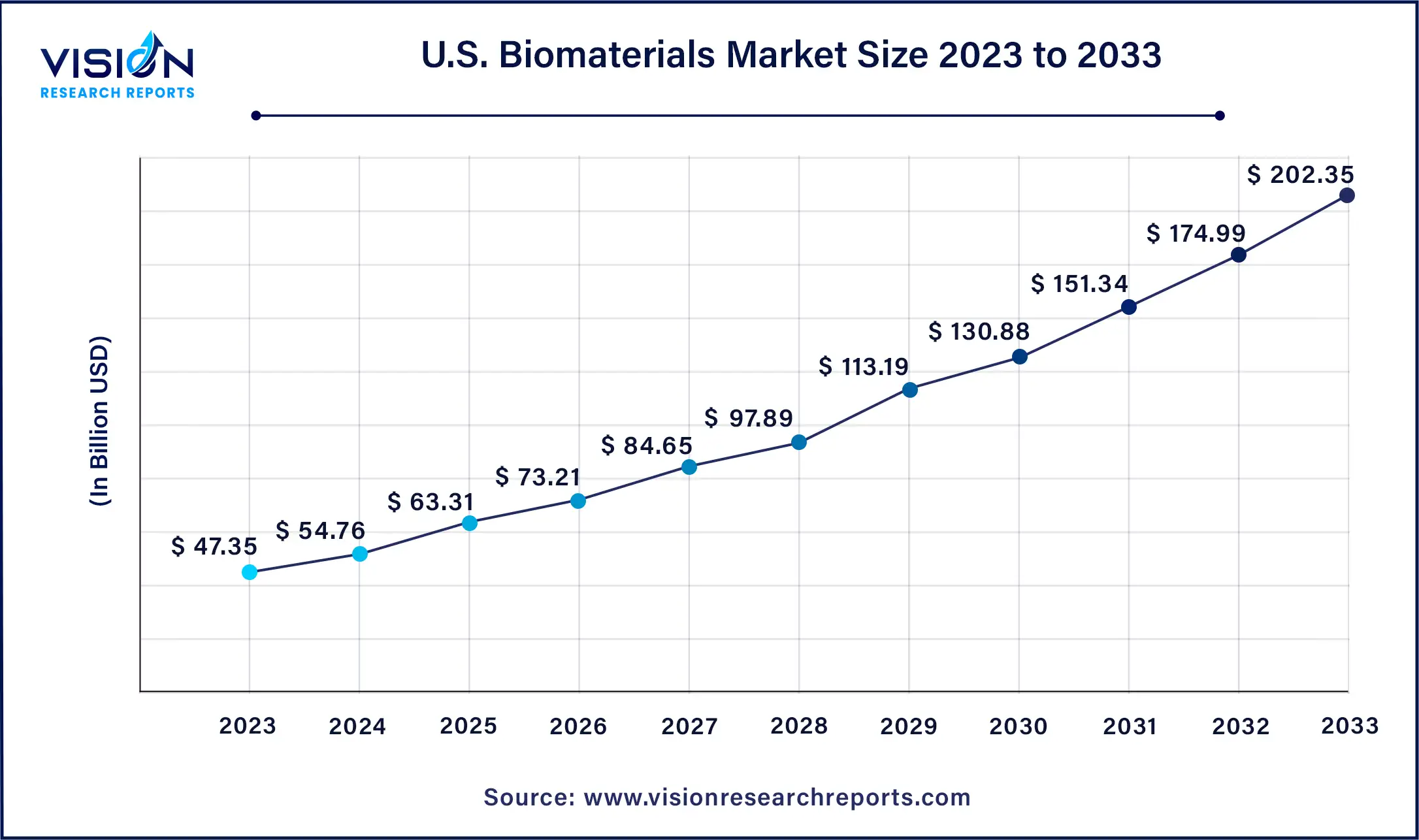

The U.S. biomaterials market size was estimated at USD 59.34 billion in 2023 and it is expected to surpass around USD 236.33 billion by 2033, poised to grow at a CAGR of 14.82% from 2024 to 2033.

The U.S. biomaterials market is a dynamic sector within the healthcare industry, encompassing a wide range of materials engineered for use in medical devices, implants, drug delivery systems, and tissue engineering applications. Biomaterials play a crucial role in advancing medical treatments and improving patient outcomes by providing biocompatible and functional materials that interact favorably with the human body.

The U.S. biomaterials market is propelled by the technological advancements in material science and manufacturing processes continually drive innovation in biomaterials, enabling the development of novel materials with enhanced properties and functionalities. Additionally, the rising prevalence of chronic diseases, coupled with an aging population, creates a growing demand for biomaterials used in medical devices and implants for the treatment of orthopedic, cardiovascular, and other health conditions. Moreover, increasing investments in research and development, supported by government initiatives and private sector funding, foster the discovery of new biomaterials and applications, further fueling market expansion. Regulatory support for innovative medical technologies and the growing adoption of minimally invasive surgical procedures also contribute to the market's growth trajectory, providing opportunities for the development and commercialization of advanced biomaterial-based products.

Metallics currently dominate the market, commanding the largest revenue share of 41% in 2023. They are primarily utilized in dental and orthopedic applications, where their strength and durability are highly valued. Metals serve as the backbone of load-bearing implants, commonly employed in orthopedic surgeries for various purposes such as wire fixation, screw placement, and joint prostheses for hips, knees, and shoulders. Their inherent properties, including mechanical strength and resilience, make them indispensable in these applications. However, their use as biomaterials necessitates careful consideration of additional factors such as wear resistance, corrosion resistance, and biocompatibility.

Natural biomaterials are poised to exhibit the fastest compound annual growth rate (CAGR) of 18.25% from 2024 to 2033. Natural polymers offer distinct advantages over synthetic counterparts, particularly in terms of biocompatibility, biodegradability, and remodeling capabilities. These qualities make natural biomaterials highly suitable for tissue repair and organ replacement therapies, where they facilitate cell adhesion, proliferation, and differentiation upon implantation. With the current limitations in tissue and organ availability, the development of artificial substitutes is imperative. The anticipated rise in their clinical application and effectiveness in tissue remodeling processes is expected to be a key driver for market growth in this segment.

Orthopedic procedures dominated the market, holding the largest revenue share of 26% in 2023. A considerable portion of the population relies on various biomaterials in orthopedic treatments to address issues related to bone and joint degeneration. These biomaterials are typically classified into three generations based on their properties and functions. The first generation comprises bioinert materials such as metals, ceramics, and polymers. Moving to the second generation, we encounter bioactive and biodegradable ceramics, cements, metals, and polymers, which possess enhanced qualities promoting biological interaction. The third generation consists of biomaterials engineered to elicit specific molecular-level responses within the body. These advancements cater to diverse needs, including fractures, extensive resections, joint dysfunctions, spinal pathologies, and related conditions. Consequently, the demand for medical devices and biomaterials in orthopedic applications is expected to significantly increase in the foreseeable future.

Plastic surgery is projected to exhibit the fastest compound annual growth rate (CAGR) of 18.05% during the forecasted period. The utilization of biomaterials in plastic surgery has seen a notable increase due to the availability of various commercial products in recent years. These products encompass a range of items such as soft tissue fillers, bioengineered skins, acellular dermal matrices, materials for craniofacial surgery, and solutions for peripheral nerve repair. Plastic surgery encompasses both cosmetic and reconstructive procedures, with popular interventions including breast augmentation, rhinoplasty, and facelifts. Ensuring the development of safe and reliable products is paramount for advancing this critical surgical field. Biomaterials in plastic surgery continue to evolve, focusing on ongoing enhancements. In 2022, data from the American Society of Plastic Surgeons revealed a significant 19.0% increase in cosmetic surgeries compared to 2019, with 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures performed in the United States. The growth of plastic surgery underscores its expanding demand and importance in modern healthcare practices.

By Product

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others