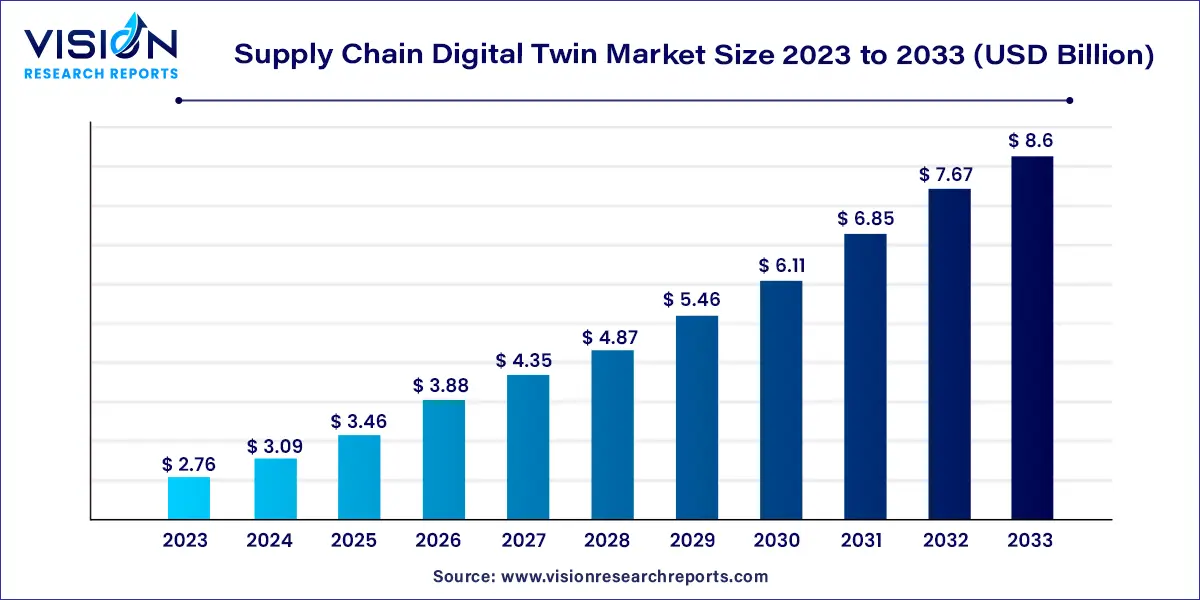

The global supply chain digital twin market size was estimated at around USD 2.76 billion in 2023 and it is projected to hit around USD 8.6 billion by 2033, growing at a CAGR of 12.03% from 2024 to 2033.

The supply chain digital twin market is at the forefront of revolutionizing how businesses manage their supply chain operations. In essence, a digital twin is a virtual replica of a physical system or process, using real-time data and advanced technologies such as IoT devices, machine learning, and artificial intelligence to create a dynamic and highly accurate simulation. When applied to the supply chain, this technology provides businesses with unparalleled insights, enabling them to optimize processes, predict outcomes, and enhance decision-making.

The exponential growth of the supply chain digital twin market can be attributed to several key factors driving its expansion. Firstly, the increasing integration of advanced technologies such as IoT devices and artificial intelligence has propelled the development of sophisticated digital twin models, enhancing the accuracy and efficiency of supply chain operations. Secondly, the rising demand for predictive analytics and real-time data insights has urged businesses to adopt digital twins, enabling them to forecast market trends, optimize inventory management, and streamline production processes. Additionally, the imperative need for risk management and resilience in the face of global uncertainties has further fueled the adoption of digital twin technology. By simulating various supply chain disruptions, companies can proactively strategize and ensure uninterrupted operations.

| Report Coverage | Details |

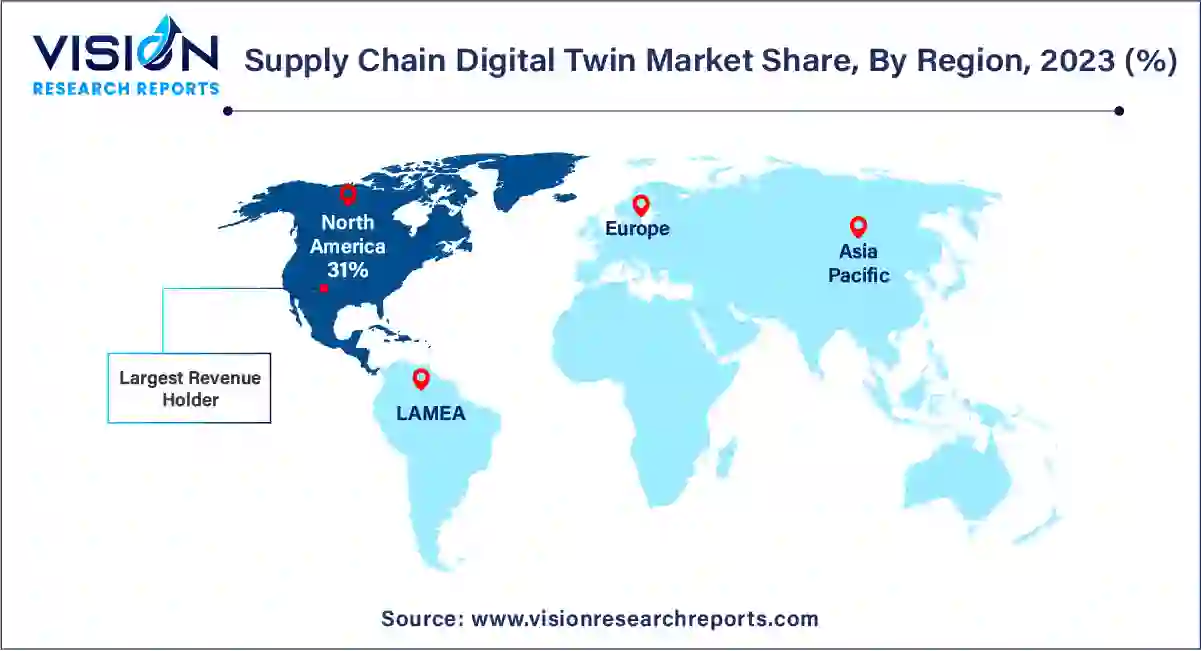

| Revenue Share of North America in 2023 | 31% |

| CAGR of Europe from 2024 to 2033 | 12.44% |

| Revenue Forecast by 2033 | USD 8.6 billion |

| Growth Rate from 2024 to 2033 | CAGR of 12.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The hardware segment held the largest revenue share of 44% in 2023. This hardware includes a wide array of devices such as sensors, RFID tags, GPS systems, and IoT-enabled devices. These components are strategically deployed across various points in the supply chain, from manufacturing plants to warehouses and transportation vehicles. Sensors, for instance, monitor factors like temperature, humidity, and inventory levels, generating continuous streams of data. GPS systems offer precise location tracking, optimizing routes and enhancing overall logistics.

The software segment is expected to register at a CAGR of 12.34% over the forecast period. Software component of Supply Chain Digital Twins acts as the intelligence behind the operation. Advanced algorithms, machine learning models, and data analytics software process the vast amounts of data collected by hardware components. This software interprets, analyzes, and visualizes the data, allowing businesses to gain actionable insights into their supply chain dynamics. It facilitates predictive modeling, scenario simulations, and decision-making processes.

The on-premise segment held the largest revenue share of 53% in 2022. On-premise deployment refers to the installation of Supply Chain Digital Twin systems within an organization's physical infrastructure. In this mode, all software, hardware, and data storage are maintained within the organization's premises. This deployment method provides businesses with a high degree of control and customization. Companies opting for on-premise deployment often have specific security and compliance requirements, necessitating direct management over their digital twin solutions. This approach allows for tailored configurations, ensuring seamless integration with existing systems and processes.

The cloud segment is predicated to grow at a CAGR of 12.76% over the forecast period. Cloud-based deployment, on the other hand, leverages remote servers and networks hosted on the internet to store, manage, and process Supply Chain Digital Twin data. Cloud solutions are characterized by their scalability, flexibility, and accessibility. By opting for cloud deployment, businesses can significantly reduce the burden of managing physical infrastructure. Cloud service providers handle maintenance, updates, and security protocols, enabling organizations to focus on leveraging digital twin technology for strategic decision-making. This mode offers enhanced agility, allowing businesses to scale resources according to demand, ensuring cost-efficiency.

The large enterprises segment dominated the biggest revenue share of 67% in 2023. Large enterprises, often characterized by their extensive resources, global reach, and complex supply chain networks, are at the forefront of embracing Supply Chain Digital Twin solutions. These organizations possess the financial capacity to invest in sophisticated digital twin technologies, enabling them to create comprehensive and intricate digital replicas of their supply chains. For large enterprises, digital twins offer unprecedented visibility into their operations, allowing them to optimize production processes, streamline logistics, and enhance overall efficiency..

SMEs, while operating on a comparatively smaller scale, are increasingly recognizing the transformative potential of Supply Chain Digital Twins. With the advancement of technology and the advent of user-friendly digital twin solutions, SMEs are now able to leverage this technology to enhance their supply chain capabilities. Digital twins offer SMEs the opportunity to gain deep insights into their operations without the need for extensive investments in infrastructure and IT personnel. These insights enable SMEs to optimize their inventory management, improve production efficiency, and enhance demand forecasting.

The automotive segment captured over 26% of revenue share in 2023. Within the automotive sector, Supply Chain Digital Twins have revolutionized traditional manufacturing processes and supply chain management. Automotive companies deploy digital twins to create virtual representations of their entire supply chain networks, enabling precise monitoring of every component and process. Digital twins allow companies to simulate various production scenarios, enhancing the efficiency of assembly lines, minimizing downtime, and ensuring just-in-time deliveries. In addition, digital twins play a vital role in predictive maintenance, enabling automotive companies to anticipate machinery failures, reduce maintenance costs, and enhance overall production reliability.

In the broader manufacturing sector, Supply Chain Digital Twins have become indispensable tools for enhancing productivity, efficiency, and flexibility. Manufacturers utilize digital twins to gain real-time visibility into their supply chains, enabling them to respond promptly to market demands and fluctuations. Digital twins facilitate streamlined collaboration among various manufacturing units, suppliers, and distributors, ensuring seamless communication and efficient inventory management.

North America dominated the global market with the largest market share of 31% in 2023. In North America, particularly in the United States, the adoption of Supply Chain Digital Twins is driven by a robust technological infrastructure, a high level of awareness about advanced technologies, and a strong emphasis on innovation. Industries such as manufacturing, automotive, and aerospace have been early adopters, leveraging digital twins to optimize their supply chains, enhance operational efficiency, and maintain a competitive edge.

Europe is anticipated to grow at a notable CAGR of 12.44% during the forecast period. Europe is witnessing significant growth in the adoption of Supply Chain Digital Twins, propelled by stringent regulatory standards, especially in industries such as healthcare and pharmaceuticals. European countries, known for their focus on sustainable practices, also leverage digital twins to create eco-friendly supply chains, aligning with the region's environmental goals.

By Component

By Deployment Mode

By Enterprise Size

By Industry Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Supply Chain Digital Twin Market

5.1. COVID-19 Landscape: Supply Chain Digital Twin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Supply Chain Digital Twin Market, By Component

8.1. Supply Chain Digital Twin Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Supply Chain Digital Twin Market, By Deployment Mode

9.1. Supply Chain Digital Twin Market, by Deployment Mode, 2024-2033

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Supply Chain Digital Twin Market, By Enterprise Size

10.1. Supply Chain Digital Twin Market, by Enterprise Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small and Medium Size Enterprises (SMEs)

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Supply Chain Digital Twin Market, By Industry Vertical

11.1. Supply Chain Digital Twin Market, by Industry Vertical, 2024-2033

11.1.1. Manufacturing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Automotive

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Aerospace and Defense

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Retail

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Pharmaceuticals

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Consumer Goods

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Supply Chain Digital Twin Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

Chapter 13. Company Profiles

13.1. IBM

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Oracle

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. SAP

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Dassault Systèmes

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. AVEVA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Siemens Digital Industries Software

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Kinaxis

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. The AnyLogic Company

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Simio

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Logivations

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others