance on contract research organizations (CROs) and contract manufacturing organizations (CMOs), which often utilize single-use systems to enhance scalability and lower production costs. These assemblies also support the shift toward small-batch and personalized medicine production, where traditional stainless-steel systems may lack the required flexibility.

One of the primary challenges faced by the single-use assemblies market is the environmental impact associated with the disposal of plastic-based components. Since these systems are designed for one-time use, they generate substantial amounts of biomedical and plastic waste, raising concerns around sustainability and regulatory compliance. While efforts are being made to develop recyclable or biodegradable materials, the industry still lacks standardized protocols for waste management and recycling.

Another significant challenge is the risk of supply chain disruptions and quality inconsistencies. The single-use assemblies market heavily relies on specialized components and materials, and any delay or shortage can significantly impact biomanufacturing timelines. Moreover, ensuring product compatibility and consistent quality across different batches and suppliers remains a hurdle. Regulatory requirements for validation and documentation are also stringent, especially when switching suppliers or integrating new materials, adding further complexity.

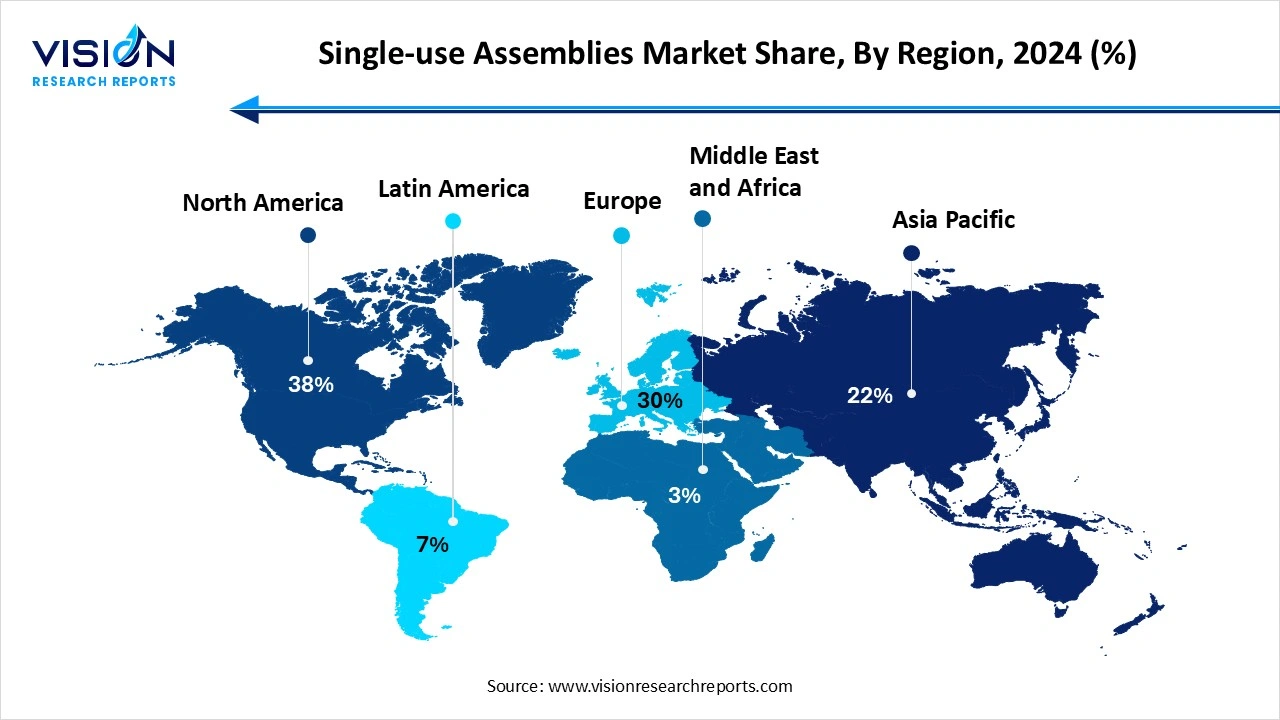

North America held the largest share of the regional market in 2024, accounting for 38% of the total revenue. North America held the largest share of the global single-use assemblies market, primarily driven by the strong presence of leading biopharmaceutical companies, advanced healthcare infrastructure, and high investment in R&D activities. The region benefits from early adoption of innovative bioprocessing technologies, stringent regulatory standards, and a mature ecosystem of contract manufacturing organizations. The United States, in particular, plays a crucial role due to its well-established biologics production capabilities and growing demand for cell and gene therapies.

The Asia Pacific region is projected to witness the fastest growth during the forecast period. This expansion is fueled by the rapid development of biopharmaceutical infrastructure, favorable government initiatives, and rising investments by global pharmaceutical companies in countries such as China, India, and South Korea. The increasing prevalence of chronic diseases, expanding patient populations, and growing clinical trial activity in the region also contribute to the rising demand for cost-effective and scalable single-use solutions.

The Asia Pacific region is projected to witness the fastest growth during the forecast period. This expansion is fueled by the rapid development of biopharmaceutical infrastructure, favorable government initiatives, and rising investments by global pharmaceutical companies in countries such as China, India, and South Korea. The increasing prevalence of chronic diseases, expanding patient populations, and growing clinical trial activity in the region also contribute to the rising demand for cost-effective and scalable single-use solutions.

The filtration assemblies segment accounted for the largest share of the overall revenue, contributing 29% in 2024. These assemblies are essential for removing particulates, bacteria, and other impurities during upstream and downstream processing, ensuring product purity and safety. Filtration assemblies offer several advantages, including reduced risk of cross-contamination, shorter turnaround times, and minimal validation requirements. As biomanufacturers strive to enhance operational efficiency and maintain high-quality standards, the demand for pre-validated, ready-to-use filtration assemblies continues to grow.

The bag assemblies segment is projected to register the highest CAGR during the forecast period from 2025 to 2034. These assemblies are typically composed of multi-layer polymer films that ensure high levels of strength, flexibility, and sterility. Their adoption reduces the need for cleaning and sterilization, offering cost and time savings to manufacturers. Bag assemblies are particularly beneficial in modular and flexible manufacturing facilities, where speed and adaptability are crucial.

The filtration segment led the market, capturing the highest revenue share of 29% in 2024. Single-use filtration assemblies help in removing impurities, particulates, and microorganisms from process fluids to ensure product sterility and integrity. These systems are commonly utilized in both upstream and downstream processes, including harvest clarification, viral filtration, and final fill-finish steps. The use of disposable filtration assemblies minimizes the risk of cross-contamination, reduces cleaning validation efforts, and enhances overall process efficiency.

The cell culture and mixing segment is projected to experience the highest CAGR during the forecast period from 2025 to 2034. These assemblies are essential for cultivating cells in a controlled environment and for the consistent mixing of media, buffers, and other process fluids. Single-use systems provide flexible, closed-loop environments that maintain sterility while supporting high cell viability and productivity. Their use significantly reduces the setup time and operational complexities compared to traditional stainless-steel systems.

The customized solutions segment led the global industry in 2024, capturing the largest share of 72% in 2024. These solutions are developed in close collaboration with end-users to ensure compatibility with existing systems, optimize workflow, and meet regulatory and operational standards. The flexibility to modify tubing lengths, connectors, filtration units, and other components makes customized assemblies ideal for complex bioprocessing needs, including multi-product and small-batch production environments.

Standard solutions, on the other hand, are gaining popularity for their cost-effectiveness, quick deployment, and ease of integration in less complex manufacturing environments. These pre-configured assemblies are designed to meet general bioprocessing needs and are readily available, which helps reduce procurement timelines and supports faster facility startup. Standard solutions are particularly beneficial for small and mid-sized companies or for early-stage production where rapid implementation is essential. While they may offer less flexibility compared to customized assemblies, advancements in standardization and modular design have significantly improved their performance and adaptability.

The biopharmaceutical and pharmaceutical companies segment dominated the global industry, contributing the highest share of 50% to the overall revenue in 2024. These companies rely on single-use assemblies to maintain sterility, reduce downtime, and increase process flexibility. The adoption of single-use systems enables faster changeovers, minimizes cleaning and validation requirements, and supports the production of high-value biologics such as monoclonal antibodies, cell and gene therapies, and vaccines.

The CROs and CMOs segment is anticipated to record the fastest CAGR throughout the forecast period. These service providers play a critical role in outsourcing strategies adopted by biopharma companies, offering flexible and scalable manufacturing capabilities. Single-use assemblies allow CROs and CMOs to manage multiple client projects with varying process requirements while minimizing cross-contamination risks and operational turnaround times. The demand for these assemblies among CROs and CMOs is further fueled by the rise in clinical trials, especially for biologics and personalized medicine.

By Product

By Application

By Solution

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Single-use Assemblies Market

5.1. COVID-19 Landscape: Single-use Assemblies Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Single-use Assemblies Market, By Product

8.1. Single-use Assemblies Market, by Product, 2025-2034

8.1.1. Bag Assemblies

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Filtration Assemblies

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Bottle Assemblies

8.1.3.1. Market Revenue and Forecast (2025-2034)

8.1.4. Tubing Assemblies

8.1.4.1. Market Revenue and Forecast (2025-2034)

8.1.5. Other Products

8.1.5.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Single-use Assemblies Market, By Application

9.1. Single-use Assemblies Market, by Application, 2025-2034

9.1.1. Filtration

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Cell Culture & Mixing

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Storage

9.1.3.1. Market Revenue and Forecast (2025-2034)

9.1.4. Sampling

9.1.4.1. Market Revenue and Forecast (2025-2034)

9.1.5. Fill-finish Applications

9.1.5.1. Market Revenue and Forecast (2025-2034)

9.1.6. Other Applications

9.1.6.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Single-use Assemblies Market, By Solution

10.1. Single-use Assemblies Market, by Solution, 2025-2034

10.1.1. Customized Solutions

10.1.1.1. Market Revenue and Forecast (2025-2034)

10.1.2. Standard Solutions

10.1.2.1. Market Revenue and Forecast (2025-2034)

Chapter 11. Global Single-use Assemblies Market, By End-user

11.1. Single-use Assemblies Market, by End-user, 2025-2034

11.1.1. Biopharmaceutical & Pharmaceutical Companies

11.1.1.1. Market Revenue and Forecast (2025-2034)

11.1.2. CROs & CMOs

11.1.2.1. Market Revenue and Forecast (2025-2034)

11.1.3. Academic & Research Institutes

11.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 12. Global Single-use Assemblies Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2025-2034)

12.1.2. Market Revenue and Forecast, by Application (2025-2034)

12.1.3. Market Revenue and Forecast, by Solution (2025-2034)

12.1.4. Market Revenue and Forecast, by End-user (2025-2034)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2025-2034)

12.1.5.2. Market Revenue and Forecast, by Application (2025-2034)

12.1.5.3. Market Revenue and Forecast, by Solution (2025-2034)

12.1.5.4. Market Revenue and Forecast, by End-user (2025-2034)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2025-2034)

12.1.6.2. Market Revenue and Forecast, by Application (2025-2034)

12.1.6.3. Market Revenue and Forecast, by Solution (2025-2034)

12.1.6.4. Market Revenue and Forecast, by End-user (2025-2034)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2025-2034)

12.2.2. Market Revenue and Forecast, by Application (2025-2034)

12.2.3. Market Revenue and Forecast, by Solution (2025-2034)

12.2.4. Market Revenue and Forecast, by End-user (2025-2034)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2025-2034)

12.2.5.2. Market Revenue and Forecast, by Application (2025-2034)

12.2.5.3. Market Revenue and Forecast, by Solution (2025-2034)

12.2.5.4. Market Revenue and Forecast, by End-user (2025-2034)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2025-2034)

12.2.6.2. Market Revenue and Forecast, by Application (2025-2034)

12.2.6.3. Market Revenue and Forecast, by Solution (2025-2034)

12.2.6.4. Market Revenue and Forecast, by End-user (2025-2034)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2025-2034)

12.2.7.2. Market Revenue and Forecast, by Application (2025-2034)

12.2.7.3. Market Revenue and Forecast, by Solution (2025-2034)

12.2.7.4. Market Revenue and Forecast, by End-user (2025-2034)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2025-2034)

12.2.8.2. Market Revenue and Forecast, by Application (2025-2034)

12.2.8.3. Market Revenue and Forecast, by Solution (2025-2034)

12.2.8.4. Market Revenue and Forecast, by End-user (2025-2034)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2025-2034)

12.3.2. Market Revenue and Forecast, by Application (2025-2034)

12.3.3. Market Revenue and Forecast, by Solution (2025-2034)

12.3.4. Market Revenue and Forecast, by End-user (2025-2034)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2025-2034)

12.3.5.2. Market Revenue and Forecast, by Application (2025-2034)

12.3.5.3. Market Revenue and Forecast, by Solution (2025-2034)

12.3.5.4. Market Revenue and Forecast, by End-user (2025-2034)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2025-2034)

12.3.6.2. Market Revenue and Forecast, by Application (2025-2034)

12.3.6.3. Market Revenue and Forecast, by Solution (2025-2034)

12.3.6.4. Market Revenue and Forecast, by End-user (2025-2034)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2025-2034)

12.3.7.2. Market Revenue and Forecast, by Application (2025-2034)

12.3.7.3. Market Revenue and Forecast, by Solution (2025-2034)

12.3.7.4. Market Revenue and Forecast, by End-user (2025-2034)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2025-2034)

12.3.8.2. Market Revenue and Forecast, by Application (2025-2034)

12.3.8.3. Market Revenue and Forecast, by Solution (2025-2034)

12.3.8.4. Market Revenue and Forecast, by End-user (2025-2034)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2025-2034)

12.4.2. Market Revenue and Forecast, by Application (2025-2034)

12.4.3. Market Revenue and Forecast, by Solution (2025-2034)

12.4.4. Market Revenue and Forecast, by End-user (2025-2034)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2025-2034)

12.4.5.2. Market Revenue and Forecast, by Application (2025-2034)

12.4.5.3. Market Revenue and Forecast, by Solution (2025-2034)

12.4.5.4. Market Revenue and Forecast, by End-user (2025-2034)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2025-2034)

12.4.6.2. Market Revenue and Forecast, by Application (2025-2034)

12.4.6.3. Market Revenue and Forecast, by Solution (2025-2034)

12.4.6.4. Market Revenue and Forecast, by End-user (2025-2034)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2025-2034)

12.4.7.2. Market Revenue and Forecast, by Application (2025-2034)

12.4.7.3. Market Revenue and Forecast, by Solution (2025-2034)

12.4.7.4. Market Revenue and Forecast, by End-user (2025-2034)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2025-2034)

12.4.8.2. Market Revenue and Forecast, by Application (2025-2034)

12.4.8.3. Market Revenue and Forecast, by Solution (2025-2034)

12.4.8.4. Market Revenue and Forecast, by End-user (2025-2034)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2025-2034)

12.5.2. Market Revenue and Forecast, by Application (2025-2034)

12.5.3. Market Revenue and Forecast, by Solution (2025-2034)

12.5.4. Market Revenue and Forecast, by End-user (2025-2034)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2025-2034)

12.5.5.2. Market Revenue and Forecast, by Application (2025-2034)

12.5.5.3. Market Revenue and Forecast, by Solution (2025-2034)

12.5.5.4. Market Revenue and Forecast, by End-user (2025-2034)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2025-2034)

12.5.6.2. Market Revenue and Forecast, by Application (2025-2034)

12.5.6.3. Market Revenue and Forecast, by Solution (2025-2034)

12.5.6.4. Market Revenue and Forecast, by End-user (2025-2034)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sartorius AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Danaher Corp.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Merck KGaA

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Avantor

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Lonza

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Saint-Gobain

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Corning Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Entegris

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. KUHNER AG

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others