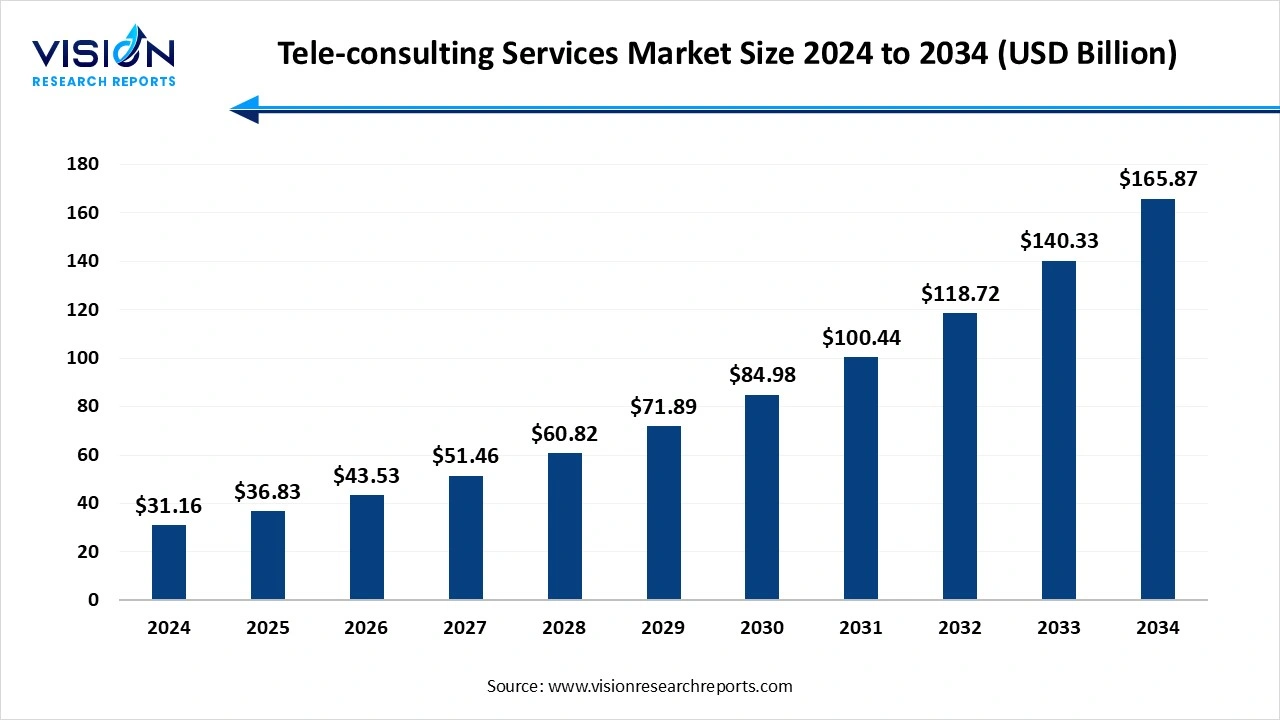

The global tele-consulting services market size was estimated at USD 31.16 billion in 2024 and it is expected to surpass around USD 165.87 billion by 2034, poised to grow at a CAGR of 18.20% from 2025 to 2034.

Key Pointers

Key Pointers The tele-consulting services market has witnessed significant growth in recent years, driven by advancements in digital health technologies and an increasing demand for accessible, cost-effective healthcare solutions. This market encompasses virtual medical consultations across various specialties, enabling patients to connect with healthcare professionals remotely via video, phone, or chat platforms. The COVID-19 pandemic played a pivotal role in accelerating adoption, with regulatory support and insurance coverage reforms further fueling expansion. Key players in the market are investing in AI-driven platforms, electronic health record integration, and enhanced user interfaces to improve service delivery and patient outcomes.

One of the primary growth drivers of the tele-consulting services market is the increasing global demand for accessible and affordable healthcare. With rising healthcare costs and a shortage of medical professionals, especially in rural and underserved regions, tele-consulting provides a scalable solution that bridges the gap between patients and providers. The proliferation of smartphones, high-speed internet connectivity, and user-friendly telehealth platforms has further empowered patients to seek medical consultations without the need for physical visits.

Another critical factor contributing to the market's growth is the evolving regulatory landscape and insurance reimbursement models. Governments and health agencies across the globe have introduced favorable policies to integrate telehealth into mainstream care, especially following the COVID-19 pandemic. This includes relaxed licensing regulations, expanded service coverage, and digital infrastructure investments. Simultaneously, advances in artificial intelligence, wearable health devices, and cloud-based EHR systems are enhancing the quality and efficiency of tele-consulting services, making them a viable long-term solution for both primary and specialized care.

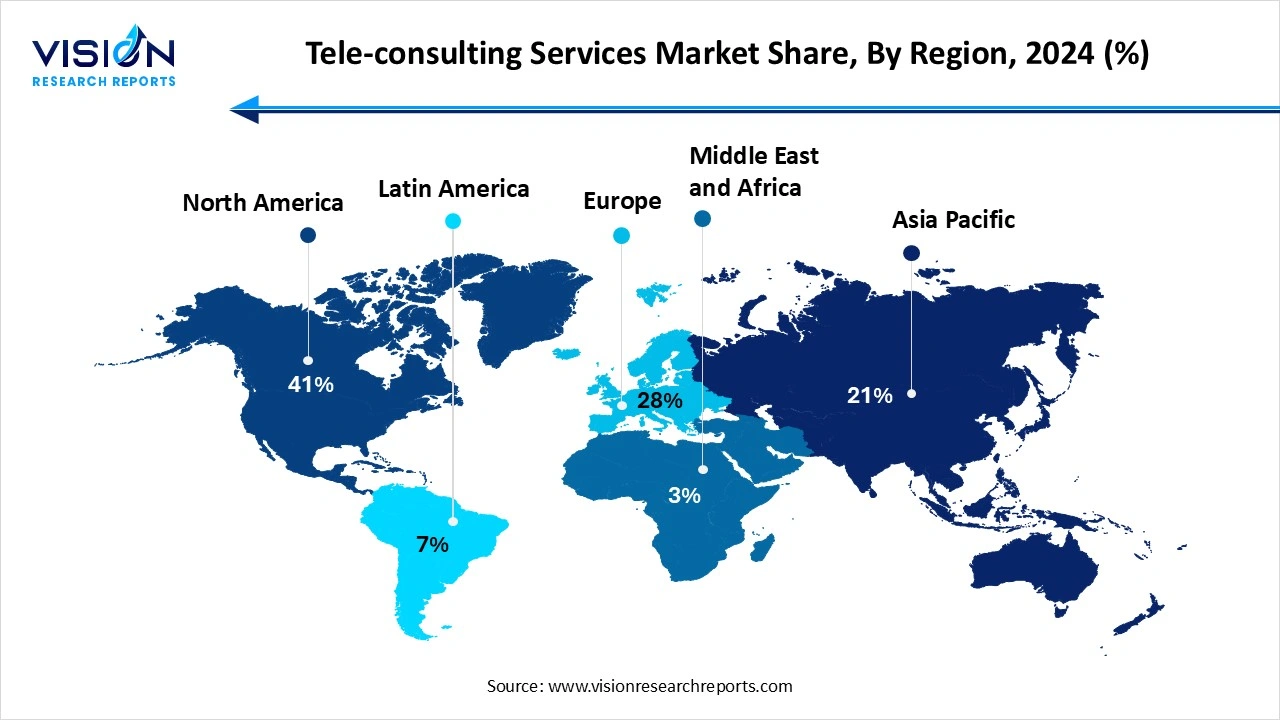

North America led the global tele-consulting services market in 2024, accounting for 41% of the total revenue share. North America remains a dominant region, driven by robust digital health ecosystems, high internet penetration, and strong government support for telemedicine. The United States, in particular, has witnessed rapid growth fueled by favorable reimbursement policies, widespread insurance coverage, and the adoption of advanced telehealth platforms. Canada also contributes to this momentum through public healthcare initiatives that emphasize remote care to address vast rural populations.

The tele-consulting services industry in the Asia Pacific region is projected to experience the most rapid growth during the forecast period. Is a emerging as the fastest-growing region due to increasing healthcare demands, expanding internet access, and government initiatives promoting digital health in countries like China, India, Japan, and Australia. The region’s vast population base and rising chronic disease prevalence further amplify the need for tele-consulting services.

The tele-consulting services industry in the Asia Pacific region is projected to experience the most rapid growth during the forecast period. Is a emerging as the fastest-growing region due to increasing healthcare demands, expanding internet access, and government initiatives promoting digital health in countries like China, India, Japan, and Australia. The region’s vast population base and rising chronic disease prevalence further amplify the need for tele-consulting services.

The mental health segment accounted for the largest market share at 37% in 2024 and is expected to experience the fastest growth throughout the forecast period. The stigma surrounding mental illness, coupled with limited access to licensed therapists in many areas, has made virtual consultations a preferred and often essential option for many patients. Tele-consulting platforms offer discreet, timely, and flexible access to mental health professionals, helping individuals receive therapy, counseling, and psychiatric evaluations without the barriers of location or wait times.

The dermatology sector is expected to experience significant growth throughout the forecast period. Through high-resolution image sharing and video consultations, dermatologists can effectively assess and provide guidance on a wide range of issues, including acne, rashes, eczema, and chronic conditions like psoriasis. This digital approach is especially beneficial for patients in remote areas who may lack access to specialized care. The growing demand for cosmetic dermatology consultations, driven by increased awareness of aesthetic treatments, has also contributed to market growth.

The real-time segment accounted for the largest market share, capturing 40% of the total in 2024. This modality allows patients and healthcare professionals to engage in live audio or video consultations, simulating a traditional face-to-face visit. Real-time tele-consulting is particularly valuable for primary care, mental health services, and emergency medical advice, where prompt interaction is crucial for diagnosis and treatment. The adoption of this modality has been accelerated by improvements in broadband connectivity, the widespread use of smartphones, and the integration of user-friendly platforms that ensure seamless communication.

The others segment is anticipated to witness the fastest growth over the forecast period. Store-and-forward tele-consulting, or asynchronous telemedicine, is another significant modality that contributes to the efficiency and scalability of remote healthcare services. In this model, patients or healthcare providers capture and transmit medical data such as images, reports, or recorded videos to specialists who review the information at a later time. This approach is especially effective in specialties like dermatology, radiology, and pathology, where detailed visuals or test results are analyzed before diagnosis. Store-and-forward systems eliminate the need for simultaneous availability of both parties, making it a flexible and cost-effective solution, particularly in regions with limited access to specialists.

By payment mode, the government and public payers segment accounted for the largest share of the market, representing 41% in 2024. Many countries have incorporated tele-consulting services into national health strategies to improve healthcare delivery, reduce systemic costs, and address physician shortages. Public health agencies have increasingly supported digital health infrastructure through funding, policy development, and partnerships with technology providers. In regions with universal healthcare, such as parts of Europe and Canada, tele-consulting is often fully or partially subsidized, making it accessible to a wide demographic.

Insurance reimbursement models also significantly influence the adoption and scalability of tele-consulting services. As virtual care becomes a mainstream component of medical practice, private and public insurers are updating policies to include coverage for a range of telehealth services. Initially limited in scope, insurance reimbursement for tele-consulting has expanded to cover mental health therapy, chronic disease management, follow-up visits, and even certain preventive services. This shift has been particularly notable in markets like the United States, where Medicare and Medicaid have broadened their reimbursement frameworks to include telemedicine.

The web and mobile segment accounted for the largest market share at 79% in 2024 and is expected to experience the fastest growth throughout the forecast period. These digital interfaces allow patients to schedule appointments, engage in video or chat-based consultations, access medical records, and receive prescriptions through user-friendly applications. The increasing penetration of smartphones, widespread internet access, and the evolution of secure health apps have collectively transformed how patients interact with healthcare providers. Mobile health apps are particularly appealing due to their convenience, real-time accessibility, and integration with wearable devices that support remote monitoring. Furthermore, many tele-consulting platforms are now embedding AI-driven features such as symptom checkers and virtual assistants, enhancing the efficiency and personalization of care.

Call center-based delivery models also play an important role in the global tele-consulting ecosystem, especially in regions with limited digital infrastructure or among populations less familiar with smartphones and web applications. These models operate through centralized hubs where trained medical professionals or support staff provide healthcare guidance, triage services, appointment scheduling, and follow-ups over the phone. Call centers have proven especially valuable during health crises and in public health campaigns, offering a reliable channel for disseminating medical advice and conducting health assessments at scale. Additionally, they serve as a critical link in hybrid care models, supporting both digital and in-person services by coordinating care pathways and ensuring patient follow-up.

The tele-hospitals segment dominated the market with a leading share of 52% In 2024. phical boundaries. These virtual extensions of traditional hospitals utilize advanced digital infrastructure to connect patients with a network of specialists, enabling remote diagnosis, treatment planning, and follow-up care. Tele-hospitals are particularly beneficial for rural or underserved areas where access to expert medical professionals is limited. They also support smaller healthcare facilities and clinics through remote consultations with specialists, effectively enhancing the quality of care without the need for patient transfers. By integrating electronic health records, diagnostic imaging, and real-time communication tools, tele-hospitals offer a seamless, coordinated care experience that mirrors in-person hospital visits.

The tele-home segment is expected to experience the most rapid growth during the forecast period. Tele-home care, another critical facility model in the tele-consulting services market, empowers patients to receive medical attention directly from their residences. This model is especially effective for managing chronic conditions, post-operative care, elderly patients, and individuals with mobility challenges. Through remote monitoring devices, video consultations, and digital communication tools, healthcare providers can continuously track vital signs, manage medications, and offer timely interventions without requiring hospital visits. The convenience and comfort of receiving care at home not only enhance patient satisfaction but also contribute to reduced hospital admissions and overall healthcare costs. Tele-home services have gained prominence with the growing focus on patient-centered care and have proven particularly valuable during health emergencies like the COVID-19 pandemic.

The patients segment accounted for the largest market share, capturing 37% of the total in 2024. For patients, tele-consulting offers unparalleled convenience, enabling remote consultations that save time, reduce travel expenses, and provide access to specialists who may not be locally available. This accessibility is particularly beneficial for those living in rural or underserved areas, as well as for patients managing chronic conditions who require frequent monitoring and follow-up. The flexibility of tele-consulting empowers patients to take a more active role in their healthcare decisions, fostering greater adherence to treatment plans and promoting preventive care.

Healthcare providers also represent a crucial segment of the tele-consulting services market, leveraging these platforms to extend their reach and improve clinical efficiency. Tele-consulting enables providers to optimize appointment scheduling, reduce no-show rates, and manage patient loads more effectively. By incorporating virtual consultations into their practice, providers can deliver timely care, conduct follow-ups, and engage in multidisciplinary collaborations without geographic constraints. This not only enhances patient outcomes but also supports providers in addressing physician shortages and reducing burnout by offering flexible work environments.

By Application

By Modality

By Payment Model

By Delivery Model

By Facility

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. End Use Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Tele-consulting Services Market

5.1. COVID-19 Landscape: Tele-consulting Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Tele-consulting Services Market, By Application

8.1. Tele-consulting Services Market, by Application

8.1.1. Primary Care

8.1.1.1. Market Revenue and Forecast

8.1.2. Mental Health

8.1.2.1. Market Revenue and Forecast

8.1.3. Cardiology

8.1.3.1. Market Revenue and Forecast

8.1.4. Dermatology

8.1.4.1. Market Revenue and Forecast

8.1.5. thers (Endocrinology, Orthopedics, Gynecology, etc.)

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Tele-consulting Services Market, By Modality

9.1. Tele-consulting Services Market, by Modality

9.1.1. Store and forward

9.1.1.1. Market Revenue and Forecast

9.1.2. Real time

9.1.2.1. Market Revenue and Forecast

9.1.3. Others

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Tele-consulting Services Market, By Payment Model

10.1. Tele-consulting Services Market, by Payment Model

10.1.1. Self-Pay (Out-of-pocket)

10.1.1.1. Market Revenue and Forecast

10.1.2. Insurance Reimbursement

10.1.2.1. Market Revenue and Forecast

10.1.3. Employer-sponsored

10.1.3.1. Market Revenue and Forecast

10.1.4. Government/Public Payers

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Tele-consulting Services Market, By Delivery Model

11.1. Tele-consulting Services Market, by Delivery Model

11.1.1. Web/Mobile

11.1.1.1. Market Revenue and Forecast

11.1.2. Call Centers

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Tele-consulting Services Market, By Facility

12.1. Tele-consulting Services Market, by Facility

12.1.1. Tele-hospitals

12.1.1.1. Market Revenue and Forecast

12.1.2. Tele-home

12.1.2.1. Market Revenue and Forecast

Chapter 13. Global Tele-consulting Services Market, By End Use

13.1. Tele-consulting Services Market, by End Use

13.1.1. Patients

13.1.1.1. Market Revenue and Forecast

13.1.2. Payers

13.1.2.1. Market Revenue and Forecast

13.1.3. Providers

13.1.3.1. Market Revenue and Forecast

13.1.4. Others

13.1.4.1. Market Revenue and Forecast

Chapter 14. Global Tele-consulting Services Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Application

14.1.2. Market Revenue and Forecast, by Modality

14.1.3. Market Revenue and Forecast, by Payment Model

14.1.4. Market Revenue and Forecast, by Delivery Model

14.1.5. Market Revenue and Forecast, by Facility

14.1.6. Market Revenue and Forecast, by End Use

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Application

14.1.7.2. Market Revenue and Forecast, by Modality

14.1.7.3. Market Revenue and Forecast, by Payment Model

14.1.7.4. Market Revenue and Forecast, by Delivery Model

14.1.8. Market Revenue and Forecast, by Facility

14.1.8.1. Market Revenue and Forecast, by End Use

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Application

14.1.9.2. Market Revenue and Forecast, by Modality

14.1.9.3. Market Revenue and Forecast, by Payment Model

14.1.9.4. Market Revenue and Forecast, by Delivery Model

14.1.10. Market Revenue and Forecast, by Facility

14.1.11. Market Revenue and Forecast, by End Use

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Application

14.2.2. Market Revenue and Forecast, by Modality

14.2.3. Market Revenue and Forecast, by Payment Model

14.2.4. Market Revenue and Forecast, by Delivery Model

14.2.5. Market Revenue and Forecast, by Facility

14.2.6. Market Revenue and Forecast, by End Use

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Application

14.2.8.2. Market Revenue and Forecast, by Modality

14.2.8.3. Market Revenue and Forecast, by Payment Model

14.2.9. Market Revenue and Forecast, by Delivery Model

14.2.10. Market Revenue and Forecast, by Facility

14.2.10.1. Market Revenue and Forecast, by End Use

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Application

14.2.11.2. Market Revenue and Forecast, by Modality

14.2.11.3. Market Revenue and Forecast, by Payment Model

14.2.12. Market Revenue and Forecast, by Delivery Model

14.2.13. Market Revenue and Forecast, by Facility

14.2.14. Market Revenue and Forecast, by End Use

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Application

14.2.15.2. Market Revenue and Forecast, by Modality

14.2.15.3. Market Revenue and Forecast, by Payment Model

14.2.15.4. Market Revenue and Forecast, by Delivery Model

14.2.16. Market Revenue and Forecast, by Facility

14.2.16.1. Market Revenue and Forecast, by End Use

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Application

14.2.17.2. Market Revenue and Forecast, by Modality

14.2.17.3. Market Revenue and Forecast, by Payment Model

14.2.17.4. Market Revenue and Forecast, by Delivery Model

14.2.18. Market Revenue and Forecast, by Facility

14.2.18.1. Market Revenue and Forecast, by End Use

14.3. APAC

14.3.1. Market Revenue and Forecast, by Application

14.3.2. Market Revenue and Forecast, by Modality

14.3.3. Market Revenue and Forecast, by Payment Model

14.3.4. Market Revenue and Forecast, by Delivery Model

14.3.5. Market Revenue and Forecast, by Facility

14.3.6. Market Revenue and Forecast, by End Use

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Application

14.3.7.2. Market Revenue and Forecast, by Modality

14.3.7.3. Market Revenue and Forecast, by Payment Model

14.3.7.4. Market Revenue and Forecast, by Delivery Model

14.3.8. Market Revenue and Forecast, by Facility

14.3.9. Market Revenue and Forecast, by End Use

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Application

14.3.10.2. Market Revenue and Forecast, by Modality

14.3.10.3. Market Revenue and Forecast, by Payment Model

14.3.10.4. Market Revenue and Forecast, by Delivery Model

14.3.11. Market Revenue and Forecast, by Facility

14.3.11.1. Market Revenue and Forecast, by End Use

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Application

14.3.12.2. Market Revenue and Forecast, by Modality

14.3.12.3. Market Revenue and Forecast, by Payment Model

14.3.12.4. Market Revenue and Forecast, by Delivery Model

14.3.12.5. Market Revenue and Forecast, by Facility

14.3.12.6. Market Revenue and Forecast, by End Use

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Application

14.3.13.2. Market Revenue and Forecast, by Modality

14.3.13.3. Market Revenue and Forecast, by Payment Model

14.3.13.4. Market Revenue and Forecast, by Delivery Model

14.3.13.5. Market Revenue and Forecast, by Facility

14.3.13.6. Market Revenue and Forecast, by End Use

14.4. MEA

14.4.1. Market Revenue and Forecast, by Application

14.4.2. Market Revenue and Forecast, by Modality

14.4.3. Market Revenue and Forecast, by Payment Model

14.4.4. Market Revenue and Forecast, by Delivery Model

14.4.5. Market Revenue and Forecast, by Facility

14.4.6. Market Revenue and Forecast, by End Use

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Application

14.4.7.2. Market Revenue and Forecast, by Modality

14.4.7.3. Market Revenue and Forecast, by Payment Model

14.4.7.4. Market Revenue and Forecast, by Delivery Model

14.4.8. Market Revenue and Forecast, by Facility

14.4.9. Market Revenue and Forecast, by End Use

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Application

14.4.10.2. Market Revenue and Forecast, by Modality

14.4.10.3. Market Revenue and Forecast, by Payment Model

14.4.10.4. Market Revenue and Forecast, by Delivery Model

14.4.11. Market Revenue and Forecast, by Facility

14.4.12. Market Revenue and Forecast, by End Use

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Application

14.4.13.2. Market Revenue and Forecast, by Modality

14.4.13.3. Market Revenue and Forecast, by Payment Model

14.4.13.4. Market Revenue and Forecast, by Delivery Model

14.4.13.5. Market Revenue and Forecast, by Facility

14.4.13.6. Market Revenue and Forecast, by End Use

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Application

14.4.14.2. Market Revenue and Forecast, by Modality

14.4.14.3. Market Revenue and Forecast, by Payment Model

14.4.14.4. Market Revenue and Forecast, by Delivery Model

14.4.14.5. Market Revenue and Forecast, by Facility

14.4.14.6. Market Revenue and Forecast, by End Use

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Application

14.5.2. Market Revenue and Forecast, by Modality

14.5.3. Market Revenue and Forecast, by Payment Model

14.5.4. Market Revenue and Forecast, by Delivery Model

14.5.5. Market Revenue and Forecast, by Facility

14.5.6. Market Revenue and Forecast, by End Use

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Application

14.5.7.2. Market Revenue and Forecast, by Modality

14.5.7.3. Market Revenue and Forecast, by Payment Model

14.5.7.4. Market Revenue and Forecast, by Delivery Model

14.5.8. Market Revenue and Forecast, by Facility

14.5.8.1. Market Revenue and Forecast, by End Use

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Application

14.5.9.2. Market Revenue and Forecast, by Modality

14.5.9.3. Market Revenue and Forecast, by Payment Model

14.5.9.4. Market Revenue and Forecast, by Delivery Model

14.5.9.5. Market Revenue and Forecast, by Facility

14.5.9.6. Market Revenue and Forecast, by End Use

Chapter 15. Company Profiles

15.1. Teladoc Health, Inc.

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Amwell (American Well Corporation)

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. MDLIVE, Inc.

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Doctor on Demand, Inc.

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Babylon Health

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Ping An Good Doctor

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. CVS Health Corporation (MinuteClinic Virtual Care)

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Practo Technologies Pvt. Ltd.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. 1mg Technologies Pvt. Ltd.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Zocdoc, Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others