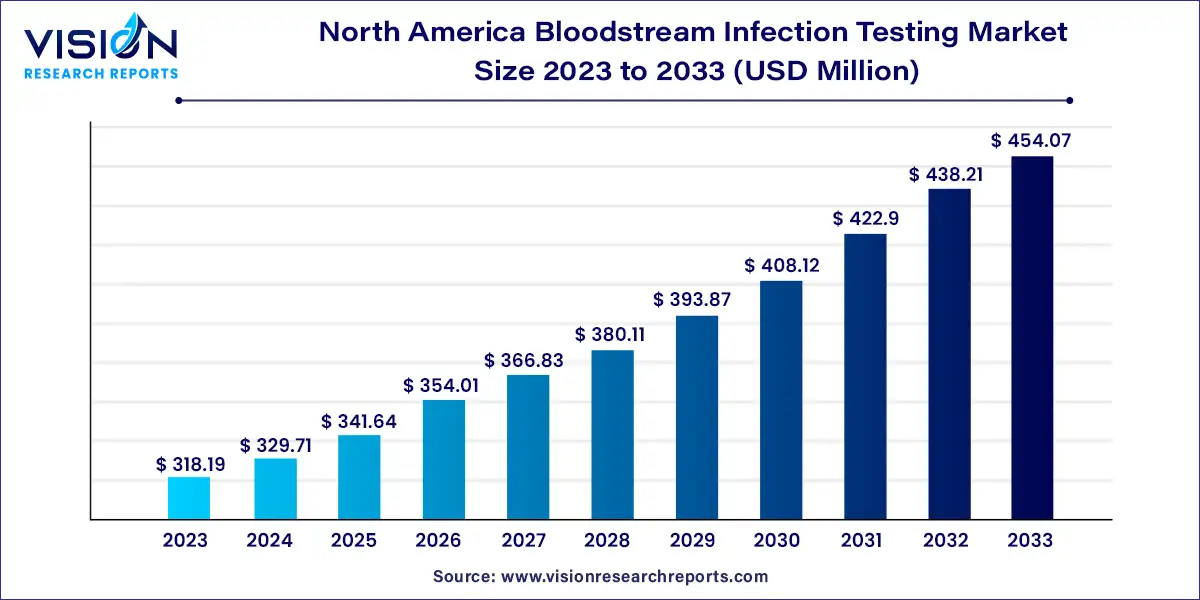

The North America bloodstream infection testing market size was estimated at around USD 318.19 million in 2023 and it is projected to hit around USD 454.07 million by 2033, growing at a CAGR of 3.62% from 2024 to 2033.

The North America bloodstream infection testing market stands at the forefront of diagnostic advancements, propelled by the imperative need for accurate and timely identification of bloodstream infections (BSIs). Bloodstream infections, a significant cause of morbidity and mortality, require swift diagnosis and intervention for effective patient management.

The growth of the North America bloodstream infection testing market is driven by an increasing incidence of bloodstream infections, driven by factors such as the aging population, rising prevalence of chronic diseases, and widespread use of invasive medical procedures, necessitates enhanced diagnostic capabilities. Additionally, growing awareness among healthcare professionals regarding the importance of early detection and prompt intervention for bloodstream infections contributes to market expansion. Moreover, technological advancements in diagnostic methodologies, including molecular diagnostics and rapid blood culture systems, enable clinicians to achieve faster and more accurate diagnoses, further propelling market growth.

| Report Coverage | Details |

| Market Size in 2023 | USD 318.19 million |

| Revenue Forecast by 2033 | USD 454.07 million |

| Growth rate from 2024 to 2033 | CAGR of 3.62% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The reagents and consumables segment accounted for the largest revenue share of 90% in 2023. The segment is also expected to expand at the fastest growth rate over the forecast period. The segment's growth is driven by the easy availability and frequent purchase of screening products for donors and recipients. Moreover, the market is propelled by the wide range of blood grouping, typing, and donor screening reagents, kits, and assays offered by North American and local manufacturers.

Additionally, the expanding product portfolio caters to the diverse needs of healthcare facilities, further fueling the growth of the segment in the regional bloodstream infection testing market. For instance, in March 2022, Accelerate Diagnostics, Inc., an in-vitro diagnostics company, launched the Accelerate Arc system. It comprises the Accelerated Arc Module and blood culture (BC) kit, an automated path for the accurate and rapid microbial recognition of positive blood cultures.

The blood culture segment accounted for the largest revenue share of 76% in 2023 and is expected to witness the fastest CAGR over the forecast period. Blood culture testing has continued to evolve with technological advancements. The introduction of automated blood culture systems and faster detection methods have enhanced result efficiency and turnaround time, further cementing the segment’s dominance.

For instance, in October 2022, BD, a global medical technology company, and Magnolia Medical Technologies, Inc. entered a commercial agreement. The collaboration aims to assist U.S. hospitals in reducing blood culture contamination, enhancing testing accuracy, and ultimately improving clinical outcomes. Therefore, such initiatives with effective tools and technologies enhance the reliability and efficiency of blood culture testing, thereby boosting the demand for such methods.

Moreover, the blood culture segment is expected to experience growth due to the increasing number of cancer cases, bloodstream infections (BSIs), and sepsis. For instance, in June 2021, Accelerate Diagnostics, a biotech company based in Tucson, Arizona, USA, was granted funding of USD 578,000 by CARB-X. The funds are specifically allocated for developing innovative fiber optic technology aimed at diagnosing sepsis or assessing the risk of sepsis. This financial support signifies a significant opportunity for the company to advance its sepsis diagnostic capabilities and contribute to improving patient outcomes.

The PCR segment held the largest revenue share of 61% in 2023 in the North America bloodstream infection testing market and is expected to expand at the fastest CAGR over the forecast period. The introduction of technologically advanced PCR tests, government initiatives, increasing prevalence of targeted diseases, and application expansion of existing technologies are expected to drive segment growth over the forecast period.

For instance, PLEX-ID (Abbott Molecular) is an advanced multiplex real-time automated PCR system with amplicon product detection using ESI MS technology. This innovative solution enables rapid and accurate genotypic characterization of various pathogens, including bacteria, fungi, viruses, and parasites within a given sample, such as cultures or whole blood. By utilizing broad-range primers targeting pathogen groups instead of specific species, PLEX-ID provides comprehensive and efficient identification capabilities. This advanced technology strengthens diagnostic capabilities in infectious disease management, offering businesses a valuable tool to enhance patient care and streamline laboratory workflows, thereby fueling segment growth.

The hospital and diagnostic centers segment accounted for the largest revenue share of 46% in 2023 and is expected to witness the fastest CAGR from 2024 to 2033. Hospitals often have R&D departments dedicated to studying bloodstream infections and developing new diagnostic tools, therapies, and preventive strategies. Their expertise and resources contribute to advancements in the field, further solidifying their position in the bloodstream infection testing market. Hospitals also possess advanced healthcare infrastructure, including well-equipped laboratories, diagnostic facilities, and skilled healthcare professionals. This allows for efficient diagnosis, monitoring, and treatment of bloodstream infections, leading to better patient outcomes.

Moreover, hospitals frequently collaborate with medical device manufacturers, pharmaceutical companies, and diagnostic companies to develop and test innovative solutions for bloodstream infection management. These collaborations ensure the availability of advanced products and technologies within the hospital setting, strengthening their dominance in the market. In addition, advanced infrastructure, infection control measures, research capabilities, and collaborations with industry contribute to their dominant position in the bloodstream infection testing market in the region.

By Product

By Sample Type

By Technology

By End-user

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Bloodstream Infection Testing Market

5.1. COVID-19 Landscape: North America Bloodstream Infection Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Bloodstream Infection Testing Market, By Product

8.1. North America Bloodstream Infection Testing Market, by Product, 2024-2033

8.1.1. Reagents & Consumables

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Bloodstream Infection Testing Market, By Sample Type

9.1. North America Bloodstream Infection Testing Market, by Sample Type, 2024-2033

9.1.1. Whole Blood

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Blood Culture

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Bloodstream Infection Testing Market, By Technology

10.1. North America Bloodstream Infection Testing Market, by Technology, 2024-2033

10.1.1. PCR

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Mass Spectroscopy

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. In Situ Hybridization

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. North America Bloodstream Infection Testing Market, By End-user

11.1. North America Bloodstream Infection Testing Market, by End-user, 2024-2033

11.1.1. Hospitals & Diagnostic Centers

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Custom Laboratory Service Providers

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Academic & Research Institutes

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. North America Bloodstream Infection Testing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Technology (2021-2033)

12.1.4. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 13. Company Profiles

13.1. bioMérieux SA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. BD

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cepheid

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Seegene Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Abbott

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. F. Hoffmann-La Roche Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Siemens Healthcare Limited

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Luminex Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Bruker

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Accelerate Diagnostics, Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others